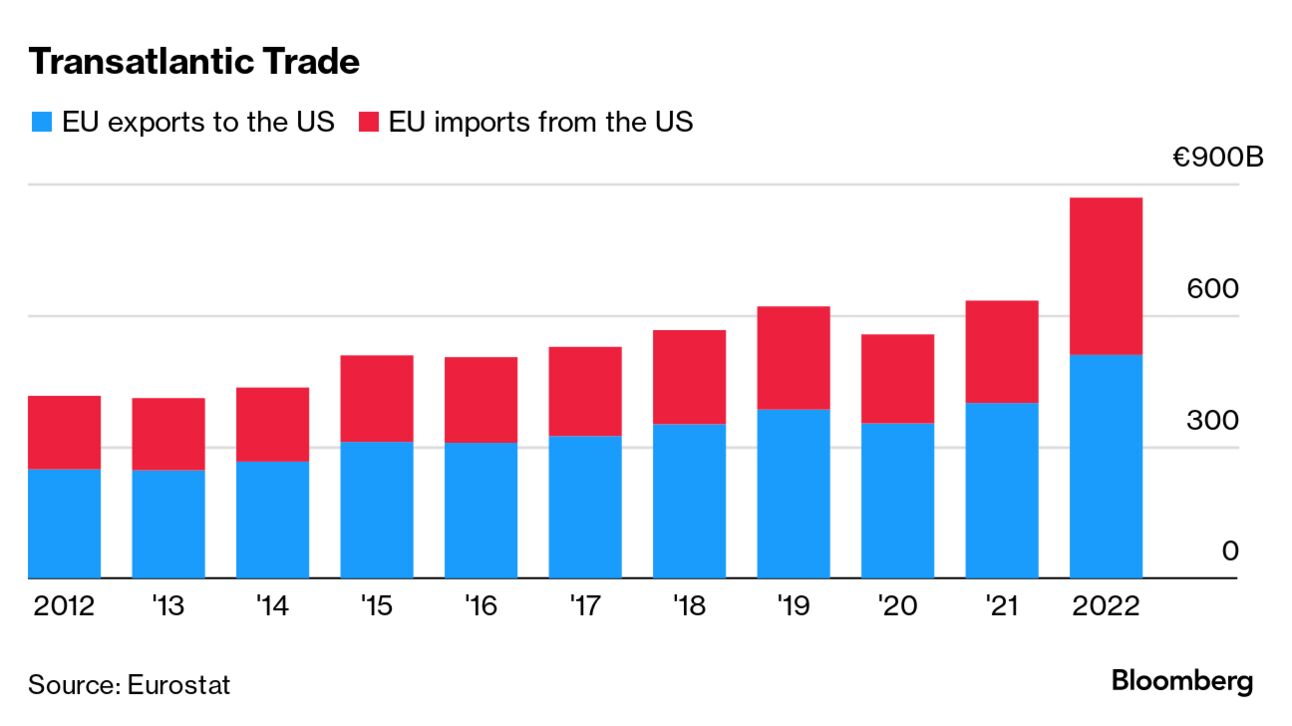

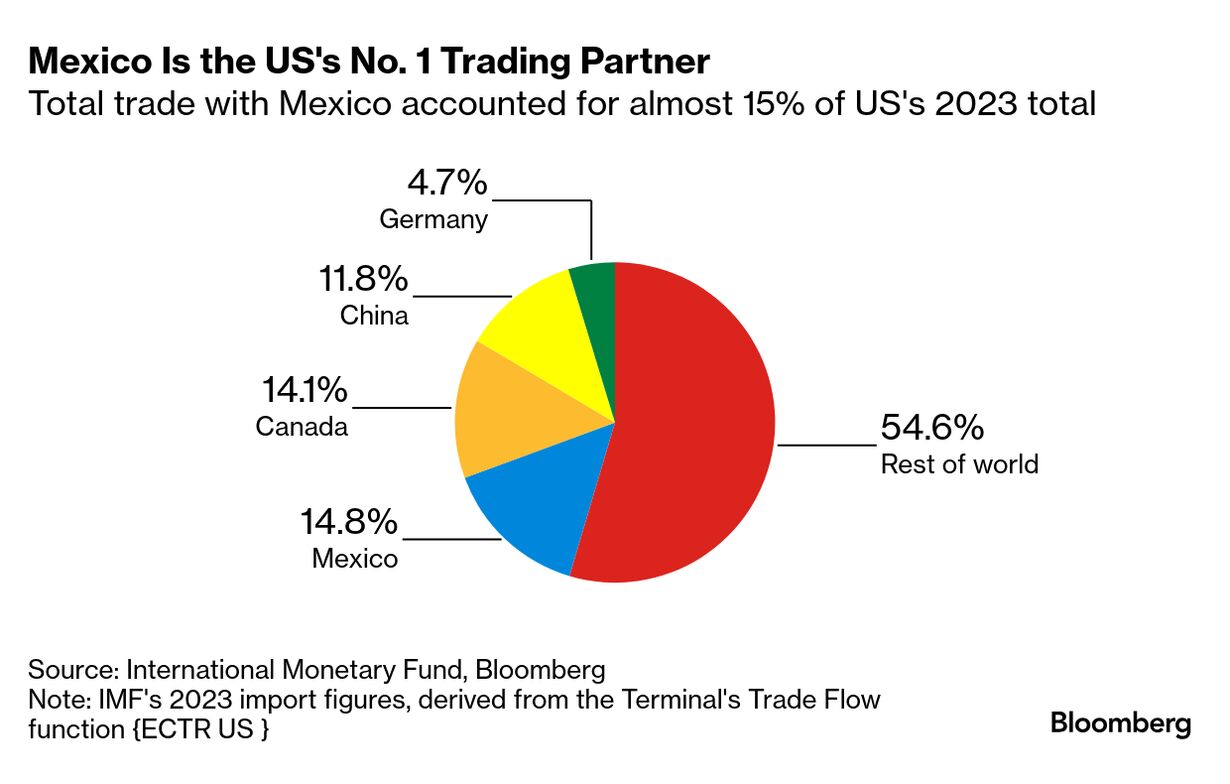

| European Union officials are rushing to strengthen their ties as concerns loom that President Donald Trump will try to divide the 27-nation bloc through tariffs. In a private meeting last week, the European Commission urged member states to remain united, with some comparing the situation to Brexit negotiations where UK officials sought bilateral deals to undermine EU unity, according to our reporting today from European capitals. Economically, Europe is heading into a trade confrontation with Trump in a weak position. Data released Thursday showed GDP in both Germany and France contracted in the fourth quarte last year. Meanwhile, figures due out later in Washington may show the economy grew at a healthy 2.6% annualized pace last quarter. A day after the US Federal Reserve opted against cutting interest rates for more of a wait-and-see approach, the European Central Bank today is expected to deliver its fifth straight reduction. As many European countries struggle with economic angst and political paralysis, Germany's Olaf Scholz, France's Emmanuel Macron and Denmark's Mette Frederiksen have traveled around the region in recent weeks to discuss the risks that a weakened EU might face from the new US administration. Read More: Trump's Transactional Foreign Policy Leads to Flurry of Pledges For many across Europe, the expectation is that a new volley of US tariffs is inevitable, and this time things will be worse than the trade fight Trump sparked in 2018. That sense of worried anticipation wouldn't have eased much after Wednesday's Senate confirmation hearing for Howard Lutnick, Trump's nominee to lead the Commerce Department. "The fact that we Americans cannot sell an American car in Europe is just wrong and it needs to be fixed," Lutnick said. And while European officials will exhaust all avenues for cooperation, they're skeptical that they can talk Trump out of a clash that could embroil everything from steel and cars to European tech regulations and tax policy. "The EU will attempt to negotiate first, likely presenting a united front," Jamie Rush, Antonio Barroso and Eleonora Mavroeidi of Bloomberg Economics wrote in a research note. "But there is limited capacity to address those concerns." —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment