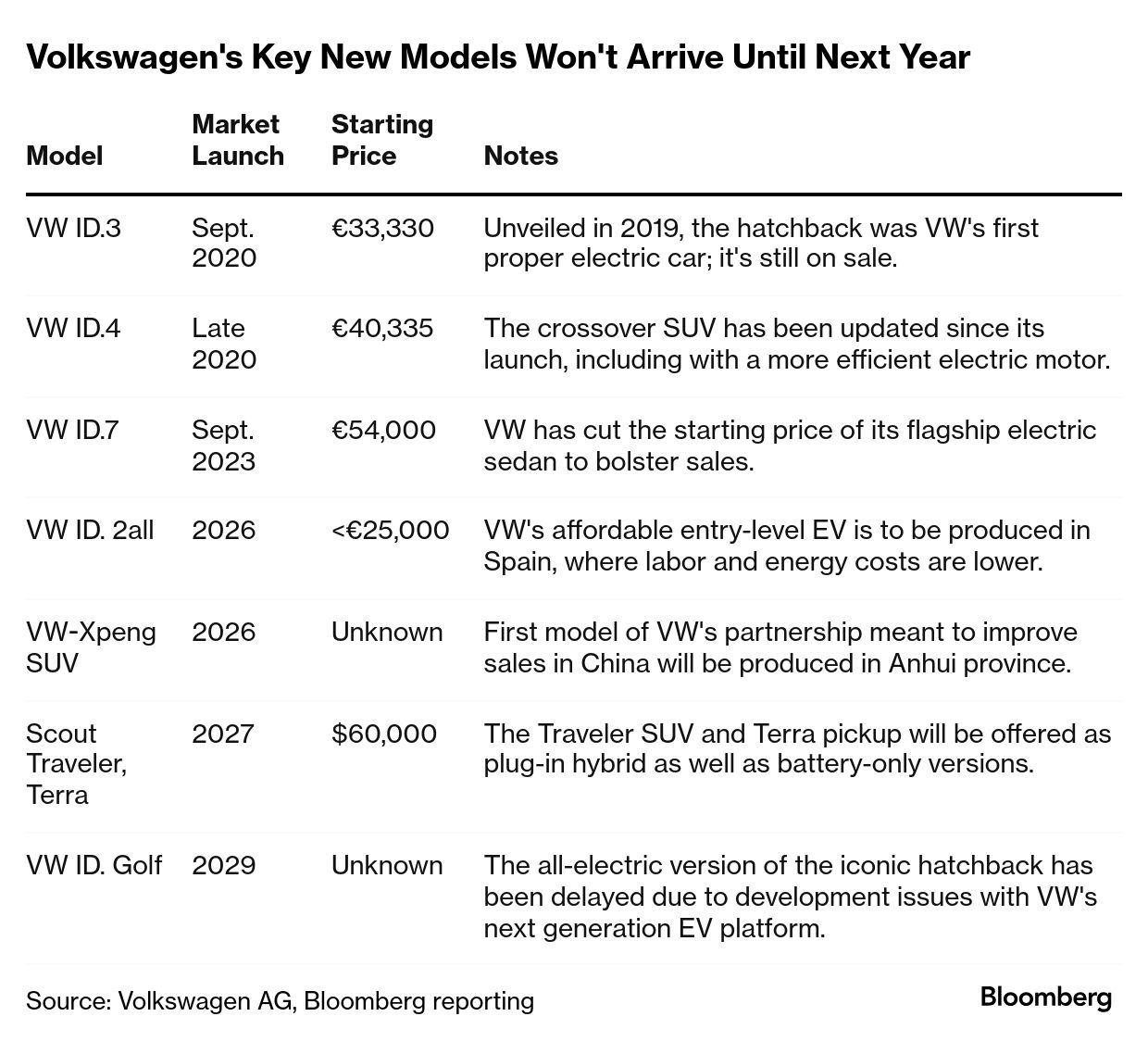

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. No New Electric VWs for 2025 | Volkswagen had a poor 2024, with sales falling and Europe's biggest automaker even raising the prospect of closing factories in Germany. This year could be even worse. The manufacturer's deliveries risk slumping again because its namesake VW brand doesn't have a new electric car coming in 2025, with key products pushed back amid delays developing software. The problems are starkest in China, where manufacturers led by BYD are dominating with affordable electric and hybrid models. In the US, where President-elect Donald Trump is threatening tariff hikes, VW still doesn't offer any pickup trucks popular among American consumers. The voids in VW's lineup are complicating CEO Oliver Blume's bid to restructure the industrial behemoth, which is reeling from overcapacity and intensifying competition. While Blume struck a deal late last year with unions to cut costs in Germany and is counting on partnerships with Rivian and Xpeng in the US and China, those new models won't be available until later this decade. "For the next year or so, VW is forced to sell old technology to new customers," said Matthias Schmidt, an automotive analyst based near Hamburg. "That's going to be difficult." Volkswagen is still profiting handsomely from its popular combustion-engine models, but its bet on fully electric vehicles isn't playing out as planned. Sales are stagnating in Europe and slumping in the US as customers are turned off by waning subsidies and patchy charging infrastructure. The manufacturer has contributed to the malaise by introducing its first electric models years later than planned and with glitchy software. In China, a key profit driver for Volkswagen, the market for luxury EVs failed to take off, hurting prospects for models including Audi's Q8 e-tron and Porsche's Taycan. In the mass market, VW is struggling to compete with BYD, Nio and Xiaomi, whose aggressively priced plug-in cars boast large screens and sophisticated voice-recognition technology. The manufacturer also doesn't offer any range-extended EVs that have become popular in the world's biggest auto market. "The main issue with VW is the product," said Stephen Reitman, an analyst at Bernstein. "They have this production capacity for battery-electric vehicles that people aren't buying."  Blume at an event in Beijing in April 2023. Source: /Bloomberg Blume is taking steps to plug the gaps. The VW brand in November started production of the Tayron, a large SUV also sold as a plug-in hybrid, with deliveries due to begin this year. The group is refreshing popular combustion-engine models including the VW T-Roc and Audi Q3 and is preparing deliveries of the Skoda Elroq, one of its most affordable electric SUVs. In Europe, Volkswagen has managed to defend its market share thanks to robust demand for its gasoline-powered models. It has also drastically improved in-car software, though Schmidt said that the VW brand's image is still hurting from its early missteps. Next-generation models that analysts rate as possible game changers — including the ID. 2all, an EV priced below €25,000 — won't start deliveries until 2026. When previewing the car two years ago, VW said it will be as spacious as the Golf and as affordable as the Polo, two models that have sold a more than 57 million units combined since their introduction in the mid-1970s. In China, Volkswagen is aiming to regain market share starting next year, when vehicles developed with Xpeng hit showrooms. Blume has promised they'll include technology that will better fit local tastes. The group aims to sell 4 million vehicles annually in China by 2030, up from 2.93 million last year. "The introduction of new models is one solution, but it is just as important to maintain our broad portfolio," said Stefan Voswinkel, a VW spokesperson. "We have worked hard over the past few years and have really good models with high-performance software and high quality."  The VW ID.3 on the assembly line at the company's plant in Zwickau. Photographer: Krisztian Bocsi/Bloomberg In the US, where business will get more complicated if a Trump-led White House imposes costlier tariffs, VW is preparing pickup trucks and rugged SUVs via its resurrected Scout brand. Scout plans to offer electric, hybrid and range-extended EV options, but they won't arrive until 2027, and their popularity may ultimately depend on whether incentives are in place to reduce their sticker prices of roughly $60,000. Uncertainty is also hitting Volkswagen closer to home. Germany is reeling from two years of recession and bracing for snap elections in February. EV sales plummeted in Europe's biggest economy in 2024, and Blume has warned that conditions in the country are insufficient for industrial companies to withstand stiffer competition. VW's union deal to reduce German capacity and labor costs is just a start, Bernstein's Reitman said. "It's good to cut costs," he said, "but it's also about finding ways to make your products sell better." — By Monica Raymunt

Wopke Hoekstra in Brussels on Jan. 14. Photographer: Simon Wohlfahrt/Bloomberg The European Union is prepared to ensure carmakers are ready to meet its 2035 goal to effectively phase out the combustion engine, the bloc's climate chief said, despite stiff competition from China. The optimistic take from Wopke Hoekstra, who began a second term overseeing the bloc's green goals last month, comes at a delicate time for the auto sector. Demand for electric vehicles has slumped in Europe as manufacturers face stricter EU emission targets and a flood of Chinese EVs. "We will do our utmost to secure that this sector has a very bright future here in Europe," Hoekstra said in an interview with Bloomberg Television. "There is no doubt in my mind that we will reach the 2035 target well in time." |

No comments:

Post a Comment