| The sale of an $8 million Dubai property. Purchases of Indonesian-made cooking oil by Tanzanian buyers. A cool $100,000 in rental payments for a Palm Jumeirah villa and private yacht. These are just a few examples of how stablecoins are being used by customers of Fasset, a Dubai-based "super app" focused on markets spanning from Morocco to Malaysia, according to co-founder and Chief Executive Officer Raafi Hossain. Fasset is one of several Middle Eastern fintech outfits looking to capitalize on a recent boom in the stablecoin market. Dubai's Careem Networks FZ LLC, which offers taxi, food and financial services, and Botim, a messaging app owned by Abu Dhabi-based Astra Tech, are also exploring rolling out payment tools powered by stablecoins, according to spokespeople for the companies. Stablecoins give users a way to "bypass geographical and institutional barriers, enabling high-value transactions with efficiency and speed," Fasset's Hossain said. The total market capitalization of all stablecoins in circulation has ballooned from less than $140 billion at the end of 2023 to more than $200 billion today, according to DeFi Llama data. They are a kind of crypto token designed to mimic the price of a fiat currency, usually the US dollar. By far the dominant stablecoin is the dollar tracking USDT, whose issuer Tether Holdings Ltd. recently signaled that it would book more than $10 billion in net profits in 2024. The total circulating supply of USDT stands at nearly $140 billion, according to CoinGecko. Where previously stablecoins were predominantly used by traders as a conduit for swapping between digital assets and traditional currencies, there is evidence to suggest that the purported dollar surrogates are increasingly relied on for cross-border trades. Tapping into demand for such services — especially in sanctioned countries like Russia and Iran that lack ready access to the banking system — can be risky. The Wall Street Journal reported in October that federal prosecutors in Manhattan are investigating Tether for possible violations of sanctions and anti-money-laundering rules. The firm has said it's unaware of any such investigation and has "well-documented and extensive dealings with law enforcement to crack down on bad actors" who seek to misuse Tether and other tokens. Yet the Middle East's fintech firms appear undeterred. Mohammad El Saadi, vice president of Careem Pay, said the technology has "the potential to drive even lower fees, faster processing, and improved working capital management for cross-border transfers." The company has opened eight new fiat payment corridors from the United Arab Emirates in the past 11 months. Botim, meanwhile, has been experimenting with dirham-pegged AE Coin, which is approved by the UAE's central bank, according to Rishabh Singh, VP of products at Astra Tech.

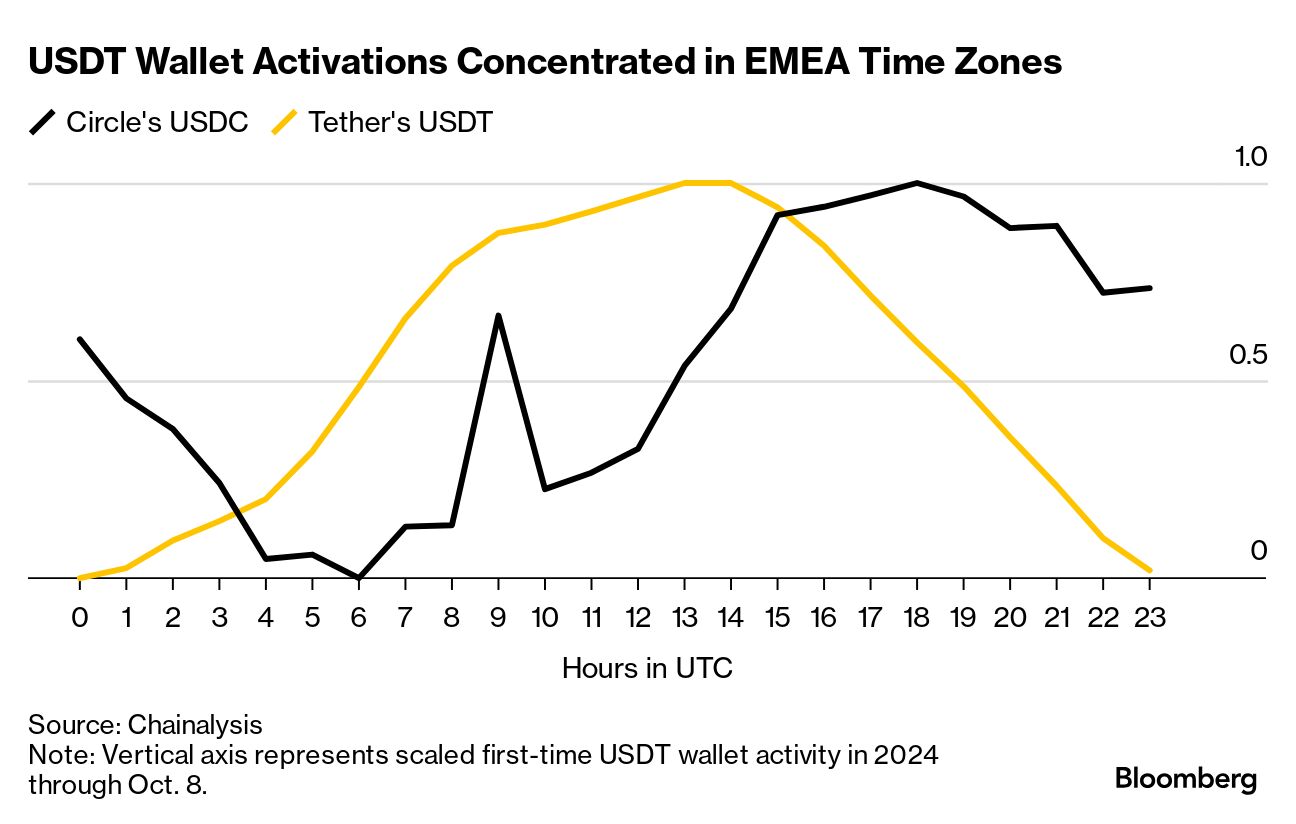

As the chart above suggests, USDT usage is already concentrated in Europe, Middle East and African time zones.

In the Middle East, especially, stablecoins are proving hard to ignore.

|

No comments:

Post a Comment