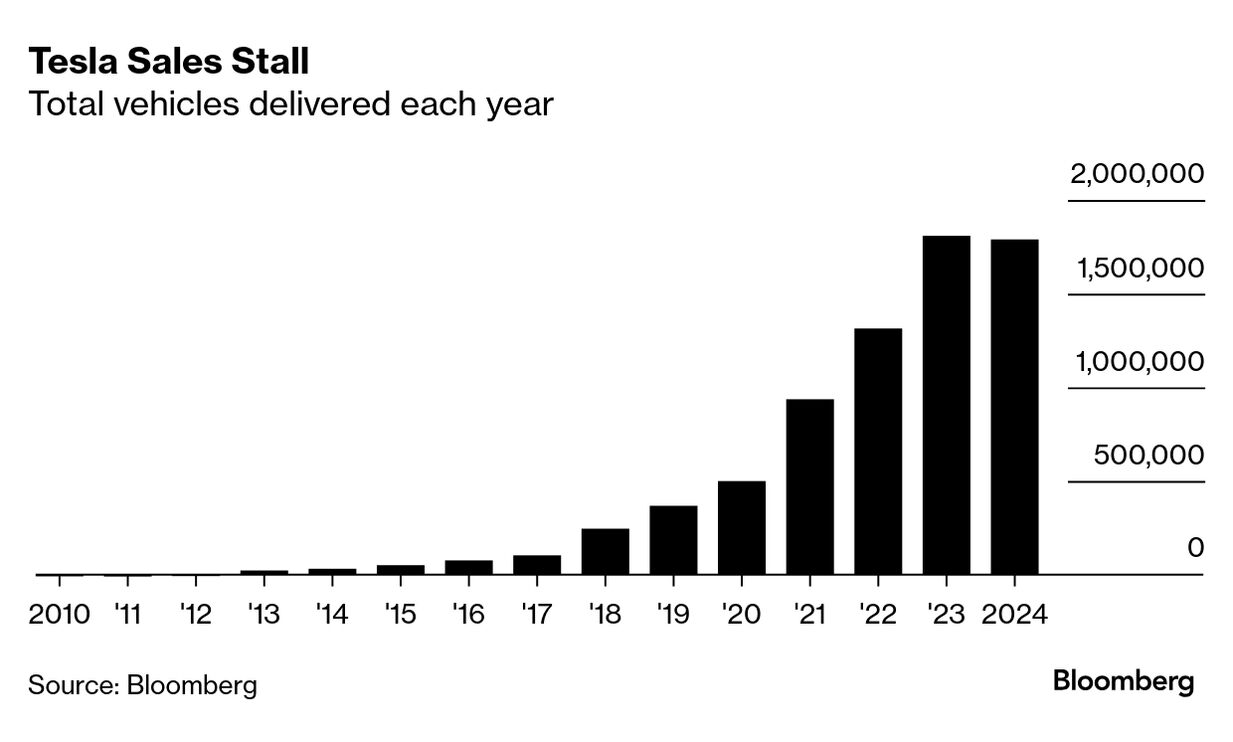

| When Tesla reports earnings on Wednesday, it will be Elon Musk's first call with Wall Street analysts since President Trump was re-elected. If you've never listened to an earnings call, you might want to tune into this one. Musk has been the CEO of Tesla since 2008, and he's helmed every single earnings call except for one since the electric car maker went public in 2010. Now, he's deeply embedded in the Trump administration and leading the cost-cutting effort known as the Department of Government Efficiency, or "DOGE." For Tesla investors, the January call is typically a look at the year ahead. In October, Musk said that he thought Tesla could achieve "20% to 30% vehicle growth next year." He also predicted that Tesla "will become the most valuable company in the world, and probably by a long shot." Among the many questions for Wednesday: How many vehicles does Tesla plan to sell in 2025, and is a cheaper model — even if that is a lower-cost Model 3 or Y — still in the works for the first half the year? What does the "S-Curve" look like for the Cybertruck? Musk made a strategic decision last year to reposition Tesla as a robotics and AI company, so there will be scores of questions about the latest iterations of software known as Autopilot and FSD, as well as Optimus, Tesla's humanoid robot. Given Musk's role within the Trump administration, he's also likely to get peppered with questions about trade, tariffs, tax credits and the Inflation Reduction Act. Which reminds me: Whatever happened with Tesla's plans to build a factory in Mexico? Is that completely dead, or just permanently on ice? It is unprecedented for an American CEO to have the kind of influence and access to the President that Musk currently does. How long it will last is anyone's guess. — Dana Hull, Bloomberg News |

No comments:

Post a Comment