| Alphabet is falling 7.3% in premarket trading after the Google parent reported disappointing revenue because of a slowdown in its cloud busi |

| |

| Markets Snapshot | | | | Market data as of 06:30 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Alphabet is falling 7.3% in premarket trading after the Google parent reported disappointing revenue because of a slowdown in its cloud business. The results raise concerns about Alphabet's AI spending.

- China's antitrust watchdog is laying the groundwork for a potential probe into Apple's policies and the fees it charges app developers. The move risks becoming another flashpoint in the trade war with the US. Apple shares are down 2.6%.

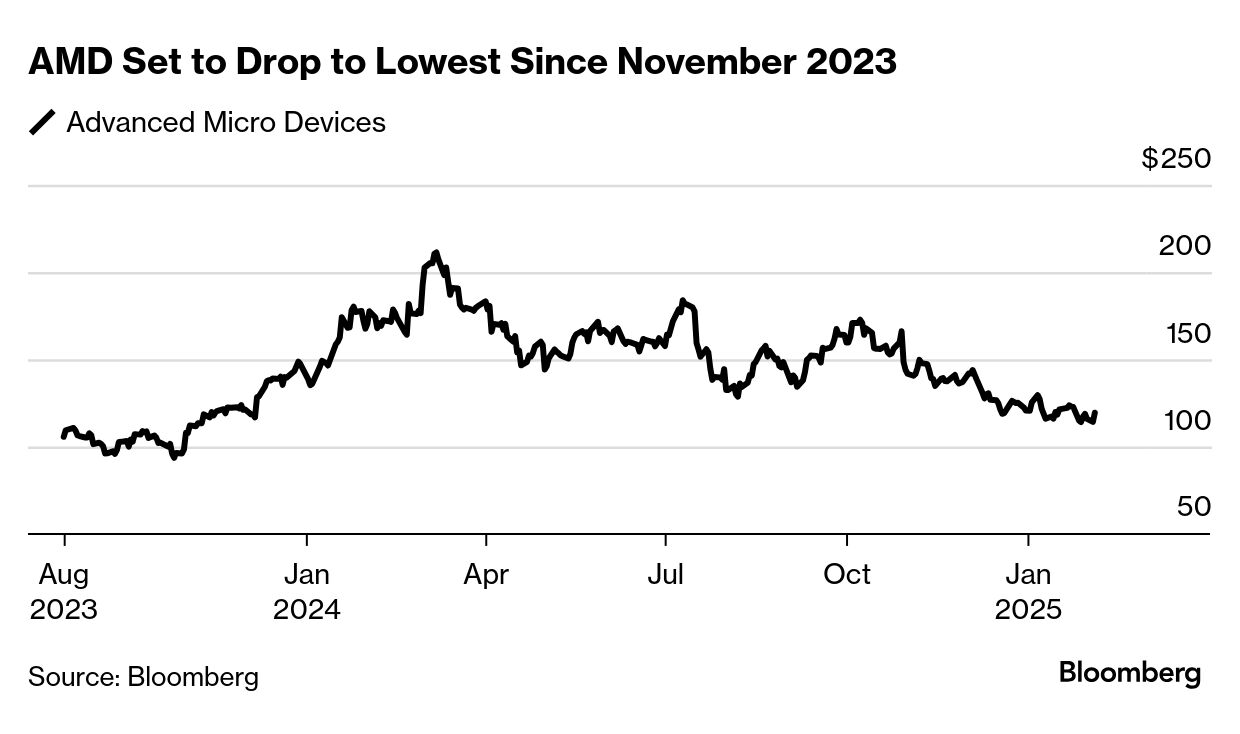

- US equity futures dropped along with stocks in Europe after disappointing earnings from Alphabet and Advanced Micro Devices. Disney, Harley-Davidson, Uber and Stanley Black & Decker report this morning, with insurers MetLife and Aflac scheduled for after the close.

- Nissan is pulling out of its deal with Honda to combine both brands, the Nikkei newspaper reported. Nissan shares slumped 4.9% in Tokyo while Honda jumped 8.2%.

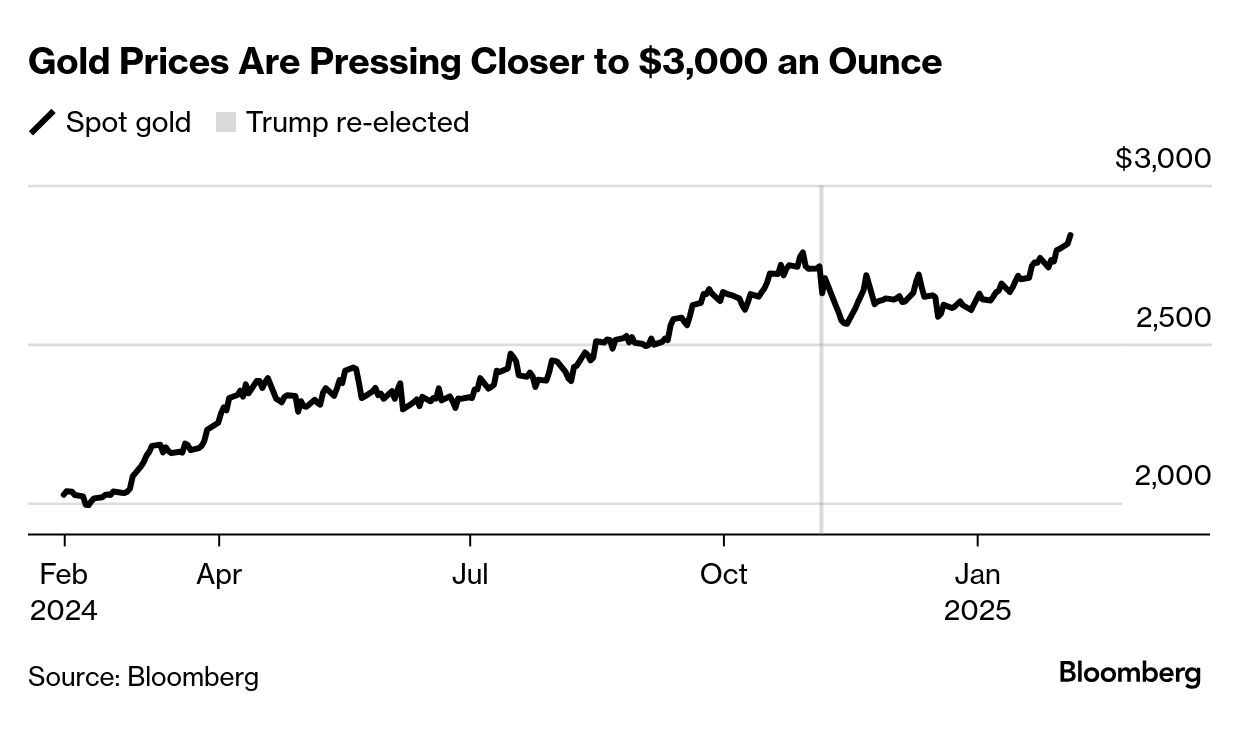

- Gold rose to a record high above $2,870 an ounce as the opening salvos of the US-China trade war stoked haven demand.

Bloomberg reporters answer questions about Trump's EU tariff threats and the impact it could have on markets in a Live Q&A at 8 a.m. EST/1 p.m. GMT. Listen here. | |

| |

| Despite the billions of dollars at stake, the US Treasury's quarterly announcement about how it plans to raise debt is often just a matter of passing interest. Traders tune in to hear about coming bond sales, but swiftly move on given the department's commitment to be "regular and predictable." Today's will draw a brighter spotlight for two reasons related to the arrival of the Trump administration.

First, as we wrote on Monday, Treasury Secretary Scott Bessent has the option to align the department's management of the nation's debt with his past view that it should be selling more longer-dated maturities.

Second, the event will provide the first opportunity for officials to be quizzed about the role being played in the Treasury by Elon Musk's Department of Government Efficiency. Musk revealed at the weekend his "DOGE team" is looking at the department's payments-processing division and shutting down some payments. If that effort veered into legally legitimate transfers, either on purpose or by accident, that would be sure to spark debates in Washington and on Wall Street over whether the federal government is following through on its obligations.

Bloomberg reported yesterday that at least two people connected to Musk have joined the Treasury. In response to questions, the department said the DOGE had read-only access to data. But Washington is already tuning in. Democrat Senators Elizabeth Warren and Ron Wyden have warned "a misstep here could result in a global financial meltdown" and asked the Government Accountability Office to investigate. Hundreds of protesters gathered outside the Treasury's Washington headquarters Tuesday afternoon chanting and holding signs declaring "Stop Elon's Takeover" and "Hands Off Our Money."

Clinton-era Treasury Secretary Lawrence Summers told Bloomberg Television that it would be a welcome development if government systems end up being upgraded.

But "this is an area where the Treasury secretary has an important responsibility – as all Treasury secretaries do – to protect the basic integrity of the way the government does finance.'' "My expectation would be that Secretary Bessent will live up to that obligation," he said. —Simon Kennedy | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Advanced Micro Devices shares fall as much as 9.6% in premarket trading. The chipmaker reported data-center revenue that was weaker than expected, indicating that it's struggling to catch up with AI computing leader Nvidia.

- Chipotle Mexican Grill shares drop 5.5%. The burrito chain's fourth-quarter sales growth missed expectations, with competition for budget-strapped customers intensifying.

- Mattel shares jump as much as 17% after the toymaker's earnings beat estimates. The company is considering increasing the price of its Barbie and Hot Wheels toys to offset the cost of President Donald Trump's tariffs. -- Subrat Patnaik

| |

| |

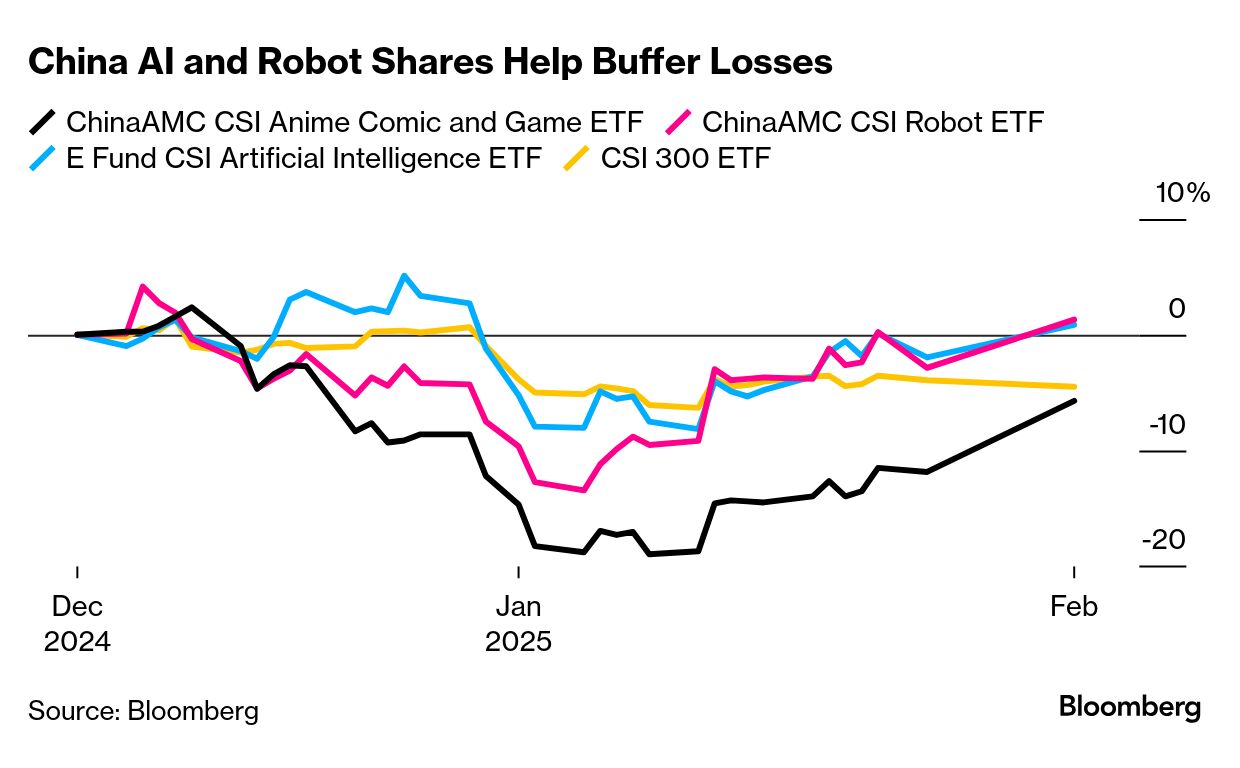

| Chinese traders returning from the week-long Lunar New Year holiday largely looked past the 10% tariffs that the US slapped on the nation's exports and instead fixated on opportunities in tech. Sure, the CSI 300 Index slipped 0.6% on the first day back, and the tariffs were to blame, but looking beyond the index, there were plenty of signs of speculative appetite. Take, for example, the troupe of dancing, AI-trained robots from a closely held company called Unitree that featured prominently in the Spring Festival Gala, perhaps one of the most-watched shows in China. That reignited excitement in a favorite trade of the past few months -- anything connected to robotics. Zhejiang Changsheng, which provides components for Unitree, jumped as much as 10%. AI product partner Shengtong Printing also gained 10%, while Wolong Electric, which indirectly holds shares in Unitree, rallied 7.2%. With the rally in robotics and AI plays, market breadth was positive, with more than 3,400 stocks gaining across China's markets, with only 1,850 falling. Global investors may be perplexed by how onshore investors have taken the tariffs in stride. For one, they were so widely telegraphed ahead of time that there was little doubt Trump would make good on his threats. If anything, the tariffs were baked in during the selloff early in the year; anyone still nervous about a trade war would have left the table long ago. —April Ma | |

| |

| Gold's surge was the stand-out event in global commodities in 2024 as records fell. Just a few weeks into 2025, the metal is again setting successive peaks and reviving talk of whether it has the momentum to reach $3,000 an ounce. That target enjoyed quite a lot of shock value when it first entered the mainstream given it was then both distant and, as a consequence, felt more than slightly outlandish. But with bullion trading today above $2,870 — and with prices on course for a sixth successive weekly gain — it's well within reach in the first half, even if the rally does pause at some stage. The old haven is turning heads as three things come together. First, gold appears to be a Trumpian asset. The new US president is long on disruption, surprise headlines, trade wars, and aggressive verbal posturing. His remarks Wednesday about Gaza, for example, have an off-the-wall quality that's reminiscent of his sessions before getting to the White House. Taken in aggregate, these are bullion-positive as pretty much anything could happen. Second, central banks continue to be gold accumulators. Their purchasing plans seem to be unaffected by the metal trading at nominal highs, or the US dollar doing well, or 10-year Treasury yields being parked somewhere near 4.5%. The People's Bank of China may tell us Friday that it has, once again, expanded its gold holdings. And where China leads, other central banks may well follow. Third, while it's getting more complicated, the Federal Reserve remains in cutting mode. The urgency of the task here may change as policymakers adapt to the evolving reality that is Trump world, especially if inflation gets a tad stickier. But they still want to reduce borrowing costs in the quarters to come, and that would mean less competition for gold from fixed-income investments. —Jake Lloyd-Smith | |

Word from Wall Street | | "It's only been a little more than a couple of weeks since the inauguration, but it feels like so much has happened: we are living through DOG(E) years." | | Stephen Jen Chief executive, Eurizon SLJ Capital, in a note to clients | | |

One number to start your day... | | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment