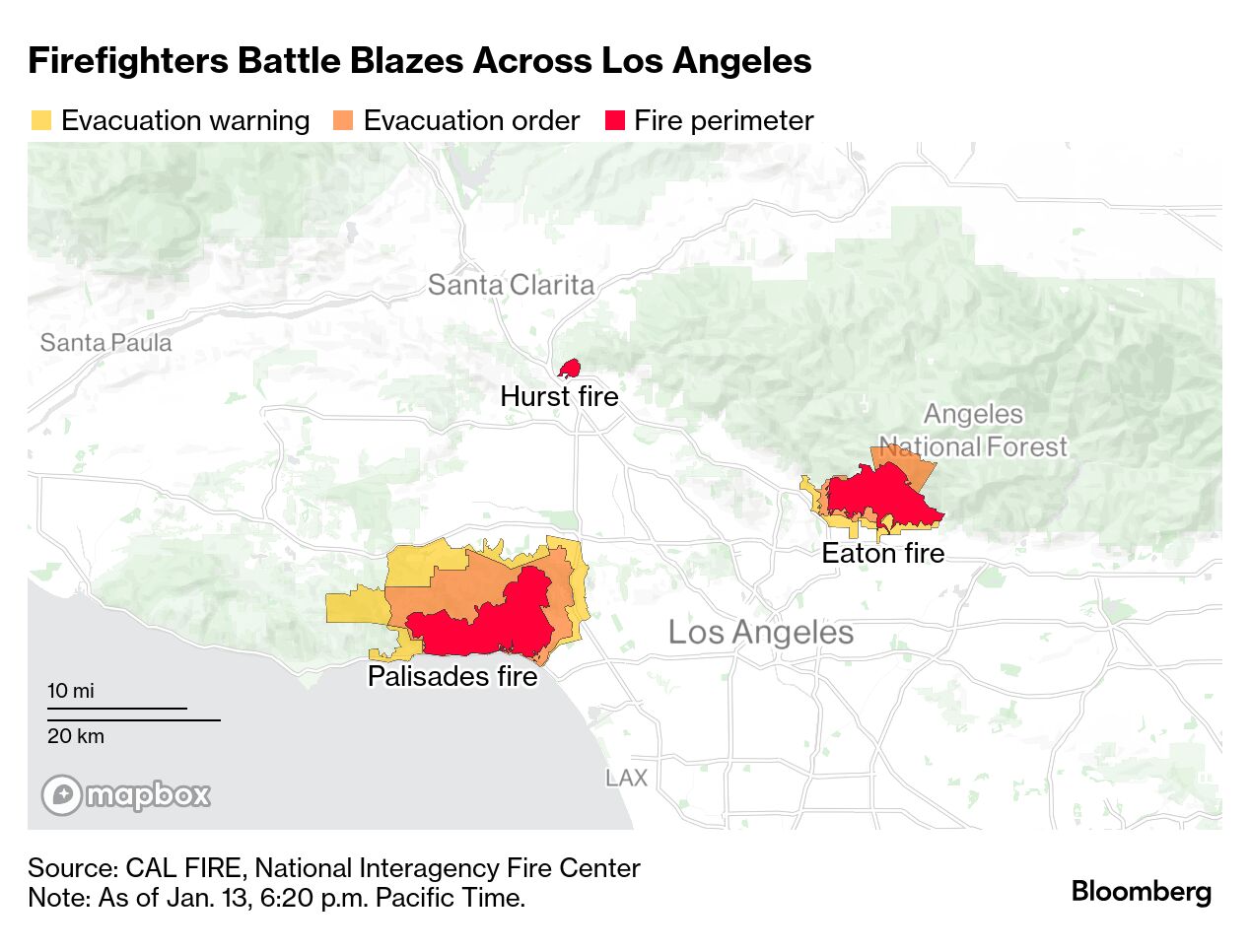

| By Alastair Marsh The exodus of Wall Street's biggest firms from prominent climate groups has been greeted with triumphant cheers from Republicans in the US who accuse such coalitions of colluding to boycott the fossil-fuel industry. It could prove to be a hollow victory, though. That's because, almost without fail, every lender that's recently left the Net-Zero Banking Alliance (NZBA), including JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Morgan Stanley, has taken great pains to claim that quitting the group wasn't the same as quitting their net-zero goals (or helping their clients achieve their targets). BlackRock Inc. for example said its departure last week from the Net Zero Asset Managers initiative "doesn't change the way we develop products and solutions for clients or how we manage their portfolios." The question to ask therefore is whether the willingness of departing firms to finance a low-carbon transition and pivot their business towards net zero will wane, since they're no longer part of groups that encourage such practices. And perhaps also whether their public claims that they will stay the course are meant to mollify clients and the broader public, both of which may not be as interested in preserving the fossil fuel industry as Big Oil and the ascendant American right. Adam Matthews, chief responsible investment officer at the Church of England Pensions Board, said the individual pursuit of net zero by financial firms is perfectly logical. "There was a lot of sense" in forming climate alliances a few years ago to work on common frameworks and to share ideas on addressing climate risks, he said. But now there's "a different political reality" and "we've also moved on in our understanding of what's needed" to meet climate goals. "The era of big alliances was about indicating a commitment to climate goals; but now it's time to roll up sleeves and move on from vague and highfalutin pledges and start demonstrating what they mean for capital allocations and investment decision-making," Matthews said. "This can be done equally well individually as it can collectively."  JPMorgan Chase Chief Executive Officer Jamie Dimon, left, with then-President Donald Trump in 2017 at the White House. Photographer: Andrew Harrer/Bloomberg Not everyone is as optimistic about the motives of Wall Street financiers when it comes to their recent announcements. Critics see the seemingly simultaneous move by the big banks and firms as an obvious attempt to curry favor with US President-elect Donald Trump. New York City Comptroller Brad Lander said BlackRock and JPMorgan have joined their peers "in a stark betrayal of the responsibility" that they have to address the climate crisis. "By absconding from their responsibilities to combat climate change, these financial institutions are yielding to the authoritarian tone set by the incoming Trump Administration," Lander said Friday in a statement. Read More: Wall Street's Top Banks Just Quit a Once Popular Alliance Still, Lucie Pinson, head of Paris-based nonprofit Reclaim Finance, said those leaving climate alliances "have never been particularly notable for the strength of their climate action." "The real question is what each bank, insurer and investor committed to net zero will do in a political context where anti-climate parties are gaining ground," she said. For those concerned with the pace of climate action in the finance sector, Ben Caldecott said the departure of JPMorgan, BlackRock and the like could be a good thing. The director of the Oxford Sustainable Finance Group at the University of Oxford Smith School of Enterprise and the Environment, Caldecott said net-zero alliances need retooling anyway, and that the high-profile walkouts may provide the impetus. "To the extent these exits aid a recalibration of finance-sector alliances around more impactful things than portfolio-temperature alignment, then they're very welcome," he said. "The focus on 1.5C-aligned portfolios above all else is unhelpful, even counterproductive, because what we actually need is emissions cuts in the real economy, not window-dressing of portfolios." Caldecott said the focus of groups such as NZBA on reducing emissions tied to lending and investing can actually dis-incentivize financiers from providing capital to help companies decarbonize. Hetal Patel, head of sustainable investment research at Phoenix Group, also sees a coming crunch moment for climate groups. He said if the current pace of warming continues (Earth's average temperature exceeded 1.5C on an annual basis for the first time in 2024), then finance firms' own climate targets, which are all pegged to the 1.5C threshold, will become untenable. Still, he credits NZBA and the other finance alliances for raising the sector's ambitions on climate. "When you have big names like the US banks pulling away, it's not a good look," Patel said. "Still, I disagree with those who say these alliances aren't important because they have sped up the process for bringing laggards to the table and have enabled sharing of ideas. Without banks having set emissions-reduction targets, they might not have engaged as aggressively with clients on the topic." But with more defections still expected, both the strength of the now-smaller alliances and the decarbonization commitments of the departing firms remain open questions. Sustainable finance in brief | After Wall Street giants like JPMorgan and BlackRock retreated from the climate alliance, Texas's prime antagonist when it comes to environmental, social and governance matters—Republican attorney general Ken Paxton—dropped his threat to cut them off from the state's municipal-bond deals. In 2023, Paxton's office announced it was reviewing the policies of finance companies that were members of the NZBA, a move that stemmed from Texas legislation seeking to punish financial firms for engaging in what it viewed as a "boycott" of the oil and gas industry, the key perpetrator of global warming.  Ken Paxton, Texas attorney general, during the Conservative Political Action Conference in National Harbor, Maryland, in February 2024. Photographer: Kent Nishimura/Bloomberg - Just as 2025 begins with wildfires wreaking devastation in Southern California, it's become clear insured losses from natural catastrophes in 2024 were the highest since 2017.

- But those catastrophic infernos sweeping across Los Angeles County are unlikely to trigger big losses for catastrophe bonds designed to capture such risks. Here's why.

- Some of France's largest companies, including Amundi SA and Electricite de France SA, have signed a letter to European policymakers urging them to ensure the bloc sticks with its current timetable for implementing ESG reporting rules.

|

No comments:

Post a Comment