| Not so long ago, cryptocurrency firms the world over had a common enemy: former US Securities and Exchange Commission Chair Gary Gensler, who had orchestrated a sweeping crackdown on the industry. In their scorn for him, crypto firms were united. Now Gensler is gone and Donald Trump — a memecoin-touting, DeFi-dabbling, born-again crypto advocate — is back in the White House. On Jan. 24, the president gave the industry largely what he promised on the campaign trail: an executive order to fast-track industry rules through a working group that will also examine the creation of a crypto stockpile. So why is everyone so angry? Top US digital-assets exchange Coinbase Global Inc. is beefing with controversial crypto mogul Justin Sun over the de-listing of a token tied to him. Bitcoiners are railing against the alleged political maneuvering of Ripple Labs Inc., which they accuse of lobbying to stop the US from establishing a Bitcoin strategic stockpile. The Ethereum Foundation has been mired in infighting over fears the blockchain it shares a name with is languishing. Coinbase, Sun and Ripple didn't immediately respond to questions from Bloomberg News. A spokesperson for the Ethereum Foundation declined to comment. Crypto outfits have spent years decrying what they call Gensler's "regulation-by-enforcement" method of overseeing the market; it's generally assumed that they'll cheer whatever the opposite of that is. But a who's who of crypto executives are jockeying for influence in a more accommodating Washington, and getting them all to agree on which policy areas to prioritize will be a major challenge, according to advocacy groups.

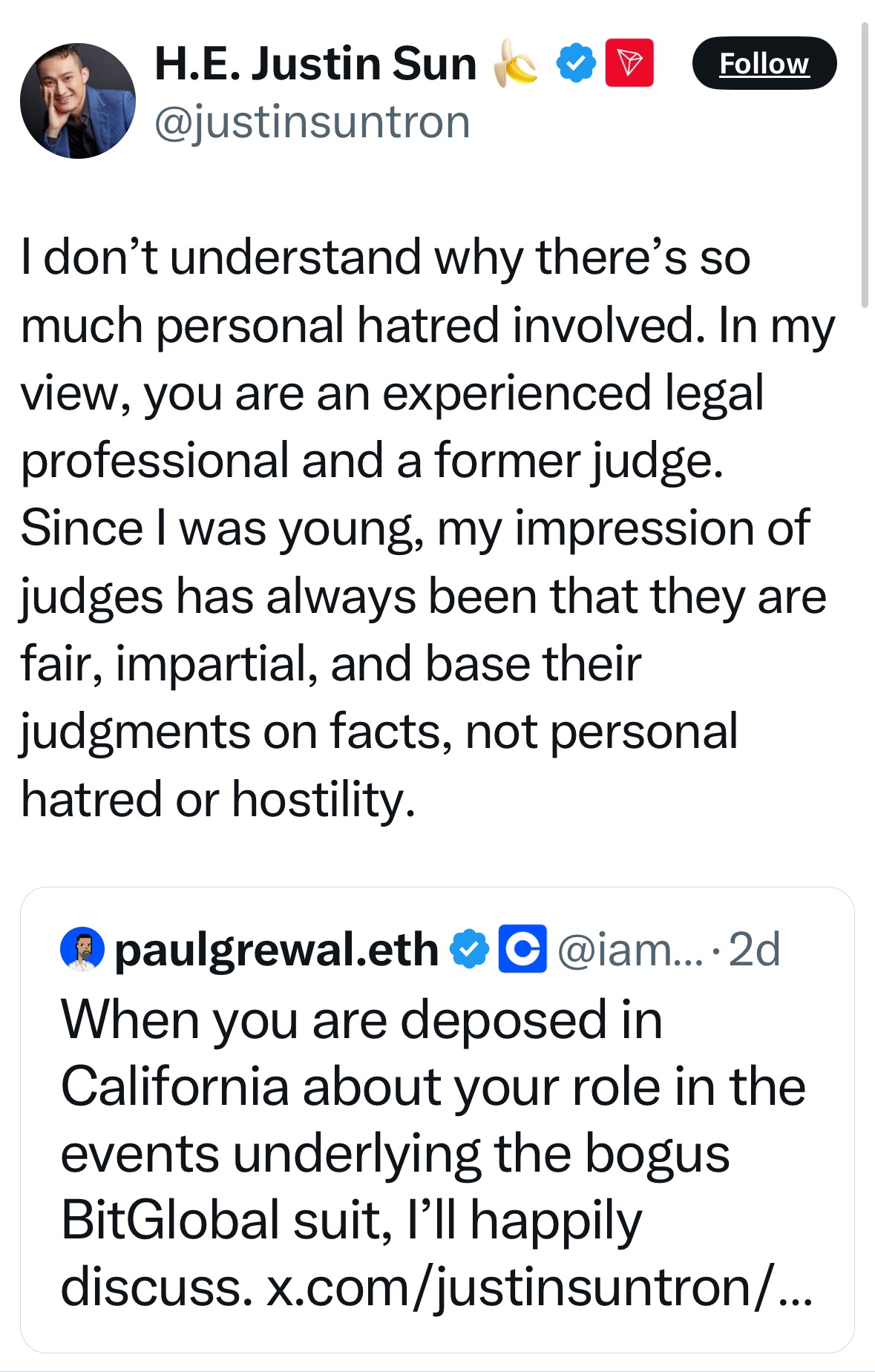

"We're at a critical moment of transition in crypto," Coinbase Chief Legal Officer Paul Grewal said in an interview. "It's quite natural and frankly unsurprising that you'd see some pretty intense views expressed and even some intense views that conflict with one another." What is more surprising is that tempers seem to be running even hotter than when the sector was on the back foot. There's a sense of urgency — anxiety even — about seizing the moment. "There's a mammoth opportunity so everybody's sparring for attention," said Raagulan Pathy, co-founder of stablecoin startup Kast. "Sometimes it's hard to decipher between people who are lobbying for the right reasons — for regulatory change or whatever — and people who just want to be in the news because it'll push their token." Indeed, that distinction could become more blurred in a nation whose commander-in-chief has launched a memecoin, profitable collections of nonfungible tokens and endorsed a decentralized finance project with its own token named World Liberty Financial. |

No comments:

Post a Comment