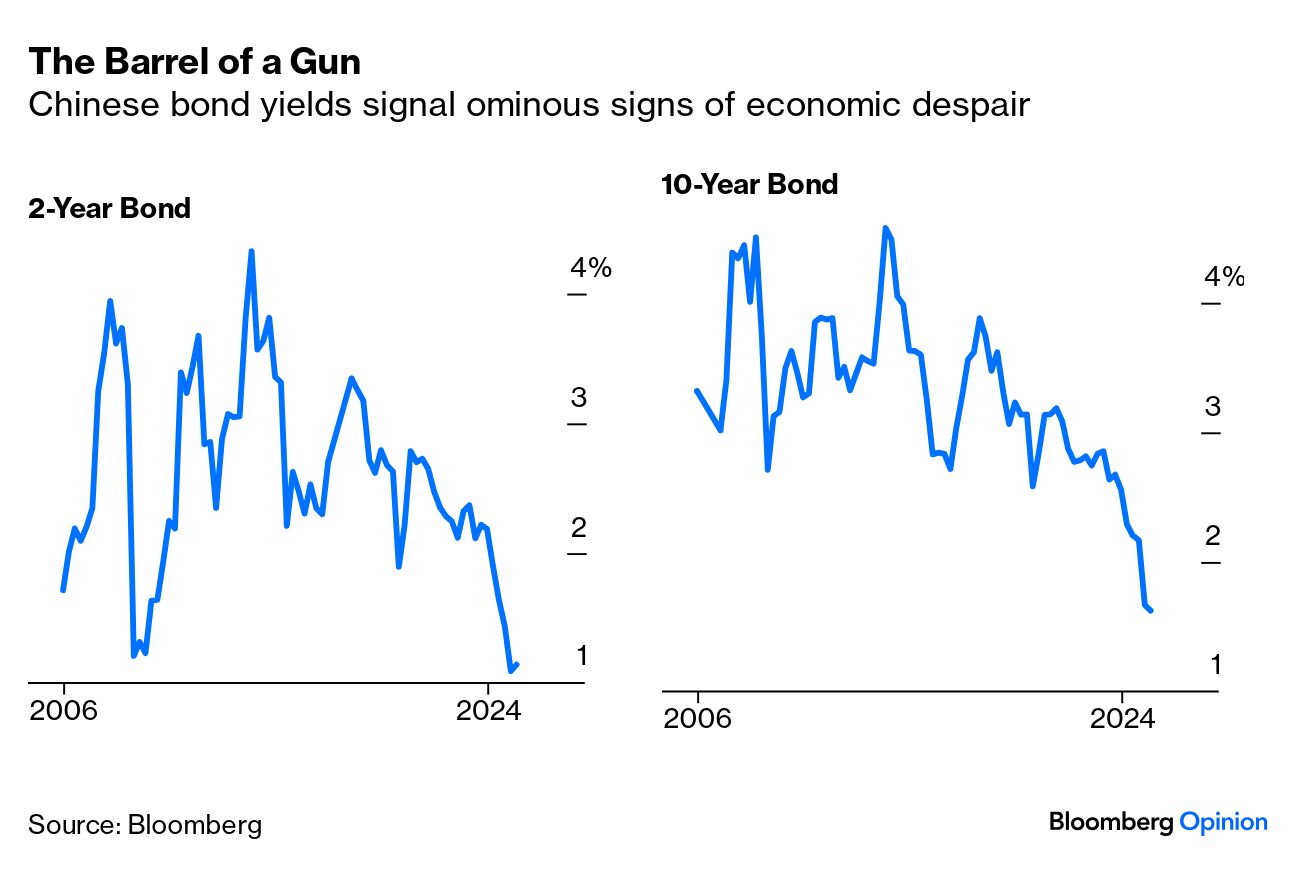

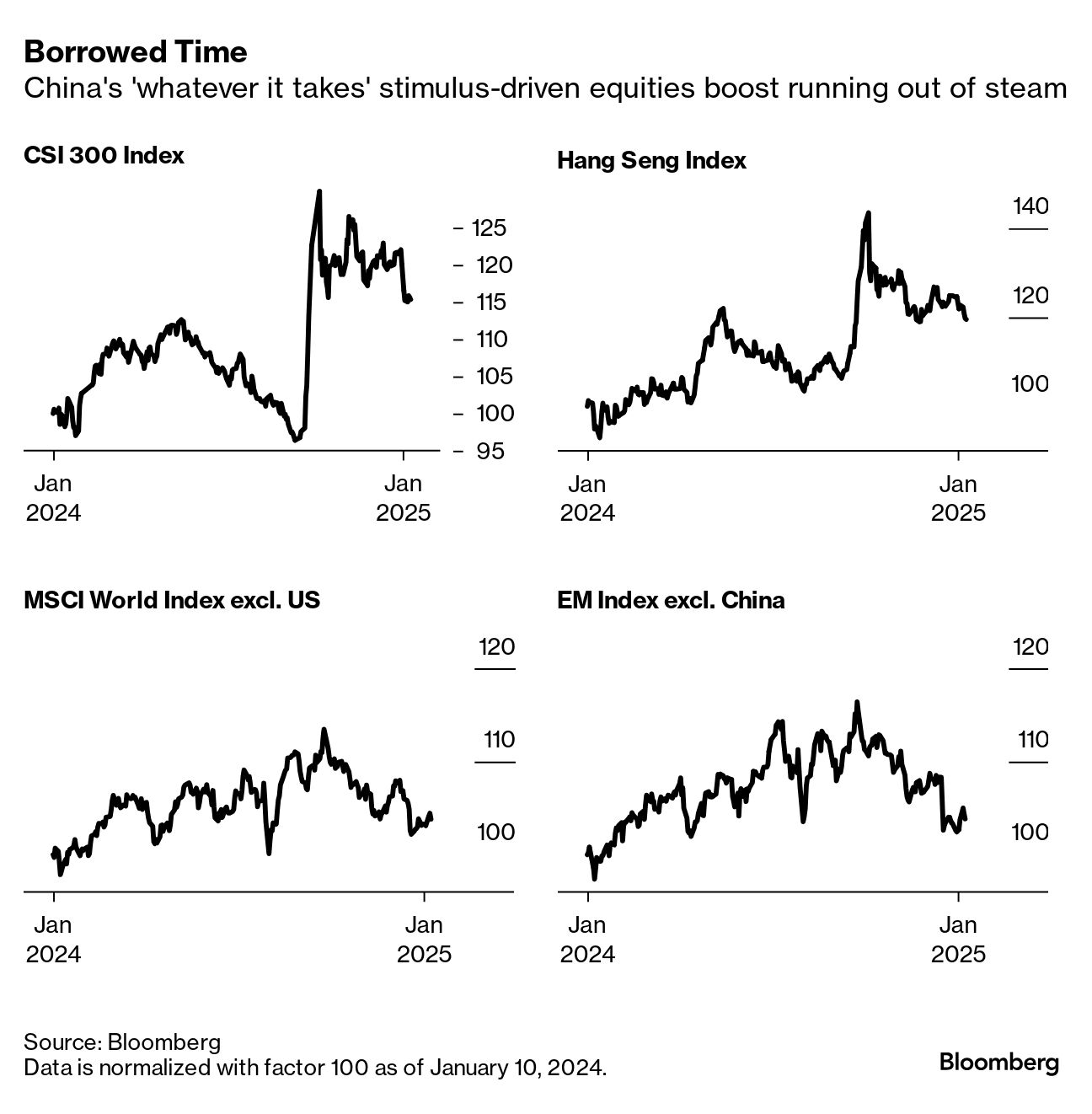

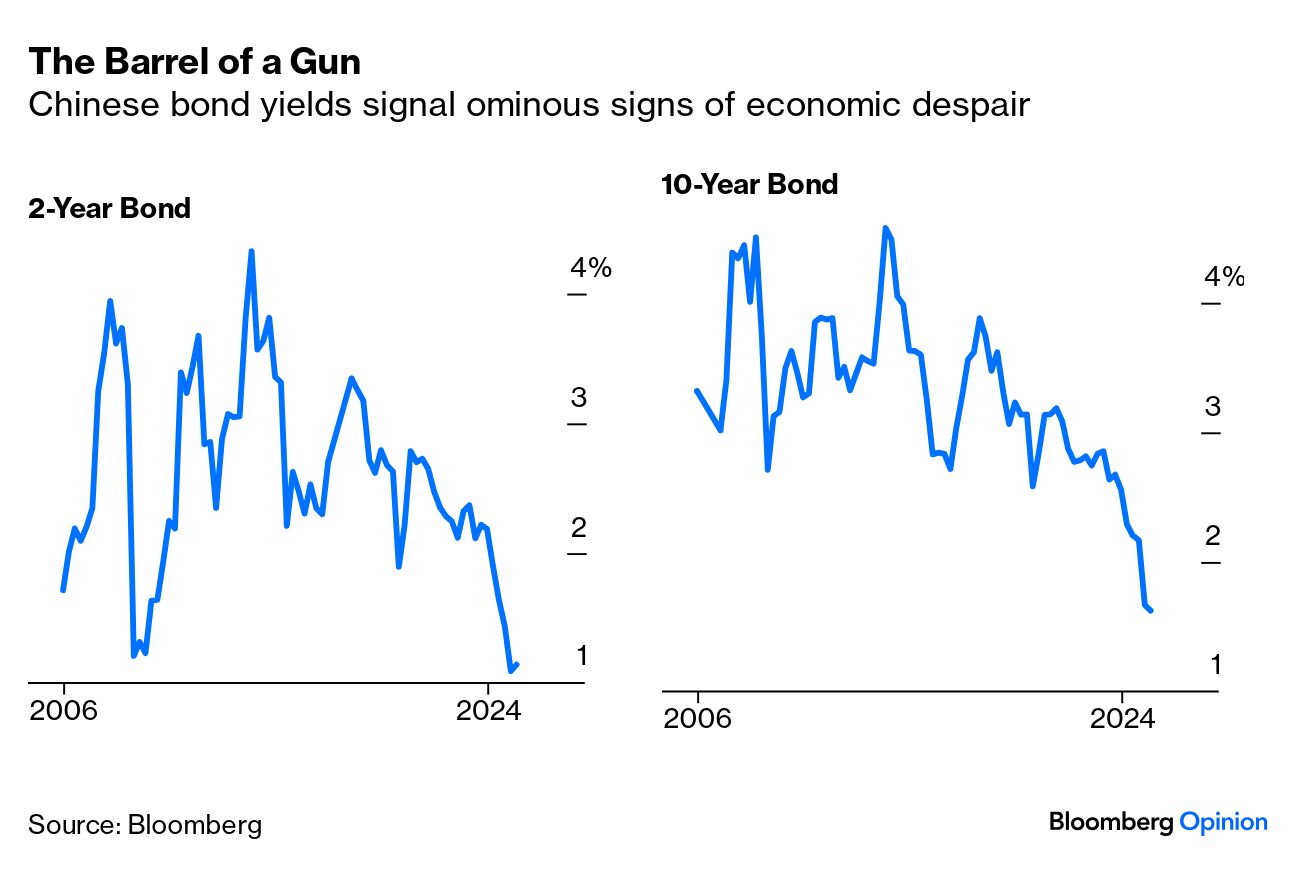

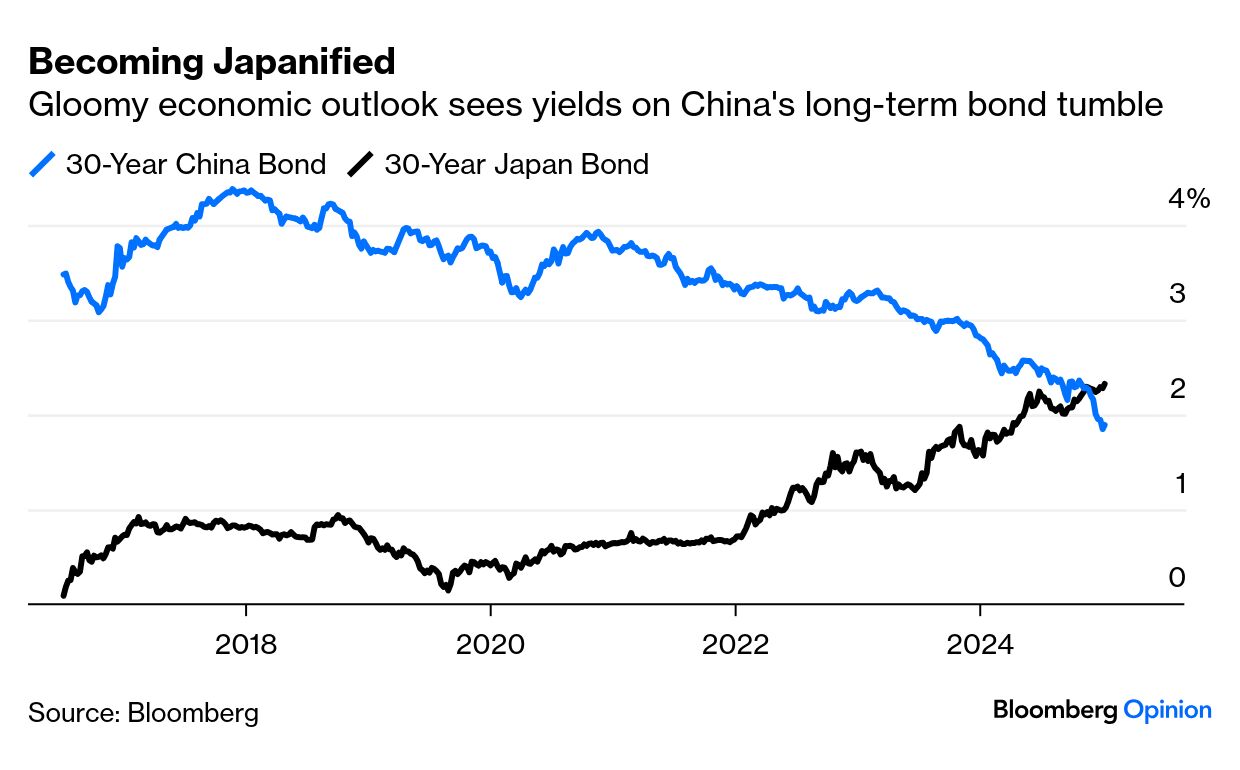

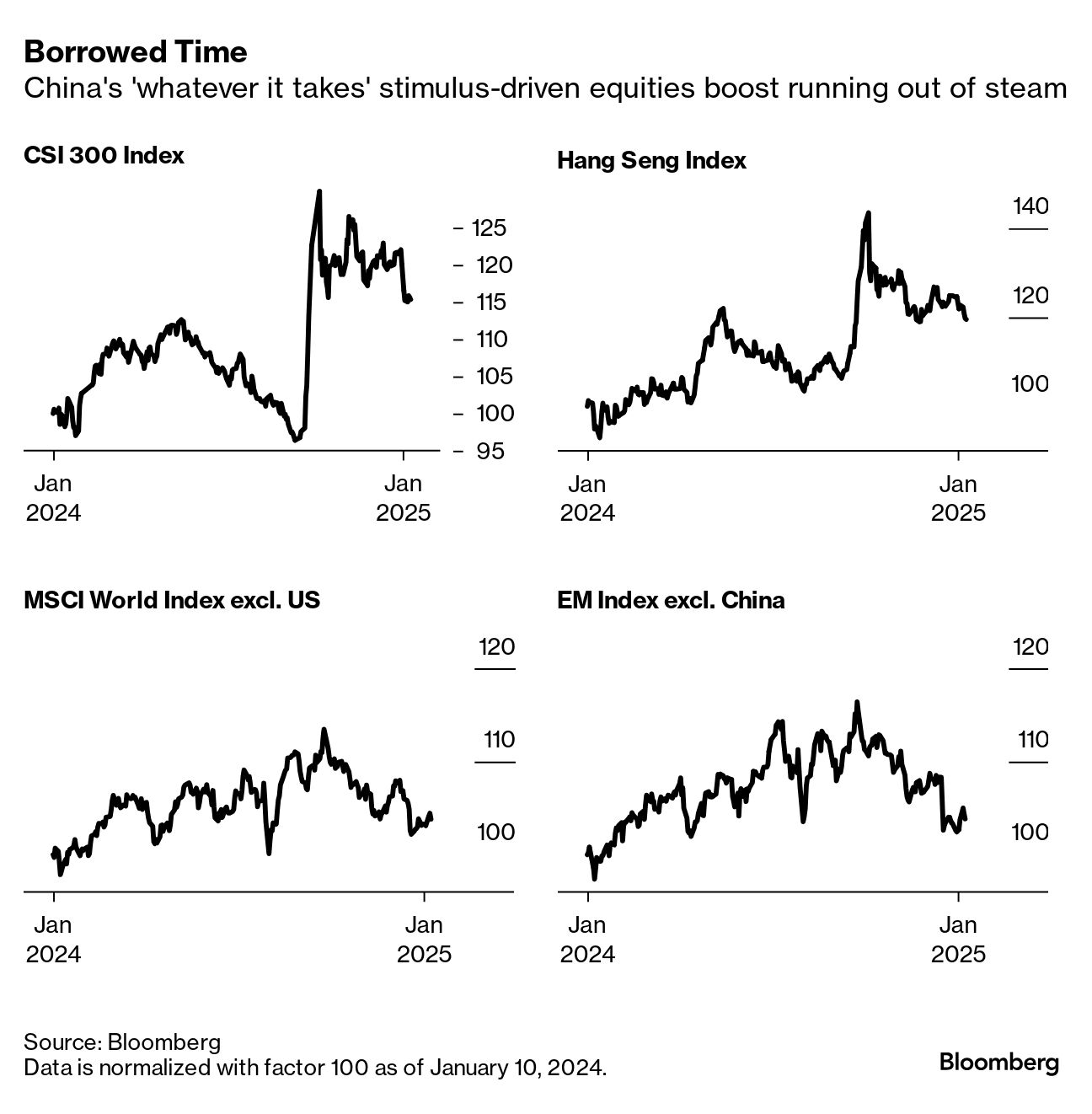

| China's post-pandemic malaise feels eerily similar to being trapped in a time loop. There is no forward motion. Barely four months ago, Beijing had investors believing it would do whatever it takes to revive its ailing economy. That led to an epic surge in share prices that has been abating for months as disappointment set in. Admittedly, a raft of policies was unleashed from the fiscal and monetary sides. Putting a floor under the real estate sector slump — at the heart of the economic troubles — was non-negotiable. The humongous local government debts of over 60 trillion yuan ($8 trillion), according to International Monetary Fund estimates, continue to act like a lead weight. The excitement that the September pivot ushered in is effectively over, with little to show for officials' resolve to get the economy back on track. Judging by the yields on Chinese bonds, investors are giving up on efforts to stop the world's second-largest economy from sinking further. Yields on both two-year and 10-year bonds seem to be in a perpetual slide. Both have touched historic lows and continue to plummet — far from what should happen when a government has decided to go for broke with a big stimulus:  That plunge helps to explain the growing belief that an even more significant bailout from Beijing is coming. The leadership has no other choice. Investors' impatience seems justified. The latest inflation print indicated that the economy is knee-deep in deflationary territory after consumer prices decelerated for the fourth straight month, while producer inflation is stuck in deflationary mode. Bloomberg Opinion colleague Mohamed El-Erian notes that this is all consistent with a deepening risk of "Japanification," the prolonged period of stagnation that crippled Japan at the turn of the millennium. The longer this continues, El-Erian argues, the greater the risk of self-feeding vicious dynamics undermining growth, as well as household and corporate confidence. Even with a further bailout firmly on the table, China's 30-year yields have dropped below 2% and, amazingly, below equivalent Japanese bonds. Not long ago, this would have been inconceivable: While the investor pessimism is concerning, the confidence sparked in Chinese equities by September's pivot hasn't been completely undone. Both mainland and offshore equity markets have held on to some of the gains. In the absence of the expected stimulus, and with US exceptionalism attracting ever more funds since the presidential election, it's no surprise that Chinese stocks have fallen back. Given the economy's importance, it's also not surprising that this has driven a broader correction, with FTSE's emerging markets index closing on Thursday 10% below its October peak, when the stimulus hype was greatest. That satisfies the most popular definition of a correction:  Still, this isn't good enough. Beijing knows this. Stimulus to bolster consumer demand is a matter of when rather than if. Anatole Kaletsky of Gavekal Research notes that recent official announcements referencing phrases like "more pro-active fiscal policy" and "moderately loose monetary policy" suggest an imminent pivot. That should boost both consumption and investment and could also compensate for a loss of exports in the event of a full-scale trade war with the US: On top of the newfound policy commitment to demand expansion, the economy will also benefit from structurally accelerating trade growth among emerging markets. And perhaps most importantly, China is achieving dominance in many of the fastest-growing global industries, including electric vehicles, solar, wind and nuclear energy, batteries, generic pharmaceuticals, and mass-market semiconductors — such dominance should be reinforced by the Trump administration's antagonism to several of these sectors.

Kaletsky points out that if this acceleration becomes apparent, Chinese stocks will look undervalued, and commodity prices will gain support. That helps to explain why investors in Chinese equities aren't fully abandoning their positions. Freya Beamish of TS Lombard points out that Beijing's knack for due process could be delaying the stimulus, as it prefers to bring all parties to the table before making a move: The worry is that the Chinese Community Party's idea of re-orienting towards domestic demand is simply to hand out vouchers for goods, the vast majority of which would simply be Chinese. But the rumour mill also includes more lasting elements such as child benefits expansion. At the same time, some greater efforts at domestically oriented investment seem likely to be part of the mix. While this won't help China — where overinvestment has been rife for the last two decades — it would help to soak up a little more of the excess savings domestically.

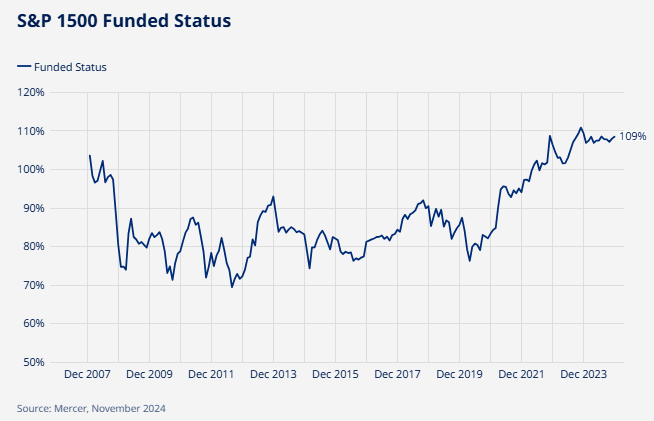

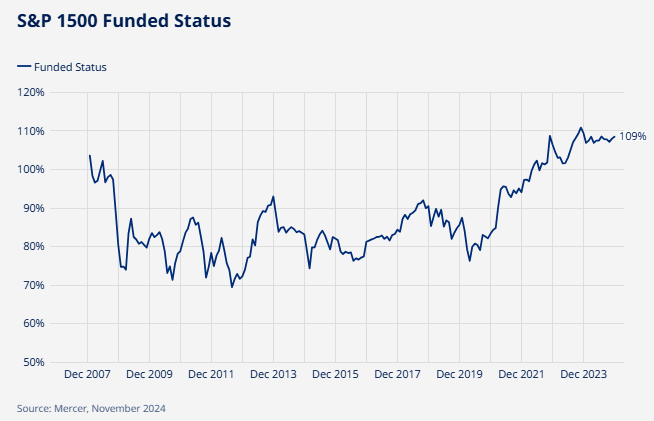

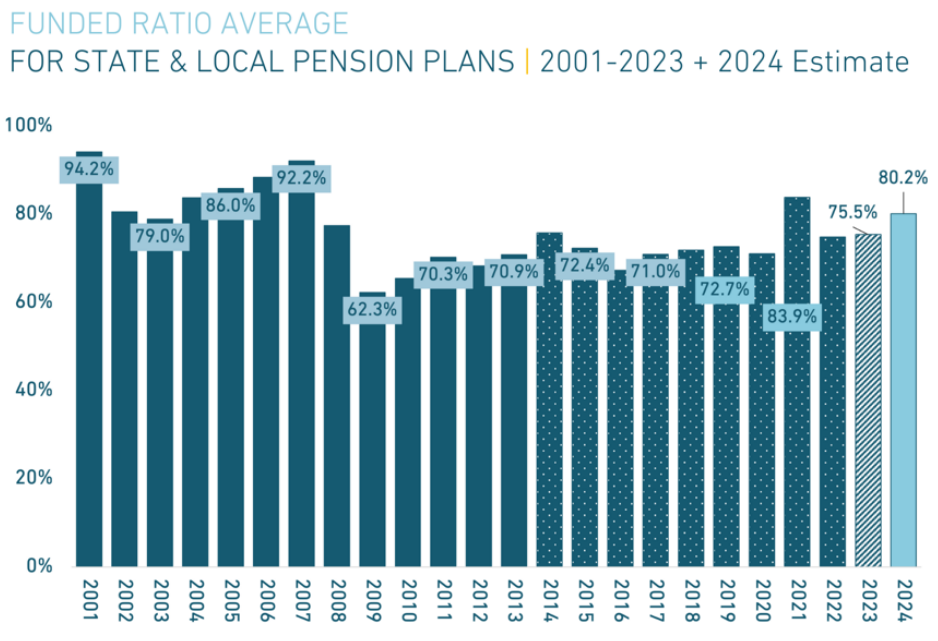

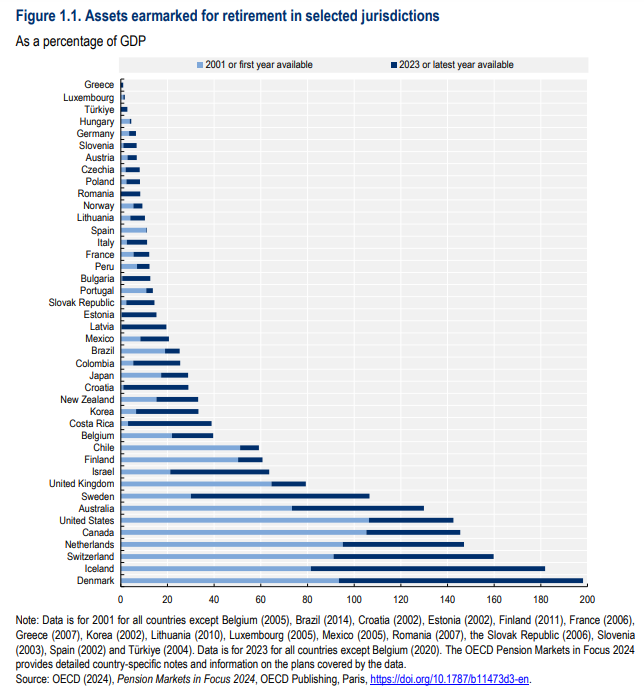

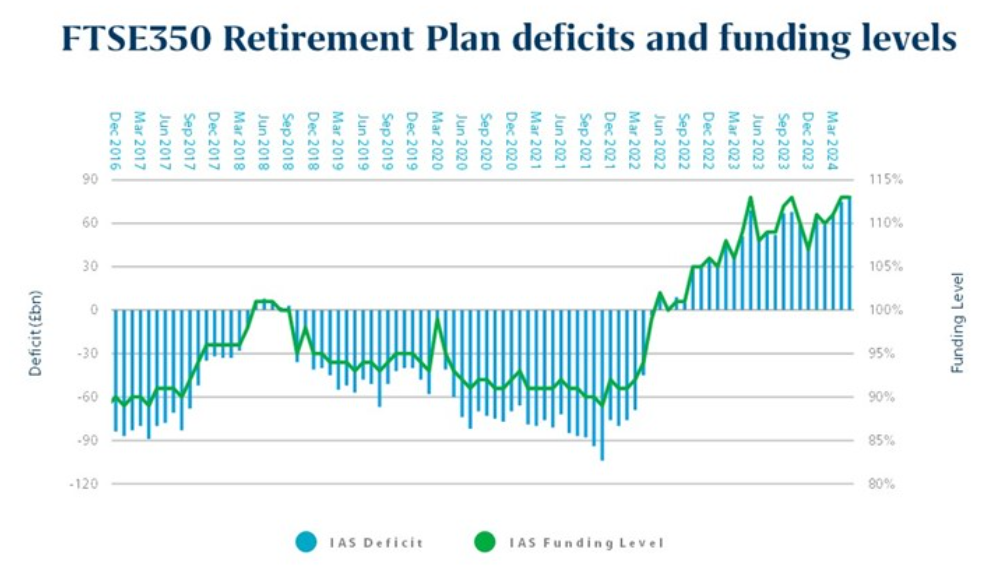

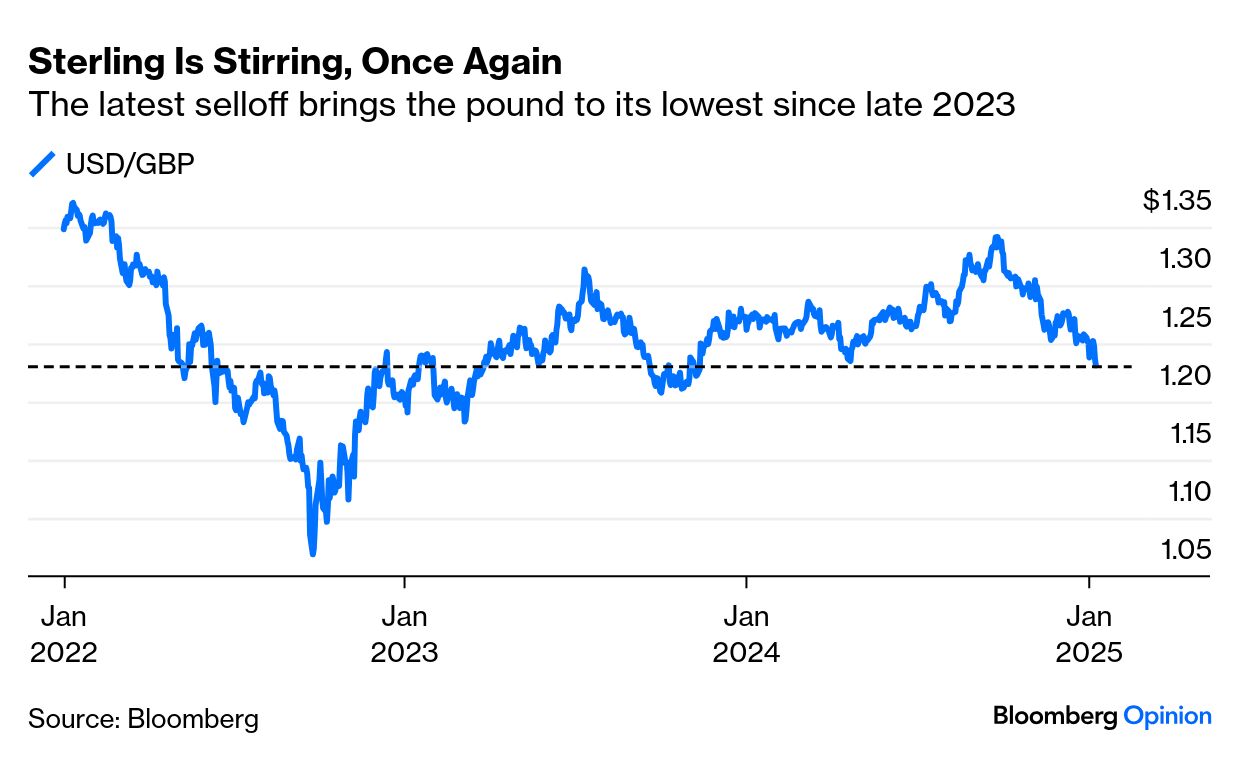

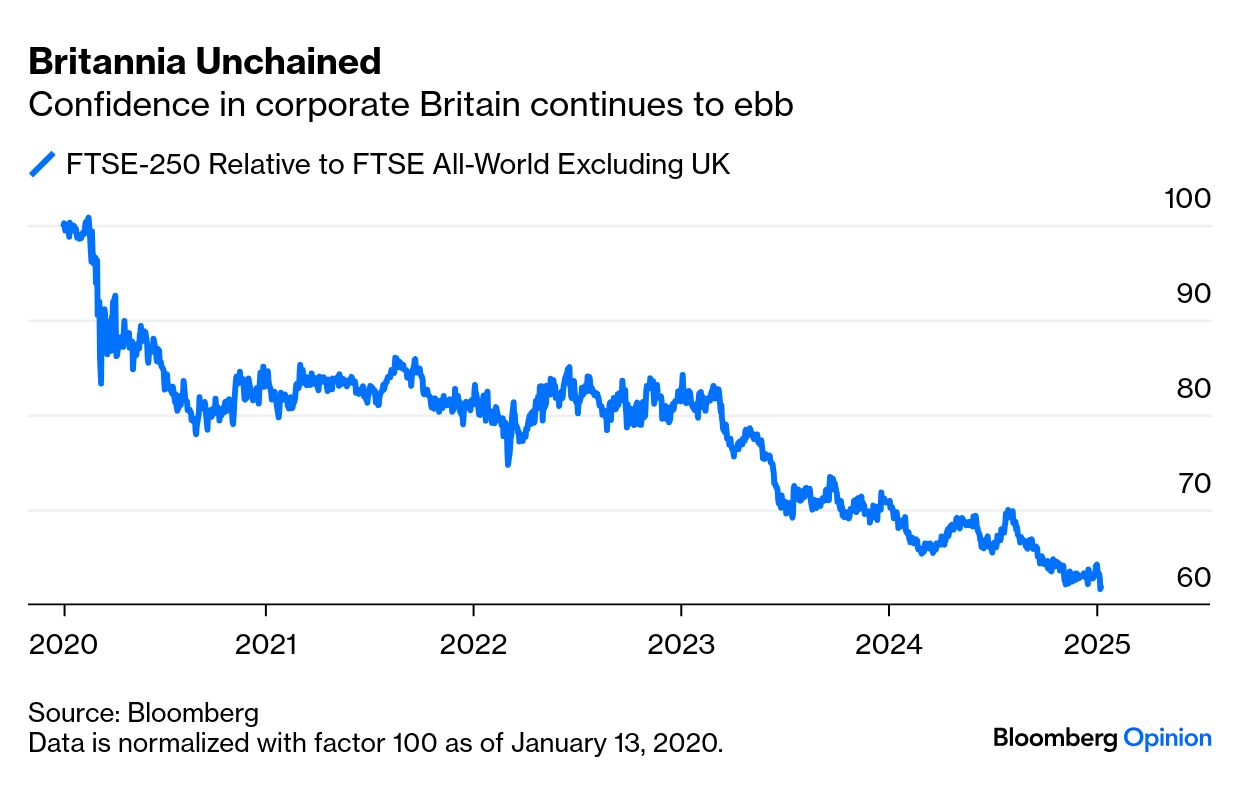

Ahead of China's Lunar New Year, the Year of the Wood Snake, which falls on Jan. 29, officials hope to invoke animal spirits. Snakes symbolize wisdom and agility in Chinese culture, while wood stands for growth, flexibility and tolerance. With Donald Trump taking office the week before, the wood snake couldn't have chosen a better time to make an appearance. —Richard Abbey Good News About Rising Bond Yields! | Higher bond yields have a silver lining, for anyone hoping to retire with a pension. Defined benefits pensions rely on buying a guaranteed income stream for retirees, using bonds. The cheaper bonds are, and the higher their yields, the easier for managers to fund their liabilities to pensioners. To make their lives easier, and ease the risk of a social crisis, the ideal combination is rising share prices and rising bond yields — which has been the story of the last two years. It's working. This is Mercer's measure of the pension deficit — assets as a percentage of the cost of liabilities — for funds operated by members of the S&P 1500:  Public sector pensions are in far worse shape than the corporate sector. But state and local pension plans are healthier for higher yields and higher equity returns, according to the most recent report by the Equable Institute. They are still collectively in deficit, as they have been every year this century, but the gap has narrowed. Assets cover slightly more than 80% of liabilities: Not all public pension plans are backed by assets. This means there is huge variance between countries in the amount of assets that they have built up as a proportion of gross domestic product. Denmark's pension assets are almost double GDP, according to the Organization for Economic Cooperation and Development. For others, they're minuscule. But pension assets have been increasing almost everywhere as governments try belatedly to deal with increasing longevity and the retirement of the postwar Baby Boom generation. Relieving the pressure on pensions makes life easier for governments: There's still reason to fear that the world's pension systems are on course to leave many elderly people without money that they had been promised. The negative effects of rising bond yields remain. But they do have some very positive consequences. Liz Truss, the former British prime minister, has sent her most recent successor, Sir Keir Starmer, a "cease and desist" letter telling him to stop defaming her by saying that she tanked the UK economy. It's a sad episode. Truss must take a big share of blame for the run on sterling and the bond market implosion that followed her budget in September 2022, and it's perfectly legitimate for political opponents to ram that home — but as Points of Return has laid out, there is plenty of blame to go around. The greatest problem was that pension funds, burdened by regulations requiring them to make sure they could fund their guarantees to pensioners, tried to juice their returns by taking extra risks. Regulators weren't on top of what they were doing. So it's encouraging that British companies' pension funds are in their best shape for a decade, as demonstrated here by Mercer: That's good, because other elements of the situation are increasingly reminiscent of the Truss episode. Sterling gave further ground to the dollar on Thursday, and is now at its lowest since late 2023. It's still a long way from replicating the disastrous fall under Truss: But UK stocks suggest that things are worse than in 2022. This is the performance of the mid-cap FTSE 250 — more exposed to the UK than the multinational-dominated FTSE 100 — compared to FTSE's index for the rest of the world. It's sunk to a new low, falling ever further since Truss left: The likelihood, judging from briefings to political journalists, is that Chancellor Rachel Reeves will judge that the rise in borrowing costs cannot be combated with extra taxes. If yields continue to rise, that will mean budget cuts. That's miserable for a party of the left, but it does avert another Truss event. As analysts at the Bank of New York pointed out: Markets have been caught off-guard by the move in UK rates where the new government has clearly ended the honeymoon phase for support and enters a place where growth, inflation and BOE policy are all issues against their own fiscal plans. The balancing point is when rate moves force financial stability actions from authorities.

Now that Truss has shown what happens to those who overstimulate, the chances are that Reeves will choose to under-stimulate. She also remains uncomfortably exposed to events elsewhere. If Friday's US unemployment data are strong, for example, that would propel Treasury yields higher, and put even more upward pressure on UK borrowing costs. As for Truss, she might heed the example of Jimmy Carter. Like hers, his tenure was shortened thanks to deep dissatisfaction with the economy. Rather than re-litigate the mistakes of her own brief time in power, she might heed how he was able to rebuild his reputation. I have received a lot more recommendations of seriously noisy music. You might want to try playing these loud: Self Esteem by Offspring, Couldn't Stand the Weather by Stevie Ray Vaughan, Waiting Room by Fugazi, Fuel My Fire or Firestarter by The Prodigy, the Dead Kennedys' Holiday in Cambodia, Spellbound by Siouxsie and the Banshees, Howl by Florence + the Machine, Scentless Apprentice by Nirvana, It's So Easy by Guns n' Roses, Love Spreads by the Stone Roses, Good Times, Bad Times by Led Zeppelin and Bring the Noise by Anthrax and Public Enemy. I've edited the submissions down a little, and accept that this could easily have been a list of the entire Led Zeppelin or Metallica discography. One last call for submissions. And have a great weekend everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

More From Bloomberg Opinion: - Paul J. Davies: Bankers Need the Right Trump Outcome to Justify Stock Optimism

- Mark Gongloff: California Fires Expose a $1 Trillion Hole in US Home Insurance

- Tyler Cowen: China's DeepSeek Shows Why Trump's Trade War Will Be Hard to Win

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment