- Expectations are uniformly positive for US stocks, and (almost) uniformly negative for the real world.

- Key question: Does inflation return?

- Second key question: What exactly does Trump 2.0 try to do?

- Key difference from Trump 1.0: World currencies are weaker and closing in on critical levels.

- AND: Rest in Peace, David Lodge

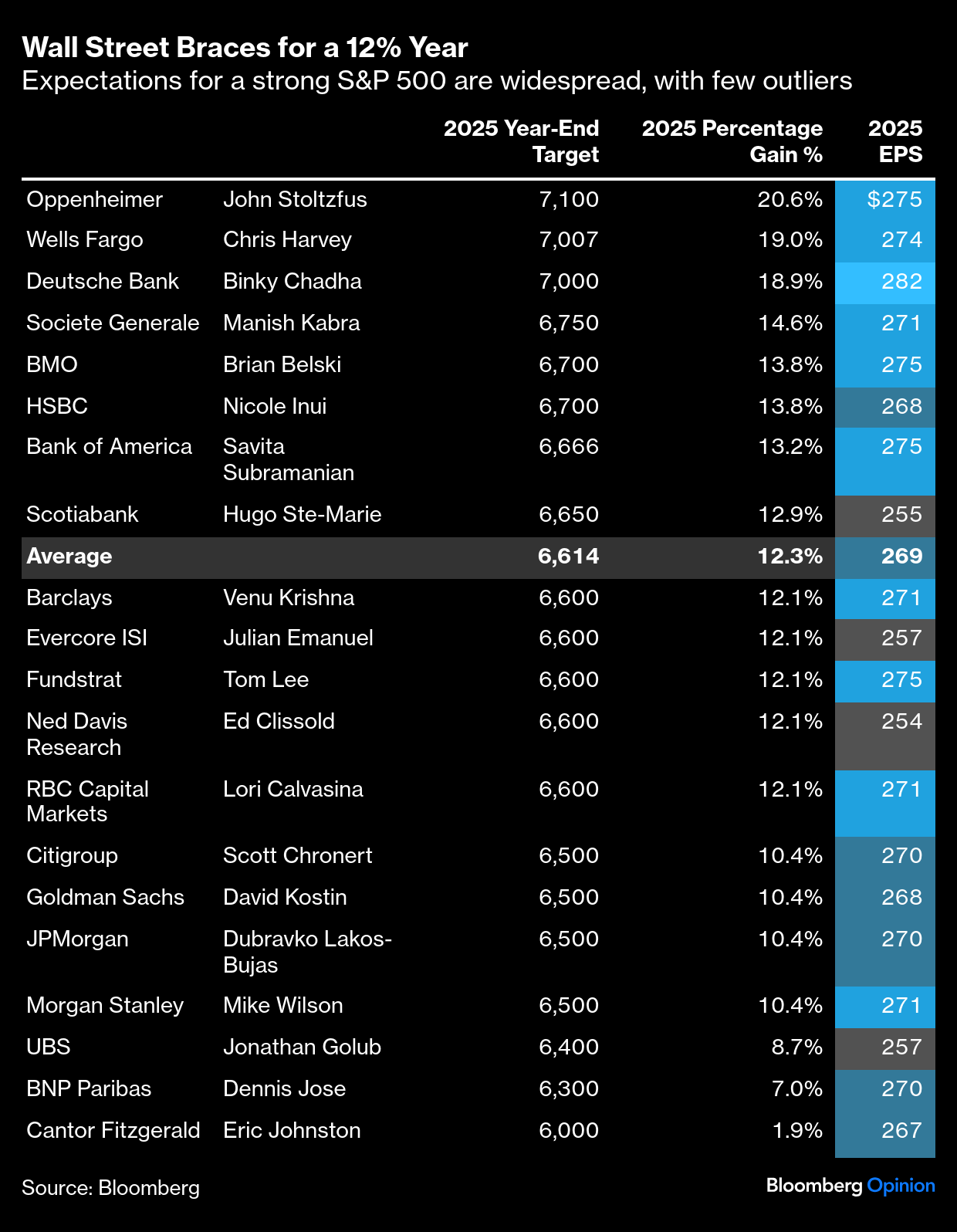

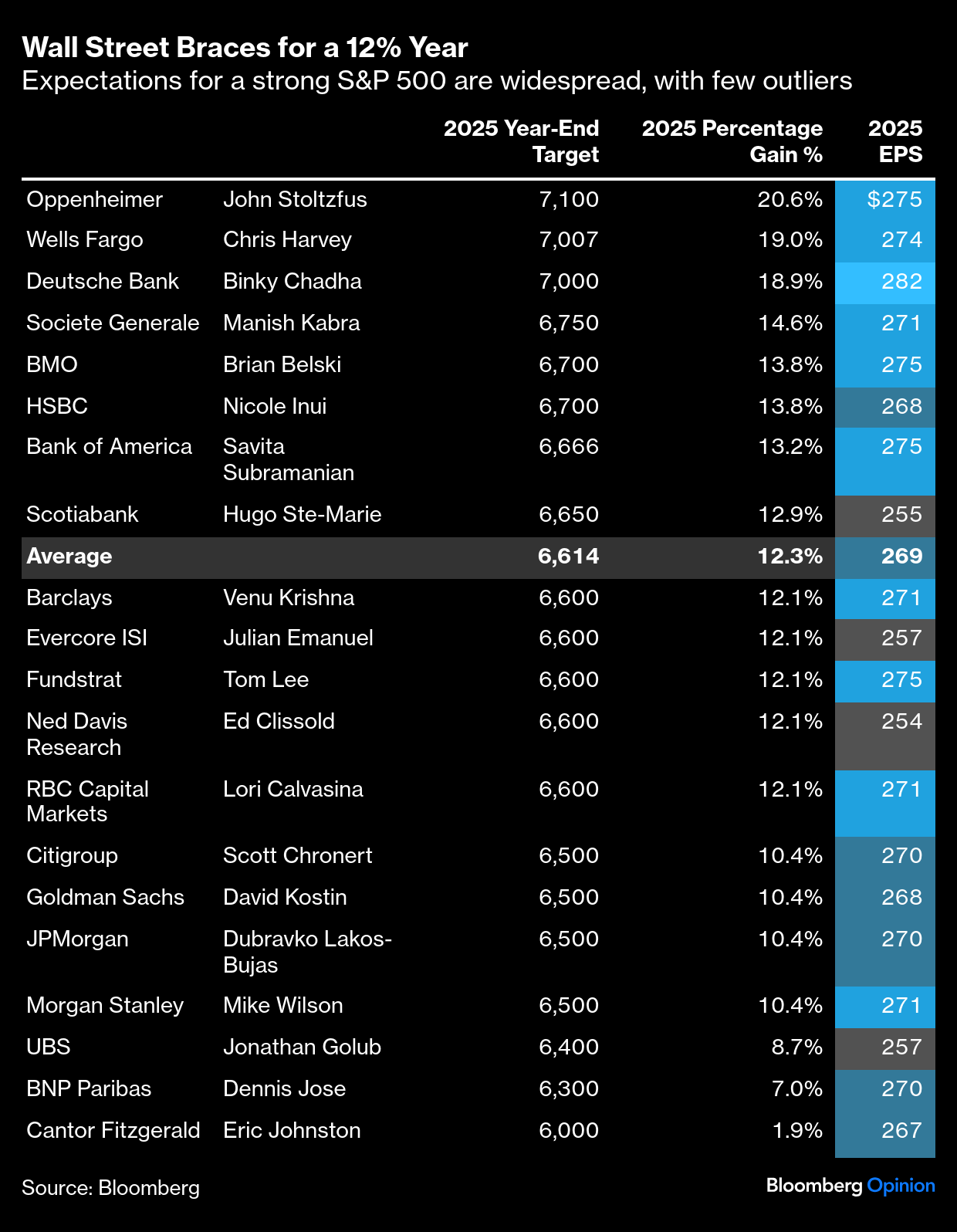

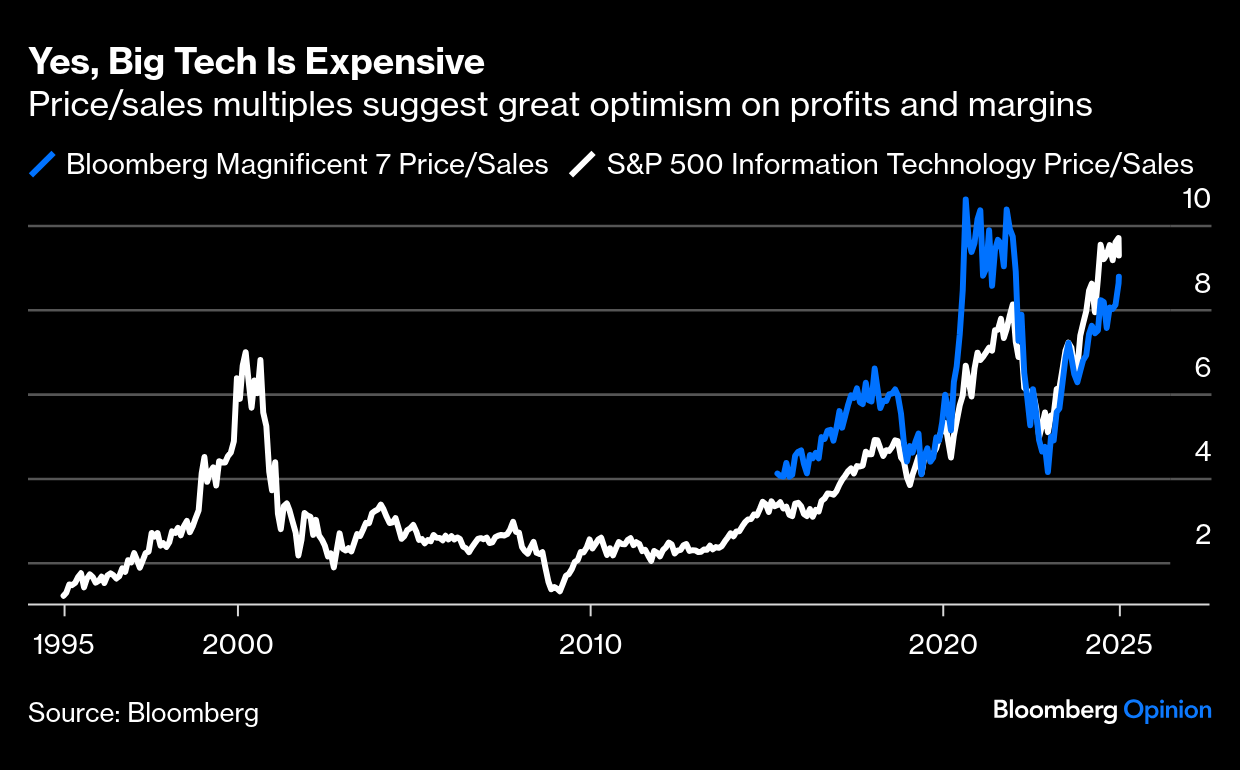

Happy Jan. 6. A date that has taken its place in infamy should be much less eventful than it was four years ago. With confirmation of his electoral victory, Donald Trump will seal one of the greatest political comebacks ever. His return to the White House will be hugely consequential, yet the growing consensus around what will happen next seems hard to sustain. Sentiment toward markets could scarcely be more positive. This owes much to politics, as Points of Return documented in the weeks after the election. Whatever they think of Trump as a person, Wall Street analysts are convinced he will be great for stocks over the next 12 months, even after a frantic post-election rally to price in that good news. Corporate tax cuts and deregulation are great for stocks, at least in the short term. Bloomberg colleague Lu Wang has long polled major Wall Street strategists on their expectations. The results of her survey for 2025 are below:  It's striking, first, that it's so positive. That's quite something when the market ended 2024 at or near all-time high valuations, even though support from low bond yields had been removed. The main indexes have been driven by Big Tech, which is not cheap. Yes, tech stocks could prove decent value if they grow as optimists expect, but their extreme multiples of revenue suggest stunning optimism that profit margins can be maintained. For almost all of Wall Street to expect a double-figure year when the market leaders are priced like this is quite something: Second, the degree of agreement is extraordinary. Nobody expects a decline. Yet this co-exists with a pervasive global sense of foreboding, whether with regard to Taiwan, Ukraine, Europe or the world in general. The tenor of conversation is dark indeed. Trump's core message is that something has gone badly wrong with America, so negativity there is natural; and the America First rhetoric has the rest of the world terrified. One way to reconcile this is that there is an obvious refuge from the resulting trouble — in America. In 2024, US stocks beat everyone else, according to the benchmark indexes kept by MSCI, by the biggest margin since the Clinton bull market in 1997: That said, there have been several years since the Global Financial Crisis when US outperformance has been almost this strong, and it has never lagged significantly. It's the extremely well-established consistency of US exceptionalism that really catches the eye. Further, the world isn't a totally zero-sum place. If the US truly squelches growth by everyone else, it will grow harder to sell stuff made by Americans. Vincent Deluard of StoneX Capital put this point nicely: So far the US has not suffered from the impoverishment of its allies: European, Canadian, and Japanese industries have relocated to the US, and these countries' entrepreneurs have greatly contributed to US tech exceptionalism. However, the US would suffer if its allies became too poor and unstable. Currencies could collapse. Banks could cause financial crises. Populists may consider switching alliances. Terrorism and unchecked immigration may fester. Foreign demand for US goods may fall. This breaking point may be reached in the coming years.

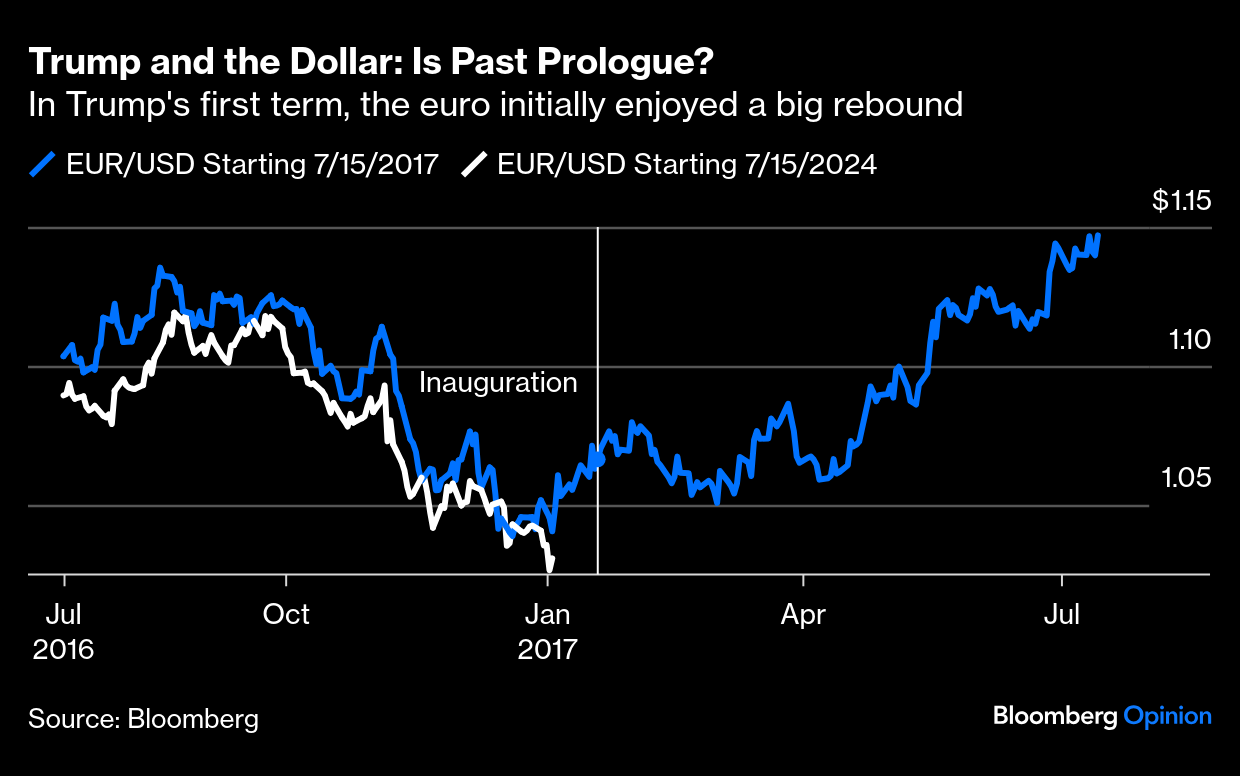

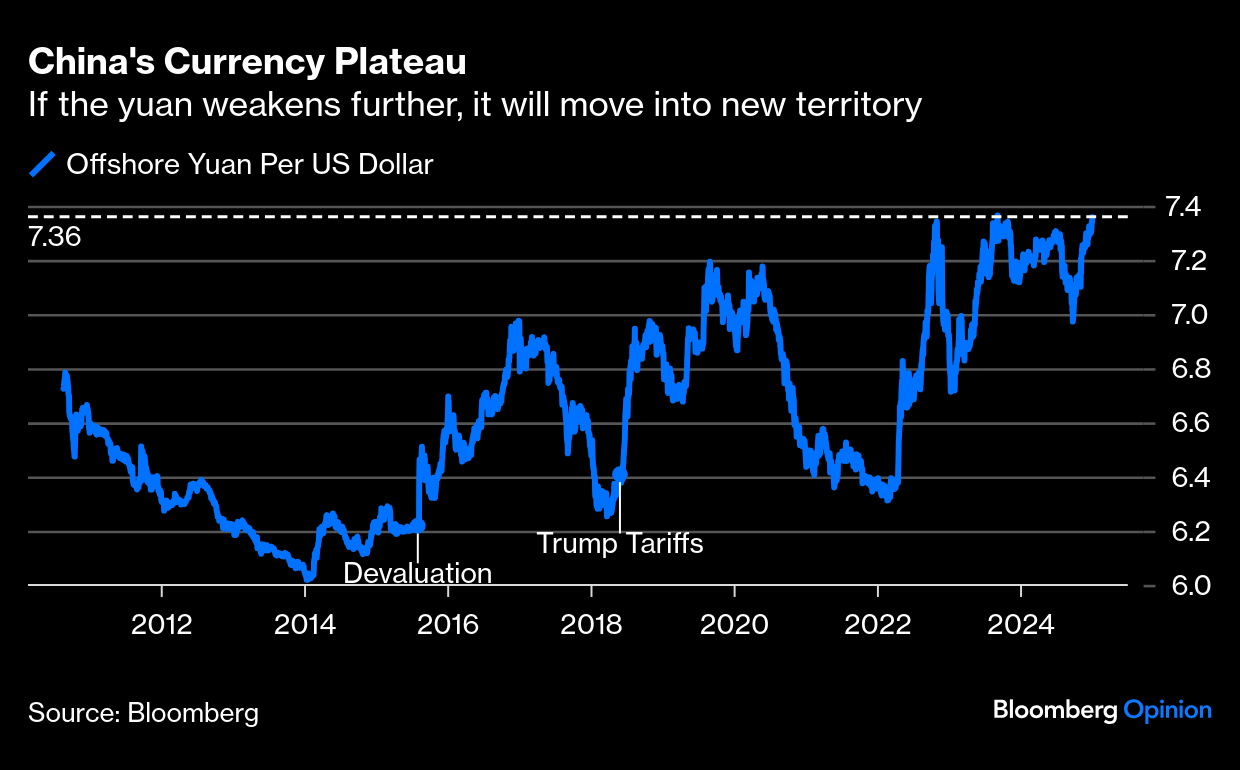

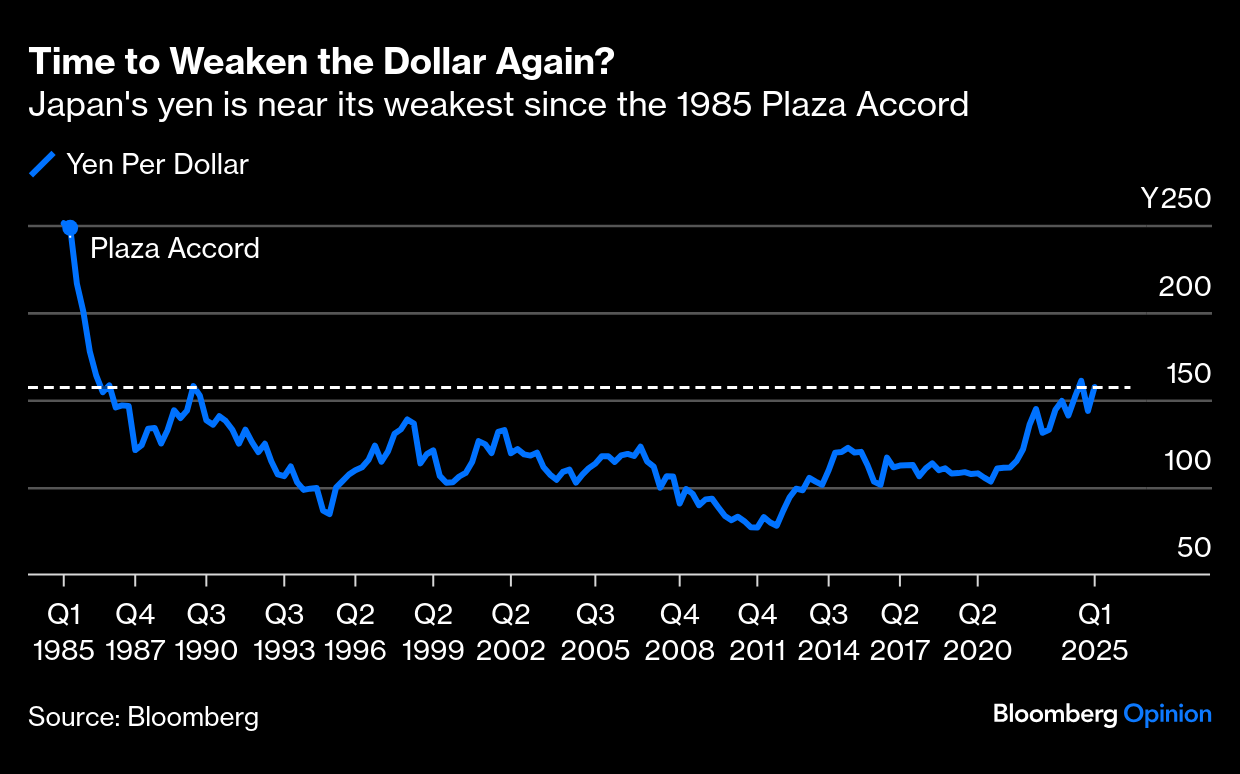

This is strongly written, but fair. The gloom provides a wall of worry for stocks to climb, as the old adage has it. But the degree of unanimity, and equanimity, about US stocks is quite hard to take. How to navigate what's coming? I'd like to suggest two crucial questions on the US. The key will then be the world's response, particularly in currency markets. First: Will Inflation Return in the US? If in another six months inflation is at or near 2%, a very real possibility, then great things are possible. This is the necessary condition for optimism. But disinflation has stopped, and the historical experience has been for inflation to come in waves.The startlingly hawkish tone adopted by Jerome Powell last month showed that the Federal Reserve itself must be somewhat concerned about this.  Powell is watching. Photographer: Al Drago/Bloomberg If inflation does make a return, then the consequences would be higher fed funds rates and bond yields. December's reverse for the stock market after Powell's "hawkish cut" was ample reminder that that a return to rate hikes will almost certainly mean lower share prices. It would also mean a higher dollar, which would tend to choke off Trump 2.0's attempt to improve US competitiveness by levying tariffs. How quickly will we know? Price rises would need to pick up again for these bad things to start happening. The latest reading for core CPI was 3.3%. Should this return to 4% by spring, then the bullish scenarios will be in serious danger. It's more likely to fall to 2%, in which case we can all enjoy ourselves; but the point is that it's necessary. Second: What Exactly Is the Trump 2.0 Agenda? This question will likely be answered more quickly, quite possibly on Jan. 20. Trump is much better prepared than last time and wants to hit the ground running. We should know very soon just how aggressive he's prepared to be on tariffs (the market would prefer he wasn't), and immigration. Tax cuts need to pass through the sausage-making machine of a finely balanced Congress, so clarity on that front will take longer. But his first proposals once in office will matter.  A Hungarian power plant as the Ukraine-Russian gas deal ends Jan. 1. Photographer: Akos Stiller/Bloomberg On foreign policy, the way the administration moves on Ukraine and Iran will be highly consequential. Some kind of resolutionwould help to stabilize concerns about the supply of oil, which in the short term would be market-positive — although the longer term could be different, particularly if peace comes at the price of emboldening malign actors. After Trump's opening moves and clarity over US inflation, we then need to worry about the response from other major economic players. That's not entirely under the control of their current leaderships. Europe: Can the Franco-German Axis Endure? The next vital date will be Feb. 23, when Germany votes and will almost certainly install a new chancellor from the center-right Christian Democrats to replace the center-left Olaf Scholz. How stable the emerging coalition can be, and whether it can govern without any help from the hard-right Alternative für Deutschland, then become critical questions. What might transform the situation for markets is a coalition with the market-friendly right clearly in control and prepared to do away with the "debt brake" that has prevented Germany from borrowing money to invest. The nightmare scenario would be a version of what happened last year in France — a weak coalition with the hard-right able to wield significant influence.  Scholz looks likely to be yesterday's man tomorrow. Photographer: Sean Gallup/Getty Images In France, further elections to resolve the impasse aren't possible until summer. President Emmanuel Macron's authority appears fatally damaged, but his mandate lasts until 2027 and there need be no legislative elections before then. It's hard to see a truly positive resolution anytime soon. The problems for Europe's core countries come with growth expectations already dropping. The European Central Bank is expected to cut four times this year, while the market has only penciled in 1½ cuts in the US. That would naturally tend to undermine the euro. The dollar-euro rate is now one of the key measures to watch. As Brent Donnelly of Spectra Markets points out, the euro's move versus the dollar over the last six months has been stunningly similar to its fall in the second half of 2016, when Trump was first elected. That time, tariffs didn't begin in earnest for another year, and the euro soon enjoyed a big rebound: Myriad factors will determine whether that happens again. But markets can create their own reality, and the euro is dropping toward the psychologically important level of parity with the dollar. If it crashes through that barrier in short order, the outperformance of American assets will be aided, but rosier scenarios will be harder to sustain with American exporters less competitive and facing weaker demand. China: Does It Break for Growth? Even if there were no US tariffs threat, China is in a hard place. Its latest dose of stimulus, announced with much fanfare in September, drove a very nice bounce in the stock market. But the performance of the most China-sensitive commodities (copper and iron ore weren't helped much), and particularly its bonds, suggests that the Chinese growth engine remains seriously compromised. A precipitous fall in government bond yields has brought the yield differential in favor of US Treasuries to a record level of three percentage points. When Trump was last elected, Chinese bond yields were higher by about one percentage point:  That speaks volumes about shifting confidence in the two economies over eight years. It also puts huge pressure on the Chinese currency. The yuan doesn't float freely, but it's not totally impervious to market forces, and a yield disparity that great makes it much more expensive for China to sustain any given exchange level. At present, the offshore yuan is teetering just above its post-GFC low. Any move lower would signal that the rules had changed: All of this before the critical decisions of whether to stimulate the economy with credit (markets would like China to do so), and whether to launch robust tariffs in response to Trump. That wouldn't be good for stock markets, even in the US. Japan: Is Inflation for Real This Time? In Japan, which like France is hobbled by a political mess following an inconclusive election, the currency is also approaching a watershed. The Bank of Japan has hiked rates over the last year. And yet the yen is around Y157, close to its weakest since the 1985 Plaza Accord saw a group of central banks coordinate to weaken the dollar: While US Treasuries yield so much more, Japan continues to offer an attractive source of cheap funds for everyone else, and that will put further downward pressure on the yen. It might even get to the point where there's a need for everyone to get together and agree on a way to weaken the dollar again. Currency markets will determine whether the optimistic scenario envisaged by Wall Street strategists can roll out as hoped. It will be very, very much easier if inflation really turns out to be beaten.  | | | Rest in Peace, David Lodge. The great novelist passed this week at 89. He had the rare knack of writing novels that were laugh-out-loud funny — particularly his Campus Trilogy, which satirized academic life around the world — while also creating characters you cared about, making you think (one of his later novels is even called Thinks..., about the mind-body problem, and the issues created by AI), and playing erudite tricks with the novel form. He also followed Graham Greene in chronicling the difficulties of being Catholic, hilariously in How Far Can You Go? Nice Work, his novel about the gap between business and academic culture, became a hilarious TV series in the 1980s that someone has kindly posted to YouTube. He makes wonderful reading for the new year. On which note, have a great year everyone, starting with a great week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Noah Feldman: Musk and His Critics are Both Wrong About Free Speech on X

- Nir Kaissar: Don't Fear the Froth. Stay Invested Even If Stocks Are Overvalued

- Jonathan Levin: Stock Bears Are Going Extinct. Time to Worry?

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment