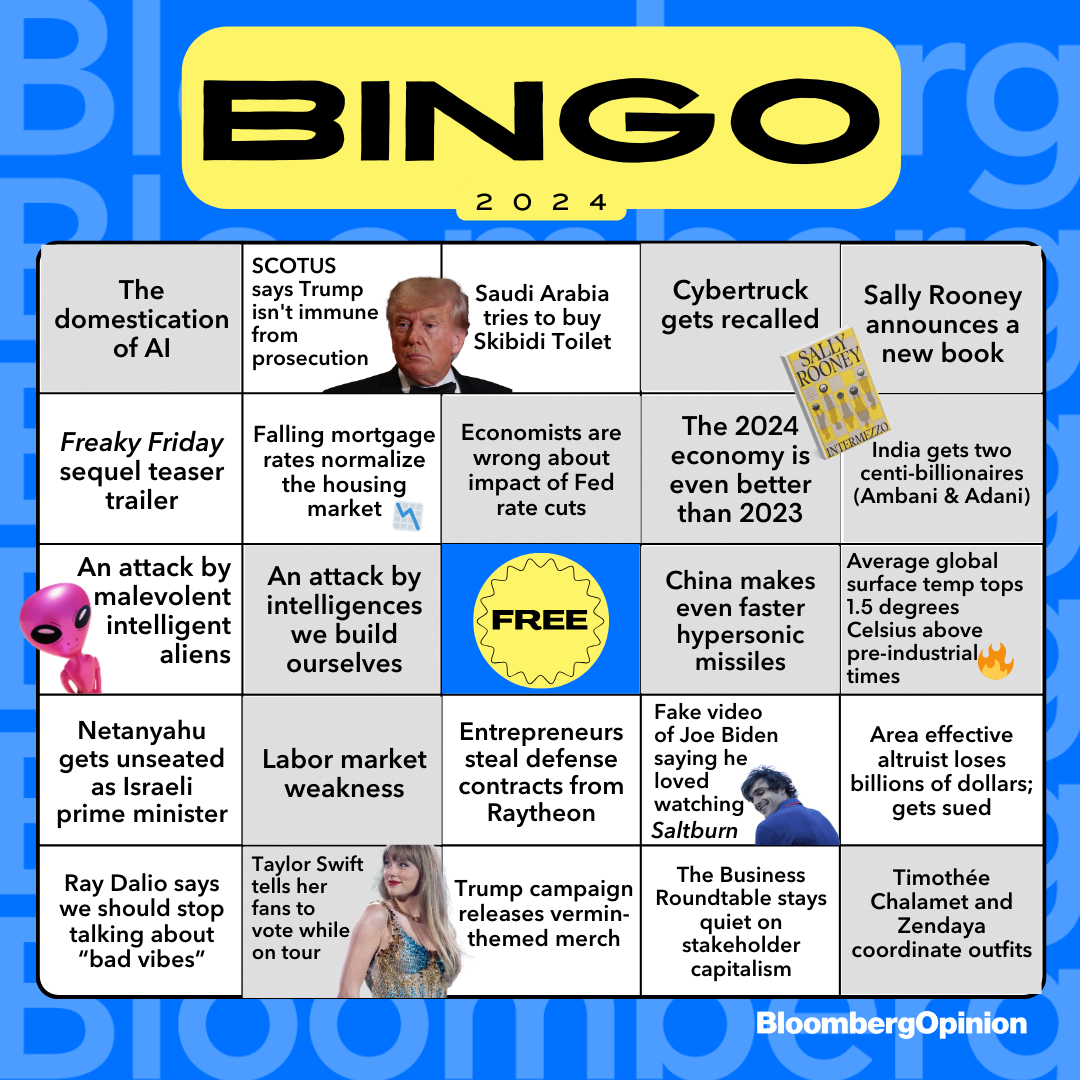

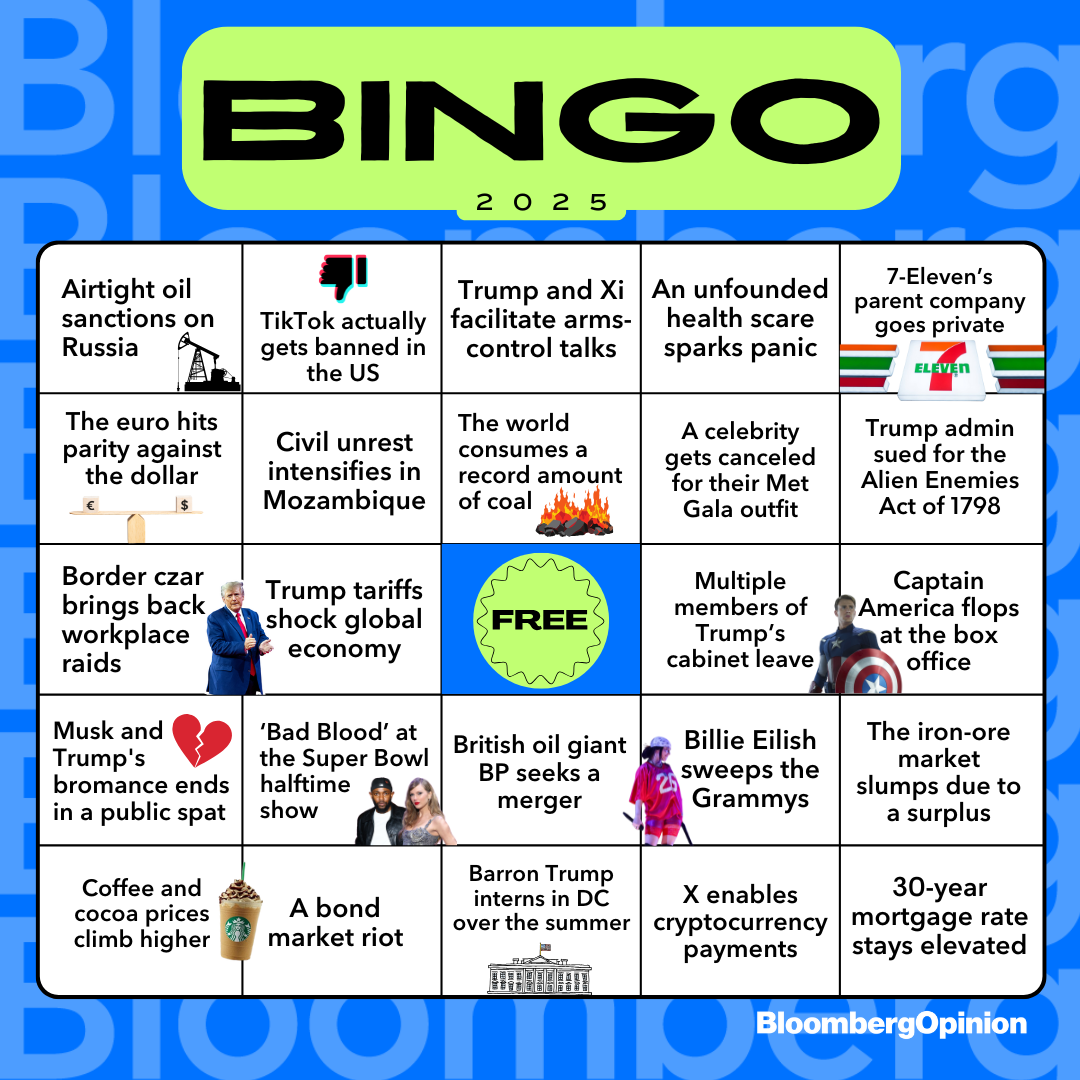

| This is Bloomberg Opinion Today, a new year of Bloomberg Opinion's opinions. Sign up here. Exactly one year ago, I cobbled together the first Bloomberg Opinion year-ahead Bingo card. And folks, I gotta say: 365 days later, it's looking ugly! So I'll cut to the chase: We failed to make a single Bingo. We were close — those gray boxes are predictions we got right, the ones that didn't come to pass are in white [1] — but we were foiled by the Supreme Court, stubborn mortgage rates and an obtuse prediction about Skibidi Toilet, of all things: Hopefully the Bingo gods will be kinder to us this year. Herewith, 2025's card: A few highlights from the new board: This year, Bloomberg Opinion's editorial board is hoping to see a real squeeze on the oil and gas revenue that continues to fund Russian President Vladimir Putin's military ambitions in Ukraine. Andreas Kluth, ever the paranoid optimist, thinks Trump's fraught relationship with Chinese President Xi Jinping could go one of two ways: petty or productive. The two could go head-to-head on tariffs — petty! — or they could convince Putin, North Korean leader Kim Jong Un and the mullahs in Iran to cool their nukes — productive! — with arms-control talks. Despite the post-Christmas stock flop, the economy is still looking strong, and it's getting harder to find true bears out there. Jonathan Levin wonders whether it's time to worry: One of the few remaining bearish strategists, Peter Berezin of BCA Research, warns of a "bond market riot" against deficit-funded tax cuts. On the flip side, there is the outlook for the housing market. Conor Sen is skeptical we'll get lower mortgage rates under Trump: "The 30-year mortgage rate is back above 7% after falling into the low 6% range in September, rising along with Treasury yields. The prospect of a stronger economy and faster inflation will only push that benchmark higher, or at least leave it at elevated levels next year." Elsewhere in elevated levels: Remember when scientists told us to throw out all of our black plastic spatulas because they were toxic? [2] That was just a typo: F.D. Flam says contaminant levels were actually 10 times lower than EPA limits, cementing the cooking utensil's place in the Unfounded Health Scare Hall of Fame. Expect more of the same in 2025. In Japan, Gearoid Reidy predicts a number of events, including the potential privatization of 7-Eleven's operator. In India, Mihir Sharma says a "tariff wall" on imports to the US wouldn't be as painful as the self-harming policies already in place in New Delhi. In the US, Patricia Lopez says there's a solid chance Trump will invoke the Alien Enemies Act of 1798 — which would almost surely be challenged in courts — and his border czar, Tom Homan, could bring back workplace raids. In Southern Africa, Justice Malala says a disputed election may hand Mozambique "a damaging period of civil unrest" — a violent prediction for an already violent year. Speaking of violence: Monday marks the fourth anniversary of Jan. 6, 2021, which is strange, considering most of us are still living in 2020: It has come to this: Congressional subcommittees aren't rehashing the events of that day, they're rehashing other committee's reports of the events of that day. It's not just meta and exhausting — it's dangerous. Francis Wilkinson says a report by Representative Barry Loudermilk of Georgia, the Republican chair of the House administration committee's oversight subcommittee — we weren't kidding about it being meta — "retraced the investigative skein of the Jan. 6 committee in an effort to discredit its evidence, conclusions and, most of all, its chief spokeswoman, former GOP Representative Liz Cheney." "Like much MAGA hackwork," Francis says, the "report has a plodding, Soviet quality." In Loudermilk's eyes, Cheney "just up and went antifa, destroying her high-flying GOP career for no particular reason" by breaking a bunch of federal laws. But that narrative has more than a few holes, especially when it comes to the Capitol's security failures and Cheney's rationale. President Joe Biden, for one, isn't buying it: Today he awarded Cheney the Presidential Citizens Medal. "The only thing we know for certain from this report is that Trump is blameless for anything bad that may or may not have happened that day," Francis writes. Convenient, isn't it, how we went from this to this in less than four years? Read the whole thing.

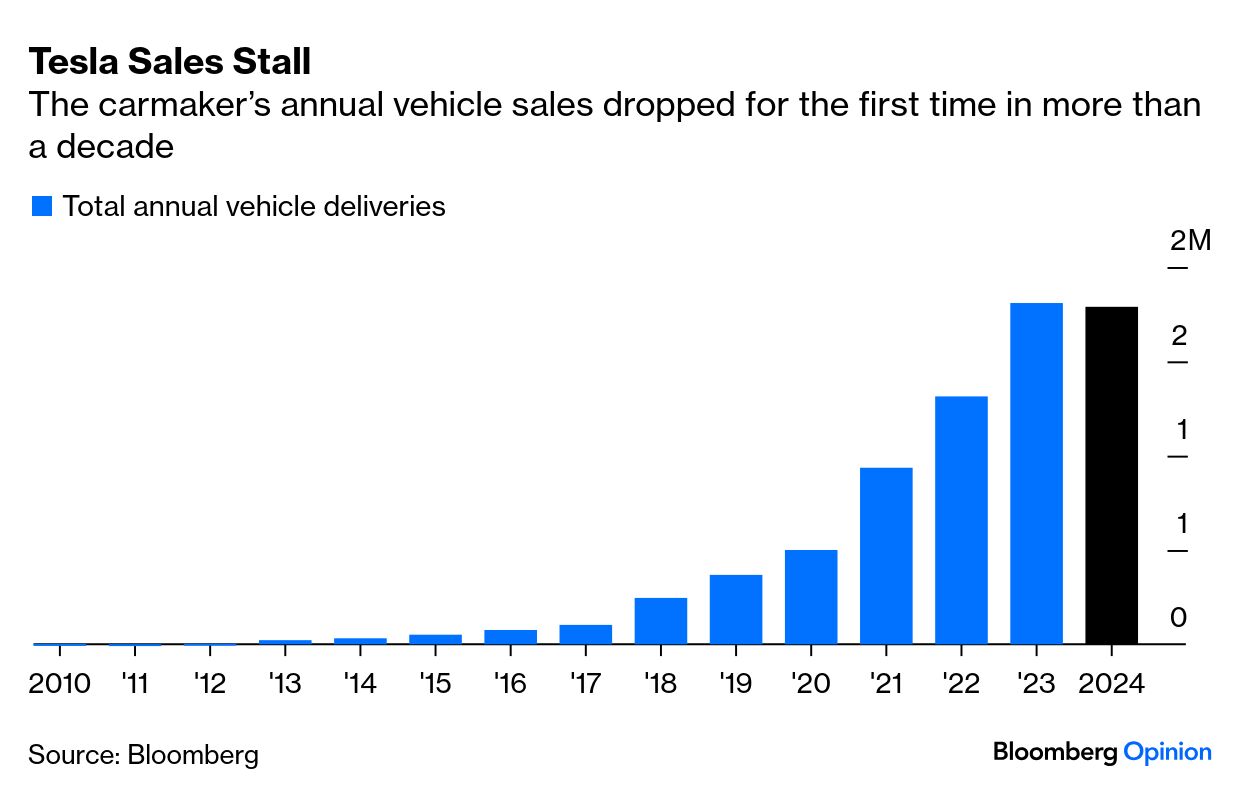

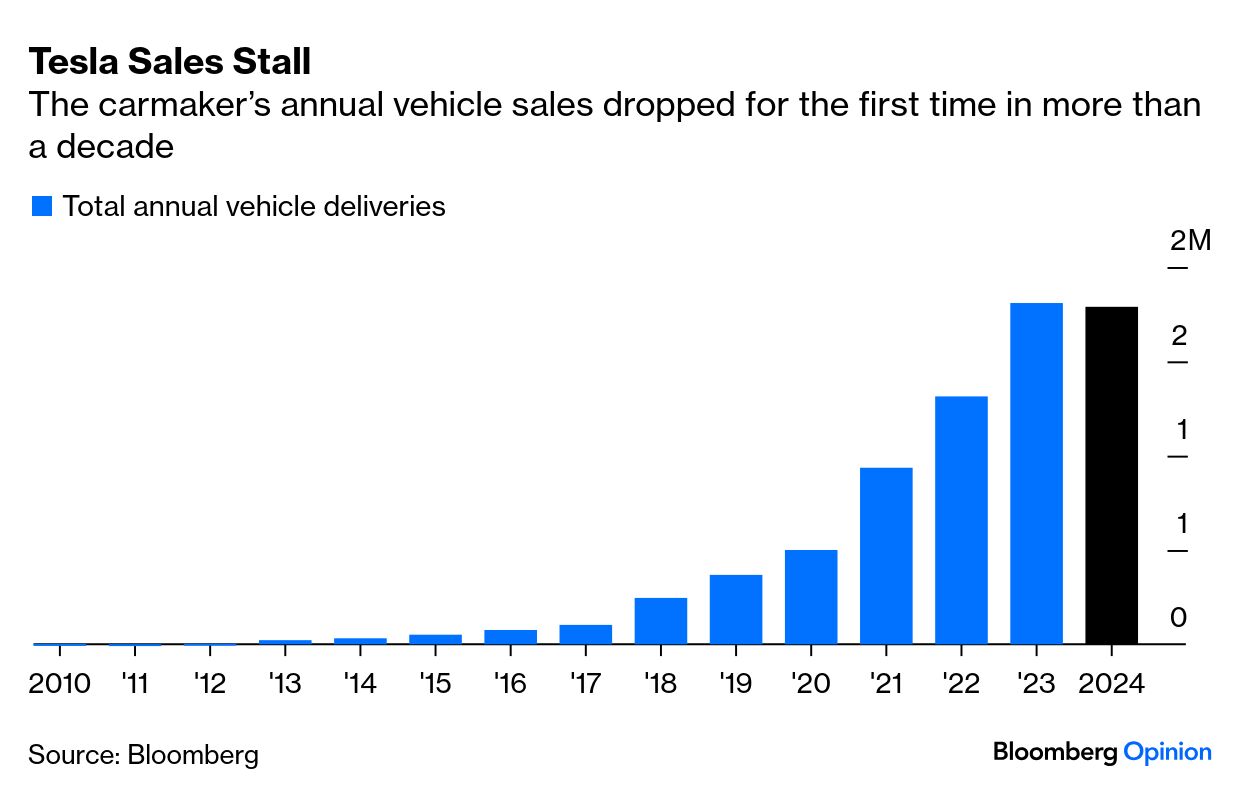

Welp, this is awkward: In October, Tesla surprised analysts by saying it expected a minor bump in annual vehicle sales in 2024. But the 515,000 figure that Elon Musk's company floated mere months ago turned out to be too good to be true: Actual deliveries for the quarter came in at about 496,000, meaning Tesla's annual vehicle sales dropped for the first time in more than a decade. "Tesla's computing chops, formidable as they doubtlessly are, still need some honing," Liam Denning writes. Not a great a look for a guy trying to streamline the government!  Marcus Ashworth and Mark Gilbert expect more of the same strength from the dollar next year: "A rampant dollar can cause particular strain for resource-poor nations having to pay for dollar-denominated commodities in their own weakened currencies, and with prospective trade tariffs a big concern, it's far from clear where any respite comes from," they write. To steal a quote from Richard Nixon's Treasury secretary: "It's our currency, but it's your problem." Yikes. Understanding the rise of the Asian aunty. — Karishma Vaswani India and China's economies are intertwined. — Mihir Sharma A "Made in China" crisis awaits Big Auto. — Liam Denning The two US attacks on New Year's Eve appear unconnected. New York City's mayoral showdown has begun. Suicide drones transformed the front lines in Ukraine. The Jeff Bezos Effect is alive and well. Popeye horror movies are inevitable. Be a hero and win free Chipotle for your entire city. Wait, Meghan Markle is cooking on Netflix now? Notes: Please send Bingo advice and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment