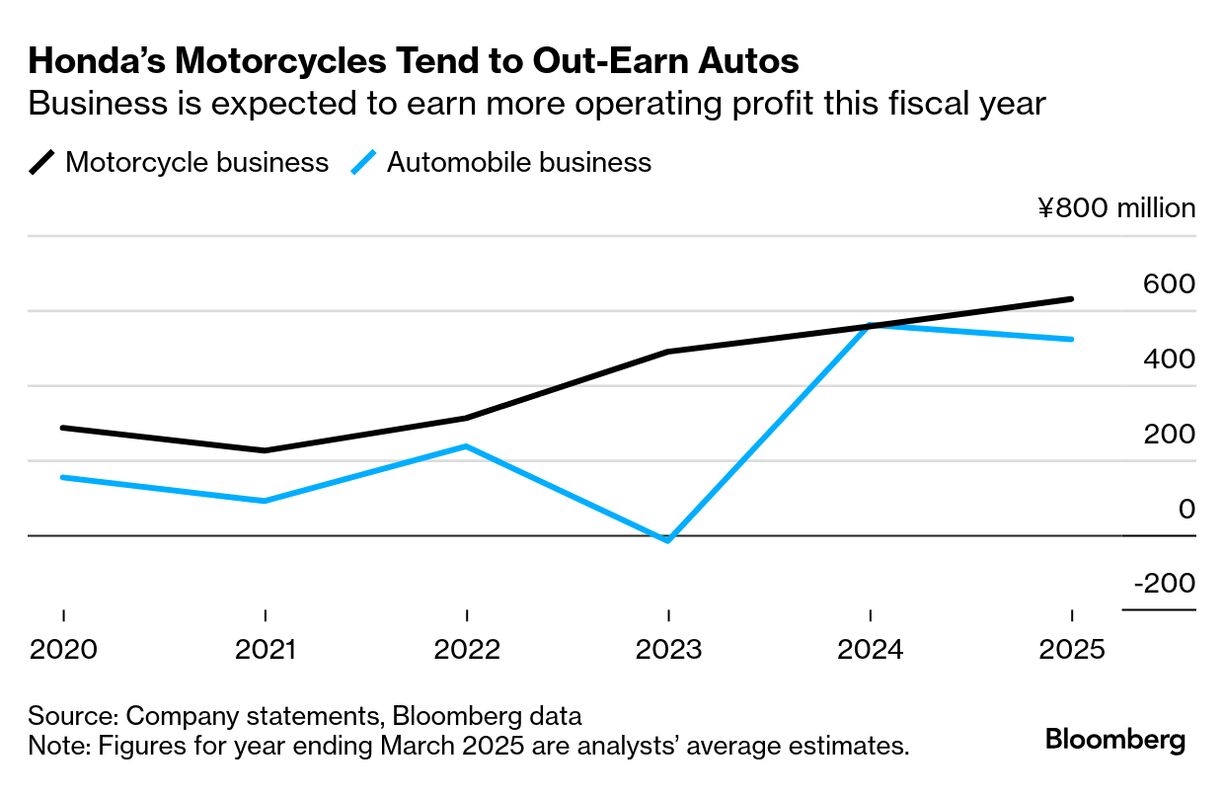

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Honda's effort to shore up car sales by absorbing Nissan could undermine an oft-forgotten but vital part of its company: a thriving motorcycle business. Honda's two-wheeler segment, which has already cornered 40% of the global market, could be better positioned to expand further if it's given more independence under a new holding structure. At the same time, its weight and veto power within Honda could mean negotiations may stall if it's made to bear the brunt of Nissan's shambolic financial situation. Honda's motorcycle division will become "even more important as a profit contributor" if combining with Nissan has a negative effect in the short term, said Julie Boote, an automotive analyst at London-based research firm Pelham Smithers Associates. The business is important for Honda and executives know it, so they may try to "keep it very much separate," she said.  Honda's two-wheeler segment has already cornered 40% of the global market. Photographer: Dhiraj Singh/Bloomberg Honda and Nissan reached a tentative agreement in December to bring both brands under a holding company slated to list shares in August 2026. The two Japanese automakers plan to put forward a framework for the deal in mid-February (the original deadline was late January) with an eye to finalize the transaction in June. While it's not yet clear what will happen to the duo's respective operations, the tie-up quickly led to speculation about the future of Honda's highly profitable motorcycle unit, and whether it may be ring-fenced from the rest of a combined company or given more freedom, albeit under the same umbrella. Nissan has much to offer when it comes to manufacturing capacity, a skilled workforce and decades of industry know-how. But it also has baggage: plunging profit, profligate incentive spending and unpopular products. Minoru Kato, the executive officer in charge of Honda's motorcycle unit, told reporters last week that he doesn't believe the two-wheeler segment will be impacted by the Nissan deal. "That said, it's crucial we find the right synergies as negotiations proceed," he added. Even if management did keep the motorcycle business at a distance, taking on Nissan's fiscal woes runs the risk of damaging Honda's bottom line. So far, the steps Nissan has taken to turn around its sorry state have underwhelmed. Two-wheelers accounted for about 16% of Honda's sales for the fiscal year that ended in March 2024 but an outsize 40% of its operating profit. "Not only was Honda founded as a motorcycle company, it's now a pillar of its profit as a business," said Bloomberg Intelligence senior auto analyst Tatsuo Yoshida. From the introduction of the Dream D-Type, the first production motorcycle model in 1949, Honda has grown to become the world's biggest motorcycle producer. It can make more than 20 million bikes a year at 37 production facilities in 23 countries and territories, and deliver them via a network of over 30,000 dealerships. But the industry's shift toward electrification could prove a sleeper threat to the division's dominance, and perhaps is another reason that shielding the business from the morass that is Nissan may make sense. Honda aims to debut 30 electric models and sell 4 million electric bikes annually by 2030. It hopes to eventually claim half of the global motorcycle market, both gas and electric, with growth mainly coming from a region Honda calls the Global South — primarily India, Indonesia and the Philippines, as well as Brazil and other countries in South and Central America. BloombergNEF predicts that global sales of two-wheelers will reach 105 million by the end of this decade, up from 96 million in 2024. The researcher forecasts the segment will peak around 2035, when some established motorcycle markets will hit a saturation point and consumers start to switch to other modes of personal transport. That gives Honda a relatively narrow window in which to make the most of its commanding position. Having its motorcycle business weighed down by Nissan, which doesn't make two-wheelers, would seem an unpalatable option. — By Nicholas Takahashi  President Donald Trump speaking to the press Monday while signing an executive order to create a US sovereign wealth fund. Photographer: Jim Watson/AFP/Getty Images President Donald Trump agreed to delay 25% tariffs on Canada and Mexico for a month after both US neighbors agreed to take tougher measures to combat migration and drug trafficking at the border, warding off a continental trade war for now. On the other hand, the US imposed a 10% tariff on all Chinese goods. Beijing hit back with a 15% levy on less than $5 billion of US energy imports and a moderate 10% fee on American oil and agricultural equipment. China also said it will also investigate Google for alleged antitrust violations, though Alphabet's search services have been unavailable in the country since 2010. |

No comments:

Post a Comment