- The ECB cut rates, and markets are convinced more will follow:

- The bank is preparing to admit it's no longer restrictive, but it may have to go further than that;

- Trump says 25% tariffs on Mexico and Canada start Saturday; and the forex market wasn't ready for it;

- Hedge funds have had a good year and they are paying capital back to investors; now to see if they can handle Trump 2.0;

- AND: In the midst of tragedy, a reminder of the beauty of figure skating.

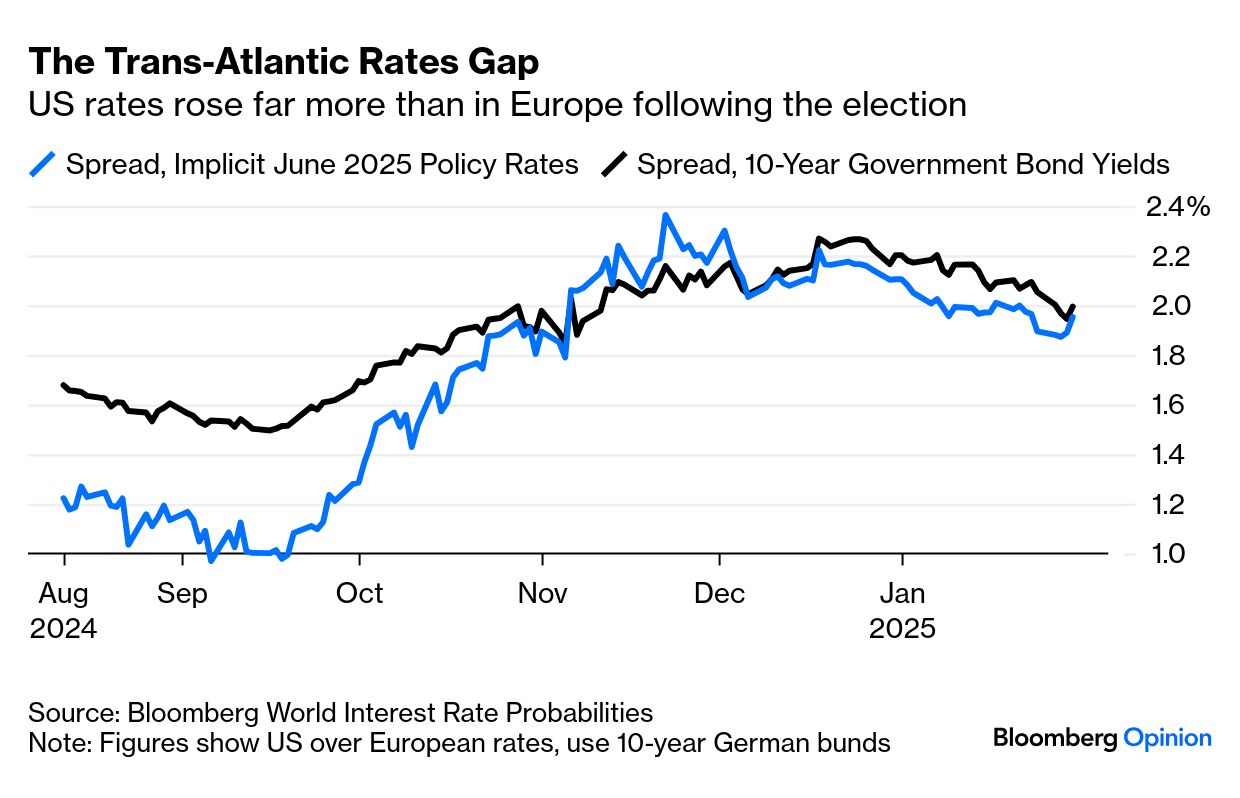

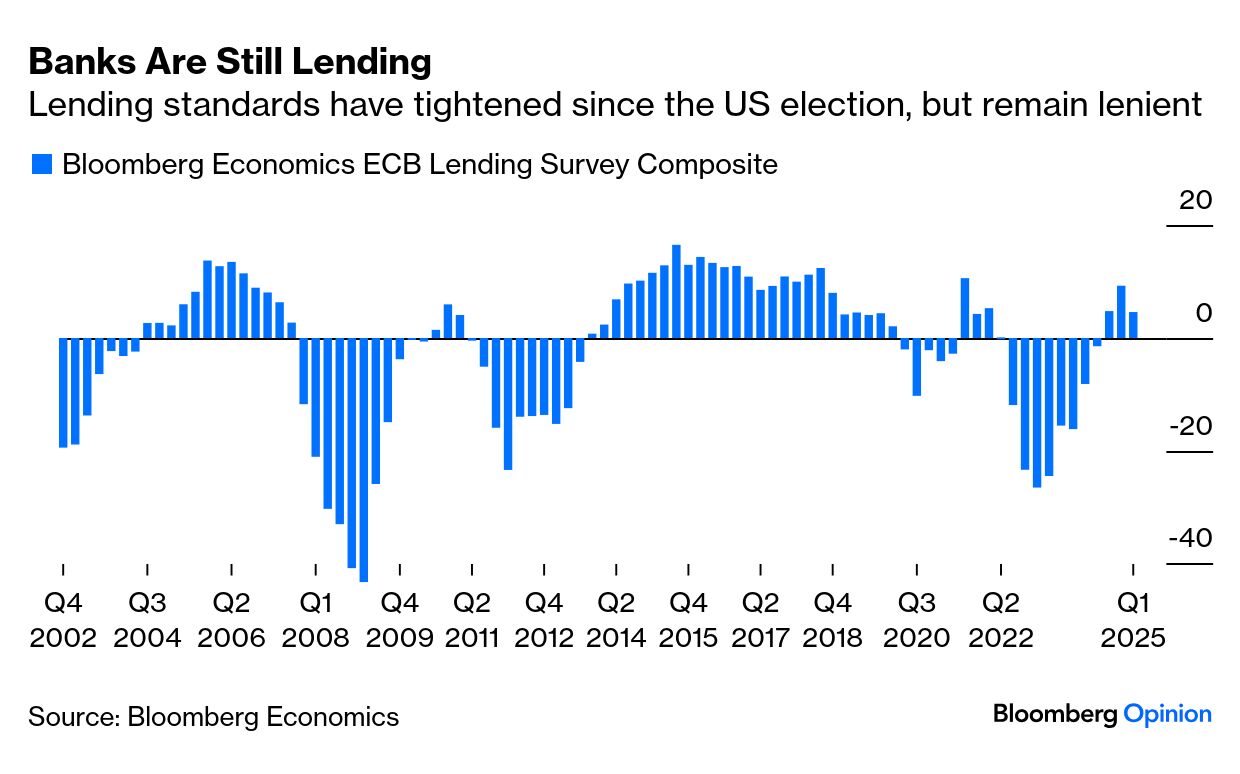

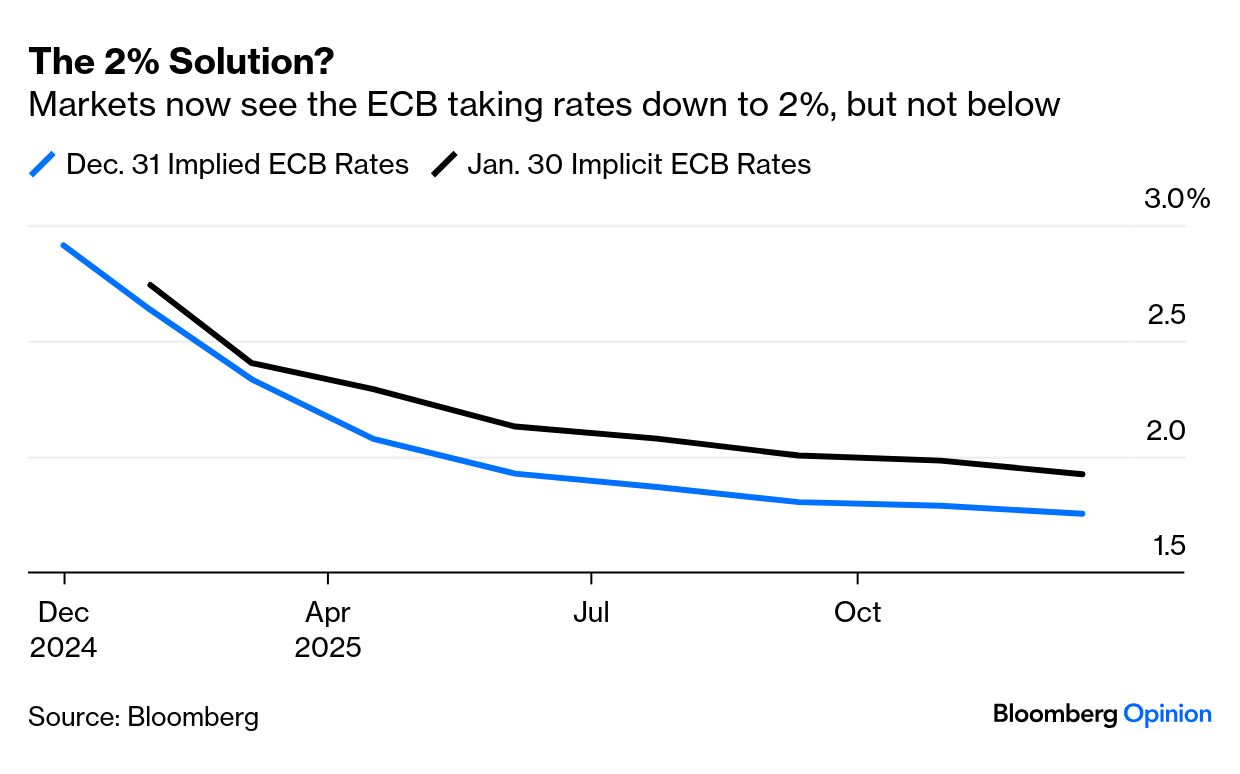

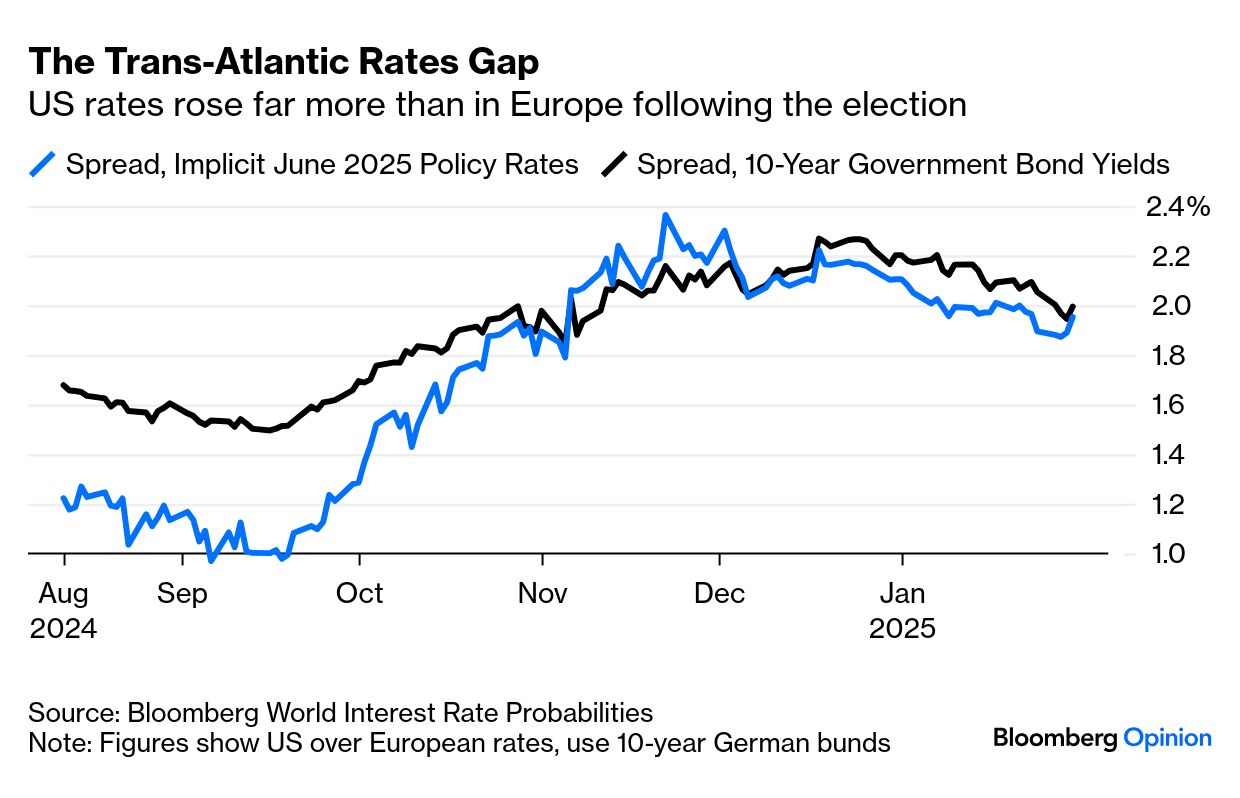

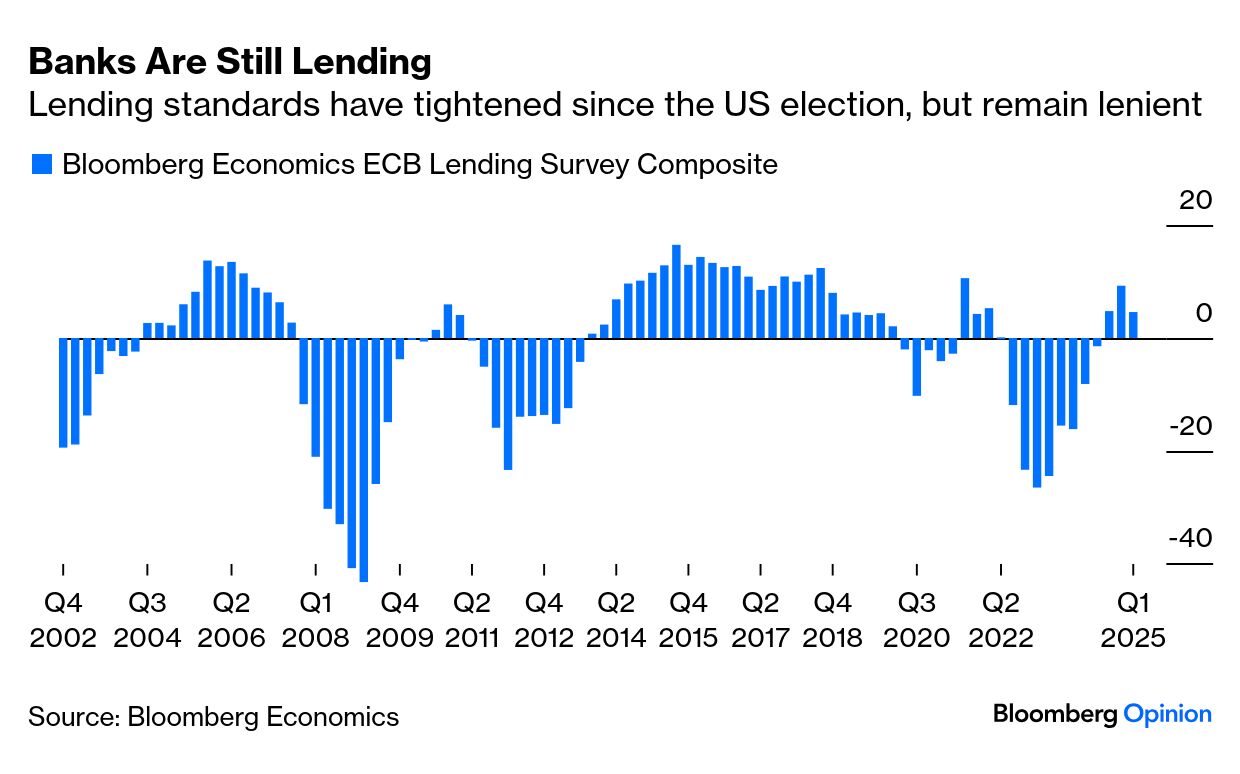

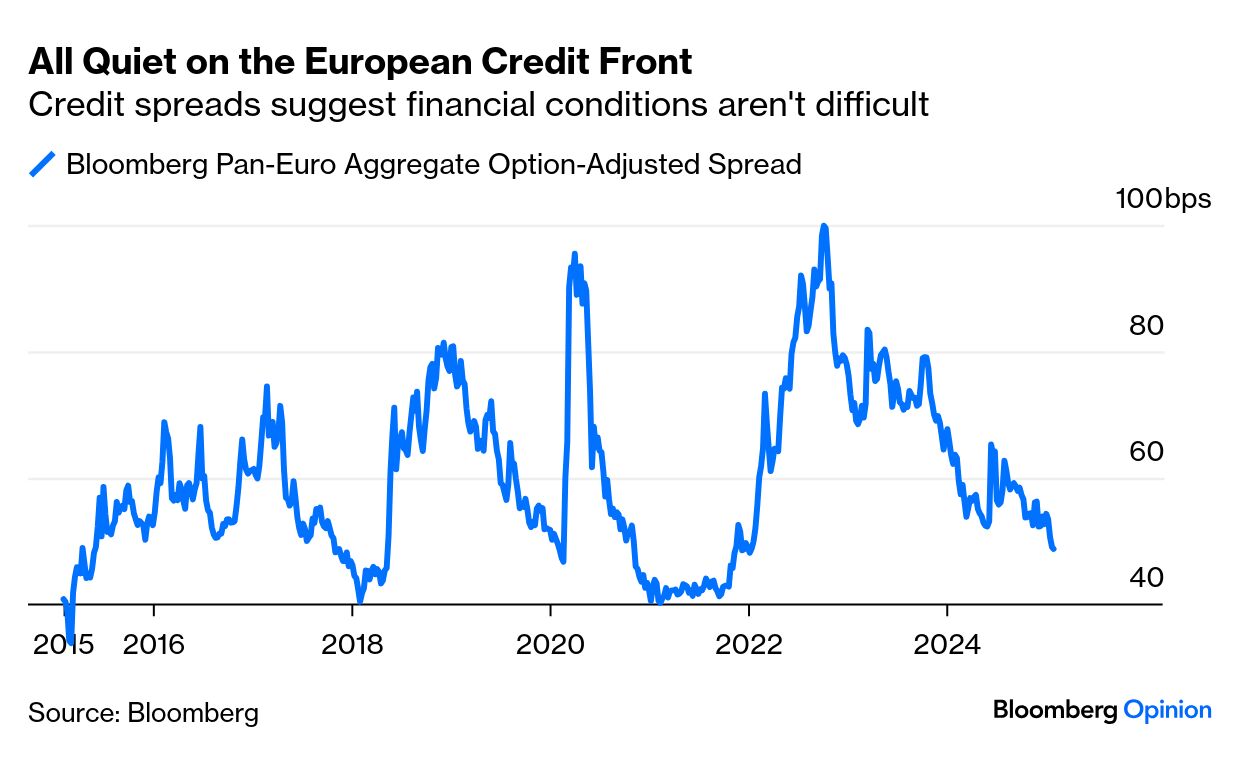

No matter how they try, sometimes central bankers can't avoid creating an event. That's what just happened to the European Central Bank, which announced a 25-basis-point cut in its policy rate Thursday, as was universally expected. President Christine Lagarde studiously declined to create news during her press conference. But the announcement came on a morning that also saw utterly lackluster GDP numbers in Germany and the euro zone. There are worries about the fiscal deficits in several European countries, led by France, which would normally push yields upward. But slow growth has convinced investors that the ECB is going to have to keep cutting, and so yields took a tumble: If sentiment moved toward more rate cuts on the day, however, that is against the direction of travel this month. On Dec. 31, there was some confidence that the ECB's policy rate would be below 2% by the year's end. Now, it's seen as unlikely to go beyond that level: In part, this reflects the global trend. Ever since last October, when markets grew confident that Donald Trump would return to the White House, yields in the US have risen far faster. That in turn puts more pressure on the euro. Last September, the consensus was that the fed funds rate would be one percentage point above that of the ECB by the middle of this year. That has now risen to two percentage points:  The critical question now is to identify the neutral rate, known in the jargon as r*, at which policy is neither restrictive nor accommodative. Lagarde said that ECB monetary policy remained restrictive, but Alberto Gallo, chief investment officer of Andromeda Capital Management in London, listed a series of metrics that suggest conditions are already easy. The ECB's own quarterly survey of bank lending officers, published earlier this week, suggests as much. Bloomberg Economics' composite measure of the 12 components in the survey, which is positive when conditions are easy and negative when they are tighter, shows that banks grew more conservative during the last quarter in response to the growing political uncertainty around Trump 2.0. But conditions in the banking system — more important in Europe than in the US where many companies rely on bond finance — remain looser than for most of the time since the Global Financial Crisis began in 2007:  Bond finance also suggests that conditions are easy. The spread on European corporate debt compared to equivalent Treasuries is now, according to Bloomberg indexes, at its lowest since 2021, when the major central banks started hiking: Another sign of growing resilience comes from banking stocks. Brutalized by the GFC and by the euro-zone sovereign debt crisis that followed, they remain far below their highs. But they are on a good run, and are now at their highest since 2012. The region looks far more resilient against a crisis than it did then, even if it's hard to get excited about growth. Conditions don't look tight: After the market closed, Bloomberg published a story sourced to ECB officials, saying that the central bank was ready to admit that conditions were no longer restrictive at its next meeting in March. But Davide Oneglia of TS Lombard suggests that the arguments over the neutral rate were a distraction: Lagarde also made a key point that is always lost on pundits but strengthens our view that this whole r-star debate is mostly a smokescreen: Any estimate of the neutral rate is not "a destination" for rates. The real debate remains if the ECB should turn accommodative and fine-tuning is hard.

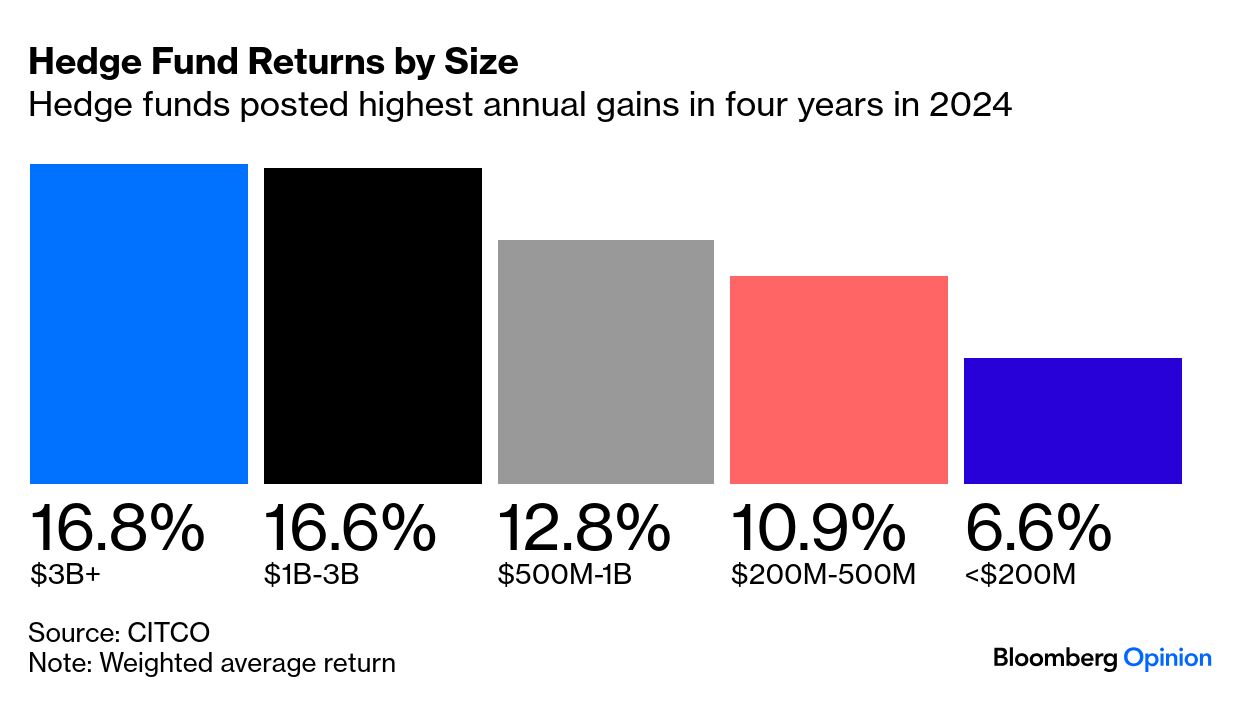

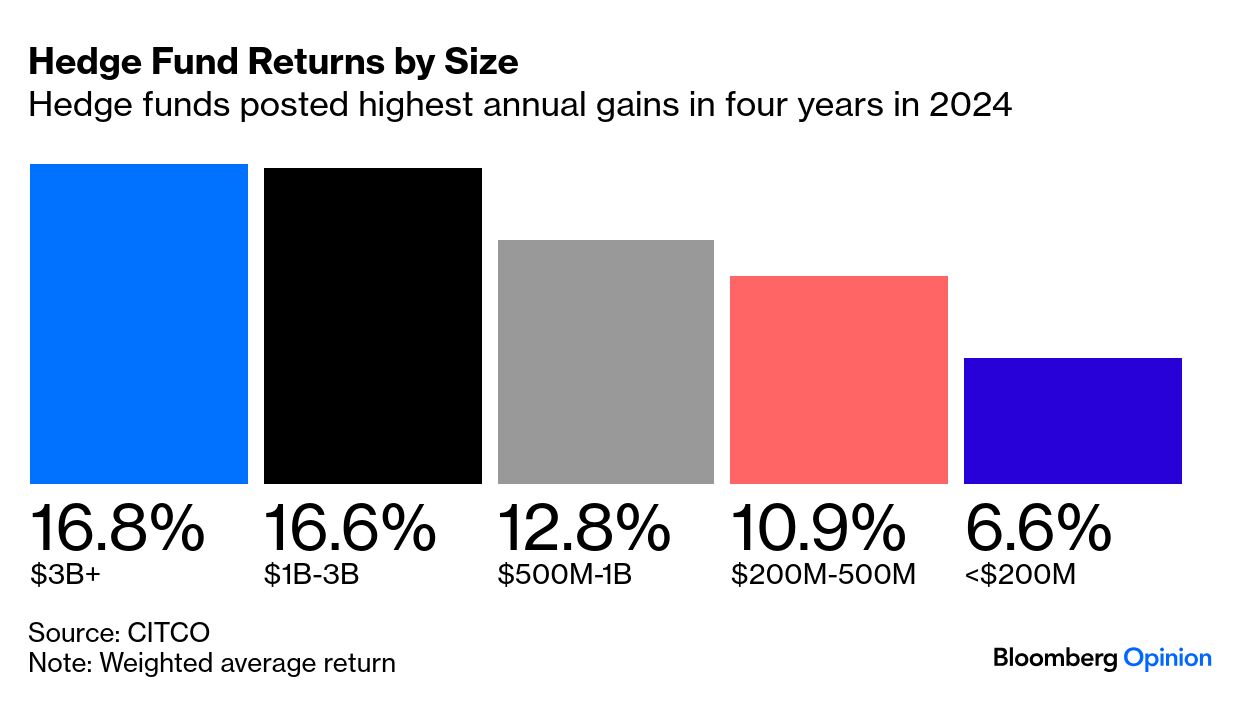

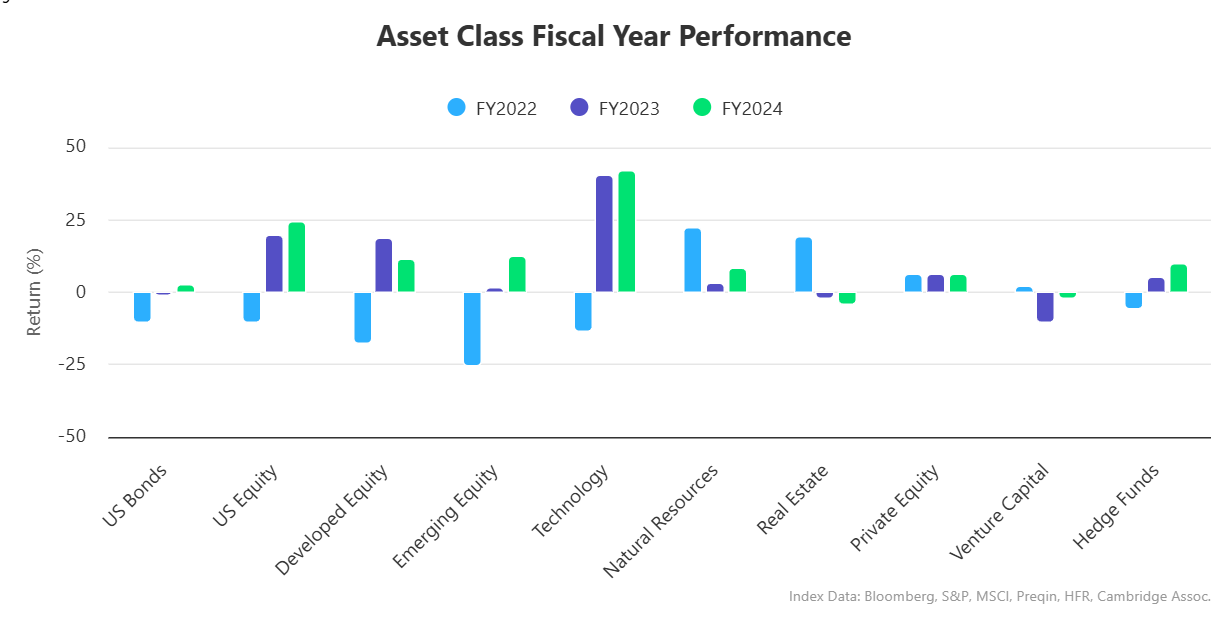

Increasingly, market players believe the slow economy and falling inflation will leave the central bank with no alternative but to cut well below neutral. That will ultimately be good for European risk assets. Oneglia suggests that the ECB should call the recent rise in long-term real yields an "unwarranted, US-driven tightening" of euro-zone financial conditions. If it's squeamish about cutting rates below neutral, it can always blame the US. Hedge funds often have good reason to return billions to their clients. For highly sought-after managers, it can be necessary as capacity of any given strategy is limited, and they may be unable to put more funds to work well. It's also a problem they're happy to have to deal with. After a robust 2024 performance, the best in the last four years, Bloomberg News reports that some of the industry's bigshots are returning about $15 billion to clients. That's resulting in a scramble among smaller peers to grab some of that extra capital. This might seem minuscule, given the scale of the $4.5 trillion hedge fund industry. But it allows alternative asset managers to showcase their competence in a business that places a premium on a track record. Data from fund administrator CITCO shows hedge funds managing between $1 billion and $3 billion did almost as well as the biggest players last year, enhancing the odds that they can vacuum up some of that cash:  Is this good enough? Judging by returns from other asset classes, it might just be. As Points of Return reported, hedge funds were instrumental in last year's outperformance by mega endowment funds like Harvard University. That tended to be obscured by the exceptional performance of US mega-tech companies. Equity strategies exposed to the sector naturally beat all comers. But as this chart provided by Markov Processes International shows, returns from hedge funds were ahead of private equity (much more popular among asset allocators in recent years), real estate, and US bonds last year: Those returns came amid sticky inflation, uncertainty arising from geopolitical tensions, and the US elections. Predicting similar returns this year is a tough call. Still, Ken Heinz of Chicago-based Hedge Fund Research says that shifts in strategy to take account of higher mergers and acquisitions activity, Trump's deregulation agenda, and potentially a rate-cutting cycle could determine success: Different people are positioning for different outcomes. And that's where I see the question of why people are allocating to hedge funds right now based on recent performance. It's because they're forward-looking, and there's a wide continuum of expectations of things that could develop over the first half of the year. And I think people want to be correctly positioned for a very wide range of possible outcomes.

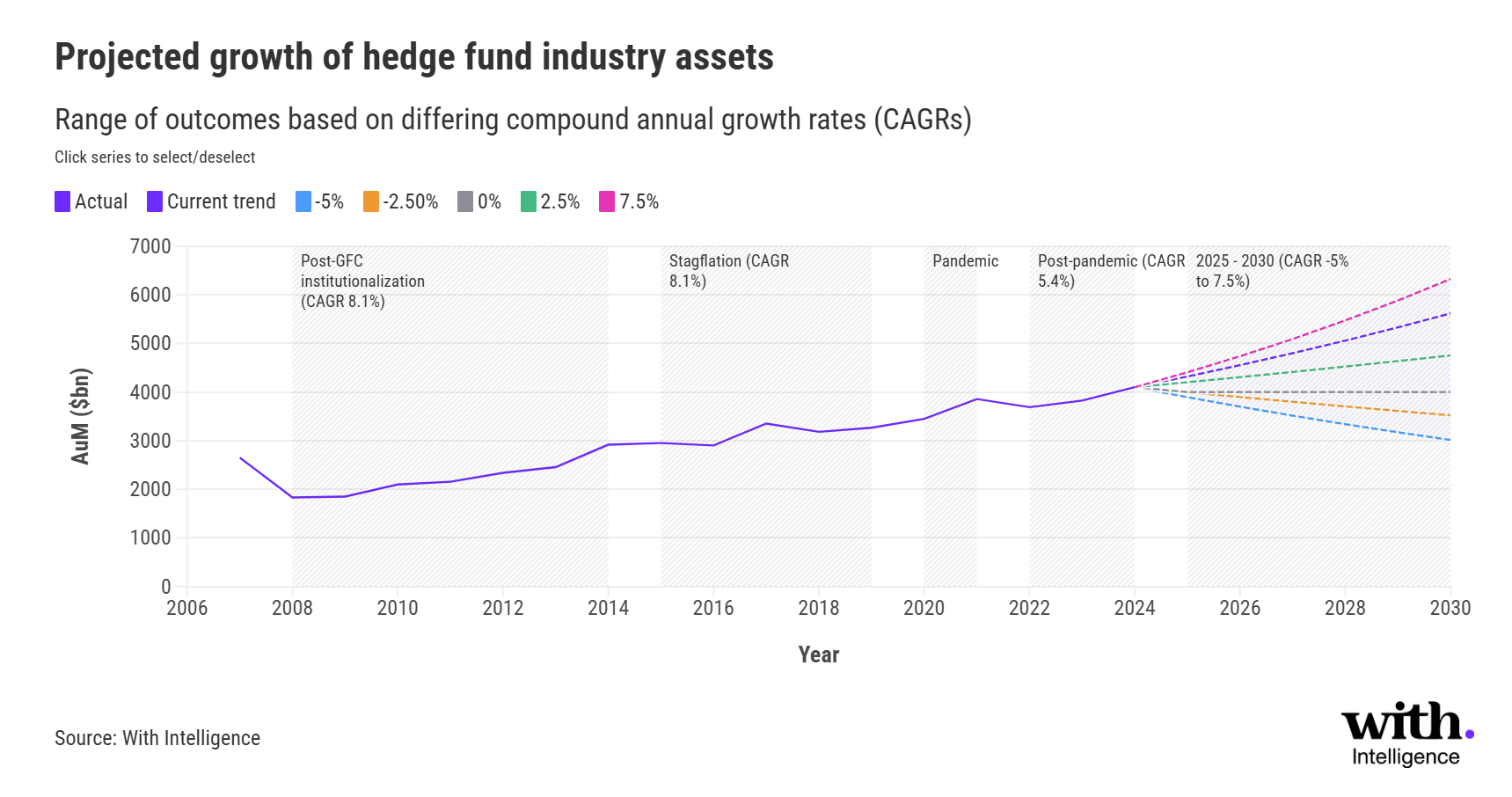

At the industry's current growth rate, London-based With Intelligence estimates it will surpass $5 trillion by 2028, topping $5.5 trillion by the decade's end. Of course, this could swing either way: Researchers led by Paul McMillan note that the industry has matured. Launches are larger, but overall numbers of funds are down, as hedge fund firms are keen to demonstrate that they can be sustainable long-term asset management businesses. Investors continue to press down on fees, but they are more likely to pay a premium for funds that have shown they can deliver returns uncorrelated to Big Tech. There's a sense, accentuated by the volatility surrounding Trump 2.0, that this year could be a crucial test. With Intelligence argues that a shift in the events driving market volatility — from central-bank actions to US policy changes and geopolitics — will likely favor macro, relative value, and event-driven funds. The flip side is that it will also increase the chances of making more mistakes: A Trump presidency, driving tax cuts, deregulation, a focus on oil and gas production, tariffs and a tougher stance on China, will likely offer opportunities for macro traders around currency fluctuations, interest rate changes, and commodity price swings, and could fuel a rise in mergers and acquisitions activity for event-driven funds, especially in energy, finance, and technology.

Trade disruptions could lead to more corporate defaults or debt restructuring, a traditional great opportunity for vulture funds to show their worth, while the potential upheaval in US industries like healthcare, technology, and energy, could result in distressed events. McMillan adds that if hedge funds are able to persuade investors that they can help hedge against risk, they could attract more capital from pensions. And on the subject of those risks… — Richard Abbey It looks like there could be 25% tariffs on goods entering the US from Mexico and Canada before next week starts. Regular followers of presidential invective will be aware that this has been a threat for a while, as President Trump believes trade sanctions will help in the fight against fentanyl smuggling. However, when he reiterated the threat in a conversation with reporters in the Oval Office, the reaction in the Mexican peso and Canadian dollar suggested that traders still didn't totally believe that the tariffs would happen: Trump spoke off the cuff, so there's room to doubt that tariffs will indeed be imposed on Saturday. He said: We'll be announcing the tariffs on Canada and Mexico for a number of reasons. Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we're giving to Canada and to Mexico in the form of deficits.

It's far from obvious that tariffs will help counter the first two problems, while trade deficits with its two biggest trading partners might show that it is taking advantage of cheap imports to invest in other things. Be it as it may, without specifics, the chance of imminent tariffs seems to have risen. Trump also insisted that tariffs on Canadian goods wouldn't hurt the US: "We don't need the products that they have. We have all the oil that you need. We have all the trees you need." While this may be true, US supply chains are geared to sourcing these goods from Canada, and substituting them would take time, and lead to price rises in the interim. West Texas Intermediate crude briefly spiked by 80 cents after his comments, but swiftly declined again. From all this we can deduce that tariffs are not priced in by markets even now, that traders are on edge, and that new trade duties will be countered by a rise in the dollar. That would reduce US competitiveness. If, as still seems likely, the presidential strategy is to use the threat as a bargaining tool on other issues, the White House might want to register that it's making the day-to-day jobs of anyone trying to run a business much more difficult. The mid-air collision that took more than 60 lives over Washington's Potomac River was awful enough. The fact that among the victims were young figure skaters and their coaches returning from the US championships in Wichita, Kansas, is somehow even more dreadful. Figure skating is a thing of utter beauty, as some of these videos will show. Their performances will live on. Have a good weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment