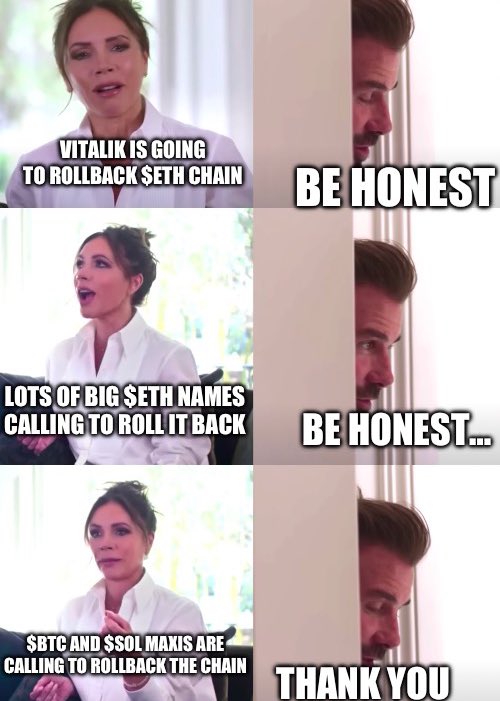

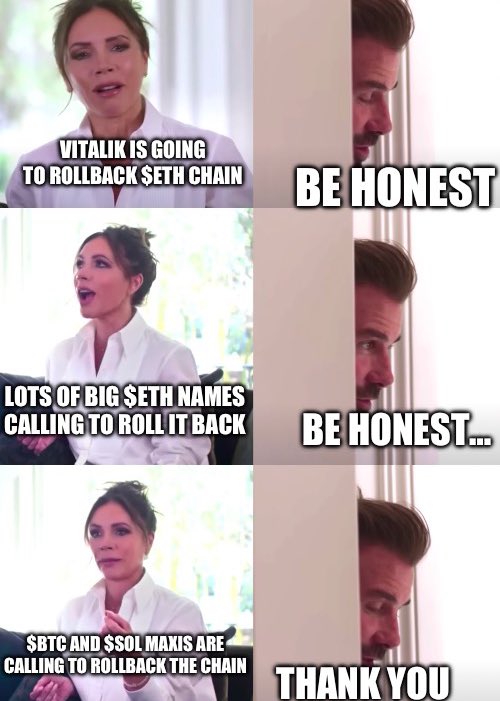

| | Ethereum does not "roll back" transactions. It's practically, if not theoretically, impossible. Bitcoin maximalists and uninformed commentators are using this moment to push misleading narratives, pretending Ethereum is on the verge of reversing transactions. In reality, the idea has close to a 0% chance of happening. | | | Sonic is back with a bang: | | Remember FOAN? The F in FOAN stood for Fantom, one of four alt-L1s poised to be "Ethereum killers" in 2021. Needless to say, that didn't happen. | This cycle, Fantom has rebranded Sonic (FTM is S) and it's back with a vengeance. Propelling the once-dead L1 back into relevancy comes with a few key incentive programs: A unique builder-first "fee monetization" program that allows applications to earn 90% of gas fees, a 200 million S grant (~$250 million) for app developers, and the main prize: a 195.5 million S airdrop (~$16 million) to users. | Before you get to farming, however, note that only 25% of your S airdrop allocation will be liquid on day one, based on Sonic's litepaper. The remaining 75% is vested over nine months in the form of an NFT, though the NFT is also tradable on the open market. That effectively makes the NFT a kind of structured note with transferable and decaying option rights that will likely trade below the "fair value" of the S market price. | The chain is now hosting $736 million in TVL, the bulk of which ($636 million) is bridged. The S token (previously FTM) is up 49% month to date. | — Donovan Choy | | | Builders and Devs: You Are Wanted on Stage! | Permissionless speaker applications are open. If you're a technical founder, CTO, or developer, apply! | Some conferences recap the past. Permissionless IV is about what's next. | 📅 June 22–26 | Brooklyn, NY | | | The Ethereum rollback idea was a joke | First, let's get one thing clear. No serious person in the Ethereum community was advocating to "rollback" after the $1.5 billion Bybit hack. | These are simply not genuine debates. As some have pointed out, they're more like an external psyop designed to sow confusion. | Ethereum has never performed a rollback. The term itself is a misnomer. A true rollback would require reversing all transactions since the Bybit hack — disrupting DeFi, liquidity pools and every user who has transacted in that timeframe. That's not how Ethereum works. | Instead, critics point to the 2016 DAO hard fork as some sort of precedent — but that was not a rollback either. For a bit of history, The DAO exploited locked funds in a time-delayed smart contract, meaning the hacker had not yet moved the stolen ETH. The community opted for an "irregular state change" — not merely semantics — transferring the ETH to a safe contract before it could be moved. | Even though it was in no way a chain-wide reversion, those who disagreed — around 20% of the network — continued using the old chain, causing a fork now known as Ethereum Classic. | Since The DAO's fork, Ethereum has had multiple "opportunities" to intervene in major hacks — but has never done so, demonstrating that its threshold for any intervention attempt is exceptionally high: | 2017 Parity Multisig freeze – $180 million locked forever. 2022 Ronin bridge hack – $620 million stolen by North Korean hackers. 2023 Multichain Exploit – hundreds of millions drained.

| In all cases, no intervention. Even if it were technically feasible (which it isn't), it would violate the very ethos of the decentralized credibly neutral network. If Ethereum didn't intervene to recover one of its own co-founder's funds (Parity's Gavin Wood) — eight years ago when ETH's market cap was about 7% of what it is today — there's no reason to believe Bybit would receive different treatment. | Well-meaning critics vs trolling narratives | It's important to separate two types of critics. | On one side, there are genuine misunderstandings in my view, like those expressed by Bybit CTO Larsson, lamenting the admittedly unpleasant consequences of the theft. But unless the entire Ethereum network itself is at existential risk, there's practically nothing anyone can do — not Vitalik, not the Ethereum Foundation. | On the other side, we have bad-faith actors, engagement farmers and trolls who are pretending there's a debate when none exists. |  | Etheraider @etheraider |  |

| |

Every $ETH rollback post: | |  | | | 5:01 PM • Feb 22, 2025 | | | | | | 1.79K Likes 243 Retweets | 39 Replies |

|

| As @ChainLinkGod pointed out, the Bybit hack was a centralized exchange failure, not a smart contract exploit. The attack method — compromising the multisig signers' machines — could have just as easily been used to steal bitcoin instead of ETH. Yet, when BTC is stolen from exchanges, there's never a similar push for a rollback — because, just like Ethereum, it's infeasible. | The irony is that Bitcoin maximalists (assuming they don't know full well that it won't happen) expose the emptiness of their own FUD — if Ethereum were centralized, the network might be compelled to attempt some action. Instead, when nothing happens, it's further proof of Ethereum's immutability. | Rolling back the chain is not, strictly speaking, impossible, but it would require a fundamental existential crisis, just like the Bitcoin inflation bug in 2010 (where BTC actually did roll back). The Bybit hack, while large, does not meet that threshold. | Ethereum has just demonstrated its credible neutrality. The sooner the trolls realize this, the better. | — Macauley Peterson | | | Sonic farming | Sonic farming season is in — wut do? | To start off, you can stake your S (previously FTM) for stS with Sonic to earn a 5.61% APY. Depositing stS on a money market like Silo earns you an additional base 2.1 APY. Silo's loan-to-value (LTV) of 95% allows you to take a leveraged position of 20x leverage (1 / 0.05 = 20x). Max leveraging your stS against S pumps your APY to ~60%, and that does not count the additional layer of accruing Sonic points, Silo points and Sonic's promised S airdrop. | If loop leveraged trading is too complex, you can opt for an easier 12.2% deposit APY on USDC at Silo. You can also earn a 10.7% APY on a fixed rate PT trade on Spectra's Sonic market using scUSD collateral (scUSD is a yield-bearing stablecoin from Rings protocol), but note that as it's a fixed rate PT, it doesn't expose you to any accruing points. | You can also head over to Euler to open a max leveraged trade earning 52% APY off scUSD while borrowing wstkscETH. The liquidity pool in question is fairly deep, at $8.3 million. | — Donovan Choy | | |  | Bybit @Bybit_Official |  |

| |

We're close to 100% on our ETH reserves, and deposits & withdrawals are back to normal. Through it all, the crypto community, our partners, and our users have shown unwavering support—thank you. We know where our funds have gone, and we're committed to turning this experience… x.com/i/web/status/1… | |  | | | 7:39 AM • Feb 24, 2025 | | | | | | 2.7K Likes 678 Retweets | 392 Replies |

|

|  | Safe.eth @safe |  |

| |

Update on Safe{Wallet} Restart The Safe{Wallet} UI displayed the correct-appearing transaction information according to ByBit, yet a malicious transaction that had all valid signatures was executed onchain. Our investigation so far shows: • No codebase breach found: The Safe… x.com/i/web/status/1… | | | 1:08 AM • Feb 22, 2025 | | | | | | 823 Likes 138 Retweets | 80 Replies |

|

| |

|  | Sunil (FTX Creditor Champion) @sunil_trades |  |

| |

Bybit, FTX and Hack 1) Bybit withdrew $1bn from FTX before bankruptcy

During 90d pref. period Bybit's trading arm, Miranda, withdrew $1bn from FTX ($400m withdrawn in Nov 7, 8, 2022 - by blackmailing executives ahead of FTX customers) FTX changed KYC settings to push Mirana… x.com/i/web/status/1… | |    | | | 10:02 AM • Feb 24, 2025 | | | | | | 132 Likes 27 Retweets | 19 Replies |

|

|  | Rishabh Khurana @0xrishabhai |  |

| |

Feels like 2025 is going to incentivize long-term builders unlike 2024 lots of tail winds: - short-term, cash-grab opportunities like memecoins being wiped out as we speak - fundamentals of crypto are better understood outside of our little bubble. Robinhood, Stripe & many… x.com/i/web/status/1… | | | 12:21 PM • Feb 24, 2025 | | | | | | 35 Likes 7 Retweets | 5 Replies |

|

| |

|

|

|

No comments:

Post a Comment