| I'm Brendan Murray, a senior economics editor reporting from Cape Town. Today we're looking at the meeting of G-20 finance chiefs in that city. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - President Donald Trump signed an executive action directing the Commerce Department to examine possible copper tariffs.

- Chances for early action on US tax cut plans improved as House Republicans passed a budget blueprint calling for deep cuts in safety-net programs such as Medicaid.

- UK Prime Minister Keir Starmer plans to increase defense spending to 2.5% of GDP by 2027 and 3% over the next decade, potentially sparking an internal backlash.

On Table Mountain National Park overlooking Cape Town, South Africa, a wildfire fed by gale-force winds cast an ominous orange glow above the picturesque seaside city past midnight as leading finance ministers and central bankers prepared to meet at a fraught time for the global economy. By Wednesday morning, the inferno appeared to be contained, a faint smoky haze drifting off the cliffs as President Cyril Ramaphosa prepared to open the two-day meeting. Inside the conventional hall, there was optimism about maintaining the G-20's usual spirit of economic cooperation, stability and we're-all-in-this-togetherness — even if there won't likely be a joint communique stating those goals. Far from the drought-ravaged southern tip of Africa, though, there was a growing sense from Gaza to Ukraine and Ottawa to Beijing that the geopolitical brushfires of trade disputes, wars, foreign-aid cuts and AI power struggles threatened to render G-20s leaderless venues for happy talk and unrealistic unity.  Cyril Ramaphosa Photographer: Waldo Swiegers/Bloomberg "Multilateral cooperation is our only hope of overcoming unprecedented challenges," Ramaphosa said in his opening address. Such difficulties stem from US President Donald Trump's positions on tariffs and the deal-making he's inviting to resolve the world's geopolitical strains and trade imbalances. Washington and Kyiv looked to be close to a minerals deal so Trump can show the US is getting something in return for funding Ukraine's defense, and ultimately achieving a balanced ceasefire between Russia and Ukraine. With US Treasury Secretary Scott Bessent skipping the Cape Town talks, one-on-one negotiations seemed to be a better strategy than bilat-room diplomacy at the G-20: South Korea's top trade official said he'll seek an exemption from US tariffs when he meets with Commerce Secretary Howard Lutnick in Washington this week. "I plan to discuss how we can protect our companies as much as possible from the various tariff measures the US is talking about," Ahn Duk-geun, Minister of Trade, Industry and Energy, told reporters Wednesday before departing for the US. "I will strongly emphasize the need for our industries to work together with the U.S. industrial ecosystem."  Xi Jinping Photographer: Oliver Bunic/Bloomberg In Beijing, Chinese President Xi Jinping was urging officials to stay composed amid challenges at home and abroad, signaling Beijing will take a measured approach to the Trump administration's new trade and investment restrictions. China "must enhance its political capabilities and calmly respond to challenges brought about by changes in the domestic and international situation," Xi told top officials including Politburo and State Council party members, according to a Xinhua News Agency report on Wednesday. In Cape Town, Ramaphosa was trying to set the tone for global solidarity, commitments to global institutions, and fighting global warming — priorities the US government has given short shrift. "At this time of global uncertainty and escalating tension, it is now more important than ever" that members of the G-20 work together, Ramaphosa said. Don't Miss the Latest Trumponomics Podcast | Host Stephanie Flanders speaks with Joshua Green, national correspondent at Bloomberg Businessweek, and editor Laura Davison about the likelihood of a US shutdown, its consequences for the government and for Americans — and whether anything can stop Elon Musk's efforts to shrink the government. Listen here and subscribe on Apple, Spotify, or wherever you get your podcasts. The Best of Bloomberg Economics | - Trump said he is starting a program to offer residency and a path to citizenship to investors who pay $5 million, offering a new avenue for legal immigration even as he carries out a sweeping crackdown on undocumented migrants.

- The European Union will unveil a plan to guide business toward its ambitious climate goals while improving the bloc's competitiveness. Meanwhile, Eurogroup chief Paschal Donohoe said that EU member states need to increase defense outlays on a national level.

- Hong Kong Financial Secretary Paul Chan said the economy will grow modestly this year, as he looks to shrink the city's deficit.

- Chile is starting to emerge from a power outage that left eight million homes without electricity and shut off power to major copper mines.

- Mexico is weighing possible levies on Chinese imports as it pushes to avoid the 25% tariffs Trump has threatened to impose on its own goods as soon as next month.

- Australian Treasurer Jim Chalmers said that he had "very constructive" talks with Bessent on tariffs. His country also plans to review the fallout on Southeast Asia and the Pacific of Trump's planned cuts to USAID.

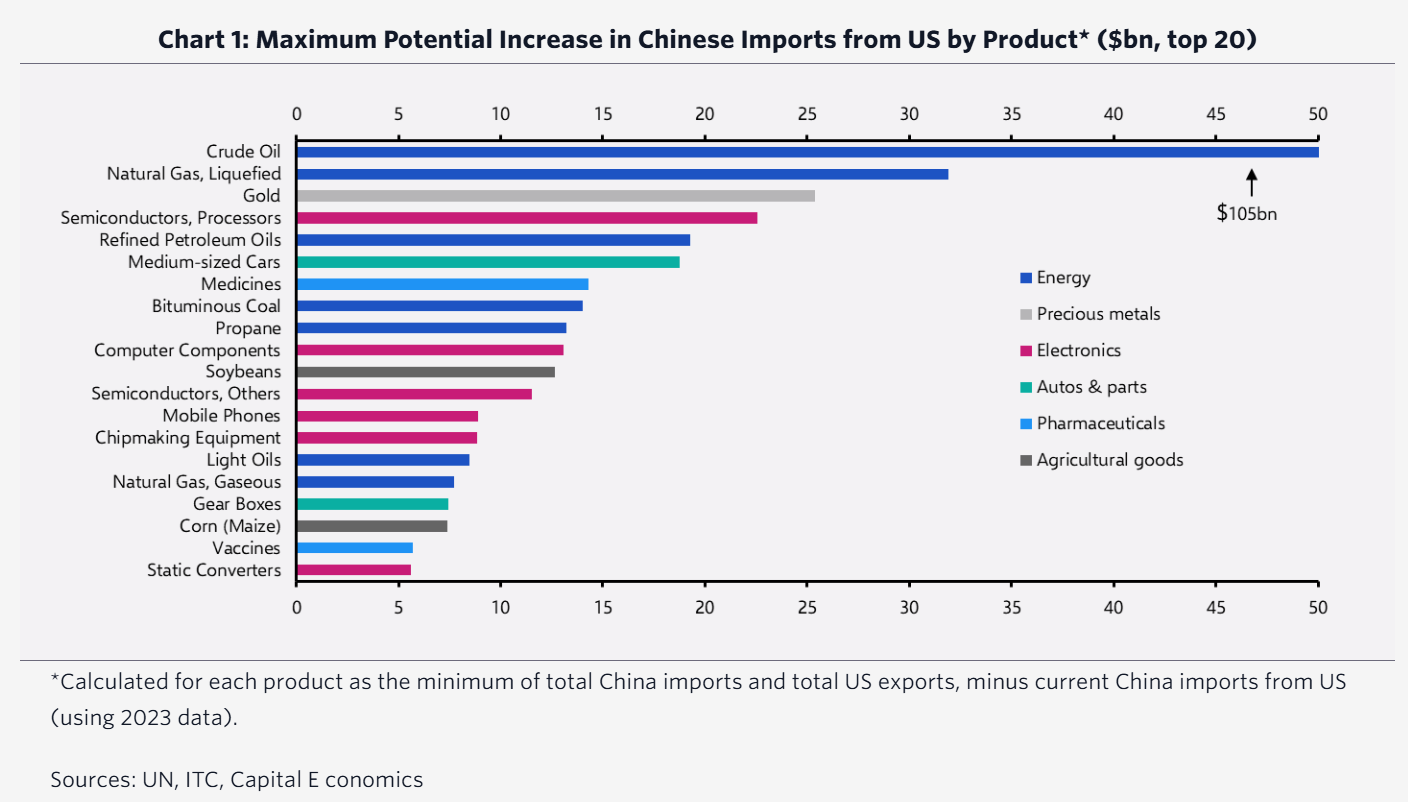

With President Donald Trump having levied a raft of tariff-hike threats, countries around the world are under pressure to come up with proposals to head them off. Capital Economics this week looked at what China might be able to offer. "Our working assumption is still that US tariffs on China will be hiked substantially, possibly to 60%" as soon as next quarter, Julian Evans-Pritchard, head of China economics at the firm, wrote in a note. But, "if negotiations do ultimately culminate in a deal, it is most likely to resemble the Phase One agreement made in January 2020," he wrote. Purchases of energy, electronics, agricultural goods, pharmaceuticals and, ironically, automobiles could all be on the list, with Capital Economics estimates suggesting China could boost annual purchases by $200 billion, as in Phase One. "But policymakers would have to go out of their way to make this happen," Evans-Pritchard wrote, and any deal probably wouldn't outlast Trump, he said — ushering a reversion to the status quo. |

No comments:

Post a Comment