| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. A Dow Inc. chemical infrastructure deal could herald the next frontier in industrial breakups. For those who missed it, late last year Dow announced a deal to sell a 40% equity stake in certain parts of its Gulf Coast operations to a fund managed by Macquarie Asset Management. The $2.4 billion transaction involves assets that support Dow manufacturing sites in Texas and Louisiana but aren't directly involved in the production of its chemicals — things like power and steam generation, pipelines, environmental operations and general infrastructure. It's a twist on the better-known real estate sale-leaseback transaction and also akin to airlines' willingness to rent jets from aircraft lessors rather than owning their entire fleet outright. The Dow investment is expected to close in the first half of this year, and Macquarie has the option to increase its holding to 49% within six months of the transaction's completion, which would raise the deal's value to about $3 billion. This isn't Dow's first foray into carving out its infrastructure: The chemical company struck a pair of deals in 2020 for railway hubs that serve six major North American manufacturing sites and chemical storage and port facilities in the Gulf Coast. But the Macquarie deal is more than twice as big as the earlier asset sales combined and analysts and investors say it's among the largest transactions of its kind for a major publicly traded US industrial company, which makes it instructive when thinking about how this model might be applied more broadly across the sector.  Manufacturers are sitting on sprawling empires of industrial real estate and operating infrastructure that are inextricably linked to the production of their wares but arguably extricable from their corporate structure, under the right circumstances. Investors have long looked for ways to wring more value from assets that companies, industrial or otherwise, tend to write off as merely a source of costs rather than financial opportunity. Not all of the ideas have been good: Boeing Co. is still paying the price for a 2005 decision to carve out its aerospace structures supply arm into a standalone company and is now trying to repurchase Spirit AeroSystems Holdings Inc. Seafood chain Red Lobster partly blamed onerous rents from a real estate sale-leaseback deal for its bankruptcy filing last year. There are plenty of other examples where attempts to slice and dice businesses went too far and ended up costing money. But the combination of higher-for-longer interest rates and weak industrial markets is likely to boost the appeal of this kind of creative thinking as a means to raise capital. In the case of Dow, the Macquarie investment coincides with a persistent slump in chemical markets that's weighing on the company's cash flow and risks stretching on not just through this year but into 2026. The cash infusion has helped eased concerns about Dow's ability to keep funding its dividend and provides the company more breathing room as it moves forward with promising capital projects, particularly the $6.5 billion expansion and emissions-reducing retrofit of its Alberta, Canada, plant, says Christopher Parkinson, an analyst at Wolfe Research.

"Things are challenged over the next two years, probably. That's just the way it is and the industry has to batten down the hatches," he said. But Dow is right to prioritize its Alberta asset, which is among the lowest cost facilities of its kind in the world with sustainably cheap feedstocks and the benefit of a favorable government backdrop, Parkinson said. Those are the kinds of things Jim Fitterling, the CEO of Dow, should be focusing on — not finding tenants for an infrastructure site in the Gulf Coast, he said. "They are not the best owner of those assets," he said. There may be other opportunities for similar infrastructure deals in the chemical sector. Macquarie signed a €3.5 billion ($3.9 billion) deal in 2019 with Bayer AG and Lanxess AG that eventually gave its European investment arm full ownership of Currenta, which oversees infrastructure, energy supply and other essential services like waste management for chemical parks in Germany's lower Rhine region. LyondellBasell Industries NV is in the process of shuttering its more-than-a-century-old Houston refinery, which sits on valuable real estate that might be appealing to an infrastructure or private equity investor. The fertilizer industry could also be a potential target for similar infrastructure carveouts, Parkinson said. But the implications could also be much broader. Philosophically speaking, an infrastructure carveout isn't that much of a stretch from industrial companies' current efforts to establish a higher worth for their businesses by parceling themselves up into what have lately become increasingly smaller packages. Read more: Conglomerate Model Works Until It Doesn't

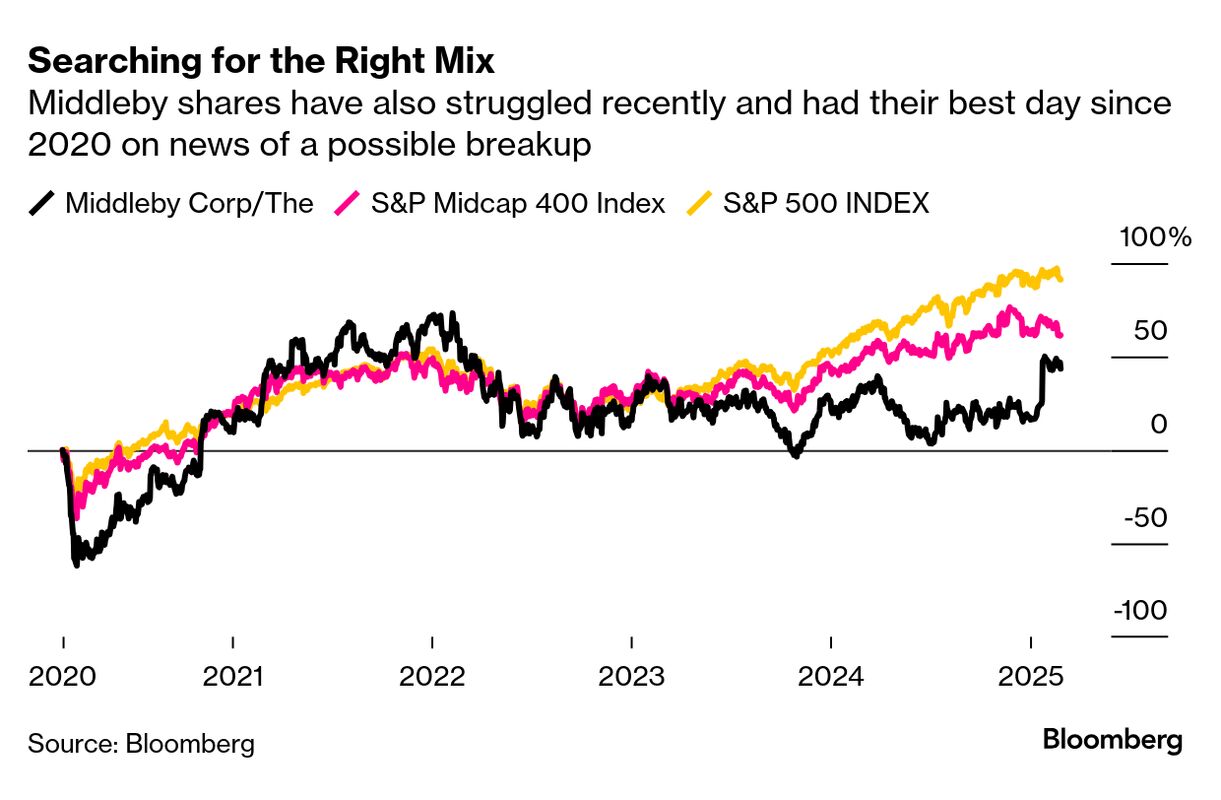

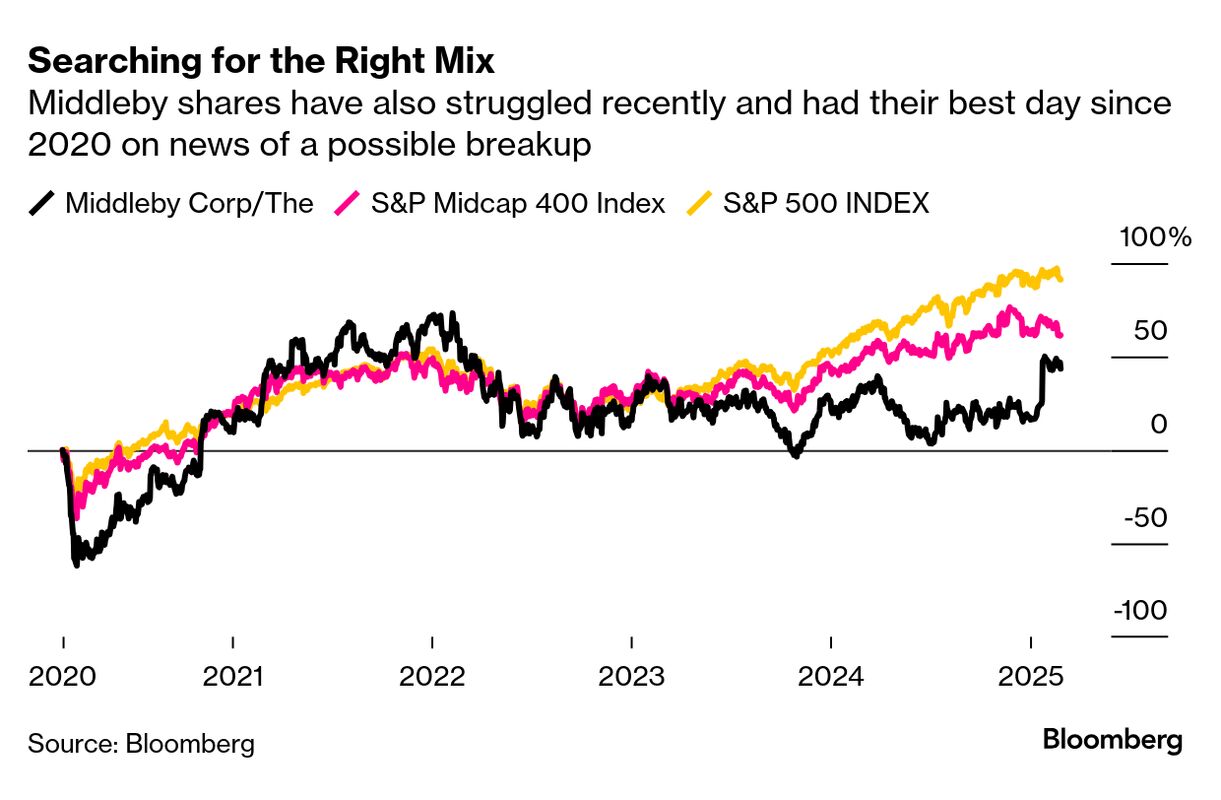

Just this week, Middleby Corp. announced it would separate the part of its business that makes meat grinders, sausage-packaging equipment and bacon presses from the divisions that sell ice cream machines to restaurants and ovens to consumers. The idea is that the food processing arm will be better positioned to do acquisitions as a standalone entity that has its own public currency and isn't competing with the commercial cooking equipment business for capital. But there is a tradeoff in the intermediate term on scale. Should the food processing unit trade at a similar multiple of earnings to publicly traded peer JBT Marel Corp., that would imply a valuation in the ballpark of $3 billion, depending on how much debt the business takes on. Middleby has a market value of about $9 billion, plus about $1.7 billion of net debt.

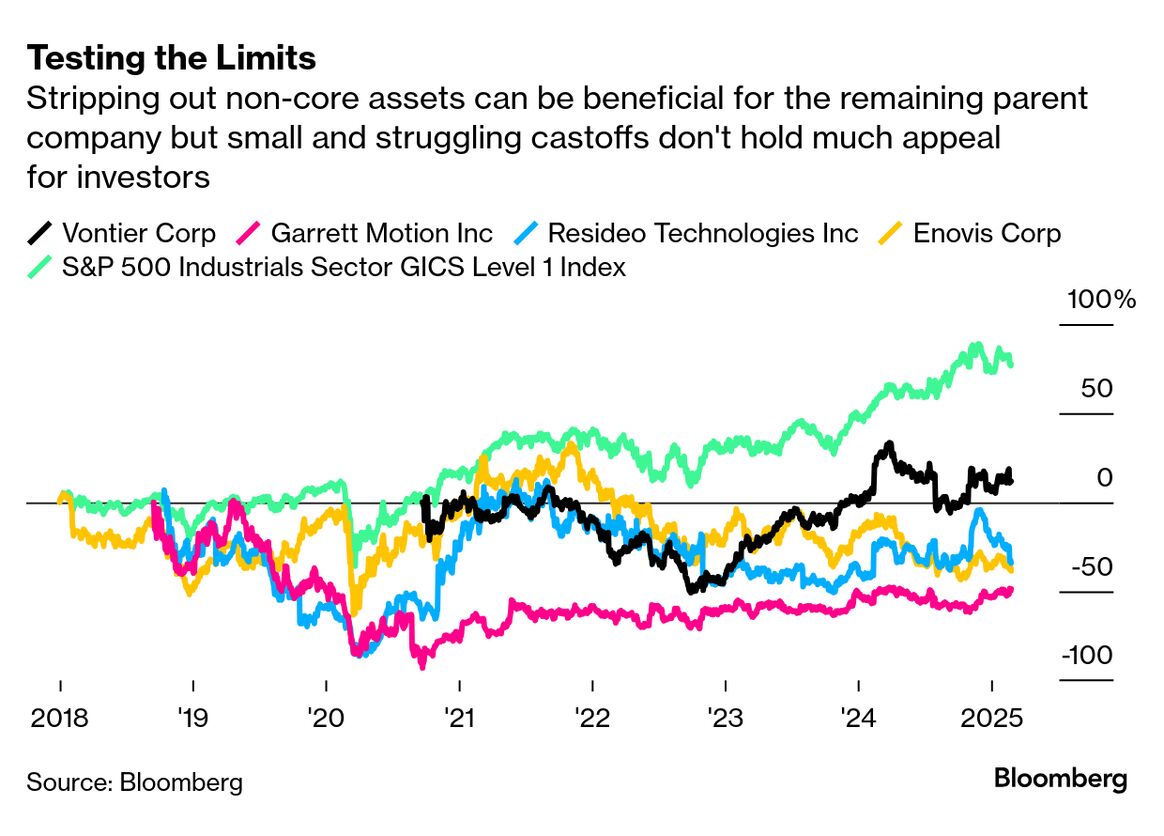

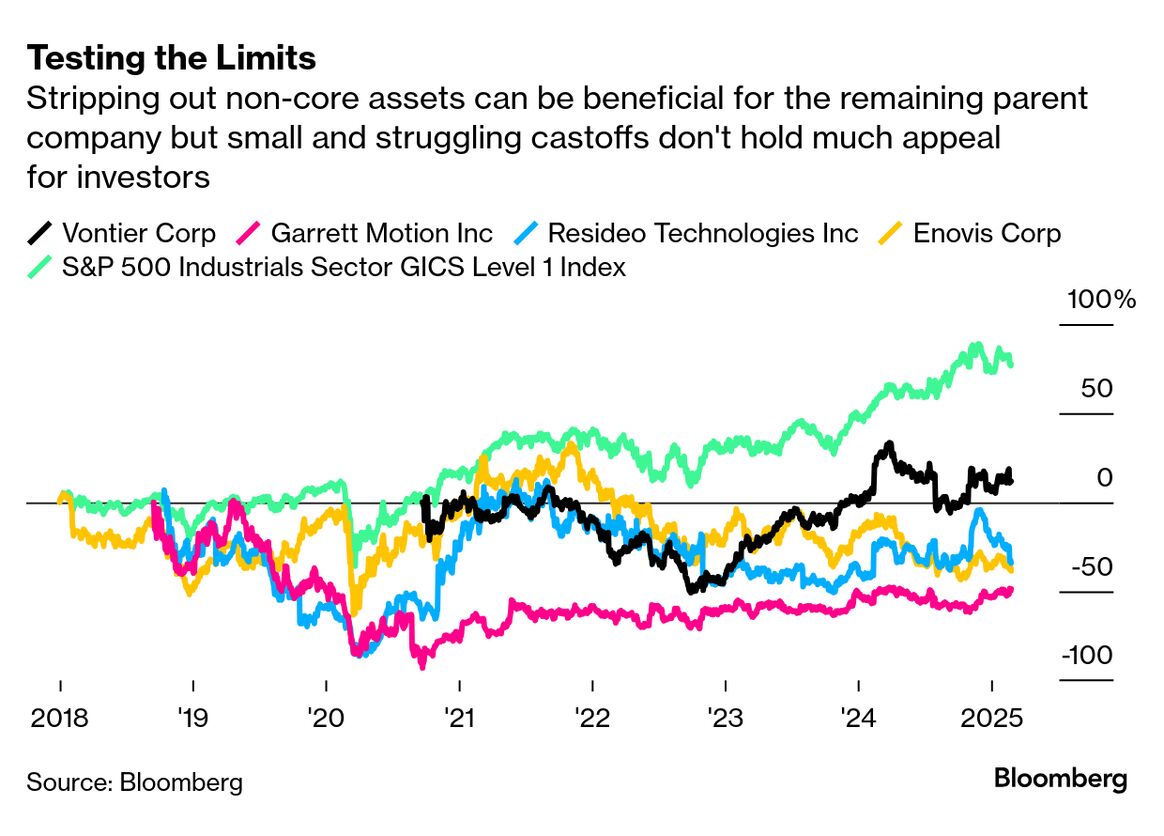

As a group, smaller companies have struggled to gain traction with investors; the S&P Small Cap 600 Index has increased less than 10% in the past two years, compared with a roughly 50% gain for the broader S&P 500 benchmark.  Time will tell how the Middleby food-processing unit fares and it's impossible to know what might have been if a company hadn't broken up. But smaller-scale splits elsewhere in industrials — including Honeywell International Inc.'s spinoffs of the Garrett Motion Inc. turbochargers business and Resideo Technologies Inc. thermostat and home-security unit, Fortive Corp.'s separation of its Vontier Corp. fueling systems arm and the breakup of Colfax Corp., now known as Enovis Corp. — haven't exactly been all-around smashing success stories. "Breakups have created value, but spinning off irrelevant pieces of assets has not created value," Melius Research analyst and founding partner Scott Davis said in an interview, speaking of the industry broadly.  In some cases, finding ways to monetize a diversified company's infrastructure could make more sense and create more value than carving its businesses up into yet more pieces. In the case of Dow, the purchase price on the Macquarie infrastructure investment implies a valuation of roughly 12 times the adjusted earnings before interest, taxes, depreciation and amortization that are associated with the Gulf Coast operations, according to estimates published by Vertical Research Partners analyst Kevin McCarthy at the time of the deal's announcement. Dow itself trades at about 7.5 times its expected earnings this year. "With enhanced financial flexibility from this partnership, Dow is in a strong position to continue to invest in growth and deliver enhanced returns to our shareholders, particularly as market conditions improve," CEO Fitterling said in late January on the company's fourth-quarter earnings call. Dow is maintaining majority ownership and operational control over the Gulf Coast assets but the deal also opens up access to the infrastructure to third parties. Not every industrial business is going to be the right fit for an infrastructure carveout. Bringing in an infrastructure partner adds a level of complexity to an industrial operation, and so the assets involved in a transaction have to be substantial enough to make that intricacy worthwhile, Aaron Rubin, head of Americas energy infrastructure at Macquarie, said in an interview. It also helps to have some kind of strategic story, he said. This isn't essential but it does make a deal more interesting for investors than a bunch of pipelines or railroad tracks might be on their own. In the case of the Dow deal, petrochemical production has been expanding along the Gulf Coast, driven in part by access to readily available and cheap energy sources derived from fracking in nearby shale formations. By opening up Dow's Gulf Coast infrastructure assets to other customers, there's an opportunity to operate them more like a utility and spread costs around a larger base, Rubin said. "A data center is a really interesting target customer market," Rubin said. Data centers "need very reliable energy, they need it at a low cost, they need to be able to get up and running quickly, they need land access and a variety of other infrastructure," including water supply and waste management at a competitive price, he said. The Dow assets tick a lot of those boxes, he said. The risk of separating out things like railway hubs, chemical storage and power generation from the rest of an industrial company is that it can create a cash outflow that wasn't there before. Macquarie considers the Dow Gulf Coast infrastructure stake to be a long-term investment, but as with most financial partner deals, it's not meant to be a permanent one, which raises the question of what might happen to these assets down the road. Turning infrastructure that previously existed just to serve one company into a separate business with its own economic drivers and priorities can also create conflicts of interest. Consider the examples of Air Canada and Gol Linhas Aereas Inteligentes SA, which spun off their loyalty programs in an attempt to create value for shareholders. For the airlines, the benefit of a loyalty program is to motivate passengers to return every time they travel but an independently run entity may seek to maximize profit through the sale of mileage credits to third parties such as credit-card partners. Both carriers ultimately reabsorbed their loyalty programs. That's why it's important to find the right partnership and establish a symbiotic relationship, Rubin said. In Dow's case, the focus on ancillary infrastructure rather than product-focused operations and the company's decision to retain majority control likely reduces some of these risks. With such critical assets, reliability is paramount and figuring out a solution that satisfies both the financial partner and the industrial operator "takes quite a bit of work and patience and creativity," Rubin said. "The tariffs go on, not all of them, but a lot of them." — Donald Trump, president of the United States Trump made the comments on Wednesday in a cabinet meeting, along with other seemingly contradictory remarks about the timing of levies on Mexican and Canadian imports in particular. On Thursday, he said that 25% tariffs on the US's Northern and Southern neighbors would take effect on March 4 as a one-month reprieve negotiated by Mexico and Canada expires. Trump also said he would put an additional 10% tax on Chinese imports, on top of a broad 10% levy that already went into effect earlier this month. He has proposed or threatened additional tariffs on everything from European imports, automobiles, semiconductors and pharmaceuticals to steel, aluminum, copper and goods from countries that tax US products — with varying timelines and clarity. The constant murkiness over tariffs is creating, to put it mildly, an extremely difficult environment for businesses to make decisions about investments. Read more: American Made Risks Becoming America Alone "It is very hard to plan. Interest rates? Tariffs? Wow," said a respondent from the non-metallic mineral product industry to the latest Federal Reserve Bank of Dallas' Texas manufacturing outlook survey released this week. "It's so weird how we are slow as molasses right now, yet a year ago, we were very busy at this time. I'm very worried about the possible tariffs affecting some of our material costs, which we will have no choice but to pass along to our customers. This is a terrible policy decision and hopefully will not be very long lived," said another respondent from the printing industry. Deals, Activists and Corporate Governance | Solventum Corp., the health-care business that 3M Co. spun off last April, agreed to sell its purification and filtration division to Thermo Fisher Scientific Inc. for $4.1 billion. The unit was Solventum's smallest business and the divestiture will leave the company focused on wound care, surgical products, health information systems and dental tools. Activist investor Trian Fund Management plans to push the company to further simplify itself by separating out the health software and dental product units, the Wall Street Journal reported, citing people familiar with the matter. A reminder that this company is itself the product of a breakup and has just announced another breakup. As discussed above, with many of the more obvious splits having already happened, anything from here is apt to involve a lot more nuance and much smaller standalone businesses that may struggle for relevance with investors.

Blackstone Inc.'s infrastructure arm agreed to acquire a superyacht and marina servicing business for $5.65 billion from real estate investment trust Sun Communities Inc. While boating sales have moderated from the boom seen during the pandemic, the marina business tends to be less vulnerable to economic swings. Capacity limits mean there usually aren't enough slips to go around. Sun Communities purchased the Safe Harbor marina business in 2020 for $2.1 billion and expects to book a $1.3 billion gain on its investment. Elsewhere in boating M&A news, François Pinault, the billionaire behind brands such as Gucci and Balenciaga, acquired a majority stake in Aqua Expeditions, a boutique luxury line that specializes in remote destinations, through his family's private investment company. Boeing Co. announced that Stephanie Pope would no longer hold the title of chief operating officer but would continue to oversee the company's commercial airplane division. Pope was granted the COO title in late 2023 under former CEO Dave Calhoun, who saw her as an heir apparent. Calhoun stepped down last year amid a cacophony of blowback from Boeing's customers after a mid-air blowout on a 737 Max jet operated by Alaska Air Group Inc. While Calhoun publicly advocated for Pope as his replacement, the job instead went to Kelly Ortberg, the former CEO of avionics manufacturer Rockwell Collins. |

No comments:

Post a Comment