| Bloomberg Evening Briefing Americas |

| |

| The US Federal Reserve's favorite inflation gauge came in pretty plain vanilla Friday, perhaps pointing the way toward Wall Street's favorite flavor: rate cuts. But even that bit of good news wasn't enough to calm investors trying to read the tea leaves as to what the White House will or won't do, means or doesn't mean when it comes to triggering a regional or global trade war. And as if that weren't bad enough, President Donald Trump issued a fresh round of amorphous trade threats today. The S&P 500 erased a rally that approached 1% while the greenback hovered near session highs amid reports there will be tariffs come Saturday, or maybe in March, or maybe not at all. "Going into the weekend it seems like even staff closest to the Oval Office don't have all the details," said Max Gokhman at Franklin Templeton Investment Solutions. "So some bulls are going back to the barn to sit out a likely storm." —David E. Rovella | |

What You Need to Know Today | |

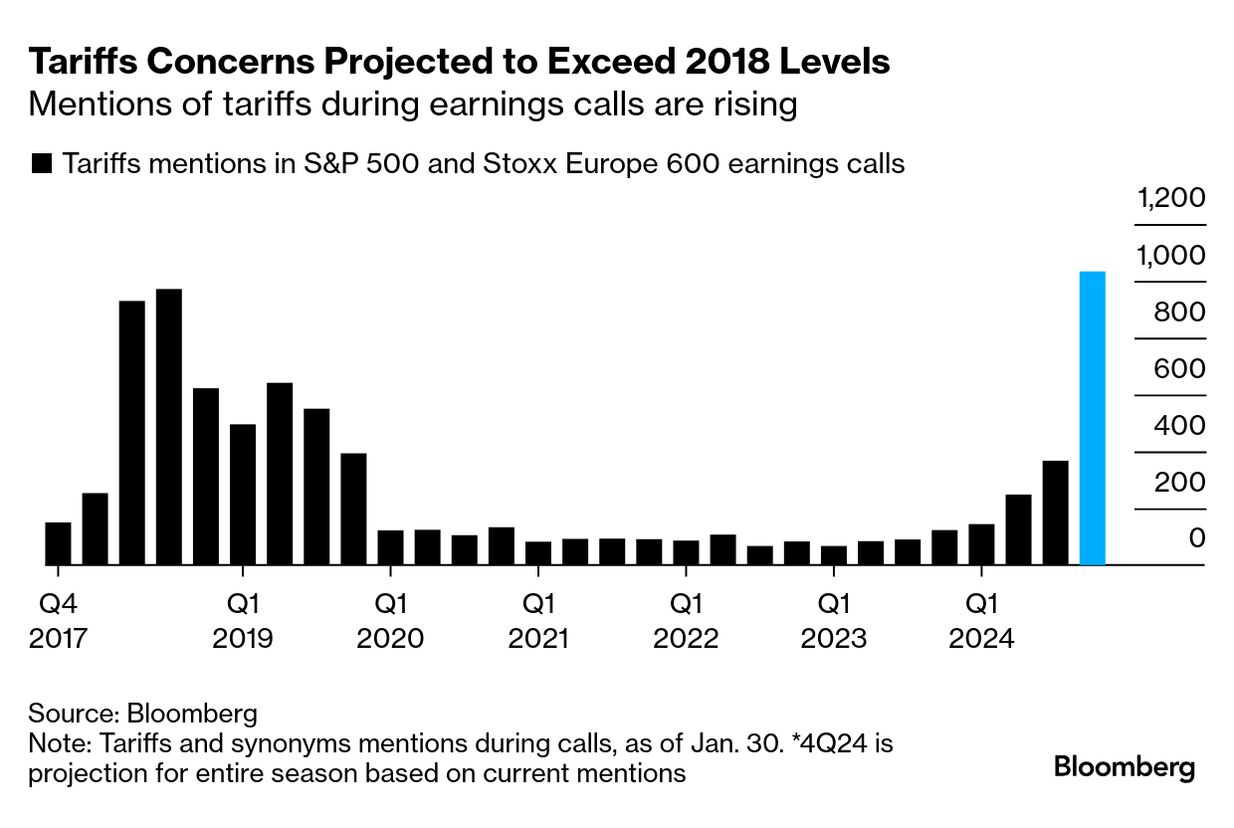

| With the exception of his one-day showdown with Colombia, Trump has failed so far to follow through on his innumerable promises of immediate tariffs against China or America's two neighbors. So what happens if he finally does it? The 78-year-old Republican now says tariffs are really coming tomorrow. Assuming that happens, the conventional wisdom among economists is that it will be some version of an own goal, with Americans suffering higher inflation or decreased economic growth or both. But when it comes to equities, the effect is unclear. "Because we don't know what's going to happen, we have to assume that there's a general increase in tariffs on just about everything which is imported into the states," Chris Beckett, head of research at Quilter Cheviot, said. "Then you start worrying about tit-for-tat retaliation and general reductions in free trade." Here's a look at which global stocks and sectors could be most at risk from Trump's threats. | |

|

| One of the most sensitive positions at the heart of both the US government and economy is being vacated, and reportedly it seems Elon Musk may have had something to do with it. The US Treasury official who oversees the world's largest financial infrastructure, including the federal government's cash-management operations and debt financing, is suddenly retiring. The Washington Post has reported that David Lebryk, the Treasury's most senior career employee, is departing after a clash with adjutants of the right-wing billionaire over access to the Treasury's sensitive payment systems, which send money to bondholders, federal workers and government contractors. Musk, at the direction of Trump, has been looking to slash government employees, agencies and expenditures, potentially in ways critics contend are illegal. The concept of only processing select Treasury payments and foregoing others often comes up in the context of those performative federal debt limit standoffs. When the Treasury is unable to issue net new debt and it's at risk of running down its cash stockpile, some lawmakers have urged it to look at paying some obligations while delaying others. Treasury secretaries have had another word for such tactics: it's called default. | |

|

| The flight path of an Army helicopter before it collided with an American Airlines Group passenger jet this week above Washington is emerging as a key line of inquiry in the probe of the midair tragedy that killed 67 people. Investigators probing the accident are said to have confirmed that the military aircraft was flying at an altitude above the upper limit for helicopters in the area. Officials on Friday restricted helicopter activity around Ronald Reagan Washington National Airport in response to the crash. The National Transportation Safety Board, which is leading the investigation, hasn't divulged initial findings on what may have contributed to Wednesday's collision. But details are beginning to filter out, including about potentially abnormal air-traffic control staffing levels in the tower. | |

|

| |

|

| Chile's benchmark stock index is on track to post its biggest monthly gain since July 2023 and best start to a year since 1997 after Congress approved a long-awaited pension reform. The IPSA is up 8.4% so far this month, hitting a record and on track for its seventh consecutive month of gains. Stocks leaped Thursday, posting their biggest daily gain since July, after lawmakers approved the pension reform, which will lift the assets under management of Chile's largest institutional investors. The vote combines with signs of economic resilience in China, Chile's largest export market. | |

|

| OpenAI rolled out a new, lightweight artificial intelligence model that it said is capable of humanlike reasoning and makes gains on efficiency—a product that will be closely watched following the release of an open-source model from China's DeepSeek. The model is called o3-mini and will be free to use. The company first announced plans for it in December at the same time it unveiled a more powerful version, o3. Both models are meant to answer complicated questions related to topics such as coding, math and science. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment