| Bloomberg Evening Briefing Americas |

| |

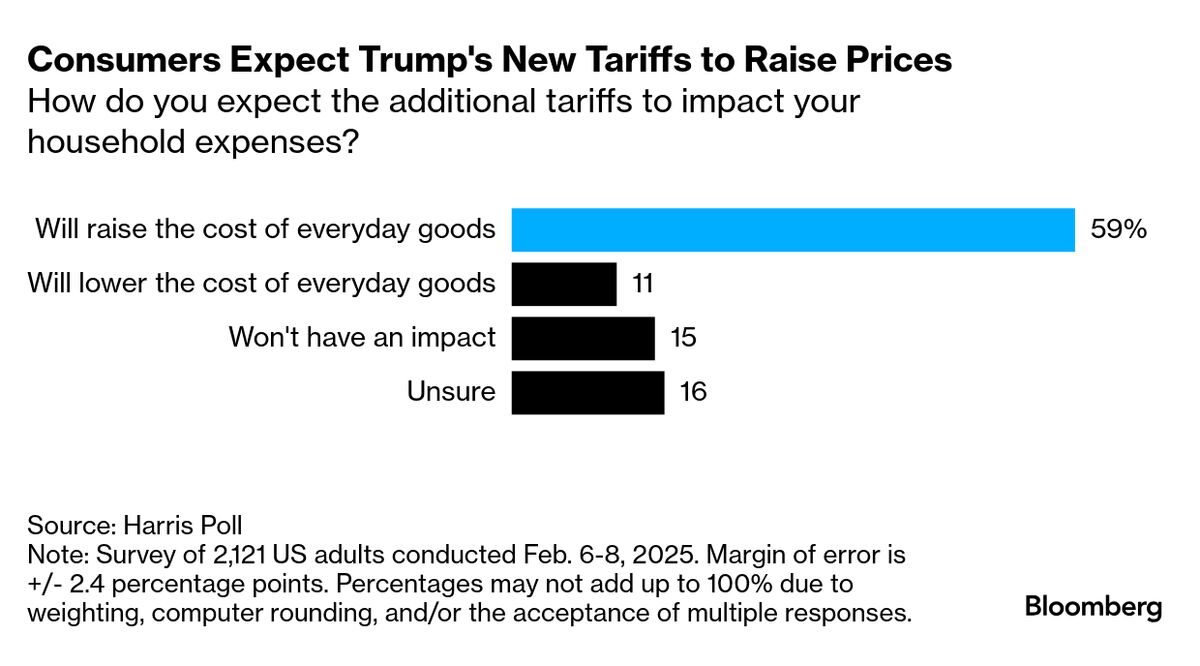

| As President Donald Trump rolls out new tariff threats on an almost daily basis, most recently promising that delayed levies against Canada and Mexico will go ahead on March 4, Americans are increasingly worried. While Wall Street sees the constant threats (and the predictable headlines and chyrons that follow) as a simple negotiating ploy, a survey of everyday taxpayers shows deep concern over what will happen if Trump actually follows through. According to a Harris Poll conducted for Bloomberg News, almost 60% of US adults expect Trump's tariffs, if enacted, will lead to even higher prices. Some 44% say the levies are likely to be bad for the US economy compared with 31% who say they'd be a boost. With more signs every day that inflation has ceased a bumpy, almost three-year decline, economists have said the "toxic" uncertainty created by Trump is already damaging the US economy. Even within his own party, whose leaders have generally maintained lockstep fealty in the face of Trump's expansive and sometimes facially illegal orders, many aren't sold on his trade agenda. Only half of Republican respondents to the poll said tariffs, likely to bring swift retaliation from targeted nations, would be an economic boon. Citizens of America's northern neighbor aren't thrilled about Trump's promises of tariff tribulations, either. Canadians are increasingly seeking out alternatives to US goods, looking to strike back at Americans and their industries. The Republican's ongoing tariff threats against Canada—along with the 78-year-old's musings about annexing the sovereign nation—has created a historic break with Canadians. A new poll shows that 85% of Canadians plan to replace US products with alternatives. That's a significant shift for a country that purchases almost as much in US goods each year as the entire European Union—a total of $349.4 billion in 2024, according to the US Department of Commerce. This too is unlikely to help the American economy maintain what up until now has been a historic streak of low unemployment (more on that below). —Jordan Parker Erb | |

What You Need to Know Today | |

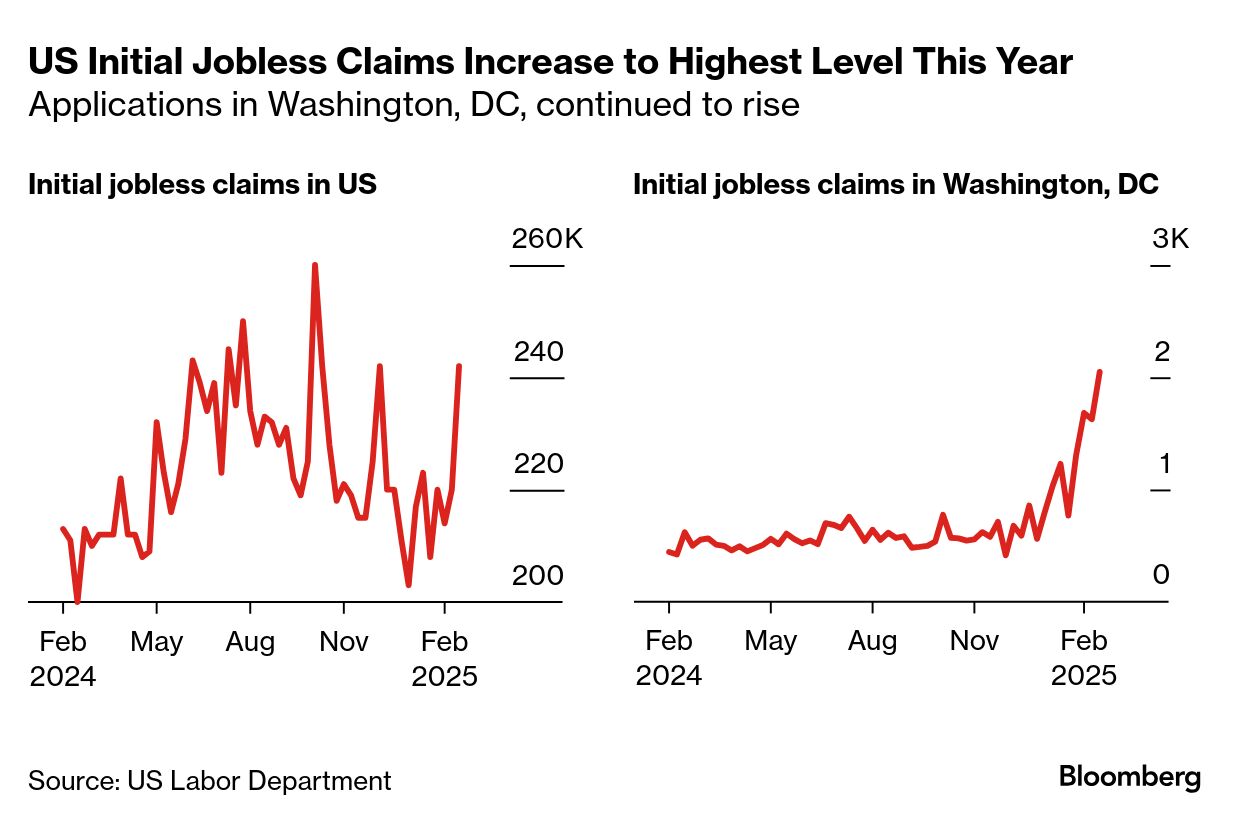

| Applications for US unemployment benefits rose to the highest this year amid an increase in company firings across the country. Initial claims increased by 22,000 to 242,000 last week, matching the highest level since October. The pickup in new applications coincides with a number of mass terminations at companies like Starbucks, Meta and Southwest Airlines. Economists have also been on the lookout for ripple effects from the Trump administration's attempts to fire thousands of workers across federal agencies, though many of those efforts are potentially unlawful and the subject of litigation. | |

|

| Stocks got hit as traders grappled with a selloff in the market's most-influential group amid less-than-pleasant economic data and potential tariff trauma. Megacaps bore the brunt of the selling as good-but-not-great numbers from Nvidia disappointed investors. The chipmaker sank 7.4%. The dollar meanwhile rose as Trump reiterated his threats against US allies Canada and Mexico, as well as a new threat to impose an additional 10% tax on Chinese imports. Home sales have been taking a tumble as well. And then there's the risk that the Federal Reserve may actually be forced to raise, not lower rates in the face of returning inflation. Here's your markets wrap. | |

|

| Investor sentiment around small-cap companies is worse than it's been in months, and the mood isn't much better inside their corporate boardrooms. The small company-focused Russell 2000 is down roughly 10% from its late-2024 high as investors have lost faith in wagers that Trump's policies would boost the sector. Corporate executives are dour as well: An analysis of earnings transcripts by Bank of America going back to 2004 showed that sentiment on earnings calls of small-cap companies has never been as negative in comparison with their large-cap peers. | |

|

| After a pandemic-era boom, rents in Austin, Texas are falling. Nowhere in the country have rents declined as much as they have there—now 22% off the peak reached in August 2023, according to Redfin. That's thanks to a development boom and new policies encouraging housing density, which have sent vacancy rates soaring. Now, landlords are struggling to fill new developments and offering major discounts to lure renters. Nationally, mortgage rates are trending downwards, too. The average for 30-year loans is 6.76%, the lowest level in more than two months.  Austin, Texas, where rent prices are falling from pandemic-era highs. Photographer: Brandon Bell/Getty Images North America | |

|

| During a meeting with UK Prime Minister Keir Starmer, Trump sidestepped any suggestion of providing a "backstop" to any European peacekeeping force in Ukraine. Trump suggested that instead of an explicit security guarantee, Russia might be disinclined from further attacks because of the presence of American workers implementing a potential deal for Ukraine's critical minerals. Europeans contend that without the threat of US retaliation, the Kremlin will be tempted to resume its three-year war, which has killed tens of thousands of Ukrainians. Trump's comments highlighted the challenge facing Starmer and other European nations as they try to slow Trump's bid to end the war on terms favored by Russian leader Vladimir Putin. | |

|

| Tesla wants to offer ride-hailing services in California. According to documents viewed by Bloomberg, Tesla applied late last year for what's known as a transportation charter-party carrier permit from the California Public Utilities Commission, a classification that means Tesla would own and control the fleet of vehicles. The application suggests Tesla is working to launch a ride-hailing business in the near term, putting it in competition with the likes of Uber, Lyft and Waymo, and opening a new revenue stream while its traditional car-selling business falters thanks to growing disdain for its chief executive. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Bloomberg Invest: When it comes to your world and your money, you want answers from leaders who know how to build empires, protect portfolios and create the next big thing. Held in the heart of New York's Financial District, Bloomberg Invest on March 4-5 is an essential gathering that convenes allocators, dealmakers and investors from across the globe. Bloomberg Invest will help you track, dissect and navigate the markets with the industry's most influential voices. Learn more here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment