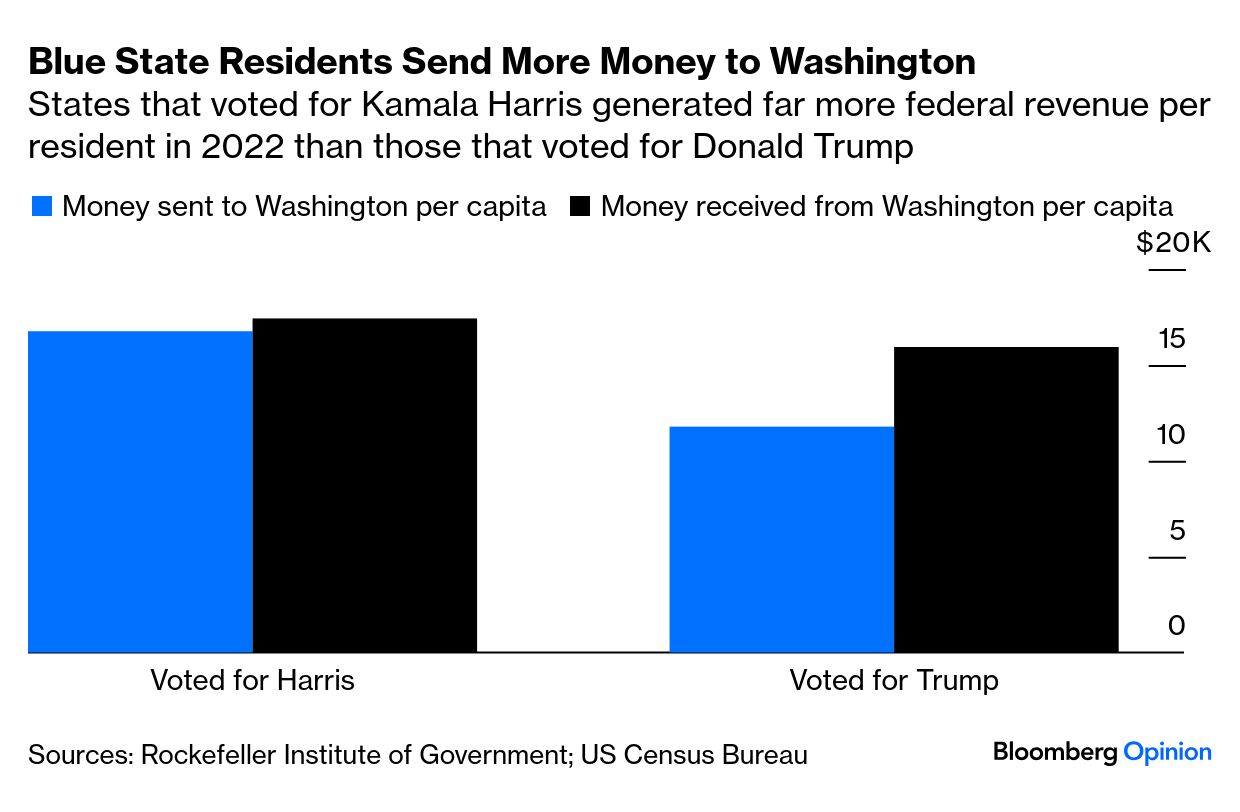

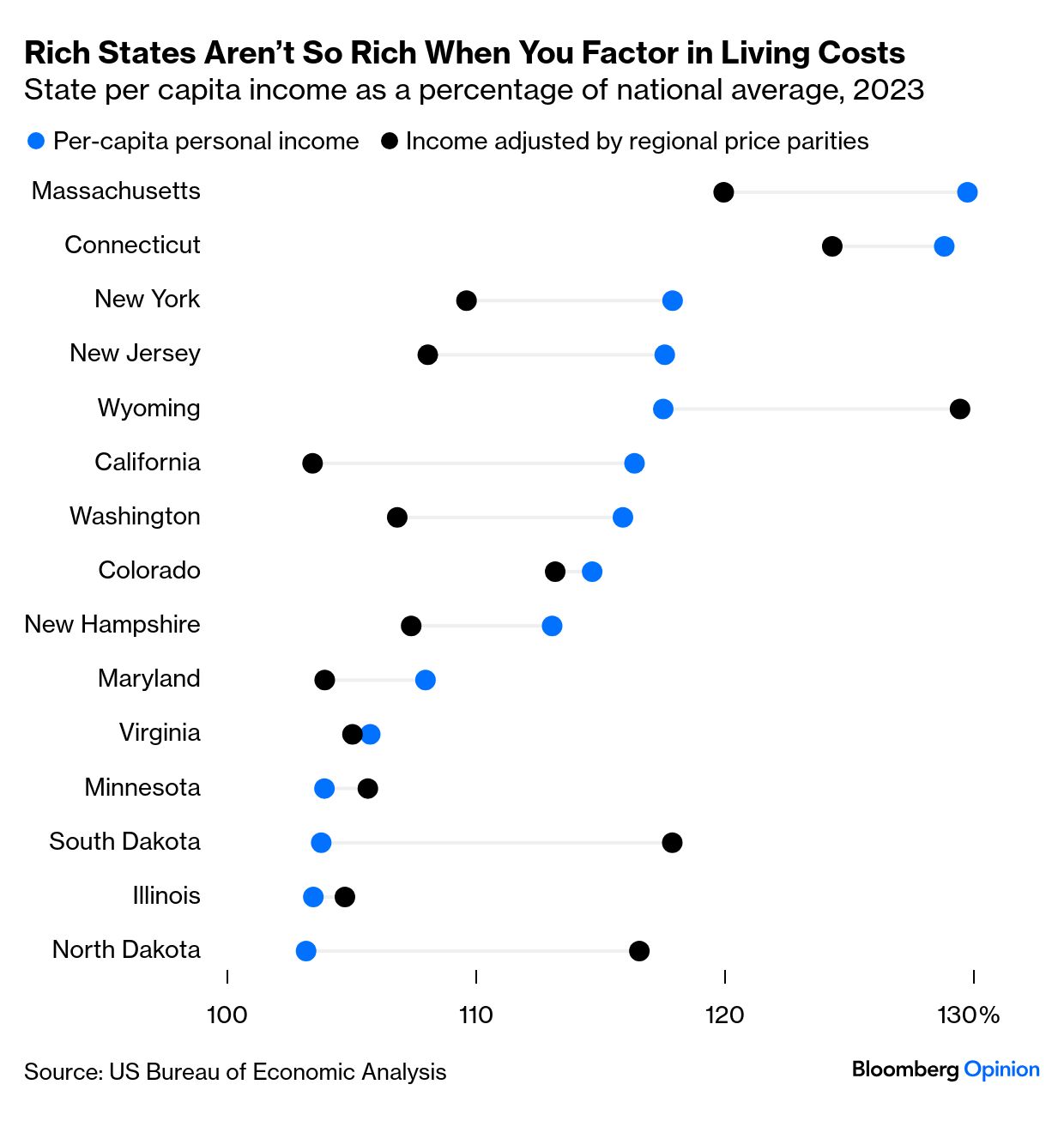

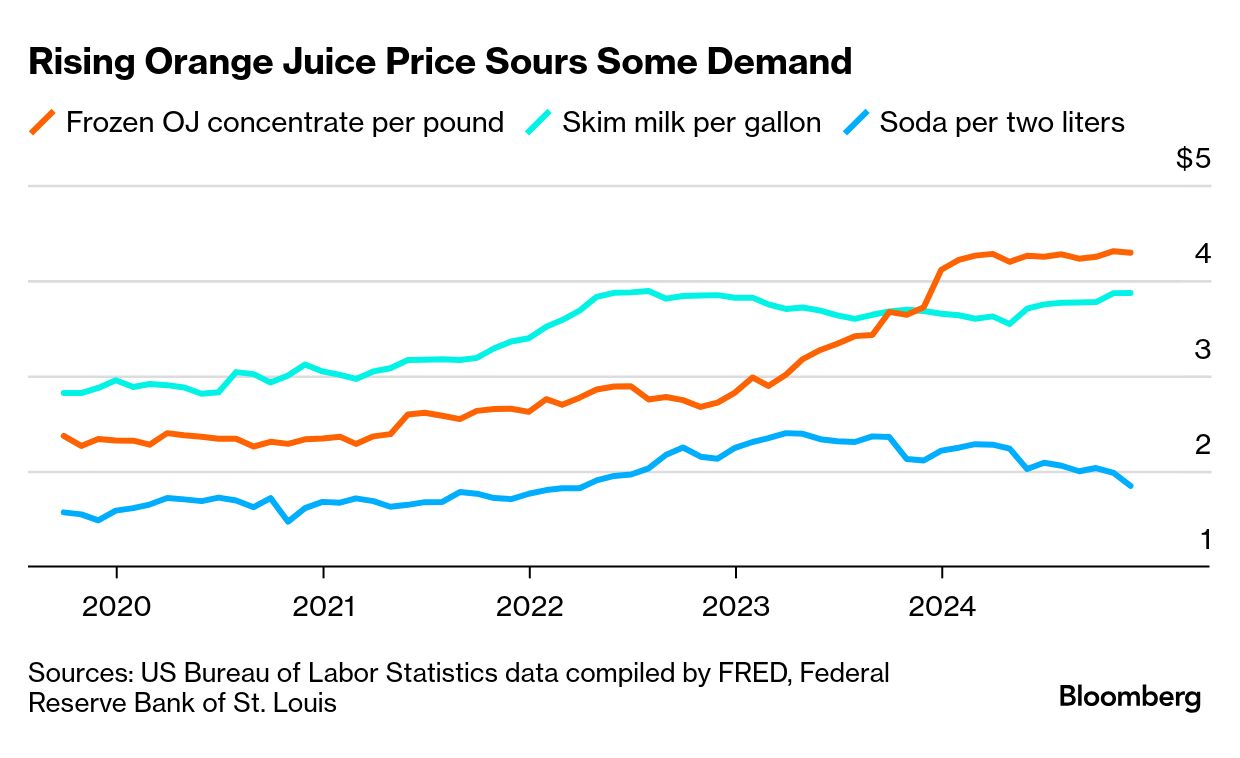

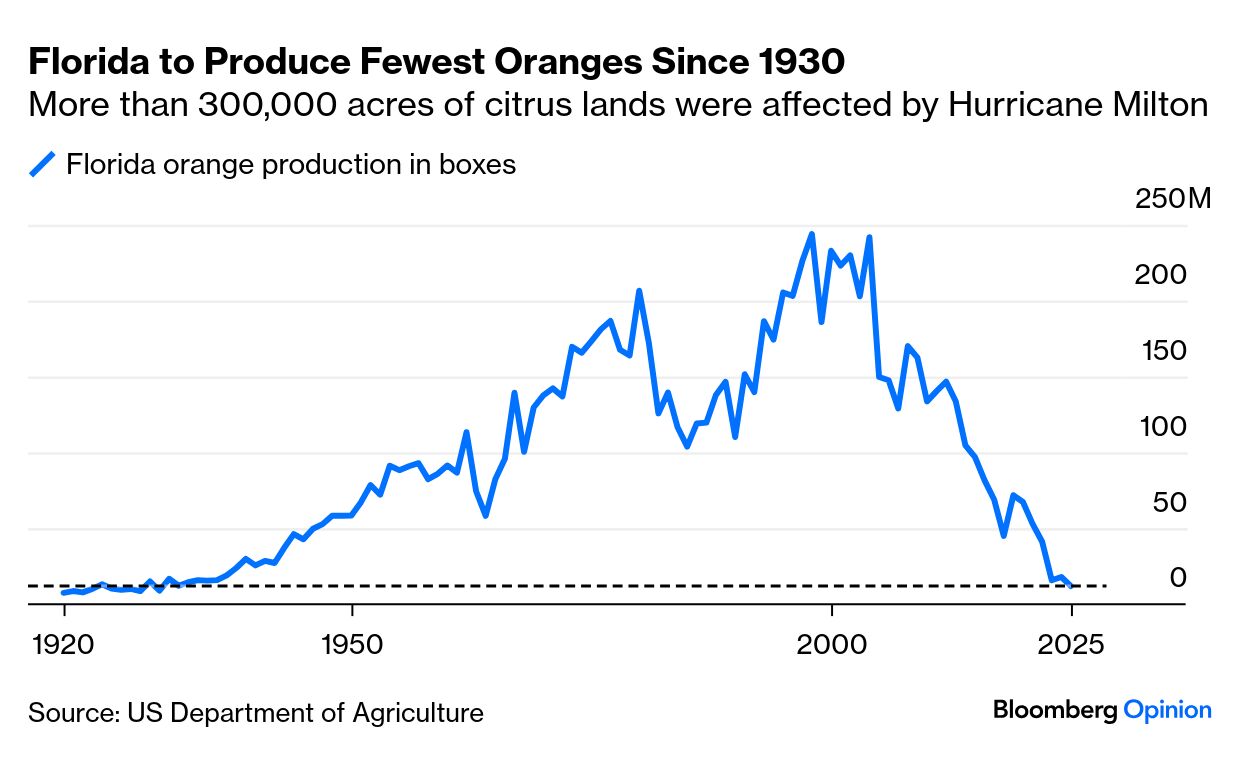

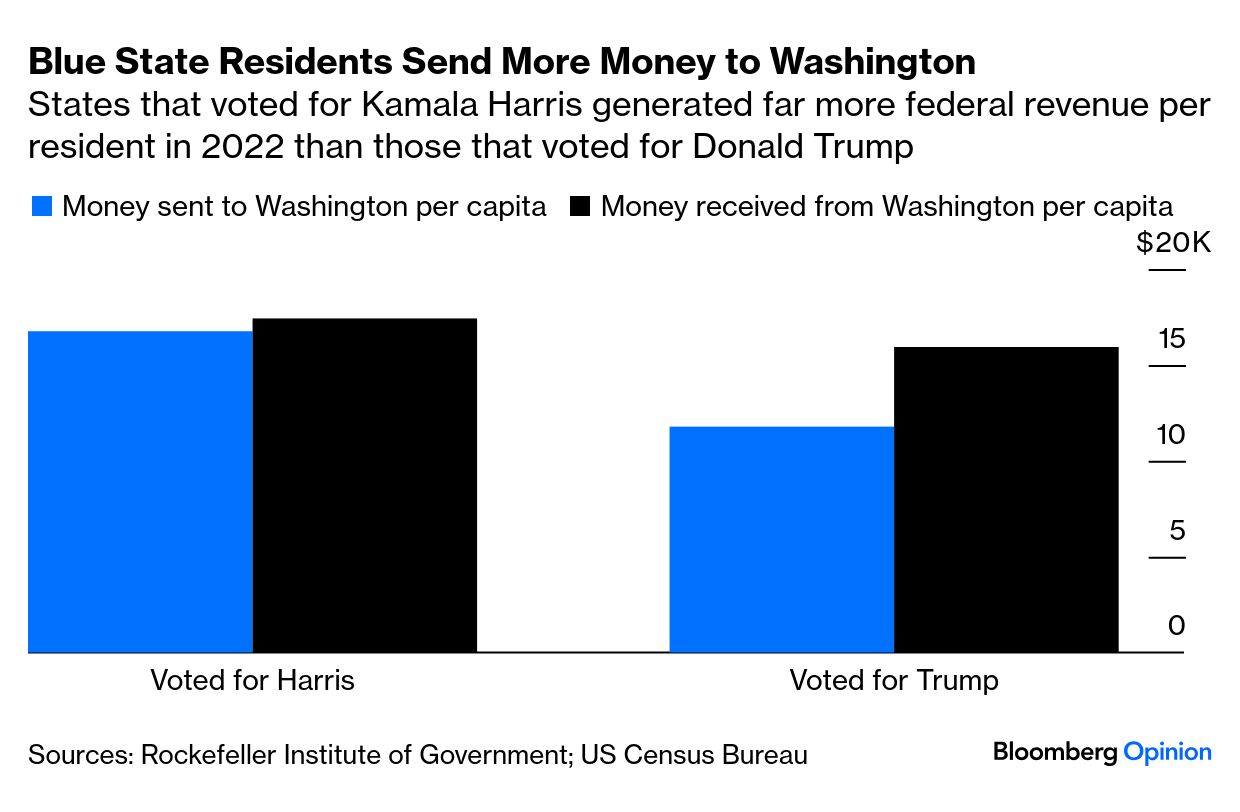

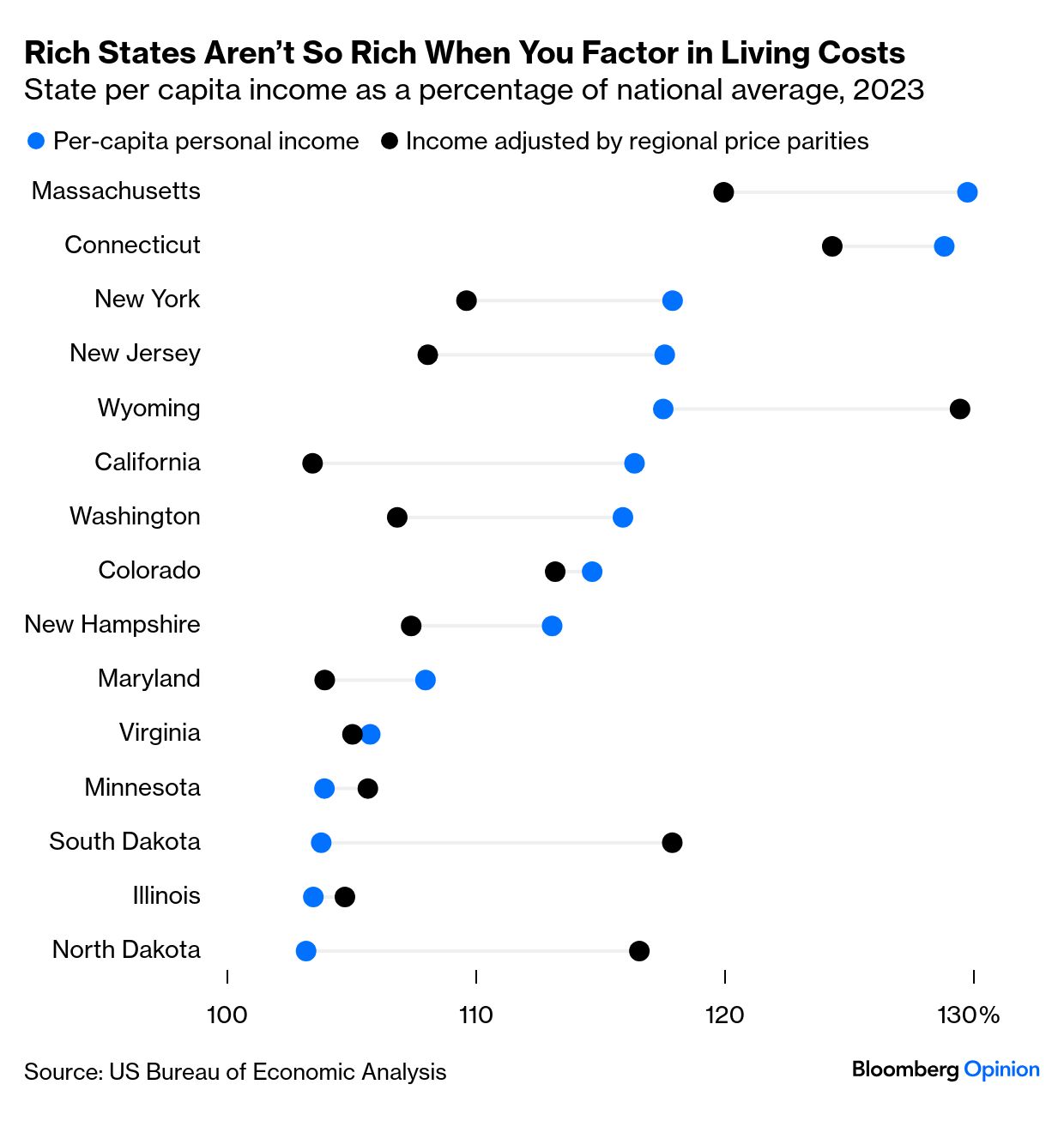

| This is Bloomberg Opinion Today, the official state beverage of Bloomberg Opinion's opinions. Sign up here. The Last Great American Dynasty | My dad's morning routine — doesn't every dad have one? — includes a dozen or so scary-looking vitamins that are chased with a protein shake, drunk straight from the blender. Each shake is slightly different, depending on what's in season. During the holidays he'll pop a Harry & David pear in there. Over the summer he's a big strawberry and blueberry guy. Sometimes he'll sneak in some chocolate syrup or peanut butter. No matter what, though, there's always orange juice — the super duper pulpy kind that you have to chew instead of drink. But after reading Mary Ellen Klas' latest column about Florida's OJ crisis, I'm not sure how much longer my dad will be making these shakes! It's an increasingly expensive habit: Orange juice is getting squeezed from all sides. Last year, Hurricane Milton wiped out thousands of fruit trees in one fell swoop — just one of many headaches plaguing homeowners and insurers, write Liam Denning and Mark Gongloff — but the Sunshine State's problem has persisted for decades prior to that. "For 30 years, the industry has been ravaged by disease and hurricanes, and citrus production has been on a steep decline," Mary Ellen explains. The orange haul in 2025 could reach century-low levels: At the same time, shrinkflation has led to slimmer packaging and pricier selections. And Mary Ellen says President Donald Trump's tariff intimidation tactics could make things even worse. You might think that "Florida's Natural" uses only oranges from its eponymous state, but you'd be mistaken: It uses imported juice from Mexico and Brazil, too. Same with Tropicana and Simply Orange. "Citrus processing plants, packing houses and nurseries supply more than 33,000 jobs in Florida and have an annual economic impact of over $6.8 billion. … That is all at risk if Trump resumes the reckless trade war with the US allies of Canada and Mexico. The impact of their retaliatory tariffs in Trump's home state of Florida alone would not only raise the cost of importing Mexican juice to Florida bottlers, it will likely send Canadian consumers to competitors," Mary Ellen writes. "Trade wars always involve trade-offs. But it is hard to imagine a Florida without oranges — the ubiquitous wholesome symbol emblazoned on the state's license plates and the source of both the official state beverage (orange juice) and flower (the orange blossom)." It's also hard to imagine breakfast — or those daily shakes — without orange juice. Between this and bird flu, those bottomless mimosa brunch deals that millennials love are all but guaranteed to die. Bonus Trade War Reading: Tariff backers suggest that currency offsets will make the inflationary impacts more muted. Maybe, but at what cost? — Jonathan Levin Is Tax Season a Thing Anymore? | Yes, it would be nice if Trump's IRS overhaul meant we didn't have to pay taxes this year, but that's not gonna happen. The employees who play a critical role in the tax filing system aren't eligible for a buyout until at least mid-May. Not to mention, a federal judge just hit pause on the whole scheme this afternoon, but more on that later. The Trump administration has been hellbent on stopping federal spending in its tracks, a move that Justin Fox says has been met mostly with applause from red states. "That's sort of what one would expect given that Trump is a Republican, but also kind of weird in that states and congressional districts that vote for Republicans are as a rule much bigger net beneficiaries of federal spending than those that vote for Democrats," he writes.  Griping about tax season may be one of America's few remaining bipartisan traditions, but residents of New York, New Jersey, Connecticut and California have special cause — they see themselves as keeping the federal government afloat. The reason is simple: Many of the richest of the rich reside in those states. "The federal government gets about half its revenue from individual income taxes, with 30% coming from Social Security and Medicare taxes. The income tax system is progressive, meaning those with high incomes are taxed at higher rates than those with low ones." But, when Justin adjusted the income with cost of living, the picture got a bit murkier:  His conclusion? "Maybe the tax system is unfair to residents of affluent blue states and cities. One possible response would be to adjust income tax brackets for regional cost of living. But that would be complicated," Justin writes. "Instead, what's on the table is increasing the SALT cap, which would benefit only a small number of high-income people in high-tax states. But yes, it would also shift a little bit of the burden of financing the federal government away from the blue states." |

No comments:

Post a Comment