| I'm Cécile Daurat, an economics editor in the US. Today we're looking at inflation expectations. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Just in: President Donald Trump said reciprocal tariffs will be announced today.

- Britain's economy registered unexpected growth at the end of 2024.

- Trump's Ukraine plans mean a $3 trillion bill for his European allies — read the BigTake.

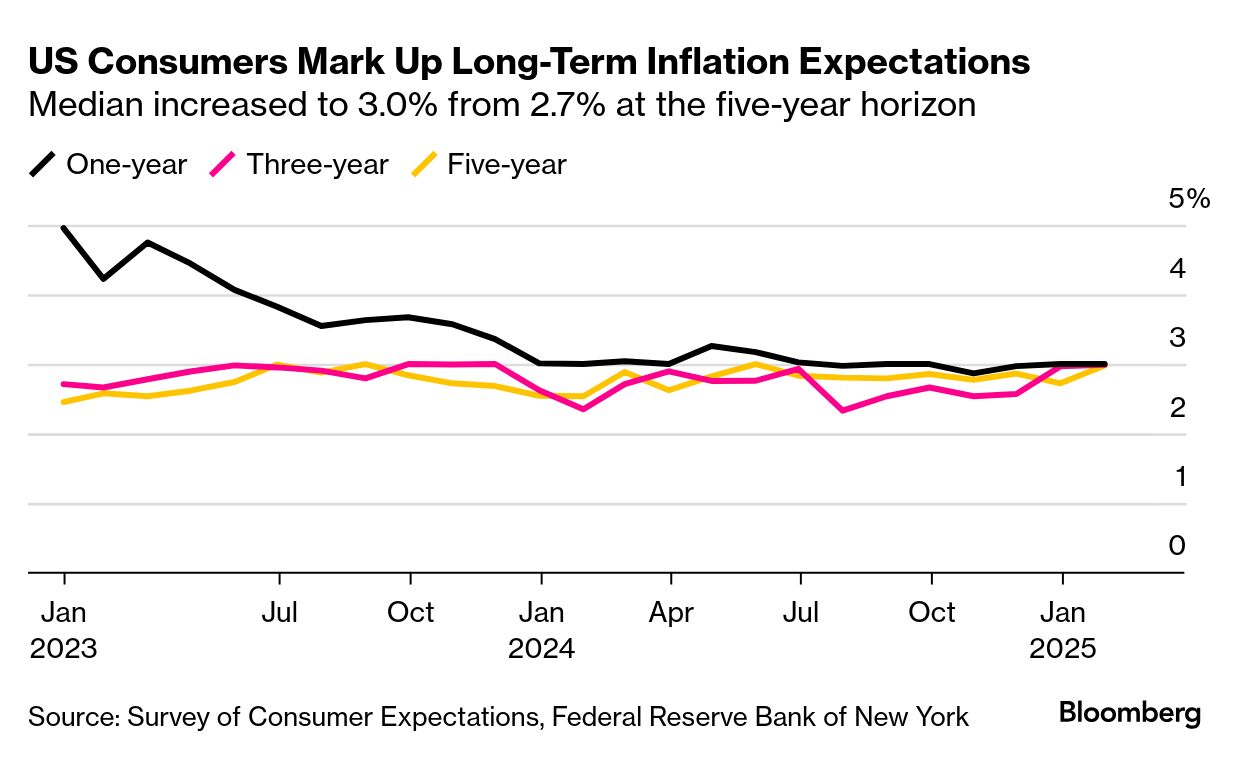

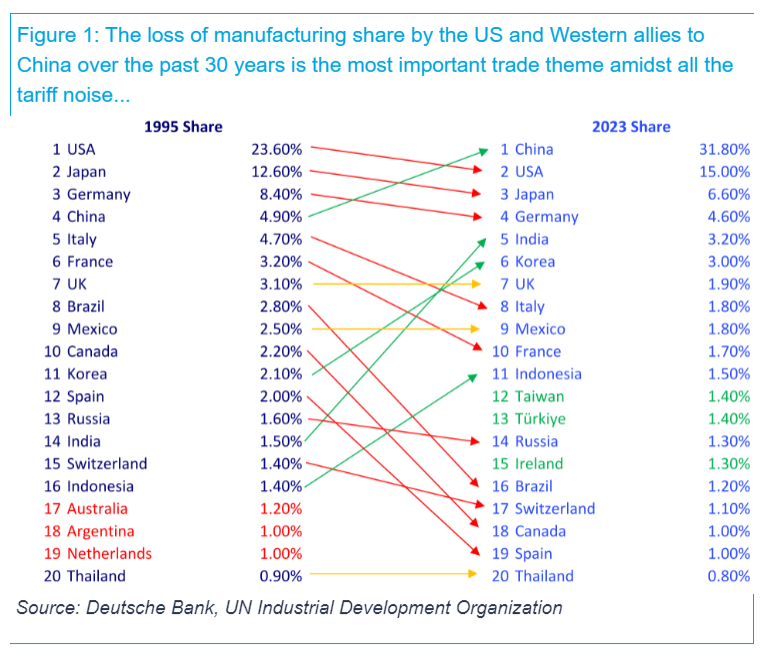

When Wednesday's US consumer price index figures were released, they surprised almost every last economist with the magnitude of the price gains and hammered assets from Treasuries to stocks. But that report may not even be the most troubling piece of news on inflation over recent days. The latest readings on inflation expectations from two separate surveys, from the University of Michigan and the New York Fed, suggest American consumers may be getting unsettled by the warnings — and in at least one case actual implementation of — tariff hikes by Trump. Inflation expectations have taken a newfound importance in the debate over next steps for the Fed, with several policymakers mentioning them in recent weeks. Fed Atlanta President Raphael Bostic said earlier this month that the central bank's response to levies would depend on whether the tariffs have an impact on inflation expectations, echoing comments from his Boston Fed counterpart, Susan Collins. "They are going to be very focused on whether those higher prices caused by higher tariffs are actually feeding into inflation expectations," said William Dudley, an opinion columnist for Bloomberg who served as head of the New York Fed from 2009 to 2018. "If they do, that will make the Fed more cautious. If they don't, the Fed will be focused on the growth impacts of higher tariffs slowing down the economy," Dudley said on Bloomberg TV. The next reading of the University of Michigan's sentiment index, which includes inflation expectations for this year and in the longer term, is due Feb. 21. The report hasn't gotten as much attention as CPI data or the monthly payrolls numbers in recent years. That may change now. The Best of Bloomberg Economics | A key question with regard to Trump's push to bring to the US the production chains catering to the American consumer is whether companies are truly prepared to break their dependence, above all, on China. "China alone has gone from 5% of global manufacturing in 1995 to 32% today," the Deutsche Bank thematic research team led by Jim Reid wrote in a recent note. The team reeled off a host of superlatives, including that more than half of industrial robots are installed in China and that it has an 80% of export market share in shipbuilding — over 200 times the production capacity of the US. "When China's dominance was limited to toys and textiles, and even laptops and smartphones this did not raise alarm, but the scale and speed with which China has broken into high-value added manufacturing is becoming a concern in Western capitals," they wrote. |

No comments:

Post a Comment