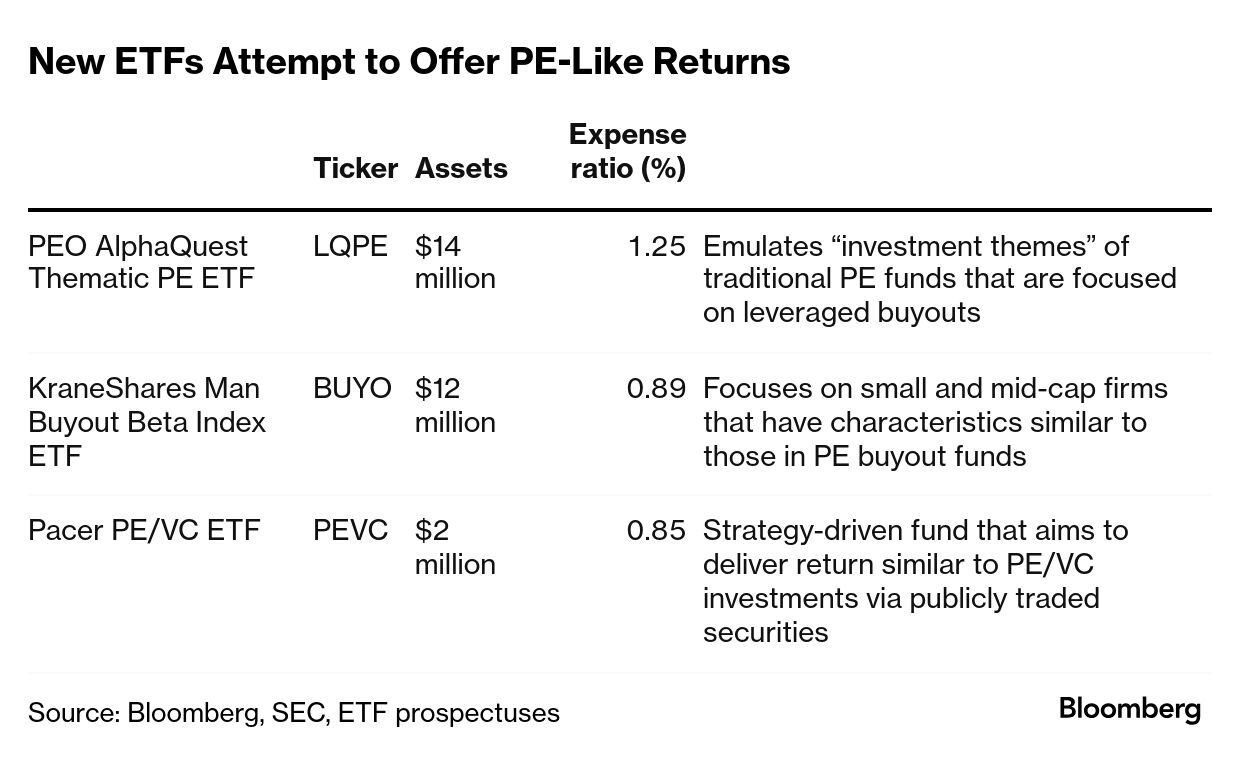

| We don't carry Diet Coke, is Pepsi okay? Bloomberg's Vildana Hajric wrote an insightful piece on the uptick in private-ish ETFs. While regulators weigh whether or not to allow ETFs that directly hold private credit investments, a handful of issuers have launched products that attempt to capitalize on demand for non-public assets. None of the new funds claim direct PE investments — rather, their holdings and portfolios are meant to mimic an approximation of them. Even so, this new breed of ETF is a good reminder that it's important to know what you own. Consider the Pacer PE/VC ETF (ticker PEVC), which launched this month and aims to deliver returns similar to private equity and venture capital investments via publicly traded securities. Its top holdings are Meta Platforms, Microsoft and Alphabet. Other recent debuts include the PEO AlphaQuest Thematic PE ETF (LQPE, i.e. "liquid PE") and the KraneShares Man Buyout Beta Index ETF (BUYO). Some firms have pursued blending public and private securities in the ETF wrapper, given that regulators only allow open-ended funds to have 15% of their holdings in illiquid assets — a bucket that most private investments fit into. The ERShares Private-Public Crossover ETF (XOVR) is the most notable example — just under 10% of its portfolio is dedicated to shares of Elon Musk's SpaceX, which ranks as one of the biggest private companies. Randy Cohen, who is the co-founder of PEO Partners, told Bloomberg's Hajric that his fund is buying "a set of publicly traded stocks that is as similar as humanly possible to the portfolio of thousands of LBO companies," referring to leveraged buyouts. "People will say, 'Come on, how can you call it liquid PE, it's not actually private equity — you're holding public companies,'" he said in an interview. But "we're saying we think this is as close to matching everything PE does as you can get while being in the public markets." |

No comments:

Post a Comment