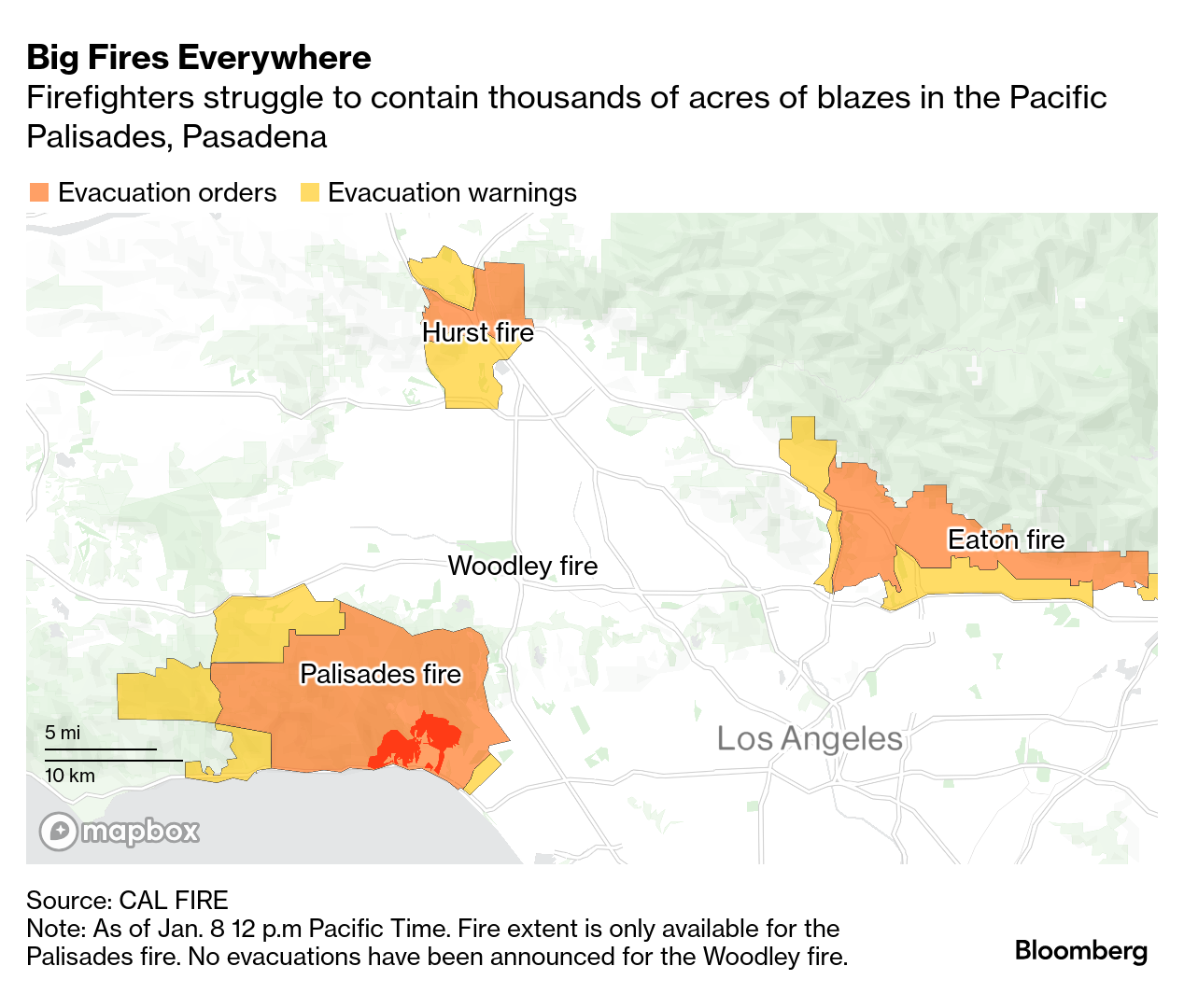

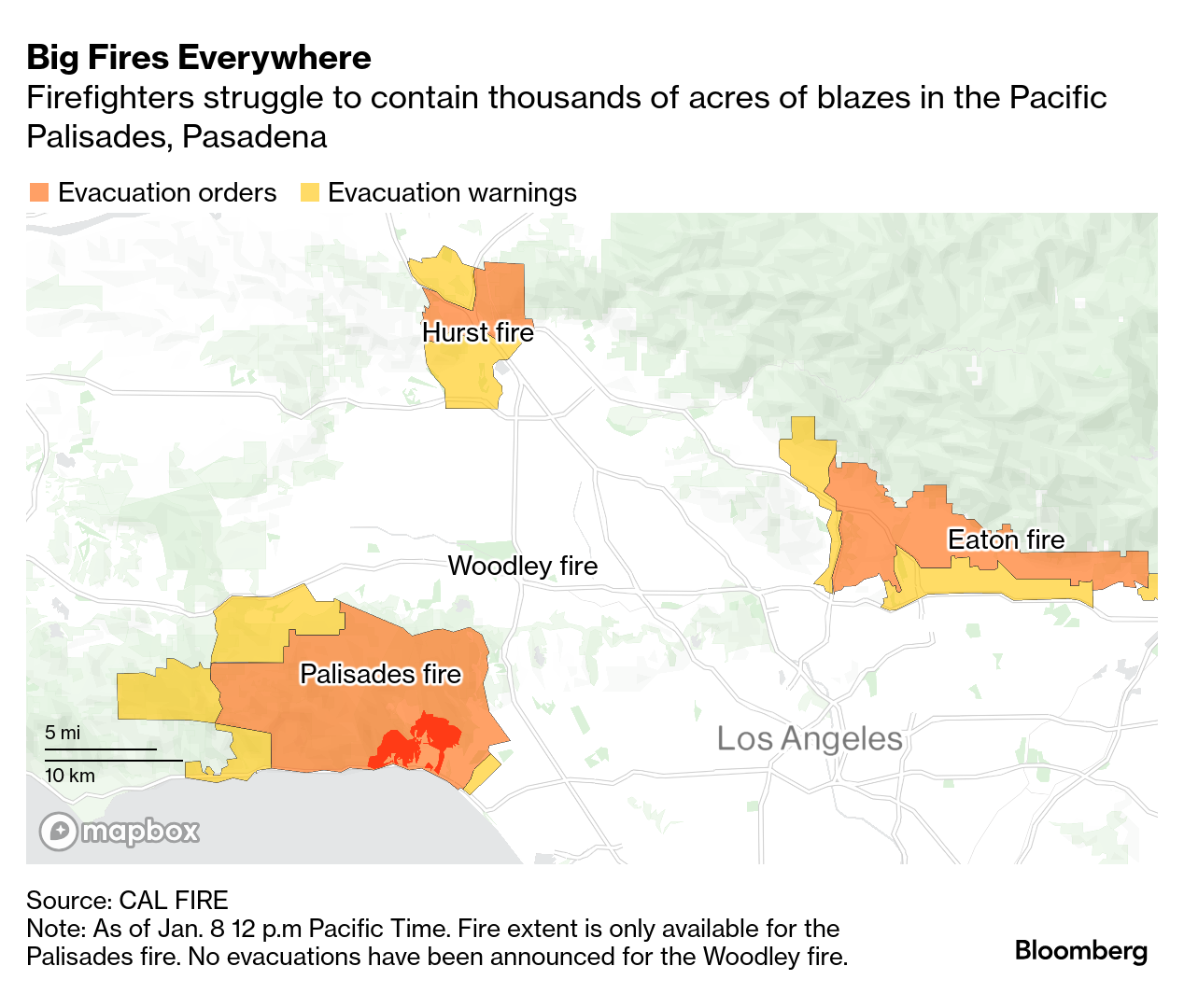

| This is Bloomberg Opinion Today, the Kool-Aid of Bloomberg Opinion's opinions. Sign up here.  A person uses a garden hose in an effort to save a neighboring home from catching fire during the Eaton Fire in Altadena, California. Photographer: Mario Tama/Getty Images North America Watching the wildfires ravage home after home in Los Angeles has "been like something out of a movie" for Mark Gongloff. In many ways, he's right: This catastrophe has all the makings of a big-budget Hollywood film. There are plenty of heroes: The firefighters, some of whom are incarcerated and get paid measly amounts. The actor who helped move cars on Palisades Drive after their owners abandoned them. The ranchers who freed their horses so they could flee to safety. There has been tone-deafness, too. In a now-deleted tweet, real estate entrepreneur Keith Wasserman asked whether anyone had access to private firefighters so he could save his multimillion-dollar home. "Will pay any amount," he pled into the ether. And there are images and videos that are so horrifyingly surreal, one could only hope they're fake, dreamt up in the brain of some bigwig director making seven figures at Netflix. The fire crews using a bulldozer to push abandoned Teslas and Mercedes out of the way? It must beFX. The skeletal buildings lining the streets of the Palisades? Surely that's just a set. The man and his dog who watch in terror as their living room's panoramic view gets engulfed in flames? That has to be AI. But no, none of this is scripted or screen-tested, despite the numerous actors involved. "The fires didn't even exist on Tuesday morning. The only hint of what was to come were forecasts for some of the strongest and most dangerous Santa Ana winds on record to barrel out of the Great Basin and into Southern California," Mark explains. "Within hours, a serious fire was threatening the Pacific Palisades neighborhood in western Los Angeles … By Wednesday morning, three out-of-control fires had spread across 4,500 acres around the city, taking at least two lives and destroying at least 100 buildings." And by Wednesday afternoon, that figure had more than tripled to over 15,800 acres, according to CalFire.  The average apocalypse movie is practically indistinguishable from the reality California now finds itself in, save one big thing: insurance. You've never seen the residents of Gotham discussing premiums and tabulating the damage after an evil monster destroys a bridge or a skyscraper. But in the real world, there's no tidy Hollywood ending. The tape keeps on rolling, and this latest deluge of fires will make an already ugly situation a lot uglier. California's insurance crisis forced many residents to turn to what Mark calls the "state's insurer of last resort," the FAIR Plan, which only has about $700 million in cash. The Pacific Palisades alone has nearly $6 billion in exposure. "How many times should we pay to rebuild a home on a wildfire-prone California hillside or a flood-prone North Carolina beach?" Mark asks. "How many first responders' lives are worth risking so people can have beautiful views? When does insurance become a Band-Aid on a gushing wound?" The answers to those questions can't be found in a movie. But in a column? Perhaps. Bonus World-on-Fire Reading: - Gavin Newsom shouldn't rely on EV mandates to persuade drivers. — Erika D. Smith

- How New York can hold banks to their climate pledges. — Mark Gongloff

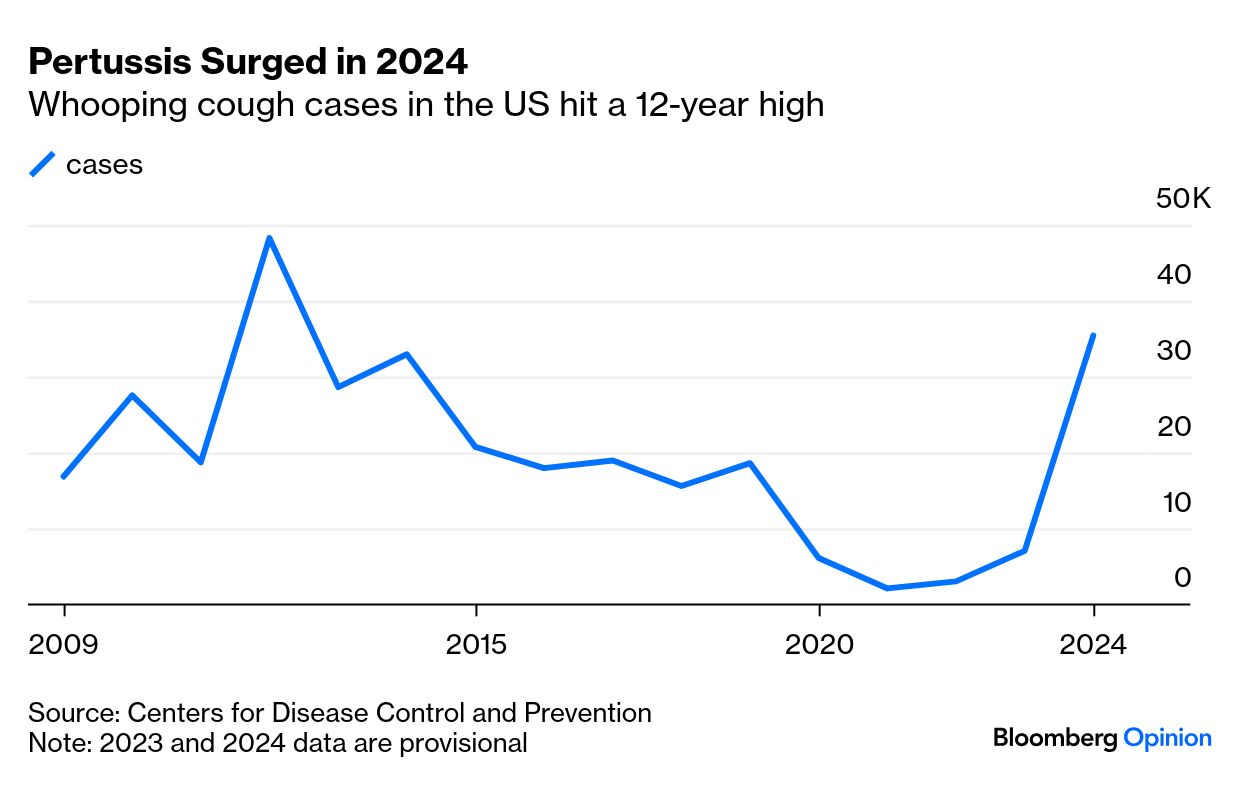

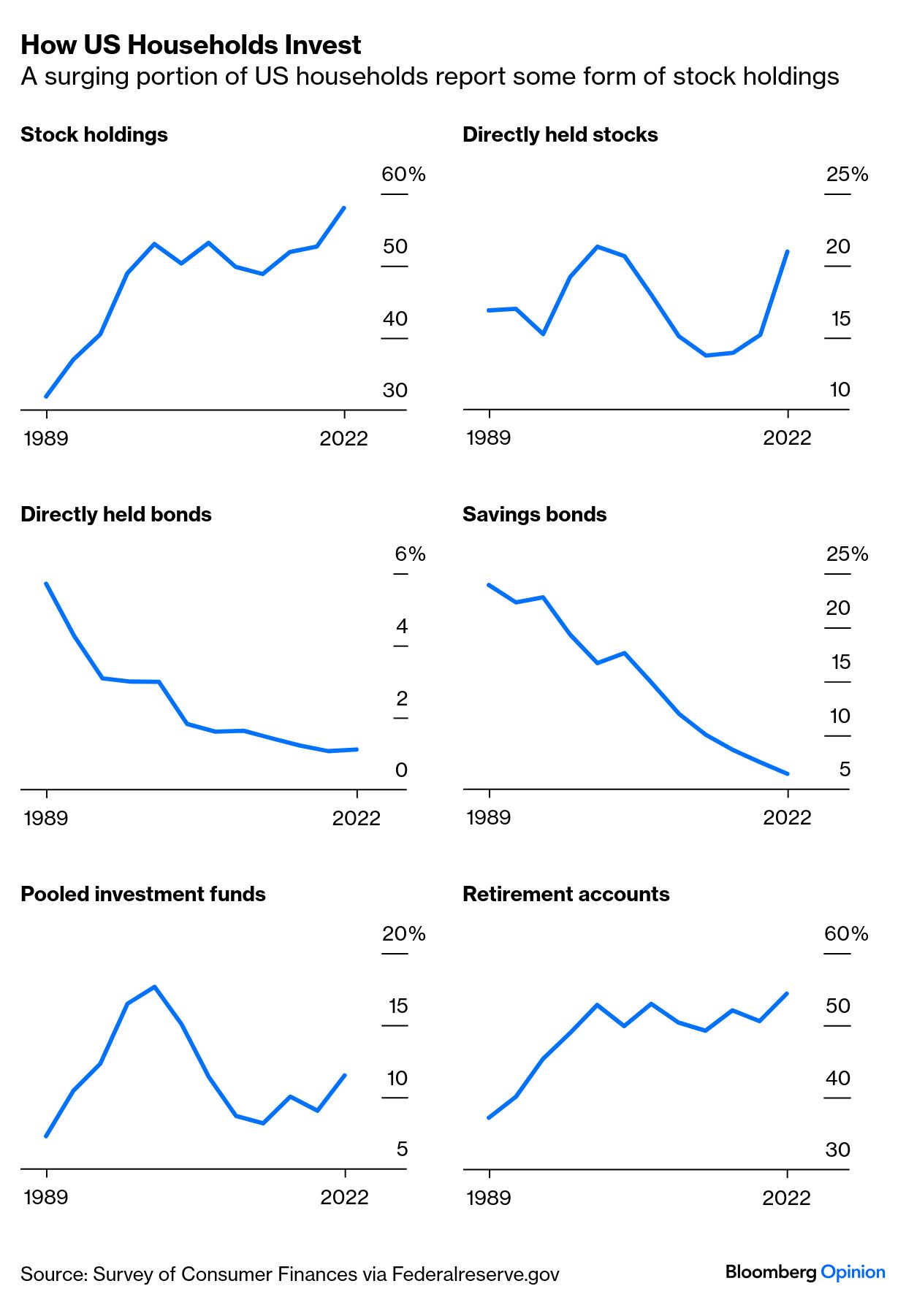

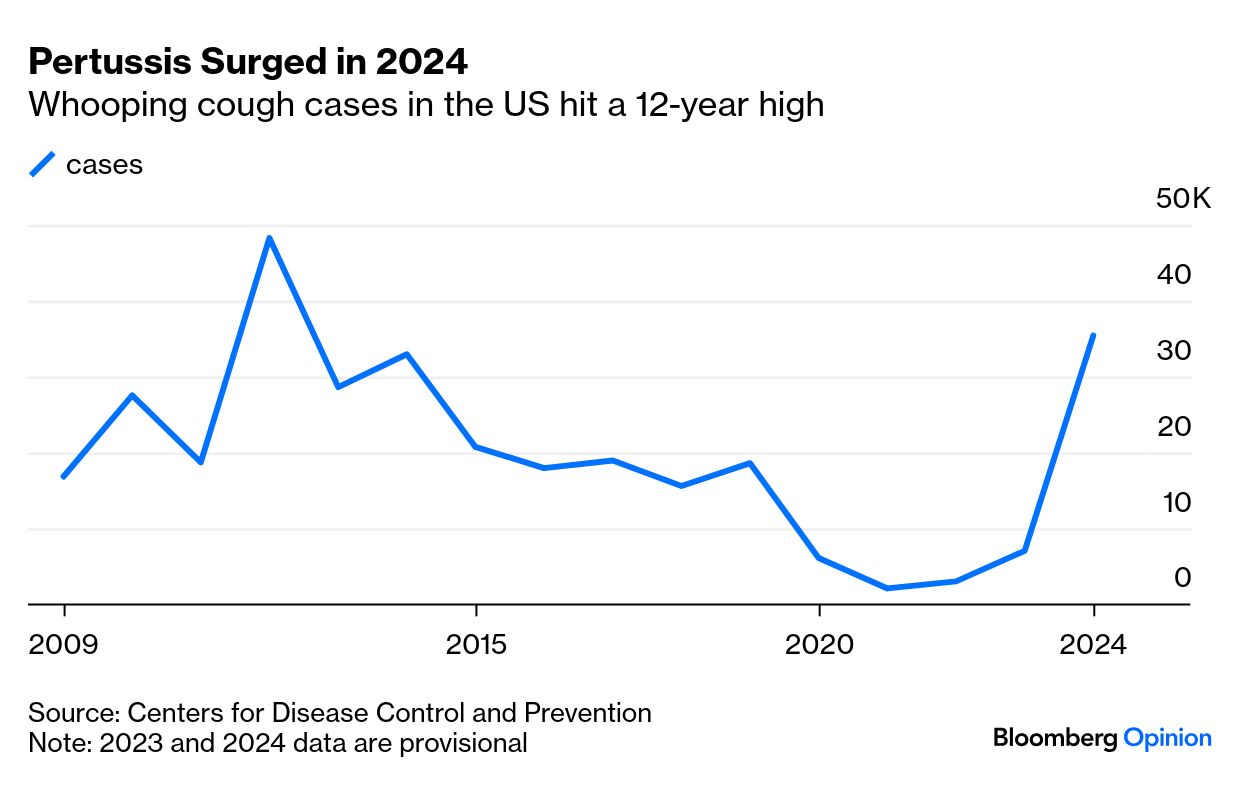

Stocks Go Up Until They Don't | A quarter century ago, Howard Marks essentially predicted the dot-com crash. Now, he worries Wall Street is risking a repeat with its can't-lose attitude about stocks. Jonathan Levin agrees: "The latest Federal Reserve data from 2022 suggests that stock ownership is more pervasive than ever among households — which is largely a positive development — but the popularity of equities may also have come at the expense of less volatile bonds." In other words, the 60/40 portfolio your Uncle Jerry once told you about is deader than a doornail: The stock obsession goes well beyond the household level, though. "The pros have been drinking the same Kool-Aid as retail investors," he notes. "Wall Street strategists, who generally doubted the market's potential in 2023 and 2024, have now caved to the view that the real risk is staying on the sidelines. And among single-stock analysts, there's a near-unanimous standing recommendation to invest in the Magnificent 7 growth companies." Everyone's doubling down on Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. But if anything goes sideways for Big Tech, Jonathan warns index investors could feel the pain, too. "Personally, I have no idea if the US bull market is in the 6th, 7th or 8th inning — and I'm not ready to stick my neck out and suggest we're in the 9th. But so many people are in on the secret that the upside has diminished meaningfully and the risks have escalated," he writes. What's a shrewd investor to do? Jonathan suggests peppering your portfolio with oft-neglected investments: 10-year Treasury notes, emerging market equities — stuff that has a track record of outperforming during a market downturn. "Whatever happens in 2025, it sure seems prudent to curb US stocks fanaticism and rediscover the benefits of diversification. At some point, the crowd will turn its attention elsewhere, and no one wants to be the last one off the bandwagon." Whooping cough is no joke: "If you've heard the telltale cough and seen an infant gasp for breath, it's easy to understand why a pertussis outbreak strikes fear in a parent's heart. Babies can wind up hospitalized or even die from the bacterial infection," writes Lisa Jarvis. In 2024, an estimated 35,435 cases were reported in the US — five times the number of infections seen in 2023. The spike is partly due to a hangover from Covid-19 restrictions, but lower vaccination rates are also to blame: "Vaccine hesitancy — even against the most routine childhood immunizations — is on the rise and could snowball under the incoming administration."  President Joe Biden's move to "indefinitely" block oil and gas development across 625 million acres of federal waters sounds drastic, but Liam Denning says it won't really make a dent in the oil industry's spreadsheets. Consider the 45th president: "As much as President-elect Donald Trump sought to foster drill-baby-drill during his first term with big auctions, less than 1% of acreage was ultimately leased — a lower proportion than under former President Barack Obama," he writes. "While presidents do shape energy policy in real ways, the oil and gas industry is subject to many other, and often more powerful, forces." Argentina is a long way from mended, but Milei is helping. — Bloomberg editorial board Meta's fact-checking reversal lets Mark Zuckerberg drop the charade. — Dave Lee Constellation's $30 billion Calpine talks are fueled by AI — and gas. — Liam Denning Scott Bessent could sow chaos at the People's Bank of China. — Shuli Ren Be wary of Sam Altman's doublespeak at OpenAI. — Parmy Olson Trump's H-1B backlash is a reality check for Indians. — Mihir Sharma The UK will find it hard to develop a Silicon Valley wealth machine. — Matthew Brooker How a $2.6 trillion fund was taken for a ride in India. — Andy Mukherjee Trump could mortally wound the Non-Proliferation Treaty. — Andreas Kluth What We're Watching in 2025, a free must-read roundup about the future. The special counsel's Trump report may see the light of day. Americans are now spending more time alone than ever. Why don't we call it Mexican America? Chick-fil-A's lemon robots save 10,000 hours of work. New York's new viral foods? Fried crust and Irish scones. Notes: Please send Mary O's soda-bread scones and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment