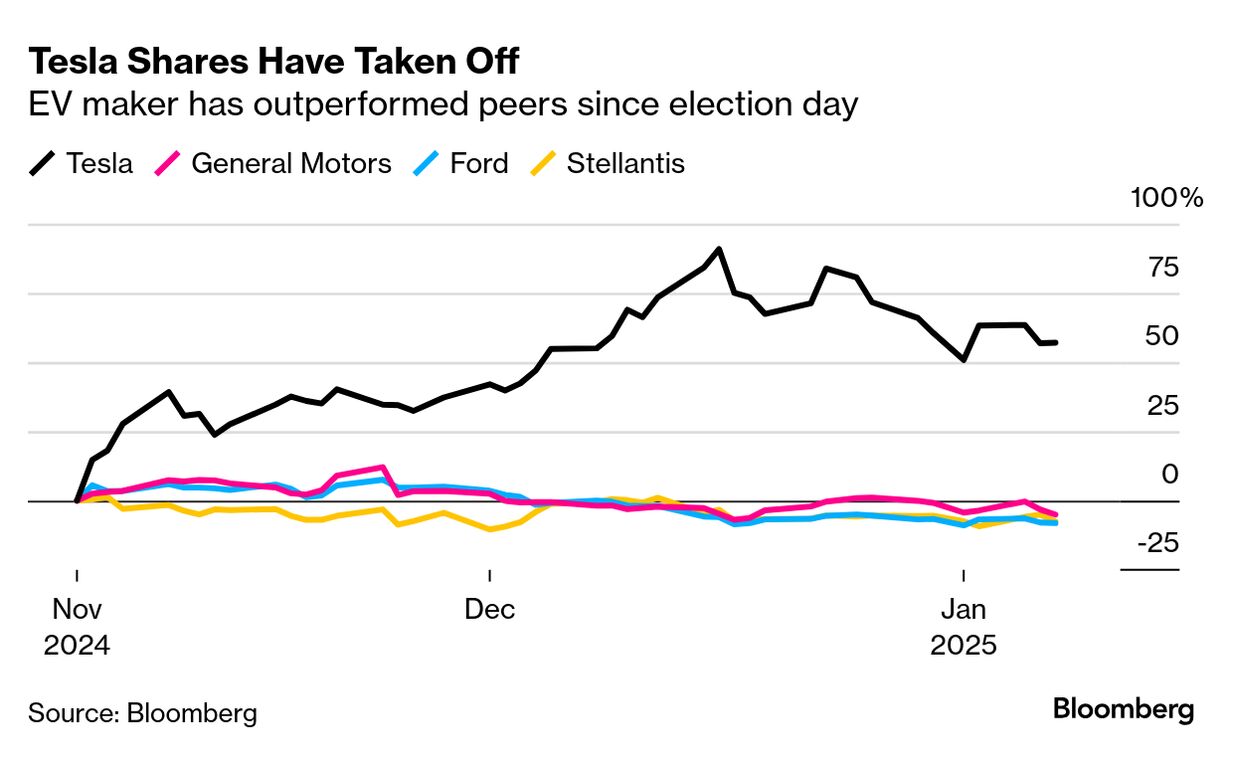

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Quantifying Trump's EV Headwinds | The prevailing wisdom since Election Day has been that Tesla will be one of the biggest beneficiaries of Donald Trump's return to the White House. Analysts at JPMorgan reckon the market has this dead wrong — that Tesla may, in fact, have the most to lose from the shifting regulatory landscape. Their back-of-the-envelope math suggests that roughly 40% of Tesla's profits could be under threat. JPMorgan's Ryan Brinkman recently met with management at General Motors, Ford, Stellantis and more than half a dozen suppliers during a trip around Detroit. Most of the executives Brinkman's team met with expect Trump to make a series of moves to the detriment of businesses producing and selling electric vehicles: - Curtail the up to $7,500 consumer tax credit toward EV purchases and leases

- Revoke California's waiver to regulate emissions separately from the Environmental Protection Agency, thereby scuttling the state's zero-emission vehicle mandate

- Relax federal standards for tailpipe pollution and fuel efficiency, the former of which allows over-complying companies to sell compliance credits to those with shortfalls, just as California's program does

This confluence of regulatory changes may preclude GM and Ford from lessening EV losses this year and potentially next year, Brinkman wrote in a report published Wednesday. However, the analyst sees these shifts being a net positive for GM and Ford in the medium term, as they allow the companies a longer leash to sell more profitable combustion engine-powered models. Tesla, on the other hand, could be in for a world of hurt. "The changes strike us as highly negative for Tesla, threatening an estimated ~40% of its profits," Brinkman wrote, casting doubt on the sharp post-election rise in the EV maker's shares. Here's how Brinkman arrives at that 40% figure: - The Treasury Department recently announced that, from January through October, it had extended more than $2 billion of EV tax credits to consumers. That annualizes to around $2.4 billion of pricing support that automakers may have to offer in the US government's stead if Trump does away with the credits

- Brinkman estimates that Tesla customers received around half of those credits last year, meaning the company would face around a $1.2 billion headwind if the tax credits expire

- He estimates that the US accounts for around three-quarters of the $2.7 billion in regulatory credit sales that analysts are projecting Tesla will generate this year, so this amounts to a further $2 billion headwind

- The combined $3.2 billion compares to the Bloomberg-compiled consensus that Tesla will earn about $8.3 billion this year before interest and taxes

Investors have tempered their enthusiasm about Tesla the last few weeks, with the stock trading down about 18% from its record high reached on Dec. 17. But the carmaker has still added more than $460 billion of market capitalization since Election Day, which is roughly the equivalent of Toyota, BYD and GM's combined valuations. It's no wonder, then, that another analyst — Ben Kallo at Robert W. Baird — noted in a report Thursday that Tesla is among the stocks he's fielding the most questions about early this year. "We expect valuation to be one of the primary bear arguments in 2025 and anticipate pushback with several unknowns," Kallo wrote.  Traffic on Madison Avenue in New York City. Photographer: Michael Nagle/Bloomberg New York City has the slowest car travel among US cities, according to a new analysis. The average time it took to drive 10 kilometers (6.2 miles), a distance roughly equivalent to the perimeter of Central Park, in the middle of New York City last year was 31 minutes and 6 seconds, according to a traffic index compiled by TomTom. The Big Apple, which became the first city in the US to institute congestion pricing this week, is working to reduce gridlock, pollution and carbon emissions by charging a $9 toll for drivers entering parts of Manhattan during peak hours. |

No comments:

Post a Comment