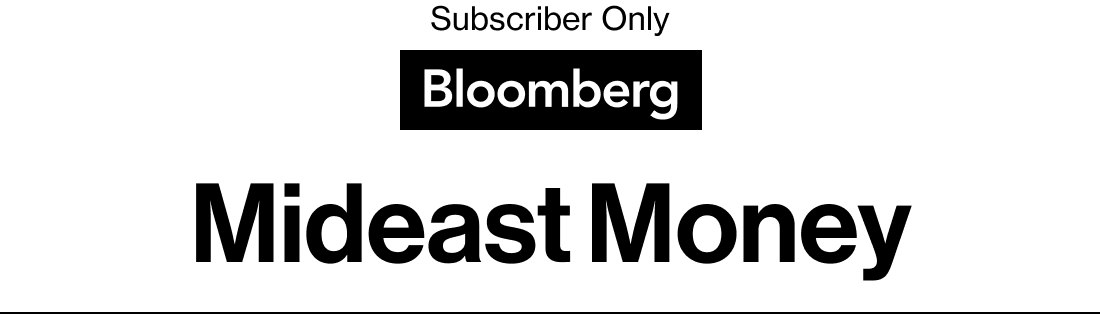

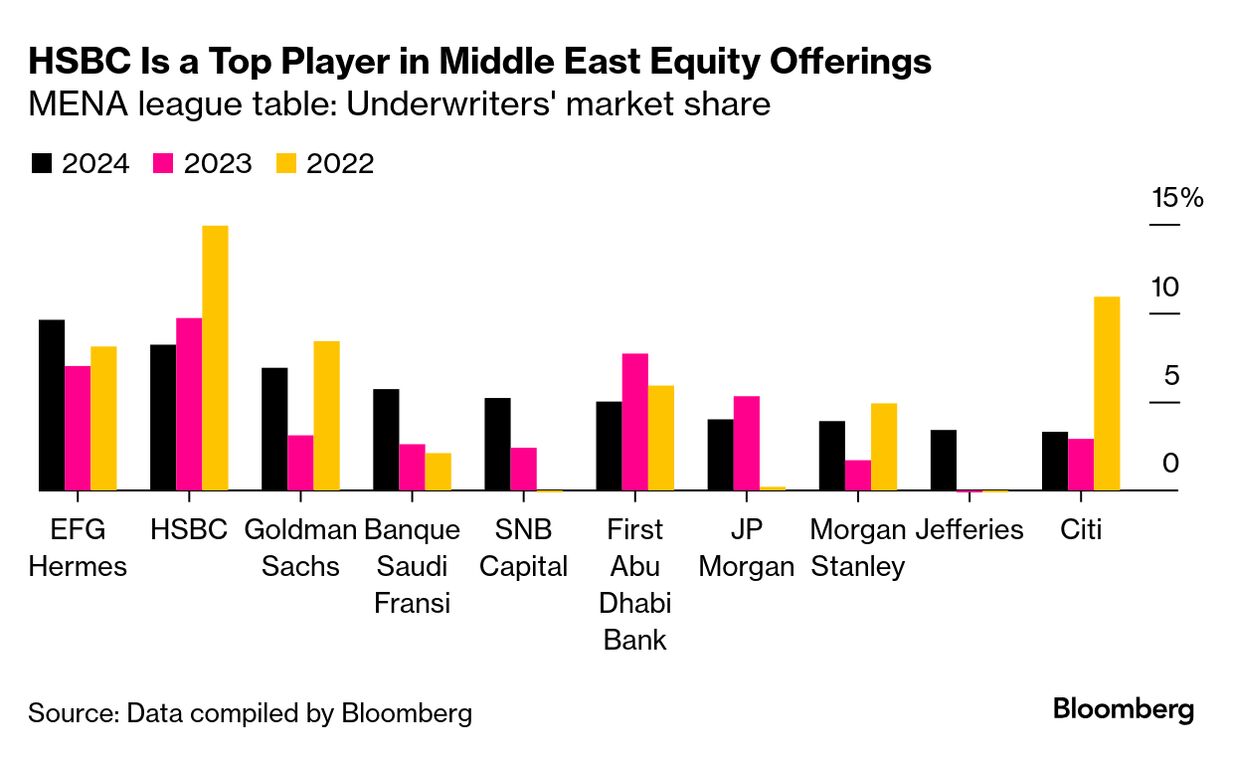

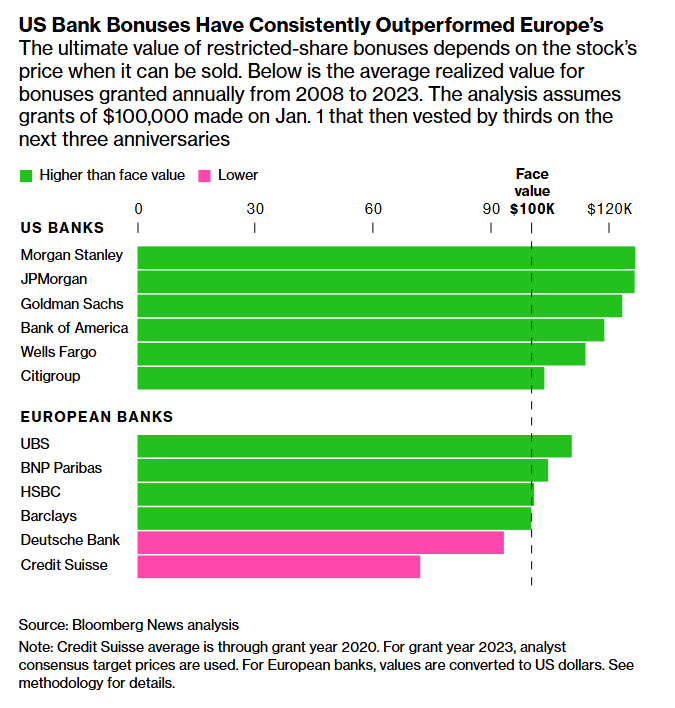

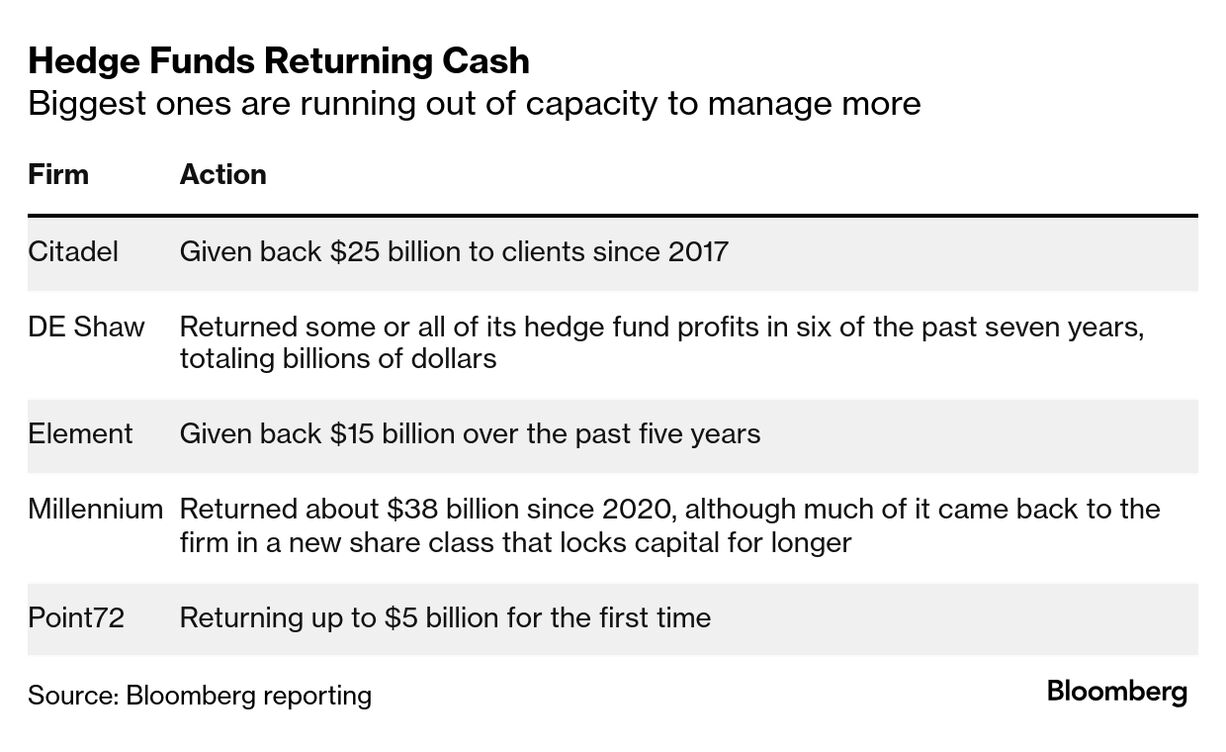

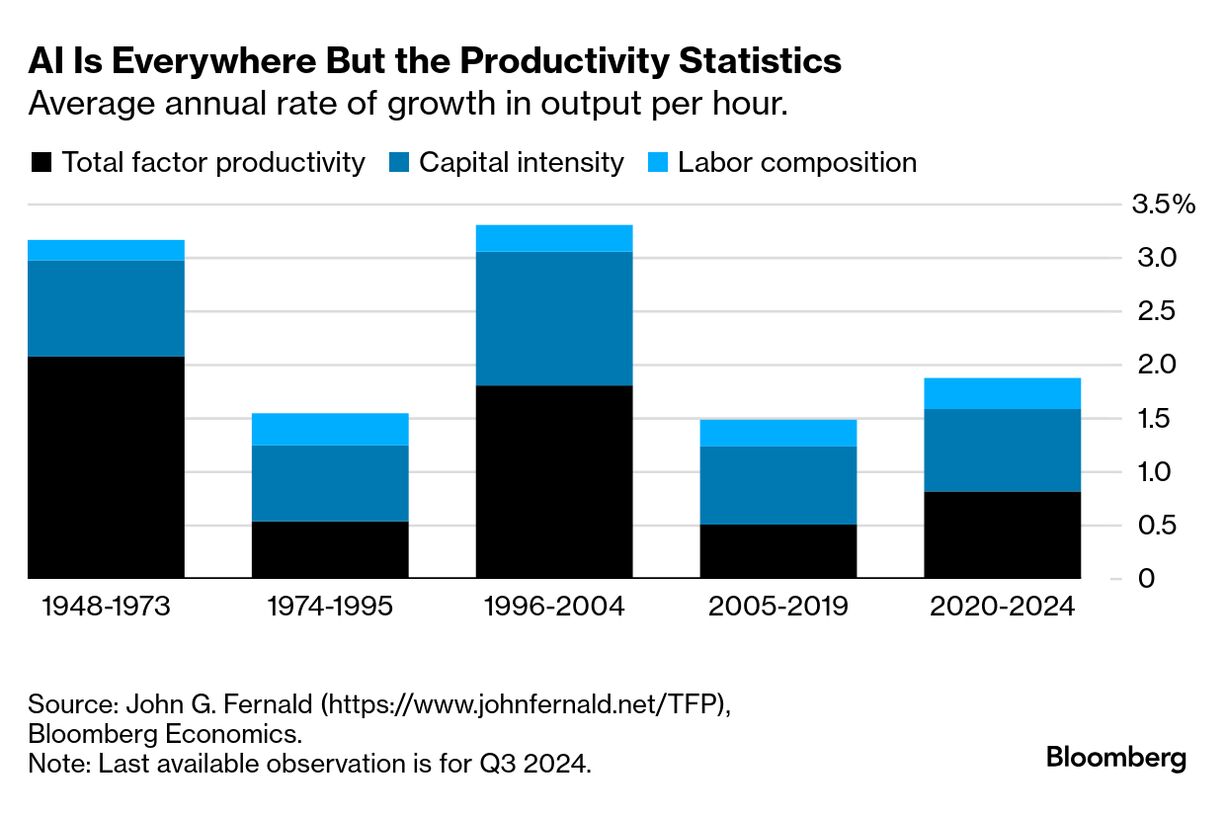

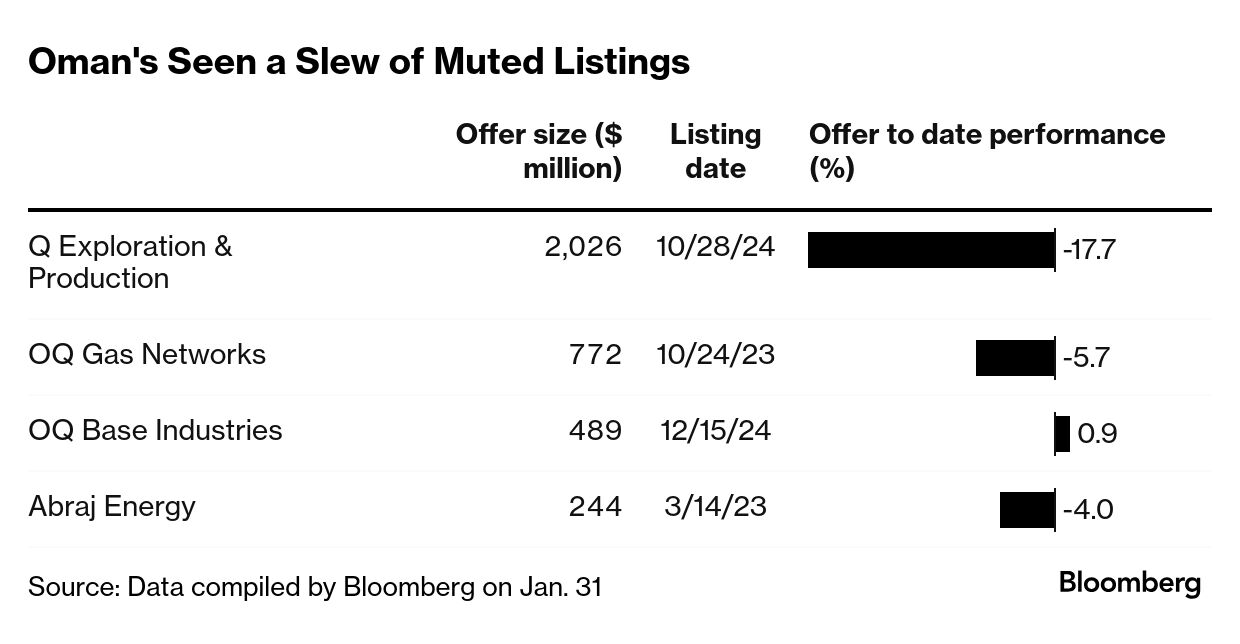

| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, Dubai's $100 million mansions, Abu Dhabi's $1.2 billion mining venture and a crucial test for Oman's IPO push. But first, let's dive into how the Middle East's trillions could offer a lifeline for HSBC. Months after taking over as HSBC's chief executive officer, Georges Elhedery has pulled the trigger on a wide-ranging overhaul that signals an end to its ambitions of becoming a global player in investment banking. It also puts the spotlight on two regions where the bank can challenge Wall Street giants — Asia and the Middle East. When he was appointed as HSBC's boss, this newsletter spotlighted Elhedery's decade-long stint in the Middle East, including three years as head of the region. That, local bankers said at the time, could lead to greater focus on the Gulf, given his deep understanding of the market and the contacts he built during his stint.  Georges Elhedery Photographer: Paul Yeung/Bloomberg Six months on, that initial optimism seems justified: the firm announced it will wind down some investment banking operations in Europe, the UK and the Americas. That means the Middle East will remain one of few markets where HSBC will continue to work on deals and new share sales — welcome news to staff in the oil-rich region, where the bank has ramped up headcount amid a flurry of deals. HSBC's top brass laid out their main goals on a call last week, my colleagues Harry Wilson, Jan-Henrik Förster and Manuel Baigorri reported. They would no longer tolerate the cost and expense of running sub-scale operations that stood no chance of competing with the likes of JPMorgan or Goldman Sachs. While the firm remains a minor player on M&A and equity underwriting in the US and Britain, the picture is vastly different in the Middle East. HSBC was second only to EFG-Hermes on equity offerings in the Middle East and North Africa in 2024, after leading the league tables for the previous two years. On deals, too, it's done significantly better relative to other regions. Read More: HSBC Bolsters Saudi Investment Banking Team to Tap Deals Boom There's another factor at play. An influx of millionaires has meant that HSBC, like its global peers, has been rushing to grab a sliver of that lucrative market. Aladdin Hangari, a key relationship manager for the Qatari royal family while at Credit Suisse, recently joined the firm. Hangari told Bloomberg News last year the bank will look to hire "opportunistically" — after adding 100 bankers in 2023. The Middle East's importance to HSBC's plans going forward was perhaps also evident in the weeks after the executive took over. Elhedery, alongside the bank's Chairman Mark Tucker, were part of a senior delegation that met with officials including Abu Dhabi's crown prince. That marked one his first major trips abroad as the new CEO. Read More: Millionaire Magnet UAE Spurs Private Banking Boom Must-read Mideast stories | Abu Dhabi developer Eagle Hills is deepening its international foray with a $6 billion plan to build projects in Georgia. Wealth fund ADQ's new joint venture is targeting investments of $1.2 billion over four years in the metals and mining sector. UAE's Adnoc and energy producer OMV are considering buying Canada's Nova Chemicals and rolling it into an industry giant they're seeking to create. Saudi Arabia's economy grew at the fastest quarterly pace since 2022 as the non-oil sector expanded. Alternative investment firm Arcapita is considering setting up a real estate investment trust to house its Middle Eastern property assets. Permira is looking to open an office in Dubai, joining private equity peers that have bolstered their presence in the region. Turkish mobile app hitmaker Dream Games is in talks with investors to raise around $2.5 billion in fresh debt and equity. M42, an Abu Dhabi investment vehicle focused on the intersection of health care and artificial intelligence, is willing to work with technology from either the US or China, but is committed to deepening ties with Washington, according to a top executive. Investcorp said Daniel Lopez-Cruz is rejoining as global head of private equity amid a series of management changes at the Middle East's biggest alternative asset manager. The UAE is testing technologies aimed at boosting the rain generated by cloud seeding, as it bids to improve water security.  A cloud-seeding flight over the United Arab Emirates in 2024. Photographer: Andrea DiCenzo/Getty Images Here're a few other stories that caught my eye: | Donald Trump's trade war with Canada and Mexico aims a wrecking ball at the decades-old regional alliance that made the US the world's economic powerhouse. The dollar surged and stocks tumbled as the beginning of US tariffs ushered in a trade war threatening economic growth around the world.  US President Donald Trump. Photographer: Yuri Gripas/Abaca What America's tech billionaires really bought when they backed Trump. When is $100,000 not $100,000? An analysis of bonuses at the world's biggest banks shows just how much they're really worth. From D.E. Shaw to Citadel, some of the world's most sought-after hedge funds are handing back billions of dollars to clients — presenting opportunities for smaller peers to seize the flow and grow. Chinese artificial intelligence startup DeepSeek has challenged Silicon Valley's assumptions about costs, and rocked the stock markets. But what will AI do for the economy? Read More: Black Swan's Taleb Says Nvidia Rout Is Hint of What's Coming A Kansas City wealth manager has built an $11 billion fortune on Goldman Sachs and TPG deals.  Peter Mallouk Source: Creative Planning A record $2.5 billion haul from new share sales helped Oman leapfrog markets like the UK last year, but the sultanate faces an early test of investors' appetite in 2025. The Oman Investment Authority-backed Asyad Group's plan to sell at least a 20% stake in its shipping unit comes against the backdrop of muted debuts for two initial public offerings, including Muscat's largest ever deal. Asyad Shipping's IPO will also serve as an indication of the government's ability to execute its divestment program, for which it has earmarked around 30 assets. Related Coverage Dubai's developers are trying to outdo each other with ostentatious mansions and penthouses — priced anywhere from $60 million to more than $120 million — as they court millionaires from around the world.  Beach front mansions command some of the highest prices in Dubai. Source: Wissam/Palace Group One builder transported a giant glass wall thousands of miles to give the owner his chosen sea view. Another worked in a private lobby and elevator for the buyer of a penthouse so big that it straddles two towers. Yet another created a movable floor for a client's swimming pool that rises to meld with the garden tiles during parties. Last year, 435 homes valued at more than $10 million each were sold in Dubai, reaching a record and surpassing New York and Hong Kong, according to Knight Frank. The property researcher estimates that ultra luxury prices will jump at least another 5% this year in the emirate after surging about 67% since 2021. Wealthy families shopping globally for second and third homes can still find more space for the same buck in Dubai. But catering to the whims of the global rich isn't cheap — or easy. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment