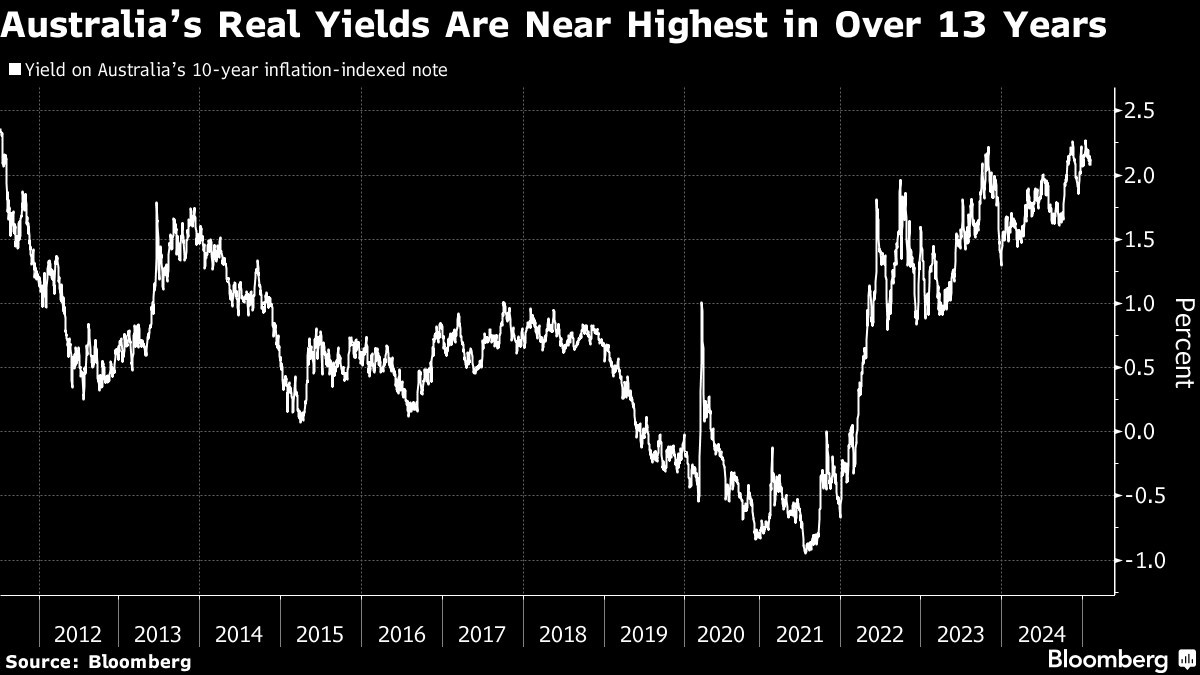

| Macquarie is shuttering its US debt capital markets arm to focus resources on private credit, according to people with knowledge of the matter. The decision will impact around 80 staff, with some being moved to other roles and others leaving the firm. Brookfield Capital Partners entered the bidding frenzy for Insignia Financial, joining Bain Capital and CC Capital Partners with an offer for the Australian wealth management firm. Allianz and Insurance Australia Group are considering bidding for the insurance arm of The Royal Automobile Club of Western Australia, according to people familiar with the matter. Australia's new bond attracted a record A$83 billion worth of bids as central bank policy easing, moderating inflation and trade tensions spurred a global rush for fresh issuance. Australia's sovereign wealth fund is tilting its investment focus to domestic assets, such as infrastructure, private credit, and data centers, to seek inflation protection and adapt to a trend of global protectionism. US private credit manager Monroe Capital is expanding in Australia to tap the nation's fast-growing A$4.1 trillion pensions pool, opening of a new office in Sydney. The firm has appointed Galen Fu as director, business development. |

No comments:

Post a Comment