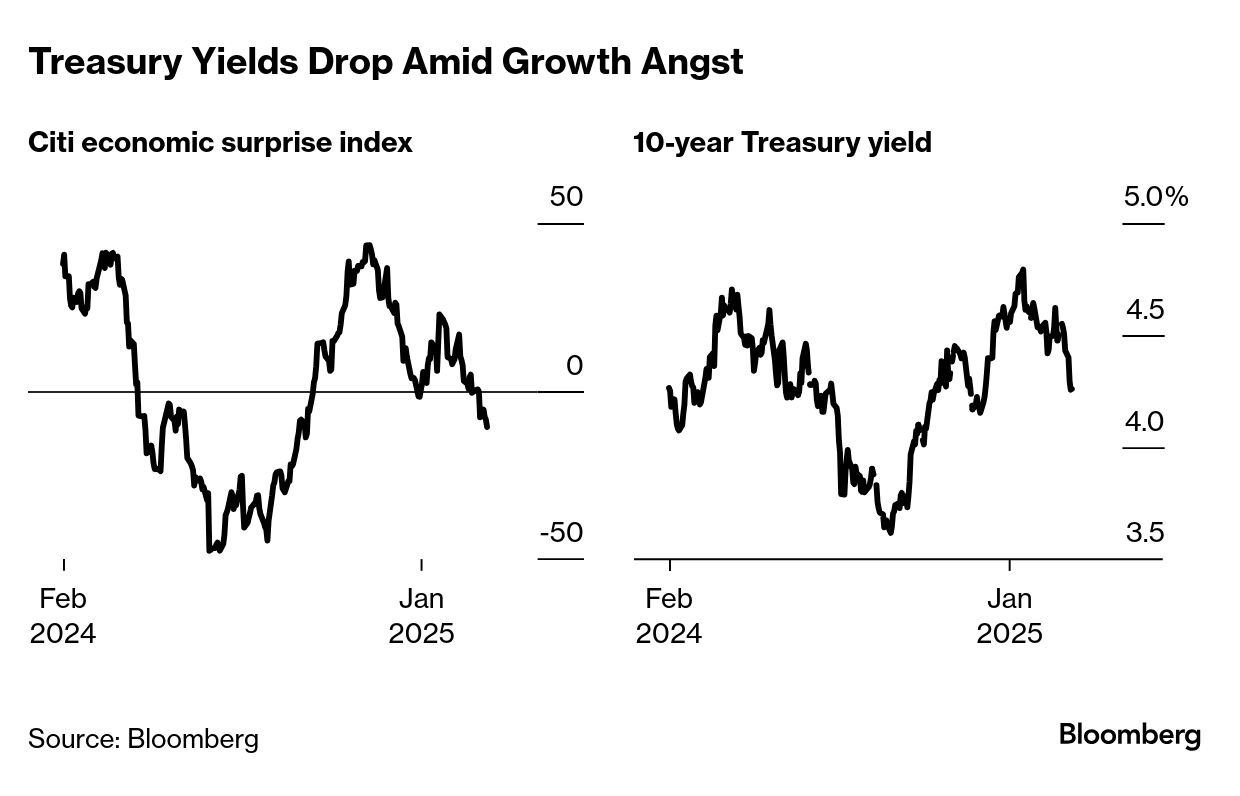

| The shortest month is ending with long faces among those investors who had hoped 2025 would reward risk-taking. As fear replaces greed across trading desks, the S&P 500 is now down for the year. On the flip side, Treasuries have extended their best start to a year since 2020. Animal spirits are also in retreat in crypto, and stocks in Asia and Europe had rocky days. A popular exchange-traded fund tracking long-dated Treasuries is on course to notch a 4% rally this month, while a similar product for broad equities is down almost 3%. That's the biggest divergence in favor of debt — the ultimate haven during moments of economic concern since March 2020. Treasuries don't often enjoy such a strong start — 2008, 2016 and 2020 were the only better initial rallies this century. That's unnerving for assets that do well in expanding economies — even if 2016 and 2020 ultimately delivered annual gains for the S&P 500 they were also very volatile times. It wasn't supposed to be this way. Trump returned to power just over a month ago amid hopes on Wall Street that his focus on tax cuts, tariffs and deregulation would deliver reflationary and inflationary impulses that would be bad for fixed-income and mostly good for equities. Instead, signs the US economy is slowing have dovetailed with the idea that tariffs could end up hurting growth more than lifting inflation. Citigroup's gauge of when economic data beats forecasts is at its lowest since September, while Trump said the 25% tariffs on Canada and Mexico would come into force from March 4 and added that Chinese imports face a further 10% levy. Speculation that the AI boom is failing to live up to the hype is also worrying some investors after Nvidia's results disappointed. Meanwhile, bonds have rallied on Treasury Secretary Scott Bessent's ambition to get 10-year yields lower and some like the sound of Elon Musk's campaign to rein in Washington spending. The demand for safety was enough to overwhelm the hawkish talk from Fed officials still focusing on sticky inflation. "Markets have undergone a bit of a 'growth scare,'" said Michael Brown, senior research strategist at Pepperstone. "For the time being, I remain bullish equities, albeit with the path to the upside likely continuing to prove a bumpy one." — Simon Kennedy, Lu Wang, Garfield Reynolds and Paul Dobson |

No comments:

Post a Comment