Waiting for Tariff Tuesday | The US starts imposing 25% tariffs on Mexico and Canada, its two neighbors and biggest trading partners, at midnight tonight, as well as 10% tariffs on China. Or does it? And if so, should we really assume they'll stay in force long enough to have an economic impact? We need to answer those questions as best we can before we assess what could be one of the biggest divergence points for the global economy in a generation. At the time of writing, dramatic moves in all three affected currencies make clear that doubt persisted even after President Donald Trump's verbal announcement Friday: The offshore Chinese yuan is close to an all-time low against the US dollar after another startling weakening. The Canadian dollar dropped to a 22-year low. Despite all the warnings, broad-spread tariffs hadn't been priced in. Why not? Andrew Bishop of Signum Global Advisors argues that even after Saturday's formal memorandum on Canadian tariffs, it's still only a paper threat, which has been delayed twice. Tariffs could have been levied on Inauguration Day, and were then scheduled for Feb. 1. And there are no "Holy Grail" concessions that Trump is holding out for: Our base case remains that Trump's threatened China and Mexico tariffs will not be implemented, and that his Canada tariffs will be whittled down and/or postponed for a later date.

Peter Tchir of Academy Securities argues that "Trump has gone out of his way to link these tariffs to the flow of fentanyl" and so there is an off-ramp: The orders could be rescinded if the targeted countries show new or improved efforts to stop its manufacture and distribution. But this cuts both ways. The fentanyl scourge has been growing for years. Canada, in particular, has a minimal role in it. Mexico has already beefed up limits on migrant border crossings to show that it's trying to help. Tangible progress could take years, and Trump's order contains no clear targets. George Saravelos of Deutsche Bank AG argues that this means there isn't an off-ramp: First, it does not have a clear set of criteria for de-escalation. Second, the overall tone/emphasis is on immigration… ie, the hawks have the upper hand. Based on the information so far, this is very much the WORST case outcome.

Even as a negotiating tactic, Saravelos puts Trump's announcement "at the most hawkish end of the protectionist spectrum we could have envisaged," including the speed of implementation and the broad scope. While others argue that limiting Canadian energy to only a 10% tariff shows leniency, he argues that taxing energy at all "pushes back against the market narrative that cost-of-living considerations would act as a restraint." Bond market inflation breakevens rose menacingly Friday, but it's doubtful they're yet at a deterrent level: Trump himself suggested to reporters Friday that the levies weren't meant as fentanyl or border bargaining tools, but were rooted in large trade deficits: "It's something we're doing, and we'll possibly very substantially increase it, or not, we'll see how it is. But it's a lot of money coming to the United States." That's an argument for sustained tariffs, which would have sustained effects. If that's right, the longer-term consequences for the global order are profound… The greatest objection to this plan is that it's stupid. This is true even if we accept the following: - Globalization has gone too far and the will of the populace is plainly to reverse it.

- Trump was elected as Tariff Man who would adopt protectionist policies.

- Tariffs can be used as a diplomatic threat and then withdrawn, as shown in the row with Colombia.

- The US has a trade deficit with both countries.

- Fentanyl poses a serious threat to both health and law and order in the US.

- Adam Smith and David Ricardo wrote centuries ago, and their arguments for free trade are now sterile and academic.

- US law and the constitution don't stop the president from doing this; and

- The USMCA trade agreement — signed by Trump himself — doesn't stop him from doing it, either.

I don't agree with all of these statements, but even we accept them, this policy is dumb. In no particular order: - If fentanyl is really driving this, then putting tariffs on Canada isn't even in the top 100 policies that might deal with it.

- If there is concern over the border, then a measure that could drive Mexico into recession and force a new "invasion" of desperate people looking for work is exactly what you don't want to do.

- Prices go up when supply chains are disrupted. Supply chains with Mexico and Canada are more tightly integrated with the US than anywhere else. Targeting them will maximize disruption, inflation and job losses.

- As the US exports a lot to Canada and Mexico, both countries can retaliate most effectively.

- Sequencing is important, and it would be wise to get tax cuts on the books (as in Trump 1.0) before trying this.

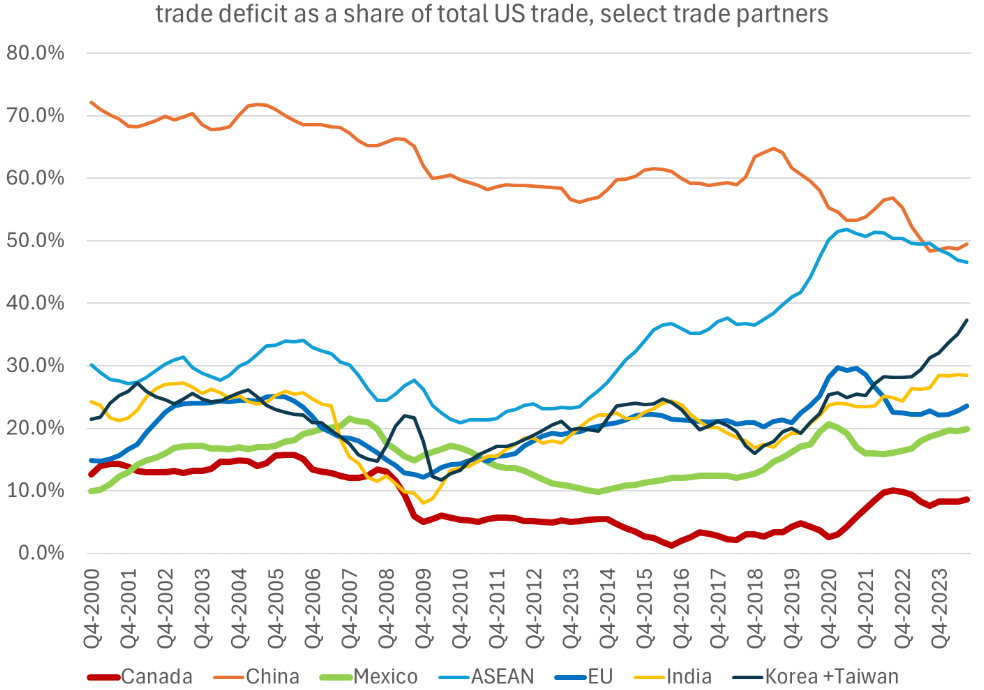

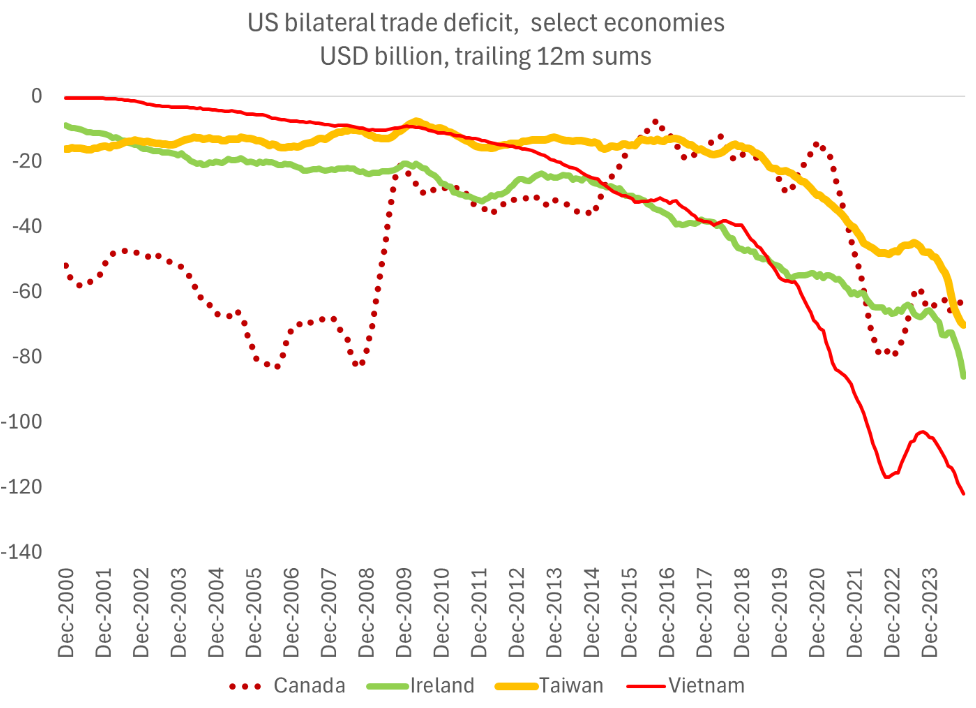

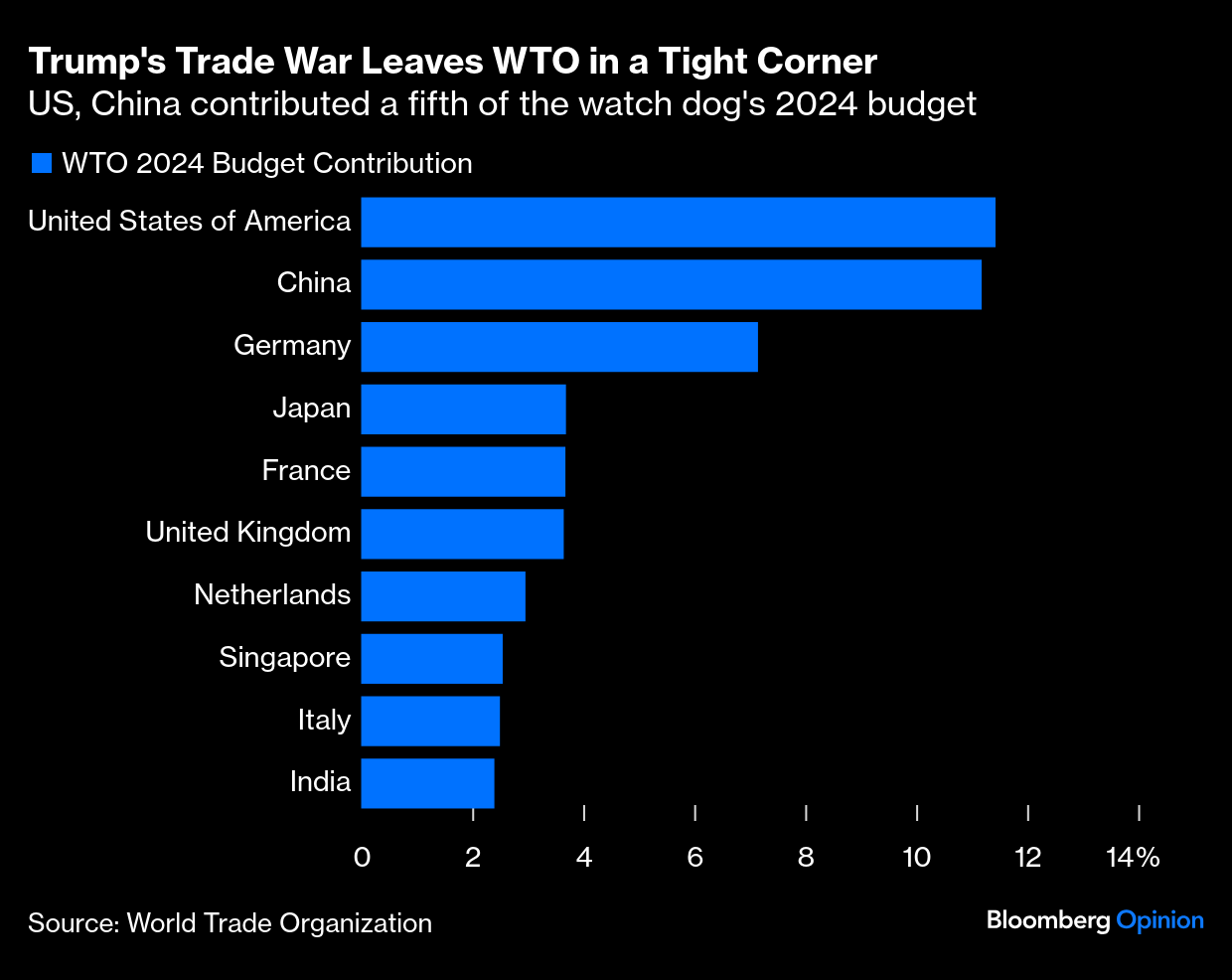

If trade deficits are the problem, these countries should be a long way down the list. Brad Setser of the Council on Foreign Relations offered a couple of telling charts. The US imports a lot from its two neighbors, but also sends them a lot. That means their deficit is low compared to several other countries that could have been picked on: Smaller countries to which the US exports little, but which are major suppliers, make better targets if trade deficits are the problem. If the US wants to make such an example pour encourager les autres, there are Vietnam, Taiwan or Ireland: In sum, even though Trump has a mandate for an anti-globalist and protectionist policy, starting with the two neighbors maximizes the risk to US jobs and prices. It offers minimal prospect of stemming fentanyl, stirs the risk of more migrants coming from Mexico, and is minimally effective in reducing the trade deficit. The reason markets appear to hate this, and didn't believe Trump meant it, is that it's a terrible idea. For a time, there was a belief that Trump's persistent tariff rhetoric was just a ploy to gain the upper hand over allies and foes at the negotiation table. This now leaves everyone scrambling to gauge the far-reaching consequences of his trade war — Canada and Mexico have announced countermeasures — and its possible impact on the retreat of inflation. How bad could this get? Barely a fortnight ago in Davos, an exasperated World Trade Organization chief Ngozi Okonjo-Iweala prayed to member countries to not get caught up in tit-for-tat tariff retaliation. Her delicate balance is understandable. In 2024, the US contributed about 11.4% of the WTO's $405 million budget; China paid almost as much: The unfolding tensions expose the weakness of the organization's watchdog role. Trump's complaints about unfair treatment by the European Union, and Japan's US $70 billion trade surplus and the yen's severe undervaluation suggest they'll also be in the America-First crosshairs. Under a full-scale trade war scenario, the WTO predicts a "catastrophic" double-digit loss in global gross domestic product, as in the 1930s when the US passed the infamous Smoot-Hawley Act. Unless there's a settlement to the immediate impasse, the mandatory review of the United States-Mexico-Canada Agreement due in 2026 looks like it could resemble a wake, says Christopher Sands of the Wilson Center, a Washington-based policy think tank: Before negotiating a truce, there must be a ceasefire. Canada and Mexico should not agree to review or renegotiate the USMCA early or ever unless the Trump administration sets aside the 25% tariff threat. Holding to this precondition will require resolve and a united front by leaders in Canada and Mexico. But without it, the USMCA in its current form is meaningless and beyond repair.

That leads to the more profound question of exactly what Trump is trying to achieve. Tina Fordham of Fordham Global Foresight asks whether the tariffs "are a source of revenue-generation to fund tax cuts or otherwise boost the US Treasury? Or… a show of force. How will we measure that we're 'winning?'" Marko Papic of BCA Research argues that the US strategy is to make an example of allies, proving that it won't use kid gloves with anyone else. But putting an onerous tax on accessing American consumers means they'll no longer drive global growth, and the rest of the world will shift away from the US market: China has been doing this already, and they have been extremely successful. This is something that I've told members of Congress directly; they are losing the battle over the hearts, minds, and pocketbooks of people in Indonesia, Brazil, Vietnam, etc.

Ultimately, any America-First policy success in asserting dominance could be fleeting. Gavekal Research argues that the narrow focus on energy will yield a quick win as the US is already the world's biggest combined oil and gas producer, but can't mask the systemic failure to reindustrialize America: The scope for further gains is small. The key energy story of the next two decades will be about managing the shift to electricity and its technologies. Oil and gas are less important here than renewables, nuclear, and modern grids — all areas where China has a big lead. DeepSeek has revealed a similar risk in other technologies; China's ability to scale up cheaply may outperform the US's high-cost innovation model.

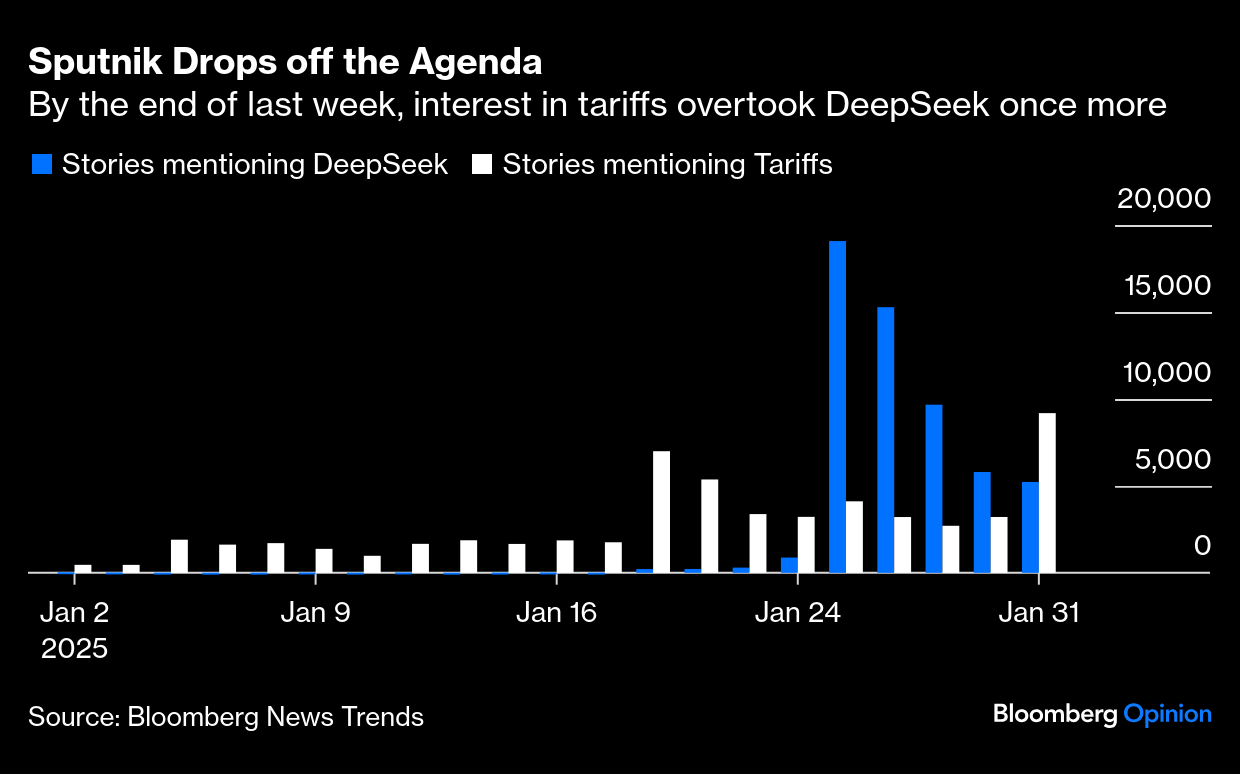

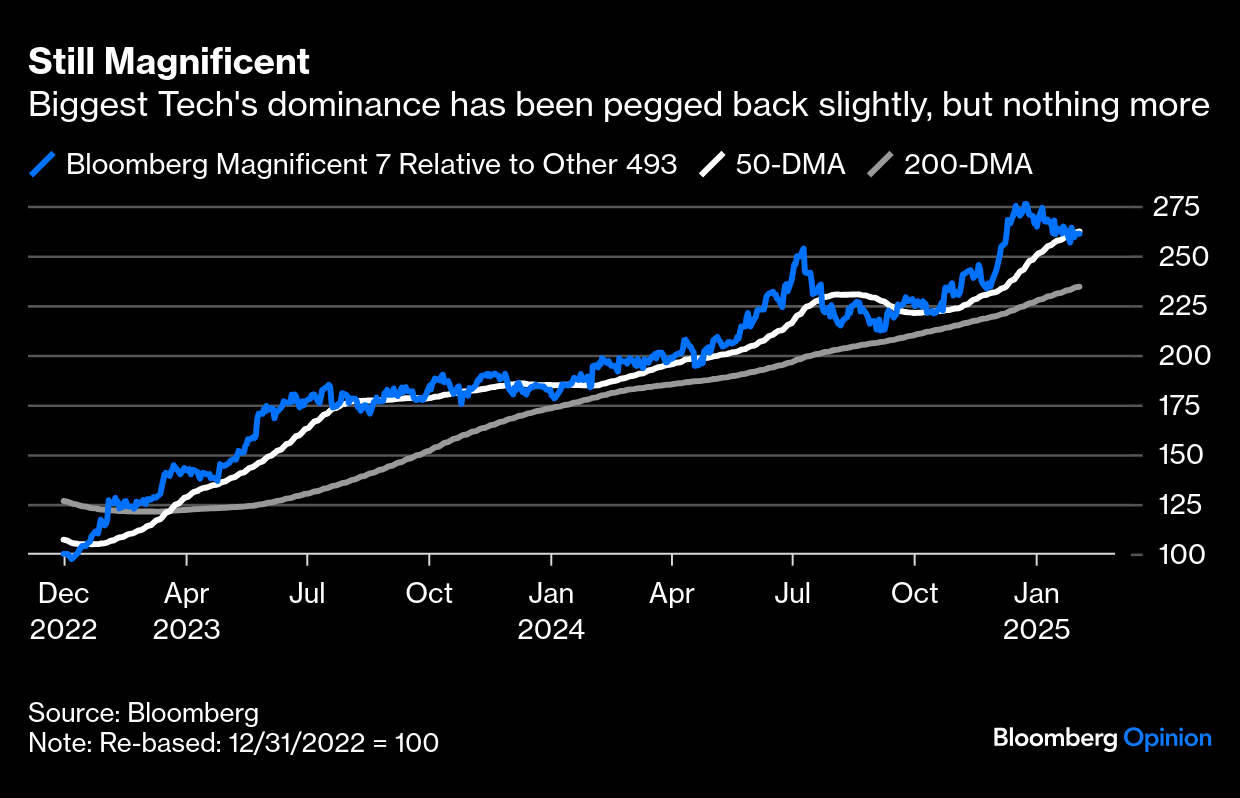

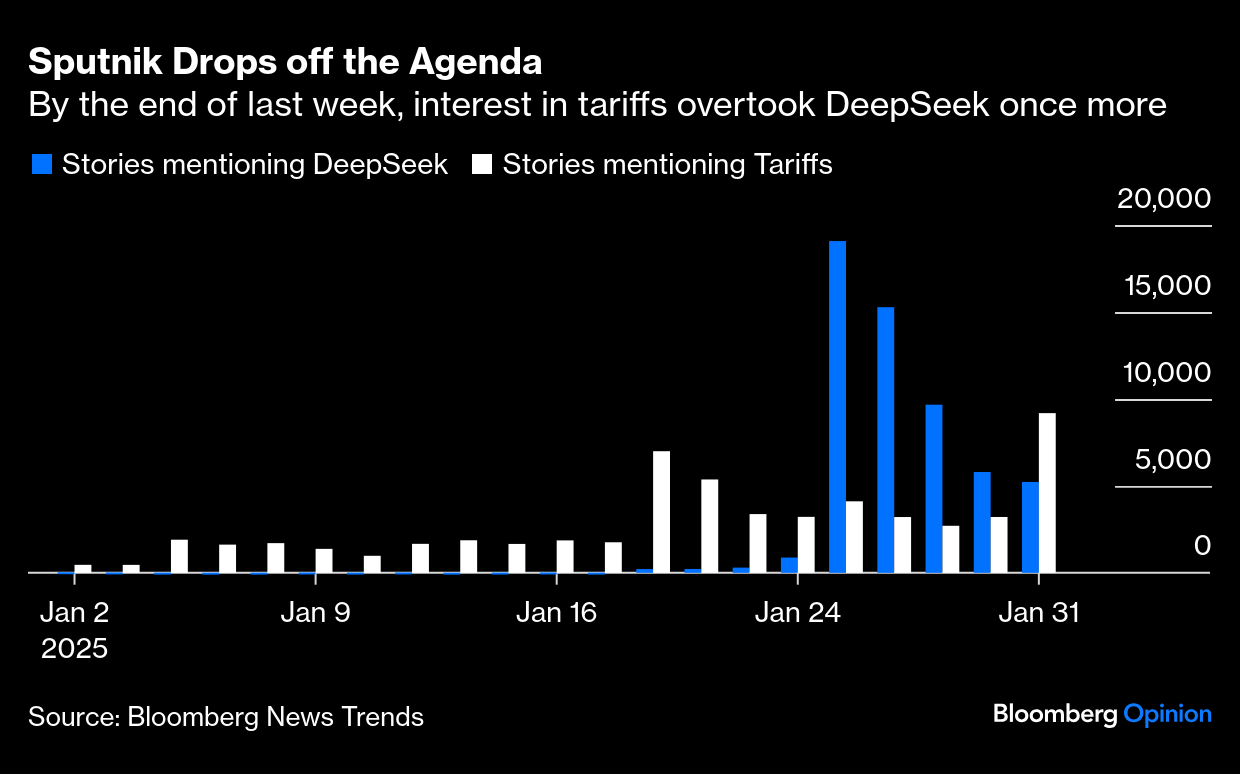

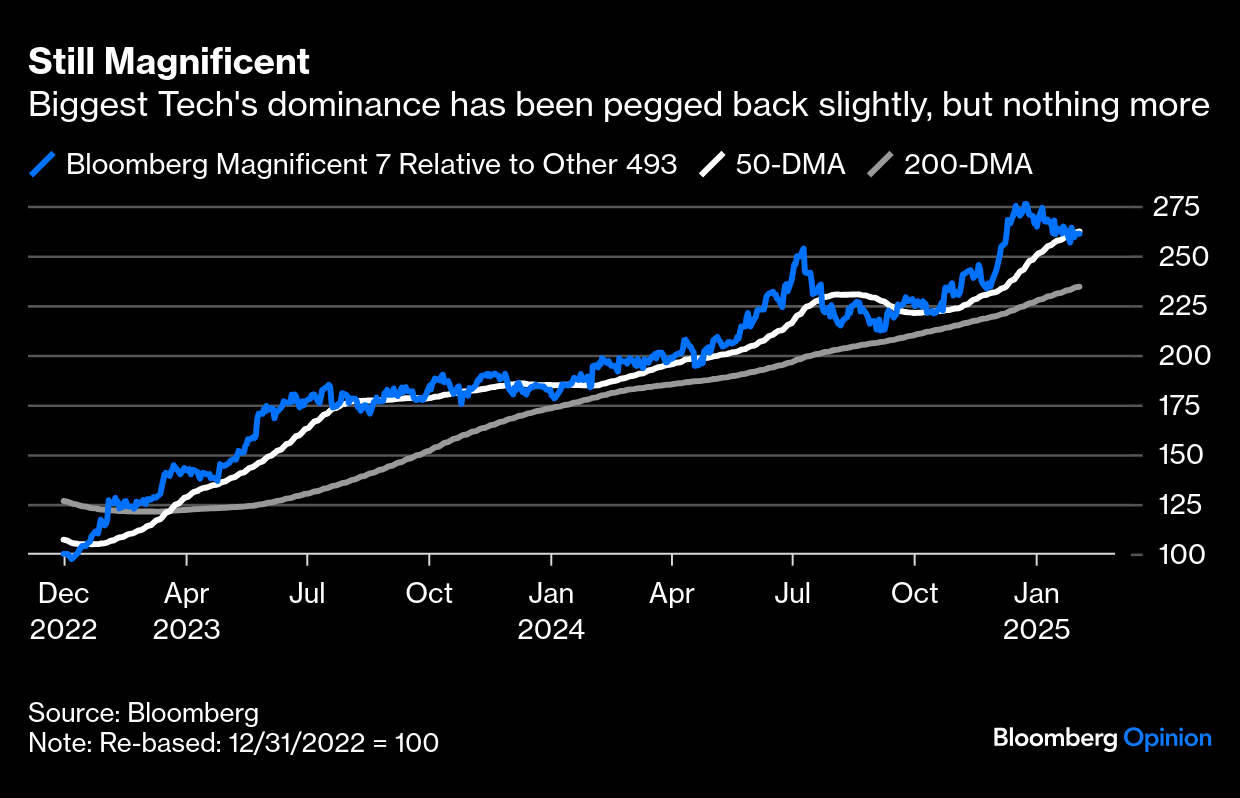

— Richard Abbey This time last week, the Chinese AI app DeepSeek dominated conversation. It inflicted the biggest ever one-day loss on any one company's market cap for Nvidia Corp. last Monday. By the end of the week, tariffs and trade were back at the top of the agenda. This chart from Bloomberg Trends shows the number of stories mentioning either DeepSeek or the word "tariffs" that appeared on the terminal, from all sources, during January:  Tariffs will dominate the agenda for a while, but it's worth taking stock of DeepSeek. First, the Magnificent Seven internet platforms have barely had their sails trimmed. This chart tracks Bloomberg's index of the Seven relative to the next biggest 493 stocks. The Magnificents have led the 200-day moving average without a break for two years now. They remain well above it, and are almost exactly at their 50-day moving average. To date, this is a minor move that can't be called a correction, despite the sense that DeepSeek was a Sputnik Moment for US tech dominance:  By far the biggest impact was on the chip manufacturer Nvidia, the dominant provider of the processors used to power AI. DeepSeek's success implied that demand for these processors needn't be so great in the future. Despite their selloff, however, Nvidia shares still benefit from a fantastically generous valuation. The average S&P 500 stock sells at a multiple of about 1.7 times its annual sales. For Nvidia, this figure is 26: There's great uncertainty over exactly what DeepSeek can do, and how broad the ramifications could be. It therefore makes sense not to price in all of the damage from a worst-case scenario just yet. But rosy scenarios were already priced. If this is a bubble, it hasn't burst. While trade war grips the world, there has been drama at the Grammys. My sources watching the TV in the next room tell me that it's been a night for the ladies. And they're really good. Try Chappell Roan, who burst through this year, Sabrina Carpenter, Billie Eilish, Beyonce (now in her 40s and winner of best country album), and Charli XCX (in her 30s and suddenly making it big). And if you'd like to take contemporary pop seriously, try this video. It's an escape from tariffs. Have a great week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment