| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, an Abu Dhabi fund is helping bankroll Trump's $100 billion AI plan, Saudi Arabia is boosting its poultry business and Middle East's billions turned heads in Davos. But first, it's over to my colleague Matthew Martin to make sense of the US president's $1 trillion demand from Saudi Arabia. If Saudi Arabia's de facto ruler Crown Prince Mohammed bin Salman needed a refresher on how to deal with Donald Trump, he got one over the past week.

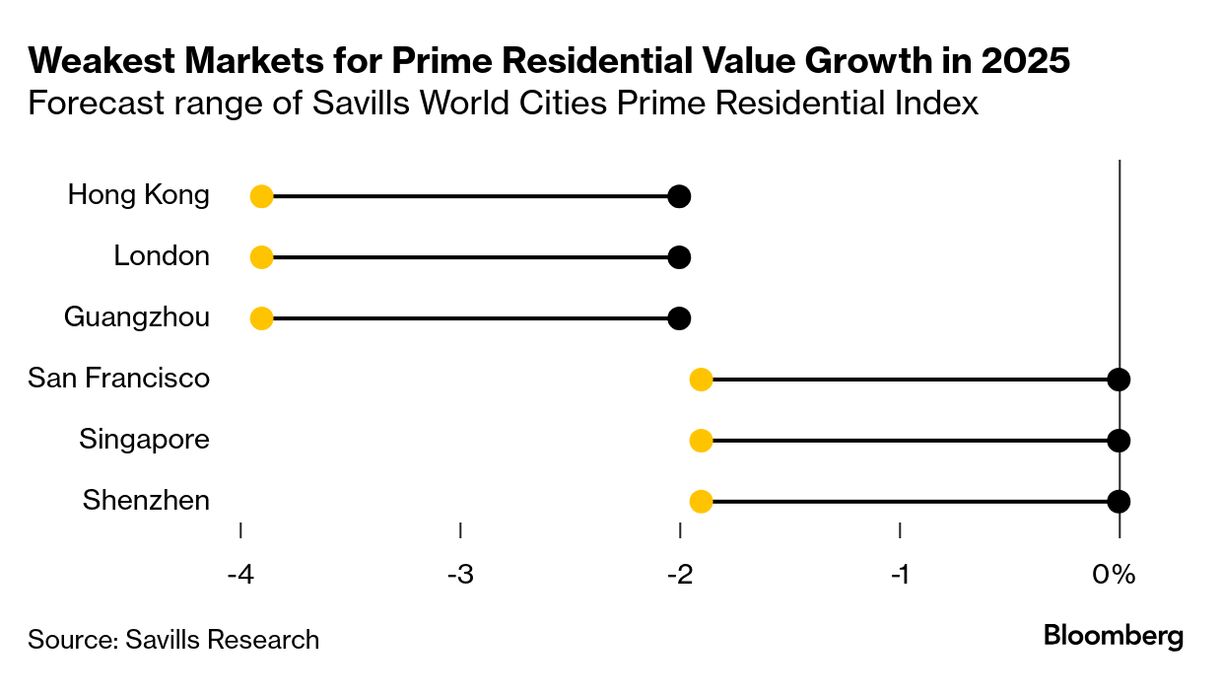

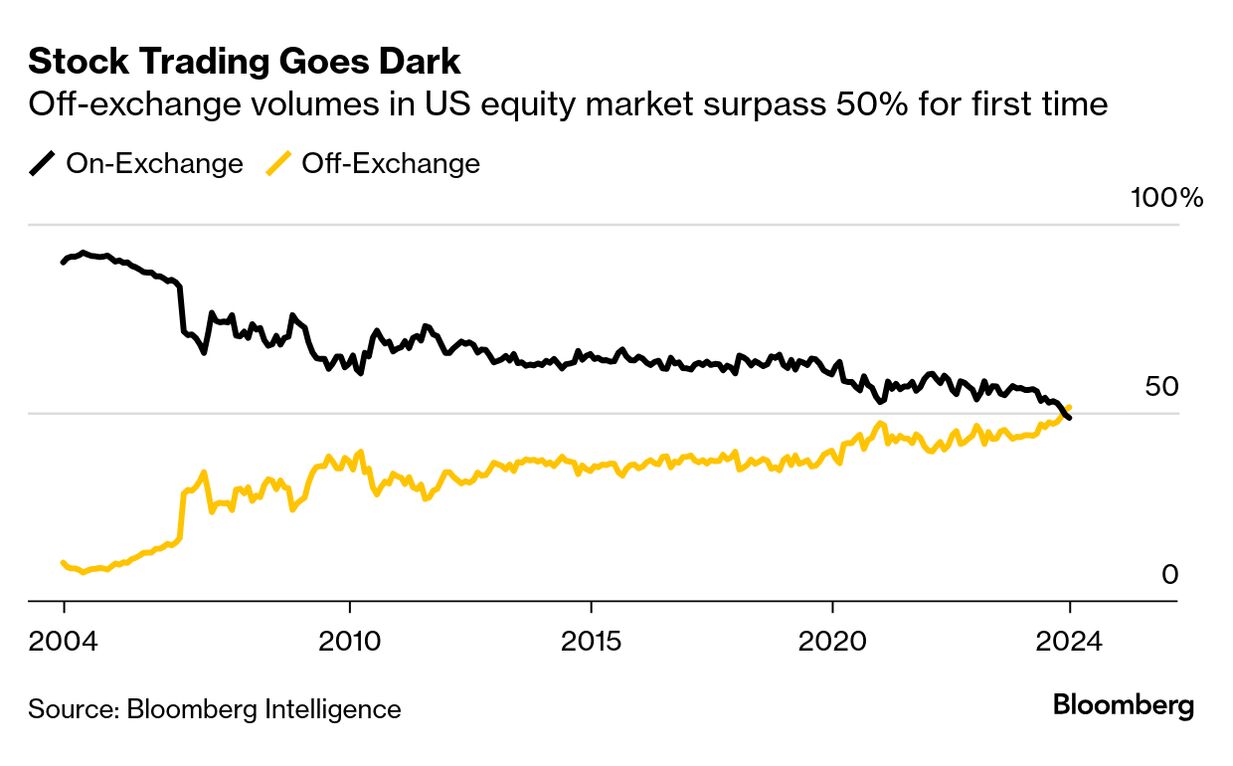

Hours after his inauguration, Trump told reporters he'd be happy to visit the kingdom again if it wanted to buy "another $450 billion or $500 billion" worth of US products. MBS, as the crown prince is widely known, offered $600 billion in trade and investment deals over the next four years. It may have appeared a canny move to get in early with a headline grabbing promise to support Trump's agenda of bolstering the US economy. Instead, Trump seems to have seen it as an opening offer. Within 48 hours of his discussion with MBS, Trump was pushing him to "round out" that figure to $1 trillion.  Mohammed bin Salman, Saudi Arabia's crown prince, left, with US President Donald Trump, in 2018. Photographer: Kevin Dietsch/Pool via Bloomberg It was a stark reminder of one of Trump's guiding principles, informing discussions with allies and foes alike. Always push for more, especially if the other side gives in too quickly. "My style of deal-making is quite simple and straightforward," according to The Art of The Deal, the 1987 business book that bears Trump's name. "I aim very high, and then I just keep pushing and pushing." Read More: Saudi Arabia Says $770 Billion Invested in US as MBS Eyes More How MBS looks to reconcile Trump's ambitions for squeezing cash out of the kingdom at the same time he pursues his own 'Saudi First' agenda to make his homeland a diversified economy fit for the coming decades, will pose significant challenges. The $1 trillion figure is "completely unrealistic," according to Karen Young, a senior research scholar at Columbia University. "That'd be like the entire Public Investment Fund, plus more, being invested only in the US," she said in an interview on Bloomberg TV. Already the $600 billion pledge, which amounts to 55% of the country's gross domestic product, seems a reversal of plans to shift the kingdom away its historic role as an exporter of capital to being a place that attracts foreign investment. Ratcheting US investments up even higher further strains credibility. Young said the kingdom could try to placate Trump through trade agreements and military deals. "What we might see then is just promises, promises of defense purchases and service contracts over a long period of time; two-three decades even." As if to make things even more uncomfortable for MBS, Trump also complained that oil prices were too high. Already facing years of budget deficits ahead as it tries to pay for MBS's domestic ambitions, the kingdom has been doing what it can to get crude prices higher. Trump's intervention in oil markets will be another unwelcome distraction, and any success he may have in convincing Saudi Arabia and other oil producers to lower prices will impact MBS's ability to fulfill his US investment pledges. One small piece of consolation may be available, though. Trump will "sometimes settle for less than I sought," according to The Art of the Deal. "But in most cases I still end up with what I want." While ties between the two nations, and two leaders, are undoubtedly strong, balancing Trump's competing demands on Saudi Arabia will be an expensive endeavor. Related Coverage Abu Dhabi's latest AI salvo | Abu Dhabi's push for AI dominance got a fillip last week when an investment vehicle set up by the city less than a year ago was named as one of the backers for Trump's $100 billion Stargate project. MGX, as the firm is known, will partner with the likes of OpenAI, SoftBank and Oracle on the venture. The Emirati firm might not yet be as well known as the other names on that list, but it's been a prolific investor. Set up in March, with Mubadala and G42 as founding partners and a goal of eventually topping $100 billion in assets, it's already backed OpenAI, xAI, and was among the investors in Databricks. MGX has also teamed up with BlackRock and Microsoft on a $30 billion plan to build data warehouses and energy infrastructure. Overseen by one of the world's most influential dealmakers, Sheikh Tahnoon bin Zayed Al Nahyan, MGX combines the financial heft of the $330 billion Mubadala — itself a significant force in the world of technology investing — with the AI arsenal of G42.  Sheikh Tahnoon bin Zayed Al Nahyan Photographer: Atta Kenare/Getty Images Read More: Gulf Royal's $1.5 Trillion Empire Draws Bankers and Billionaires Since September, its chairman, Sheikh Tahnoon, has met with Nvidia CEO Jensen Huang, Alphabet President Ruth Porat and Elon Musk. In those conversations, as well as those with heavyweights of global finance like BlackRock CEO Larry Fink, AI appears to have been a dominant theme. For Abu Dhabi, which has made AI a key a facet of its attempts to diversify away from oil, MGX is clearly the firm to watch. Read More: What Is China's DeepSeek and Why Is It Freaking Out the AI World? More must-read Mideast stories | The Qatar Investment Authority expects Donald Trump's return to lead to a boom in US technology deals. "For now, it's probably one of the best tech environments that we've ever seen in the US," an executive said. The UAE's economy minister expressed concern about the European Union keeping it on a list of countries with deficiencies in combating illicit money flows: "I do not understand how the UAE is still on the black list." Brevan Howard has cut around 7% of its trading workforce, affecting about a dozen traders in its offices spanning New York, London and Abu Dhabi. Abu Dhabi's PureHealth is buying a majority stake in a $2.3 billion hospital group from CVC Capital Partners. Abu Dhabi-based Modon has purchased a 50% stake in the London skyscraper that will house Ken Griffin's Citadel once complete.  Artist impression of 2 Finsbury Avenue, London. Source: 3XN Dubai's prime residential property prices are expected to grow as much as 9.9% in 2025, according to Savills. Overall, the firm expects growth in 30 global cities it monitors to slow to 1.6%, marking the lowest gain since 2020. Derayah Financial is considering seeking a valuation of about $2 billion in its initial public offering in Saudi Arabia, while Asyad Shipping is considering seeking a valuation of at least $1 billion in its share sale in Oman. State Street, which manages $4.7 trillion globally, is looking to launch more exchange traded funds tracking Gulf capital markets. Saudi Arabia is facing investor skepticism over its $100 billion mining ambitions. Turkey's central bank cut its main interest rate by 250 basis points for a second straight month and signaled similar cuts in future meetings. Turkey's navy welcomed two new 3,000-ton frigates, marking a significant step in the country's aim to diversify its booming domestic defense industry. Meantime, Ankara is hoping to reach a $6 billion defense deal with Saudi Arabia.  The Turkish Navy's IZMIT Milgem I-Class frigate. Source: STM Here're a few other stories that caught my eye: | Goldman Sachs promoted a slate of star executives to run its biggest Wall Street business lines, spotlighting the firm's next generation of leadership. JPMorgan CEO Jamie Dimon said asset prices are "kind of inflated" in the US stock market.  Jamie Dimon, chief executive officer of JPMorgan Chase. Photographer: Kent Nishimura/Bloomberg Most trading in US stocks is now occurring outside the country's exchanges. Crypto's richest man, Changpeng "CZ" Zhao, is turning the former venture capital arm of his Binance Holdings into a family office.  Changpeng Zhao, former chief executive officer of Binance. Photographer: David Ryder/Bloomberg

Podcasters like Joe Rogan and Logan Paul turned young men, a once apolitical demographic, into a powerful voting bloc for Trump.

Saudi Arabia is increasing its poultry production to achieve food self-sufficiency, with a goal of producing 100% of its chicken domestically by 2030. The country has almost doubled its poultry production in the past decade, and is also investing in producers abroad and building farmland in countries like Brazil and the US to secure its food supply. At a rate of about 6% a year, Saudi Arabia is one of the fastest-growing producers in the world, according to consultant Gira. The country's coops have come a long way in a relatively short time. A glitzy Davos shindig hosted by Qatar's $510 billion wealth fund attracted financial heavyweights from Blackstone's Steve Schwarzman to UBS' Colm Kelleher and private equity billionaire Robert Smith. Footballer David Beckham even posed for selfies with attendees. The event was just the latest sign of the finance industry's rush to make inroads in the Middle East. For the last two years, bankers from around the world have been landing in Riyadh, Doha, Abu Dhabi and Dubai to win business from the governments and investors that control some of the biggest pools of capital on the planet. Related Davos Coverage Despite lower crude prices and tightened budgets, Wall Street is still betting big on the region, citing its growing client base and opportunities for expansion. "Aside from exporting capital globally, the region also has needs for vast amounts of capital to fulfill their own infrastructure and other investments and it's a good opportunity for us to play an even more meaningful role," said Filippo Gori, JPMorgan Chase's co-head of global banking and head of the bank's presence in Europe, the Middle East and Africa. For many Gulf countries, the World Economic Forum was also a chance to showcase the efforts of their cities to become global hubs. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment