- No tariffs on Mexico and Canada after all, at least for a month.

- Both gave Trump enough to claim a political victory without conceding anything of consequence.

- Extra tariffs for China are still on schedule.

- Crypto endured one of its periodic crashes while the tariff argument played out.

- AND: An example of how to stop the flow of drugs from Breaking Bad.

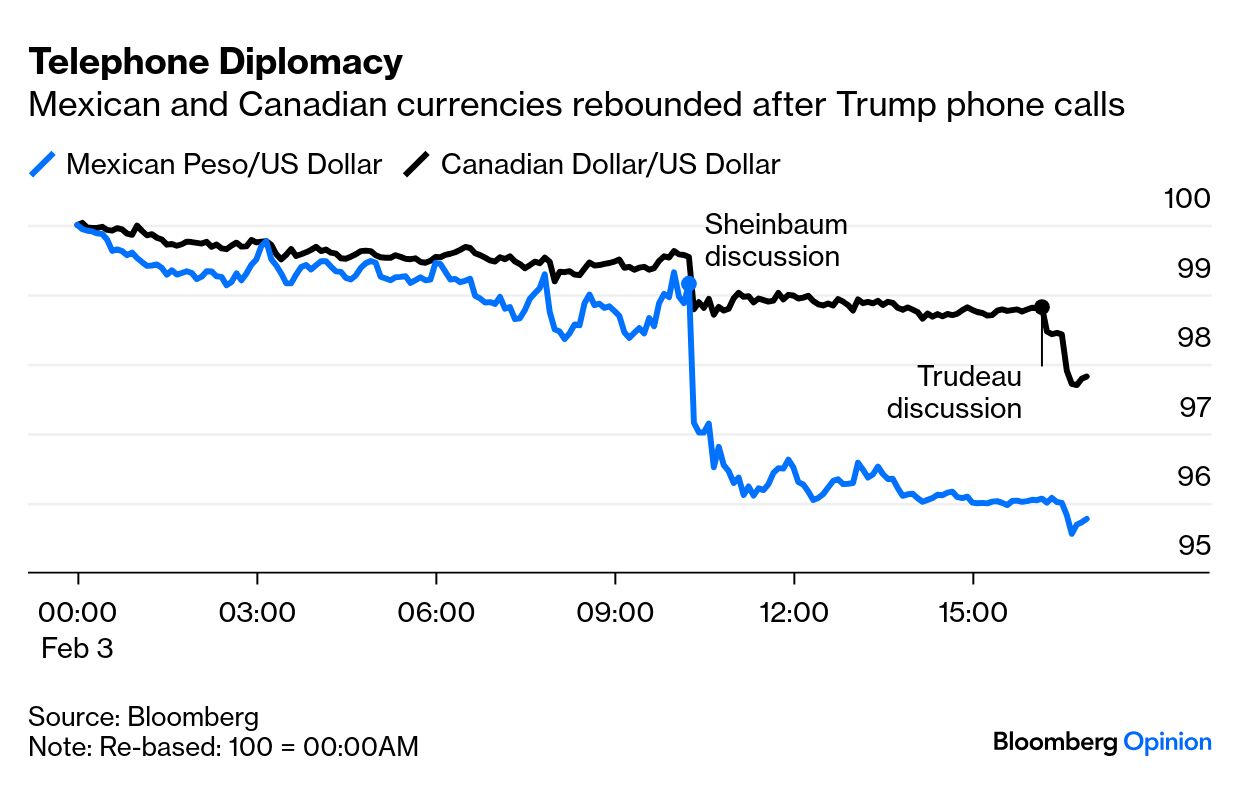

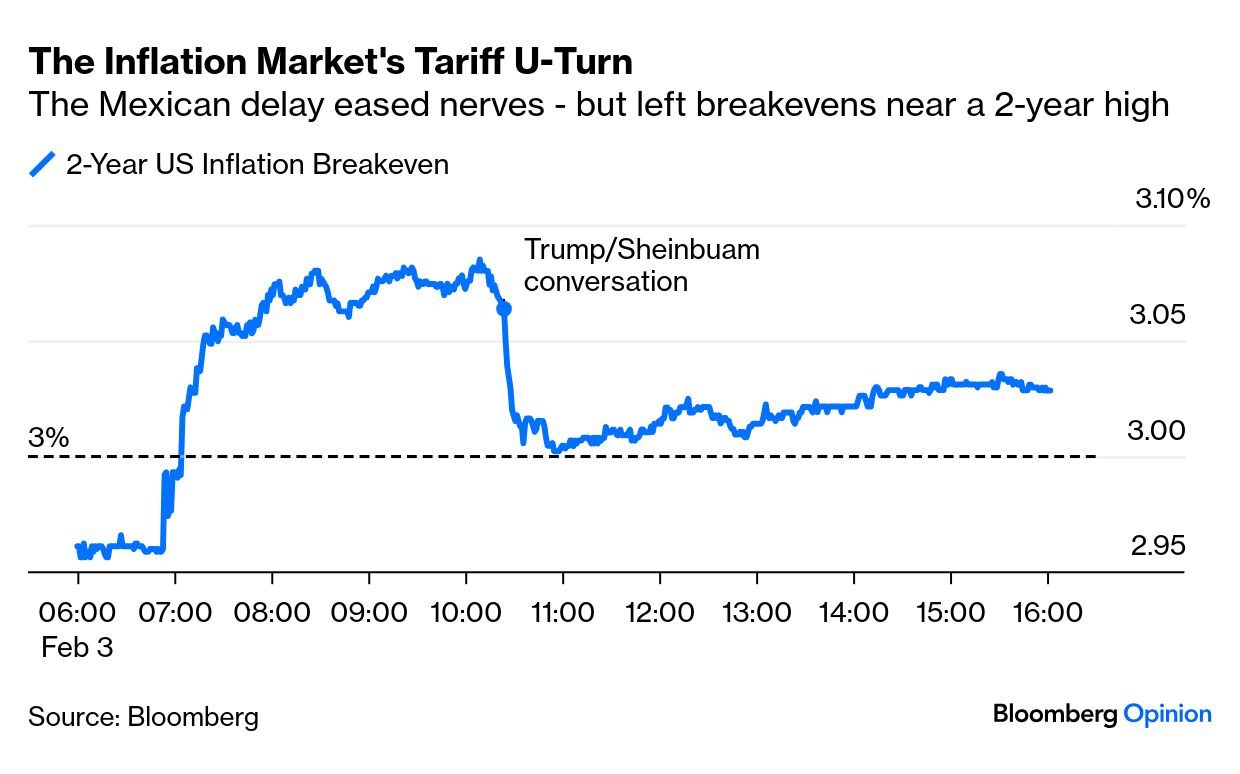

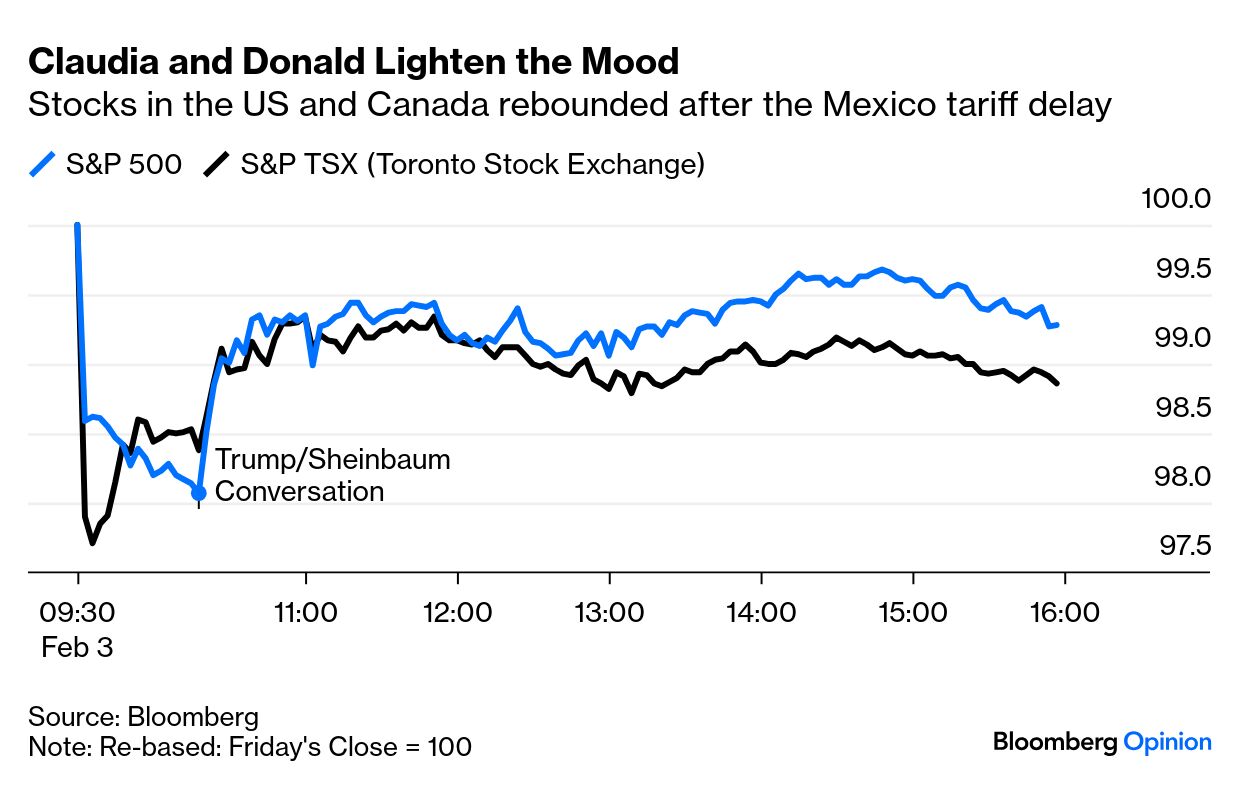

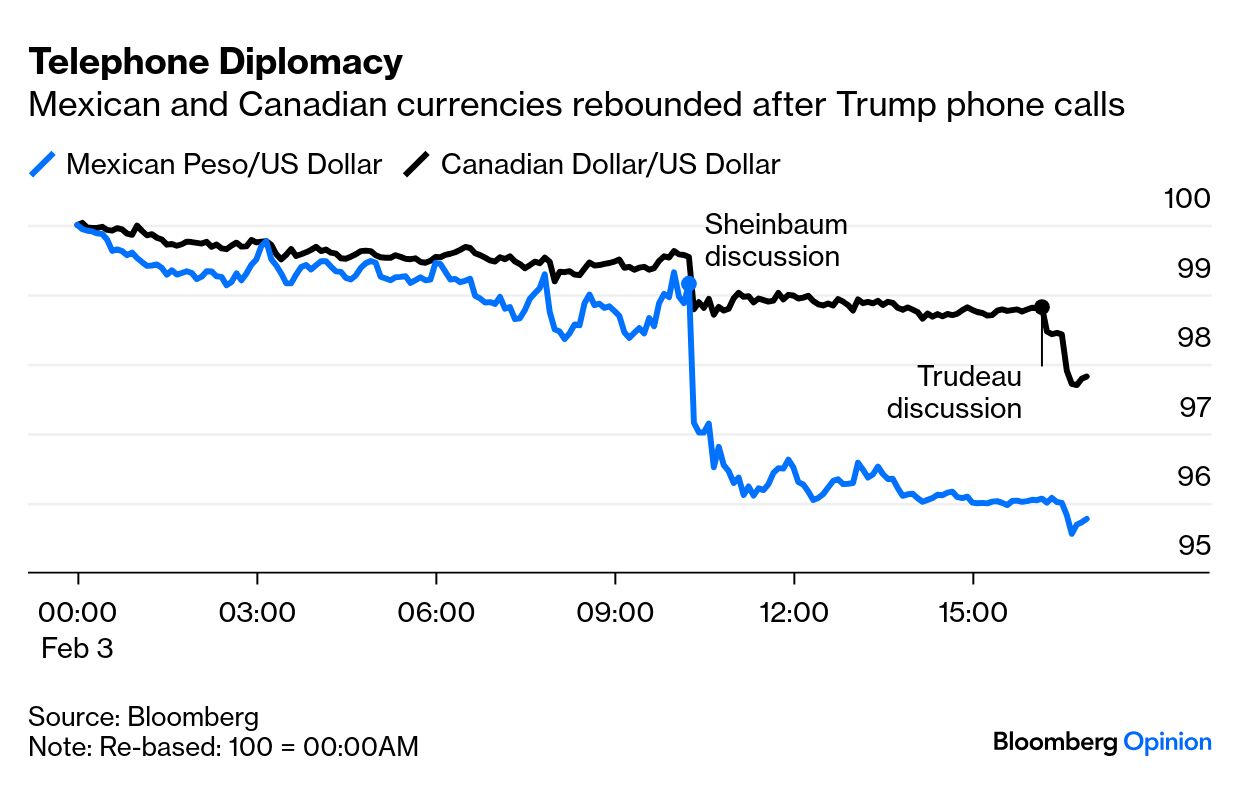

"Make someone happy with a phone call" was one of the more beloved British advertising slogans of the 1970s, an era when it made sense for the nationalized telecoms group to tell its customers to use its land lines more. It featured Bernard Cribbins, the voice of the Wombles, and it all seems terribly old-fashioned now. But sometimes, you really can make someone happy by picking up the phone, and that's what happened Monday after Claudia Sheinbaum, Mexico's president, got on the line to chat with her American counterpart Donald Trump. Once the call was over, Sheinbaum briefed the press that the US tariffs, due to start at midnight, had been delayed for a month after she undertook to station 10,000 members of Mexico's National Guard to the border. Trump confirmed this, and a surge of market concern about US inflation died down a little. After the bond market's expected two-year level of inflation had surged well beyond 3% for the first time in two years, the Trump/Sheinbaum conversation brought that number down swiftly, although it remained elevated: In the short term, the bond market works on the cast-iron assumption that tariffs will mean higher inflation. Stock markets also rebounded after steep selloffs. Mexico was off for a national holiday, but the main indexes in both New York and Toronto rebounded after a bad start: After the market closed, we got news of the phone call Trump held with Justin Trudeau, who is still serving out his time as prime minister of Canada. The bottom line was that the tariffs were delayed for a month, as in Mexico, in return for the deployment of Canadian forces to the border and the appointment of a "Fentanyl Czar." The Canadian dollar rallied in response:  How big are the concessions? They don't appear great. Mexico's 60,000-strong National Guard was created by Sheinbaum's predecessor, Andres Manuel Lopez Obrador, and members already been sent to beef up the country's southern border with Guatemala in response to concerns in Trump's first term about migrants passing from Central America through Mexico on their way to the US. The Guard normally has about 15,000 personnel in the border states. Carlos Loret de Mola, one of Mexico's most prominent journalists and a trenchant critic of the party of Lopez Obrador and Sheinbaum, put it as follows in a column for El Universal (my translation): Deactivating the threat of tariffs in exchange for 10,000 Mexican soldiers acting as Border Patrol is exactly the same thing that Trump achieved with AMLO six years ago. It appears that Trump and Sheinbaum entered the game knowing that they were repeating a play they had already rehearsed. She calculated that he is the same old Trump, and he calculated that Sheinbaum is like AMLO. They already knew the script.

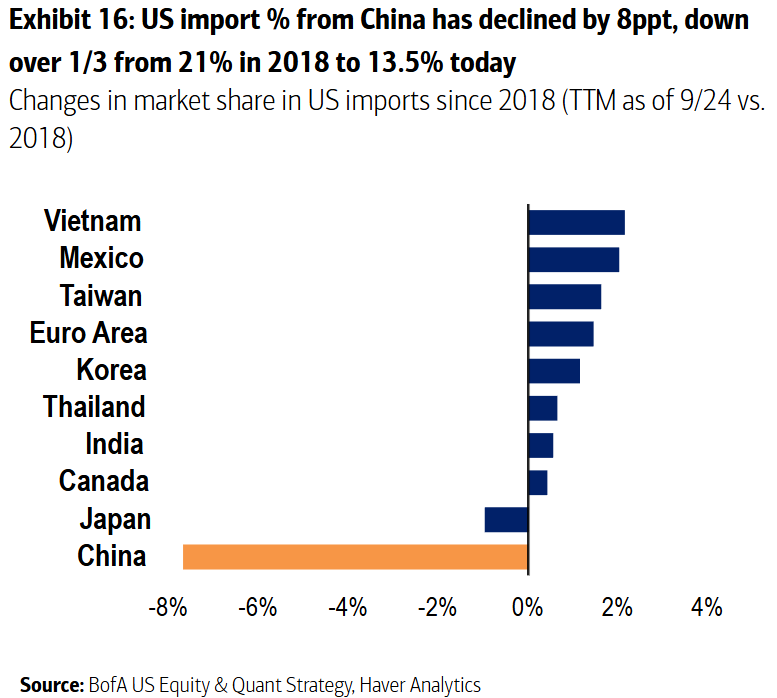

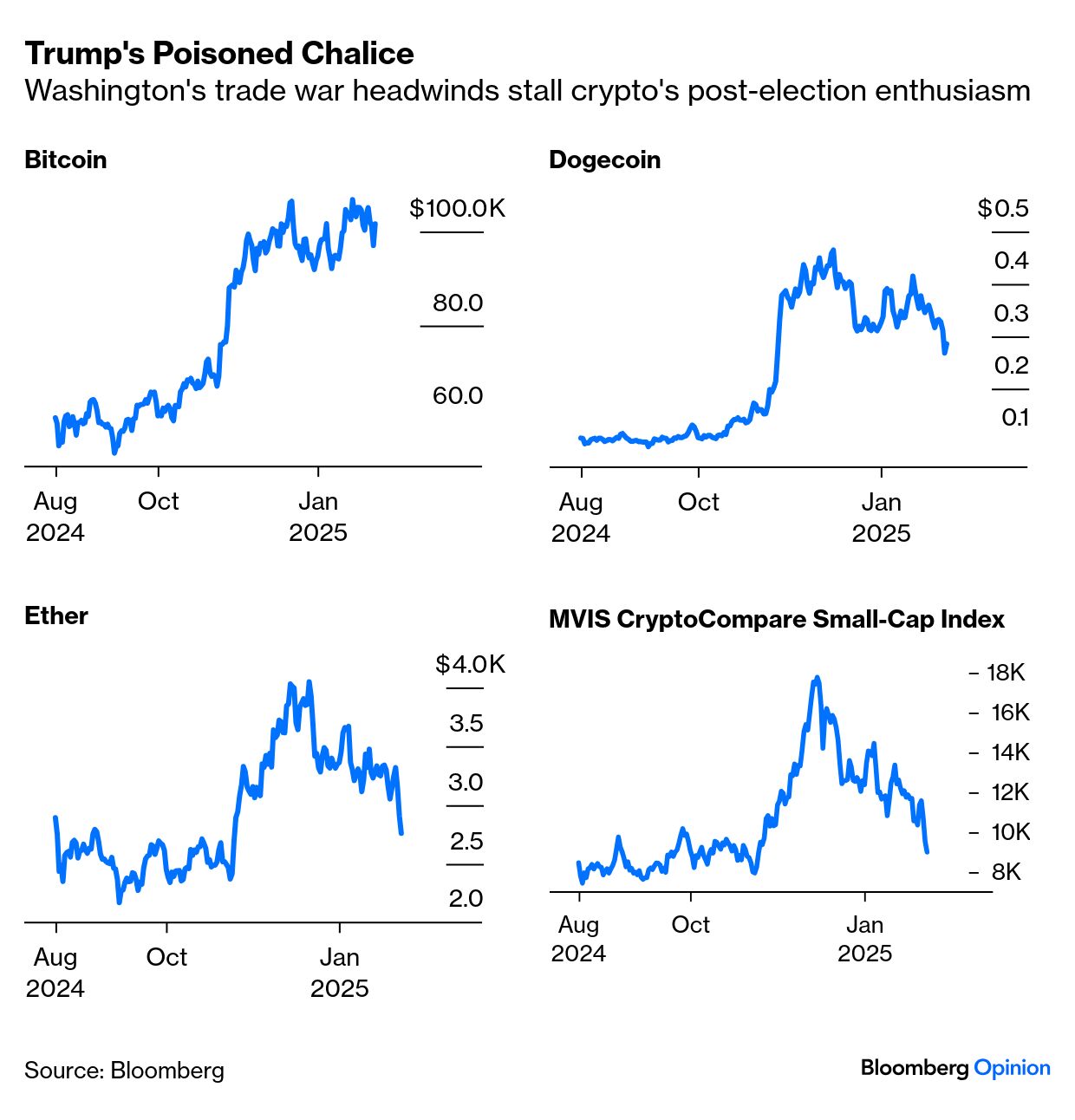

In Canada, Trudeau stated that "nearly 10,000 frontline personnel are and will be working on protecting the border." The Canada Border Services Agency says it has "8,500 frontline employees." It's unclear whether there will be any significant redeployment. Trudeau's government had been offering a C$1.3 billion ($900 million) plan to improve border security since last year. And while Trump said that Trudeau had agreed to "finally end the deadly scourge of drugs like Fentanyl that have been pouring into our Country, killing hundreds of thousands of Americans," only 43 pounds of fentanyl were intercepted crossing the Canadian border last year, compared to more than 20,000 pounds from Mexico. It's not clear that Canada could do much to impact the US fentanyl problem. If there was a concession, it was the commitment to appoint a "czar." The likely conclusion that other governments will draw is that they can parry away tariff threats by giving the US the appearance of a victory. There has been a debate over whether Trump saw tariffs as a negotiating tool or a means to raise extra revenues; Monday's events suggest the former. It's fair to question whether he ever meant to go through with it. Andrew Bishop of Signum was one of the few political risk strategists to continue predicting throughout the weekend that the tariffs would not take effect. "It was about fulfilling his campaign promises," he said. Indeed, Trump supporters have greeted the developments as concessions from Sheinbaum and Trudeau. However, this could create a false sense of security for US competitors. The 10% additional tariff on China is still due to take effect at about the time this newsletter is published. Chinese trade with the US has been falling for a while, so this doesn't threaten the same kind of sudden jolt, but the situation continues to evolve, and China will soon have a response. This remarkable chart is from Bank of America Corp.: As the tariffs on the US neighbors still slated to start a month from now are "roughly five times as large as the cumulative sum of all the trade actions taken under the first Trump administration," to use a Deutsche Bank AG calculation, they still represent a threat disproportional to the reward — a sledgehammer to crack a peanut. Bishop suggests that the key date will be April 1, when Trump has asked for the results of a review by his trade team. That would likely involve a very different approach, with specific sectors targeted, and lengthy notice given of future increases. Even if the last few days have been political theater, the new president plainly wants to shift the way the global trade system works, and has the means to make it happen. The European Union could be more useful as a test case, as there is no way to claim threats to national security as Trump did with Canada and Mexico. "If he imposes tariffs on the EU, it can't be about fentanyl or immigration," said Dhaval Joshi of BCA Research. Trump Trades Are No Immunity | The return to the White House hasn't yet delivered for the so-called Trump trades. Since last autumn, money has flowed into investments on the assumption that Trump 2.0 would go for tax cuts first, followed by tariffs. They offered little protection from the uncertainty surrounding his policies, and the risk-off moves during the tariffs imbroglio suggest that they didn't price the possibility that the president would actually walk his talk. There's nothing to suggest the expected pro-business agenda of tax cuts and deregulation is in danger, but some assumptions have been shaken. Digital assets, which benefited most from Trump's victory, barely pared losses after the Sheinbaum phone call. Before that, the MVIS CryptoCompare Small-Cap index of smaller cryptocurrencies slumped as much as 21% in Monday's trading, compounding an 11% drop on Sunday. Ethereum plunged 29% from its high at the end of last week, and 48% from its December peak, before trimming losses. Bitcoin, the biggest cryptocurrency, was the least scathed, falling nearly 6%. All are still up at least a little since Election Day: There may have been other contributors to the sharp volatility, but it's hard to look beyond tariffs as the main reason behind the slump, especially as the recovery started with the Sheinbaum phone call. Still, Arca Investment's Jeff Dorman suggests that crypto is merely prone to market dynamics, with tariffs just a convenient headline to send prices were they were likely heading anyway: The digital assets market was already on a weak footing for the past six weeks, with a variety of theses on why the market would tank or why the market would rip higher. There were theses based on too many coins, bad tech earnings, technical analysis, seasonality, end of cycle, market structure, and everything else under the sun… but I encourage anyone to find a well-written thesis on the relationship between crypto and tariffs written before Friday. There have been many reactions and predictions post the news, but I did not see any before the news.

ByteTree's Charlie Morris argues that there's a chance something good comes out of this for crypto, although it might take a while: Trump wants low interest rates, and what Trump wants, Trump gets. When rates start to fall, that ought to ease the pressure on the dollar, which, in turn, will support crypto. Something needs to support crypto, because while Bitcoin still holds up quite well, crypto breadth is structurally weak.

Economic policy uncertainty produces very few winners, and crypto's performance is not isolated as the market faces up to the likelihood of more brinkmanship. Morgan Stanley economists argue that if the tariffs were fully implemented, then recession in Mexico would become the base case — while in the near term, inflation and growth in the US could also be compromised. That makes Trump's readiness to deploy this negotiation tactic deeply unsettling, and helps to explain how gold topped its all-time highs amid the scare. The 10-year Treasury didn't see similar action as a safe haven, although the incident has helped to bring yields lower; asset classes more sensitive to global growth, such as industrial metals, have continued to be quiet. Bank stocks, thought likely to be prime Trump 2.0 beneficiaries, dropped almost 3% at the open but recouped about half of that:  What happens to these trades? Trump's unusual policy messaging leaves them vulnerable to more volatility as tariffs crimp earnings forecasts. Lori Calvasina of RBC Capital Markets parsed last week's earnings calls to show that tariffs were shaping conversations in the boardroom: The conversation had evolved from those we saw in the November conference season, when most companies that discussed tariffs focused on how they'd reduced their footprint to China (in some cases by moving manufacturing to Mexico), emphasized their ability to manage through supply chain challenges, and noted that they would pass through any tariff costs via pricing.

This time around, there was less confidence and a wider range of assessments. Calvasina said some companies were hoping for exemptions, while one said that it had seen "unusual movements in supply chains (i.e. demand pull forward)" because of the tariff risks. Expect more questions like this. Answers won't be clear for a while, although the next key moment now appears to be April 1. —Richard Abbey If we want to control the flow of drugs from Mexico, archvillian Gustavo Fring showed how it was done in Breaking Bad. This is what happened after he served the entire leadership of a cartel with poisoned tequila. At least the tariff negotiations didn't go like this one. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Jonathan Levin: Three Unsettling Lessons From Trump's Tariff Drama

- Javier Blas: Why Norway's Political Crisis Is a European Energy Problem

- Liam Denning: Tesla Is a Car Company. Its Stock Is a Meme.

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment