- DeepSeek suggests US tech might not be so exceptional after all.

- No, we cannot be sure that DeepSeek will change the world.

- It does reveal how much is riding on the belief that Nvidia has an entrenched monopoly.

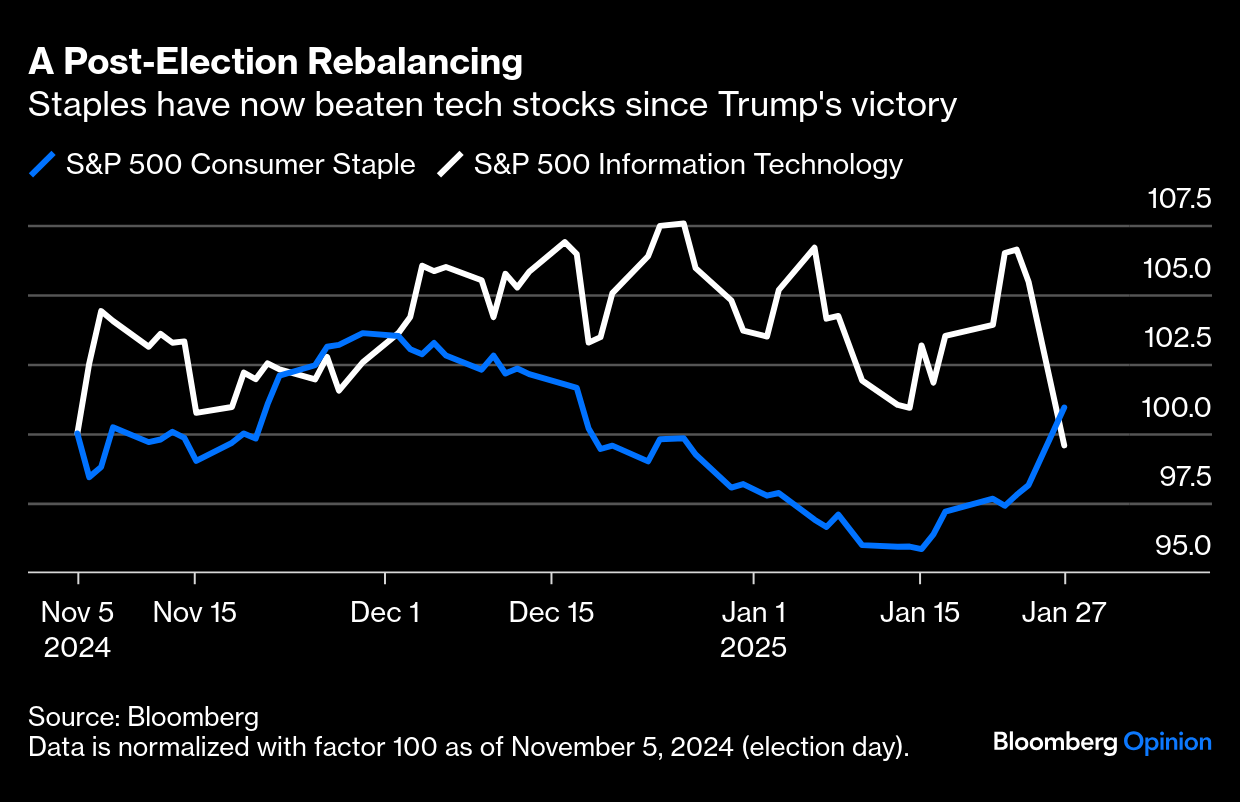

- There are winners. The consumer staples sector has beaten tech since the election.

- AND: Some music for a Sputnik Moment.

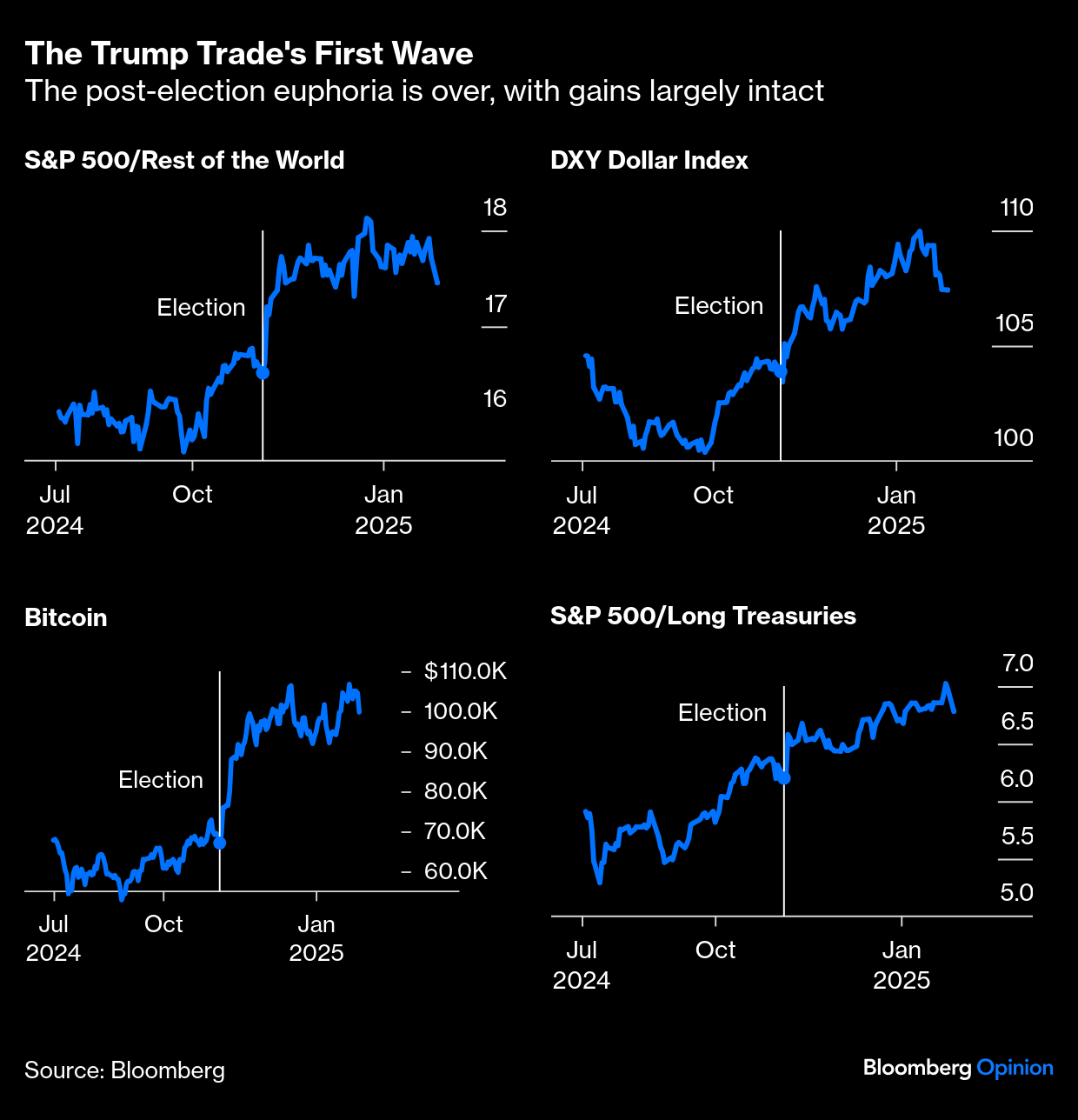

News about the biggest US tech groups has become a macro event. Wednesday will see the Fed's Jerome Powell talk to the press on monetary policy, within an hour of results from Tesla Inc., Microsoft Corp., and Meta Platforms Inc., and it's not at all clear which will be more important. But most spectacular was the leviathan splash made by the Chinese artificial intelligence startup DeepSeek (whose logo is a whale), which suddenly emptied the monopoly moat that has protected Nvidia Corp.'s domination of the AI landscape. On Monday, DeepSeek was more or less solely responsible for cleaving $589 billion from the chipmaker's market value, and even move currency and bond markets as well. No other single company has ever lost so much in value in one day. Indeed, only a dozen companies currently have that big a market cap in the first place. Nvidia's loss was equivalent to the entire market value of Oracle Corp.:  Broader markets treated this as a Sputnik Moment. The "Trump trades" that set in when the president's odds of victory started increasing last fall now seem to have run their course. The dollar, Bitcoin, and the S&P 500 have all held on to most of the gains made during the post-election rally, but all were trimmed as traders pulled back from bets on American exceptionalism. DeepSeek matters so much because it calls into question two fundamental assumptions that have underpinned the market since the launch of ChatGPT in November 2022. First, companies wanting to compete in AI, or to use it, will have to make massive and very energy-intensive expenditures to do so. And second, Nvidia's lead in producing the chips needed for AI was so great that it effectively had a monopoly. Companies would have to spend a lot of money, and they would have to spend it with Nvidia. To show how important these concepts are, mark these words from Louis Navellier, a veteran and very canny growth investor. He doesn't try to be politically correct about why he holds a large chunk of Nvidia. Back in May, he upped his price target for the company by 40% and said: Nvidia is a monopoly and it's going to remain a monopoly for the end of the decade. They're not going to have competition because they spent over $2 billion to build their Blackwell chip and no one can afford to compete with them.

In November, he pressed on with the bull case as follows: Since Nvidia spent approximately $2 billion developing the Blackwell GPU, it has no competitors and as it develops even more powerful GPU successors to Blackwell, I do not expect any competitor to "crack" Nvidia's monopoly on generative AI. By the end of the decade, there are not expected to be any Nvidia GPU successors since the transistors in each chip will be approaching the "atomic" level, so sheer physics will prohibit Nvida from making its CPUs faster.

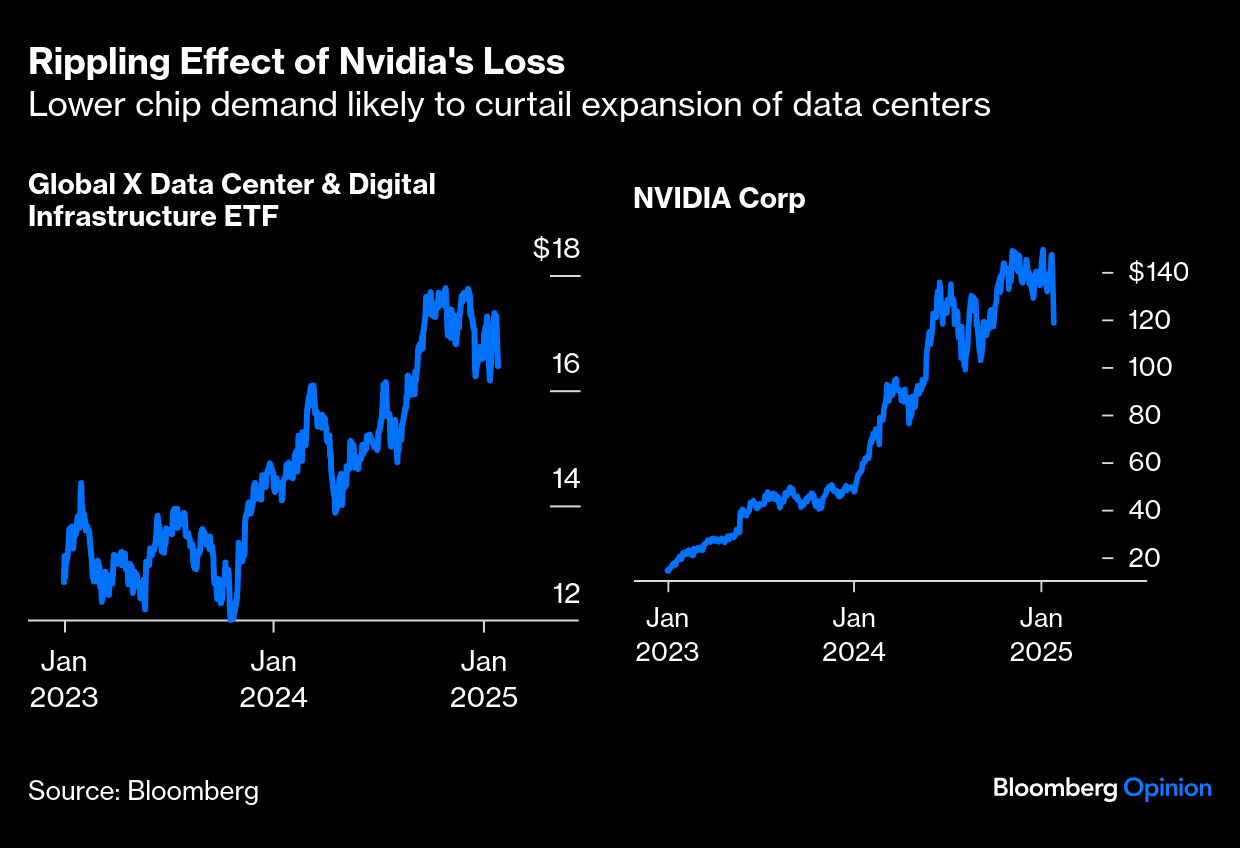

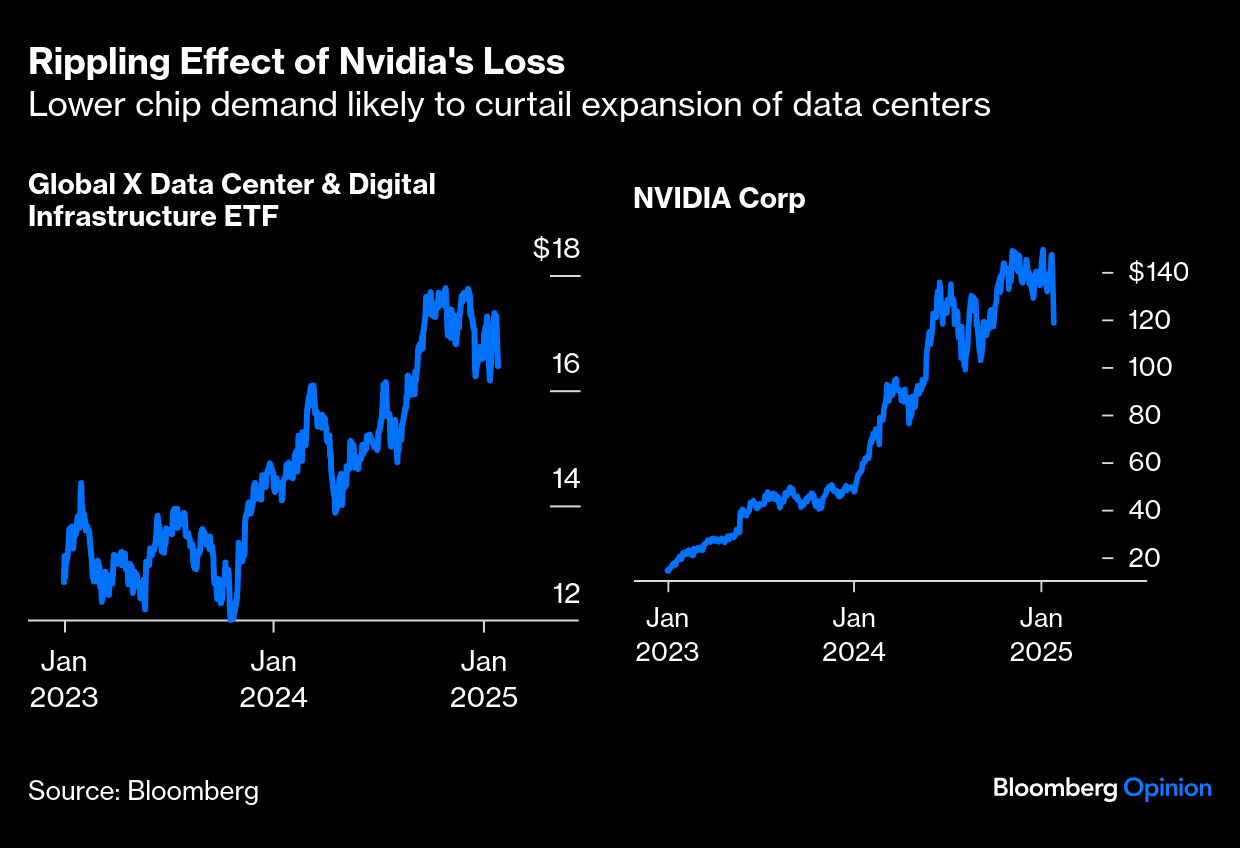

If this sounds like an exaggeration, look at the profit margins that Nvidia has been able to generate. They have been running at more than 50% for the past year, a rate of profitability that even tech groups once dominant in fast-growing sectors could not match. Nvidia's current level of profitability is roughly double any margin that Apple Inc. or Cisco Systems Inc. has ever been able to produce: Capitalism, working properly, would spur someone to come up with a technology to grab a share of those margins. That might just have happened. The question remains: Is DeepSeek really such a big deal? Unlike OpenAI and other AI ventures at the forefront of US tech optimism, relatively little is known about it, but it certainly appears to undercut the dominant players. It has speeded up a rotation away from Big Tech that looked overdue. The tension between the US and China is likely to curtail advances, but others might benefit. As Keith Lerner, chief market strategist at Truist argues, if DeepSeek's claims are true — that it offers a robust AI tool utilizing low-level Nvidia chips, open-source code, and can be deployed at a fraction of the cost — then it could inspire hundreds of copycats, especially in the US. That's where the damage will be felt, and it's not necessarily a win for DeepSeek.  Ramparts breached. Photographer: Qilai Shen/Bloomberg Also, as experts unravel DeepSeek's capabilities, they will also get to examine the lofty tech valuations and concentration risks that have grown since ChatGPT's introduction. An efficient and cost-effective open-source artificial intelligence model should be good news for the economy, but not necessarily for the stock market. As Adrian Cox and Galina Pozdnyakova of Deutsche Bank AG put it, there's a sudden realization that you don't need a Tesla Model X to drive around the corner to pick up a pint of milk — a much cheaper Chinese BYD can do the job just as well. If this belief becomes conventional wisdom, then Nvidia will find it hard to claw back much from its half-trillion-dollar hit. Data centers that support the supercomputers currently thought necessary to run complex AI models also stand to lose. Both Nvidia, the Global X Data Center, and Digital Infrastructure exchange-traded funds plunged by the most since 2021:  How long could the damage endure? Michael Reynolds, investment strategist at Glenmede, argues that if DeepSeek's claims are proven, an aggregate reduction in demand for the chips would damage high expectations for both unit sales and prices: This is kind of the moment where we turn the corner and some of these companies will begin to have to take a hit to their valuations. If it should persist and these claims prove to be true — we think investors are going to have to take a hard look at some of the premium valuations that some of these companies are garnering because embedded is an expectation that you almost have a parabolic increase in earnings into the future.

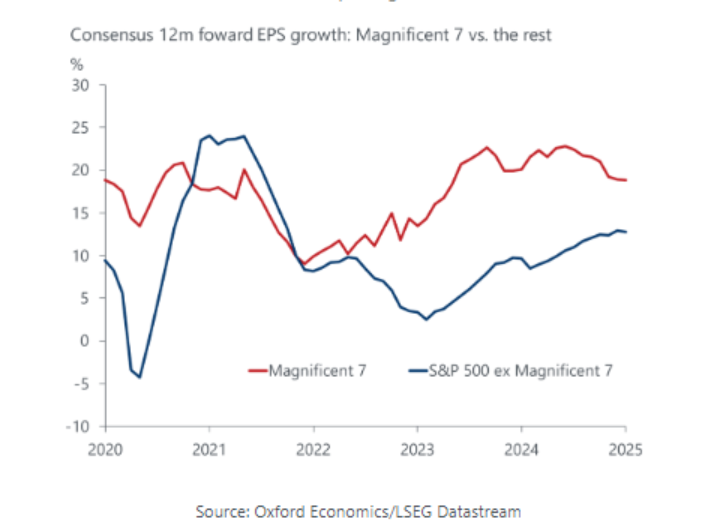

Worries about unrealistic expectations for tech have been around for a while. The question was whether there was a catalyst or mechanism to bring them down. DeepSeek might well prove to be that catalyst. Ahead of this week's tech earnings, the Chinese firm's introduction ups the ante. Daniel Grosvenor, equity strategist at Oxford Economics, argues that a tech correction could be a meaningful near-term headwind for the market given the high level of concentration in the US: The Magnificent Seven are no longer the sole driver of US earnings, as there has been a clear broadening of EPS growth over the past few quarters. We think this trend will continue, underpinned by strong consumer spending and a revival in manufacturing, and expect it to support the outperformance of small-cap and equal-weighted indices.

As this Oxford Economics chart shows, the mega-companies' earnings lead is narrowing: Monday's rout has enhanced market breadth. Consumer staples stocks had a great day, and have now outperformed tech since the election: Truist's Lerner observes that money is rotating within the market. Although AI-related stocks fell sharply, the S&P 500 Equal-Weight Index, a proxy for the average stock, was down less than 0.5%, with four sectors trading higher at the time of writing. If there is a silver lining, the rotation underway could lead to somewhat more of a balanced near-term market. The sky hasn't fallen just yet. And parallels with the dot-com bubble aren't quite right. As John Canavan, lead analyst at Oxford Economics, points out, the dot-coms were built on froth. The question was whether they could ever make a profit, and most didn't. This time, the leading companies are making huge profits, and the question is whether they can be sustained. If they can't, that will hurt shares in the tech sector, but not necessarily the broader financial markets, or the economy. —Richard Abbey What Does This Mean for Trump? | It's still too early to try to get through a newsletter without once mentioning Donald Trump. It looks as though his predecessor's attempts to make it harder for China to replicate US technology haven't been too successful. This development will affect the troubled US-China relationship, in ways that are hard to predict. George Saravelos, head of foreign exchange at Deutsche Bank, makes these guesses: - The odds of a more aggressive net fiscal easing would likely go up.

- The odds of a potentially more aggressive containment policy vis-à-vis China would likely go up, in the context of a shrinking technological lead.

- The odds of a more aggressive non-China tariff policy in the context of greater US growth vulnerabilities would go down.

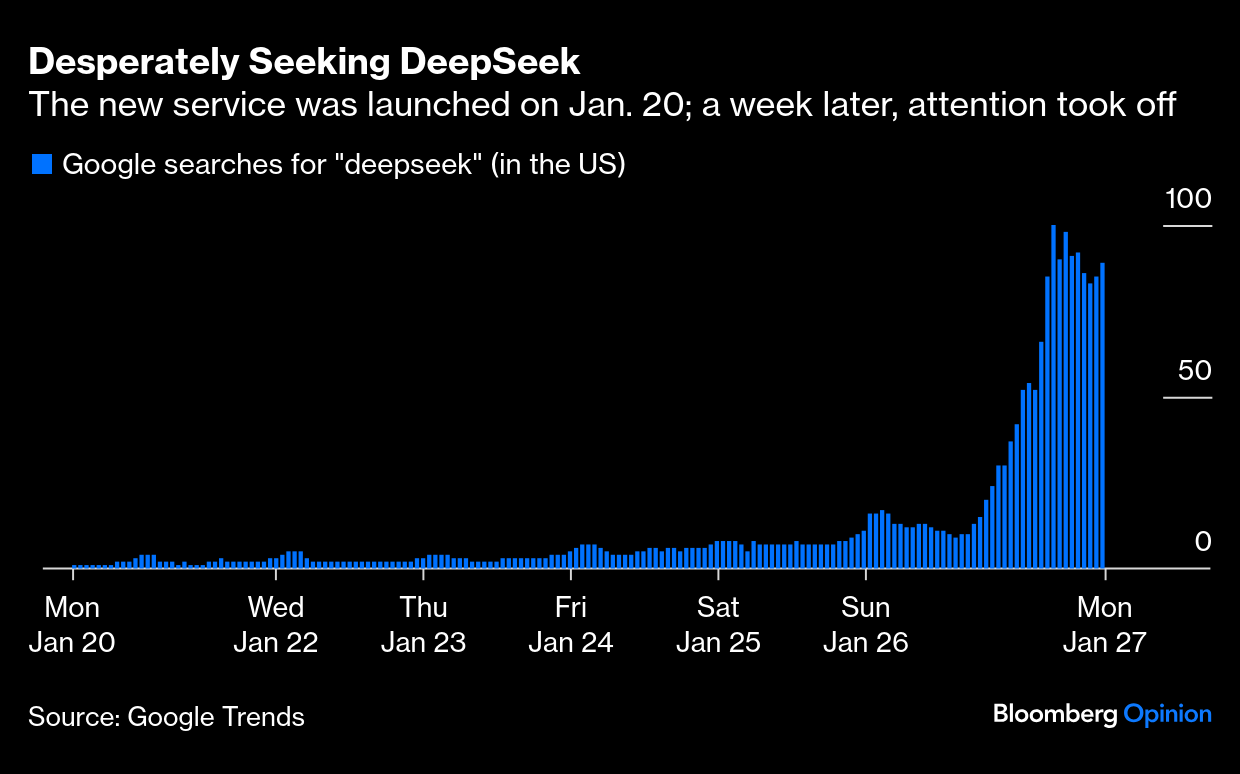

So it's just possible this will convert Trump 2.0 into a policy package that is somewhat less detrimental to the rest of the world outside China. But keep watching. One footnote on Monday's selloff. It was the fifth trading day in which investors could have taken action. DeepSeek released the app at the center of the drama on Monday, Jan. 20. That was US Inauguration Day, so naturally it didn't garner much attention at first, but by Friday, news was proliferating. This chart ends Jan. 24, when more than 800 stories mentioning the company appeared: Over the weekend, as people had more opportunity to process developments, DeepSeek appeared more and more on social media. On Sunday evening, search activity exploded. This is a Google Trends chart of searches in the US for "deepseek" over the last seven days: It's an oddly delayed reaction. Markets are supposed to be a random walk in reaction to news, but the general idea is that they try to react when the news is fresh. Stories alerting to the rise of DeepSeek had been around for a while. Opinion's own Catherine Thorbecke wrote back in June how it was impressing the global tech community. The TechCrunch blog carried this story last November, when Bloomberg Intelligence also listed the company as the leading Chinese exponent of AI. It's common for information to reach a tipping point and then suddenly go viral in the social media age. The way this story suddenly gathered the critical mass to inflict $580 billion of damage in one day, however, must surely be hard to match. Thanks to all those who joined in with the chat I had with Jonathan Levin and Candice Zachariahs last week, on inflation. This Wednesday, at 11 a.m. New York Time, we will move on to discuss — what else? — DeepSeek. Dave Lee and Parmy Olson (who literally wrote the book on AI) will try to explain all of this to me and Jonathan. To listen in to the second Opinion Live Q&A, and ask your own questions, Bloomberg subscribers can go to this link. As this could be a Sputnik Moment, maybe try listening to: Sigue Sigue Sputnik's "Love Missile F 1 -11," Arcade Fire's Laika (about the dog the Soviets sent into space), David Bowie's Space Oddity and Ashes to Ashes, Babylon Zoo's Spaceman, Tasmin Archer's Sleeping Satellite, "Satellite of Love" as performed by Lou Reed, and covered by Morrissey and U2, Telstar by The Tornadoes, Satellite by Khalid, Satellite by the Dave Matthews Band, and Satellite by Harry Styles (all those satellites are different songs). Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Parmy Olson: DeepSeek Shows Silicon Valley's Huge Blindspot on AI

- Marc Champion: Trump's Call to 'Clean Out' Gaza Is Immoral and Ineffective

- Mohamed El-Erian: The Three Forces Shifting the Investment Landscape

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment