| This is Bloomberg Opinion Today, a recap brought to you by Bloomberg Opinion's hurriedly-formed and ill-defined Department of Opinion Efficiency. Sign up here. Move Carefully and Be Sensible | I can't say it's how I'd run things, but one approach to saving money in government might be to unleash a social media-obsessed billionaire to selectively pick through budgets before targeting specific low-level federal employees for harassment. That's the track record of Elon Musk's so-called Department of Government Efficiency so far, t-minus 17 days from the return of Donald Trump to the White House. Alternatively, there's a better way for DOGE to bring about real reform that doesn't involve a sledgehammer, writes Max Stier (free to read): The new administration should choose agency leaders who are capable managers of large organizations and will prioritize fixing current government operations, not just announcing new policy.

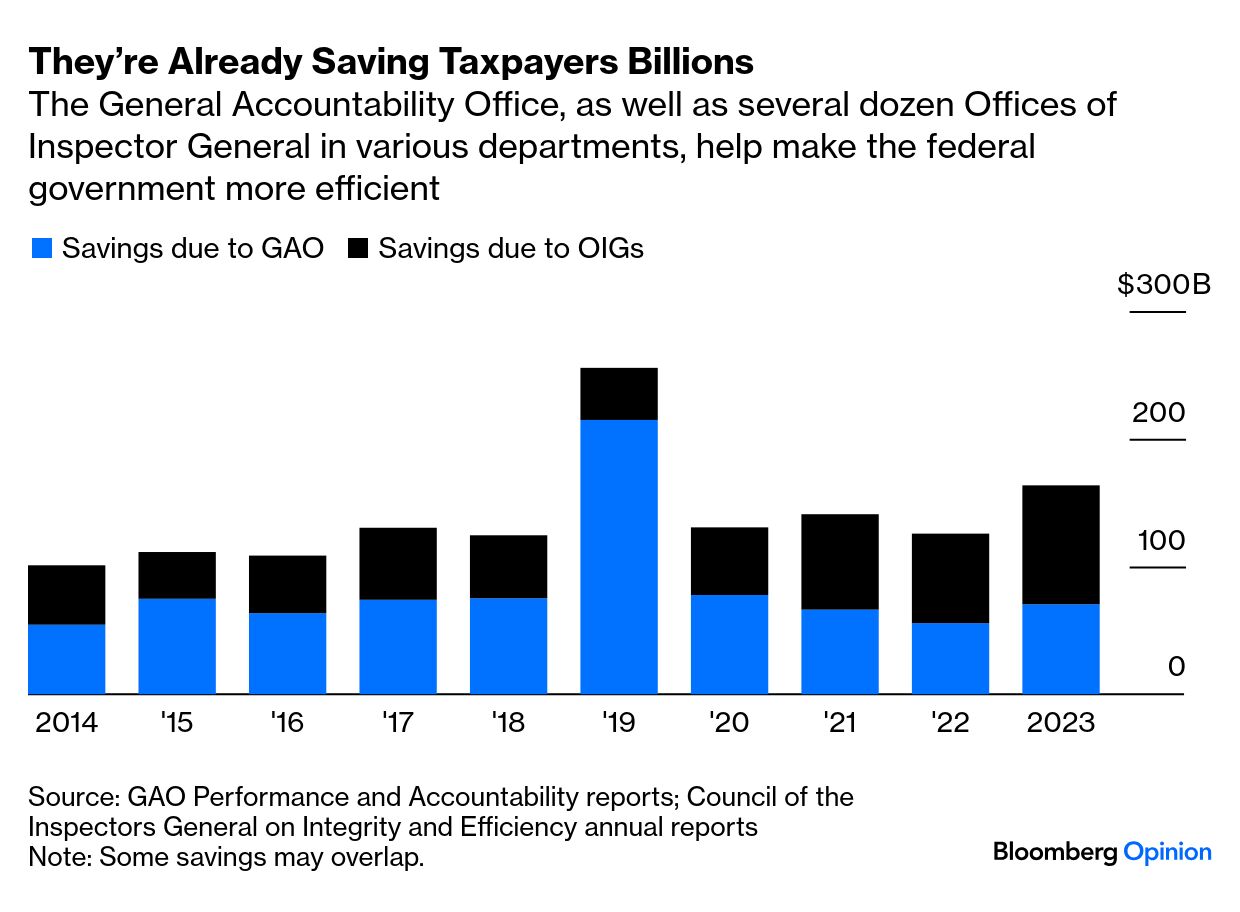

Max is president and chief executive officer of the Partnership for Public Service, a nonprofit, nonpartisan advocacy group that has pushed for better and more efficient government services for more than two decades. He says the evidence shows government spending is tightening: Put the above data to Musk and his excitable DOGE sidekick Vivek Ramaswamy and they will argue much more can be done — $2 trillion more, no less. Max worries the DOGE boys will careen into their remit with Silicon Valley's "move fast and break things" mentality, rather than using their influence in the Trump administration to nail down some of the less-sexy foundations that might actually make for a better federal government. One idea to start, Max says: push Congress to pass bills that give agencies consistent funding so they can properly plan ahead without worrying about their finances becoming a political football whenever a government shutdown looms. There may be worse things than being a political football, mind. Try being a political piñata, which is how Meta has been described over the past few years as founder Mark Zuckerberg — who of course first coined the "move fast" mantra — mounted an impossible campaign to appease politicians of all stripes on matters of moderation and "free speech." Zuckerberg's hired help on the political scene is now on the way out, writes, er, me (Dave Lee) in this free read. Nick Clegg, the former UK deputy prime minster, will leave the company as part of Meta's retooling for the changing political winds. Both Clegg and Zuckerberg know the time for the Englishman's mild-mannered but firm diplomacy has long passed. In his place as Meta's new head of global policy: Joel Kaplan, the company's most senior Republican. As I explain in the piece, whereas Clegg's mandate had been to "mop up the reputational carnage left behind by the Cambridge Analytica scandal," and lobby for Meta's interests in Europe, the new survival strategy for Zuckerberg is in staying on the good side of the returning Trump, who only this past summer was threatening to put him in jail. Wonder if that came up during the pair's recent dinner at Mar-a-Lago. "Prophecies of doom are legion," writes Hal Brands, summing up the general vibe as the volatile Trump administration heads back into power and stares down a "maelstrom of crises." Yet by many of the most important measures, Hal argues, the USA is actually in ship-shape. Its GDP has pulled comfortably clear of Europe's, and talk of China rising to be the world's number one economy has not (yet) come to pass. And, Hal continues: Look beyond GDP, and the picture is even brighter. In recent decades, US labor productivity has risen faster than that of any other advanced economy. US firms account for more than half of global profits in high-tech sectors, compared to 5% for Chinese firms. America's research and development investments, the lifeblood of future innovation, lead the world. China is a stronger economic rival than the Soviet Union ever was. But the US is well-positioned to remain the world's richest, most dynamic economy for a long time to come.

Confidence in the US should also extend to confidence in the financial markets, writes Nir Kaissar, even though many investors are braced for a comedown. With the S&P 500 trading at 25 times forward earnings — levels that previously precipitated major busts, like the dot com crash — a correction seems "overdue," Nir acknowledges. But the wise investor should play a longer game and realize that "history shows that the market grinds higher more often than it backtracks." There's no such optimism in the UK stock market, where the 2024 "rot" seems almost certain to persist, writes Chris Hughes. In his downbeat lookahead: The big picture remains depressingly familiar. Support from UK pension funds for domestic stocks has all but evaporated. London trades at a discount to New York when priced against expected earnings, a function partly of its lower weighting in highly valued technology stocks. There's a lack of analyst research covering small and mid-sized companies. And trading volumes are thin, making it hard for investors to build sizable holdings.

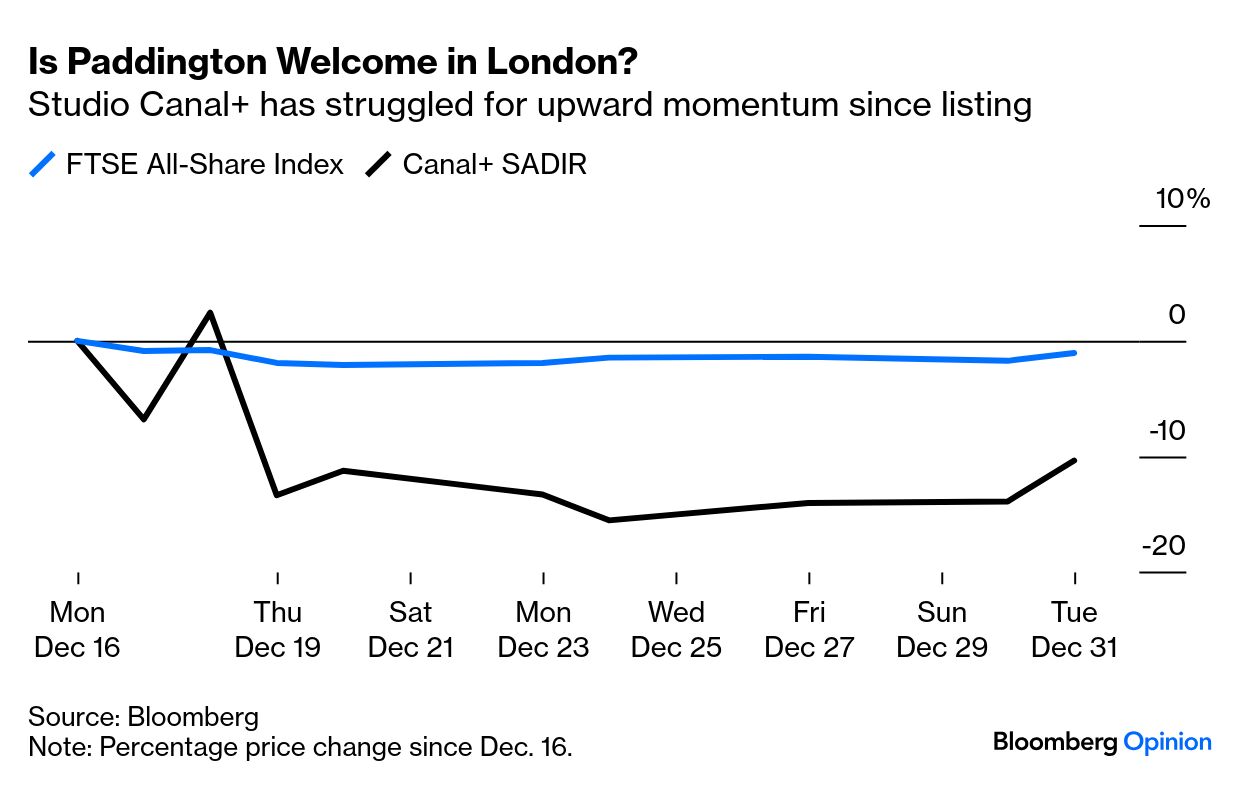

Not helping matters has been the performance of recent UK listings. The London debut of French movie studio Canal+, freshly spun out from its former parent, was heralded by British Chancellor Rachel Reeves as a "vote of confidence" in the country's status as a financial center. It's ended up being rather (Paddington) bearish: The possibility that fast-fashion giant Shein may list in London next year could provide some much-needed replenishment, Chris says. Democrats' key contests in 2025 as it seeks to rebuild. — Nia-Malika Henderson India and China should admit their economies are intertwined. — Mihir Sharma The UK Labour Party's education agenda smacks of pettiness. — Martin Ivens Mike Johnson holds on to the speakership. The US Surgeon General wants cancer warnings on alcohol. Nippon Steel's $14.1 billion takeover deal for US Steel was nipped in the bud by Biden. The show(s) must go on in grief-stricken New Orleans. Kenyan man tending to his cow heard a loud bang. It was a half-ton piece of space junk. Grandpa Brian isn't a real grandpa. He's a tacky Meta AI. The hot sauces on Hot Ones aren't as hot as they claim.

Notes: Please send Daddies Sauce and feedback to Dave Lee at dlee1285@bloomberg.net.

Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment