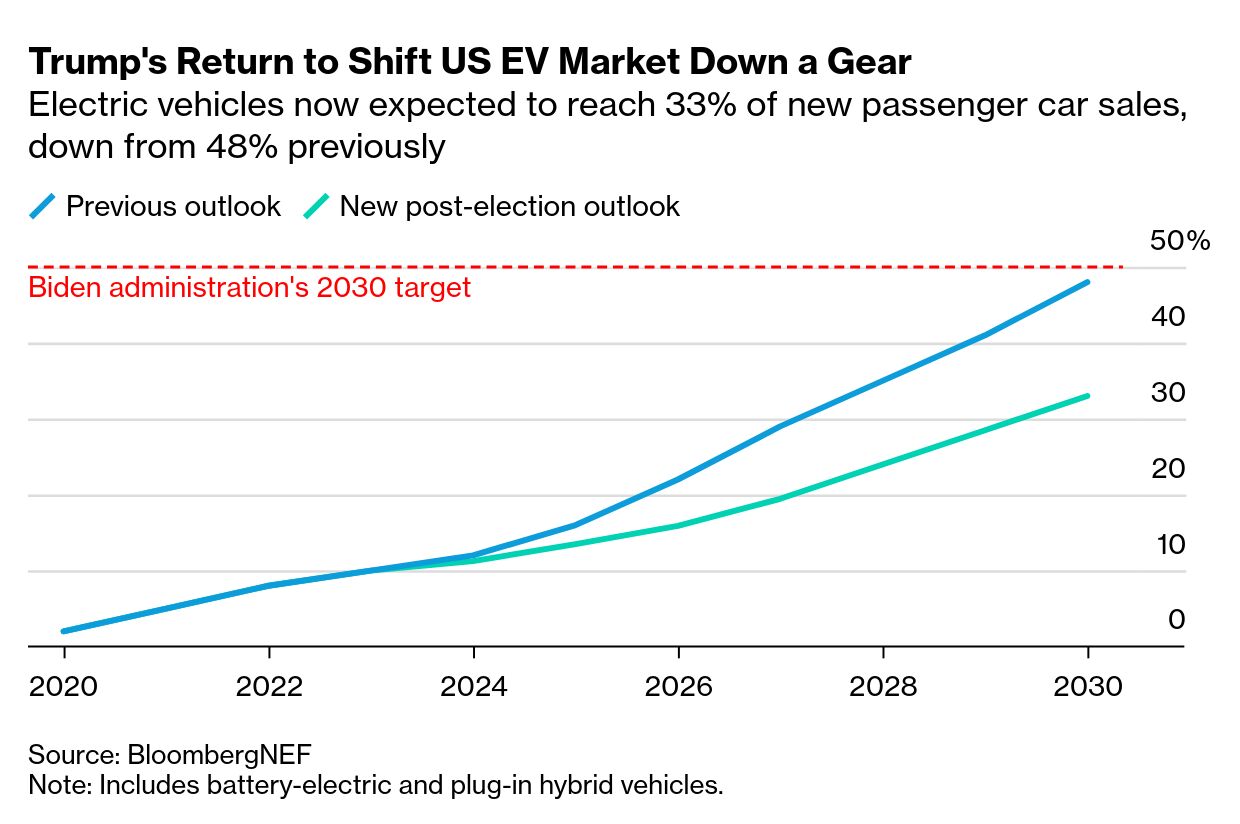

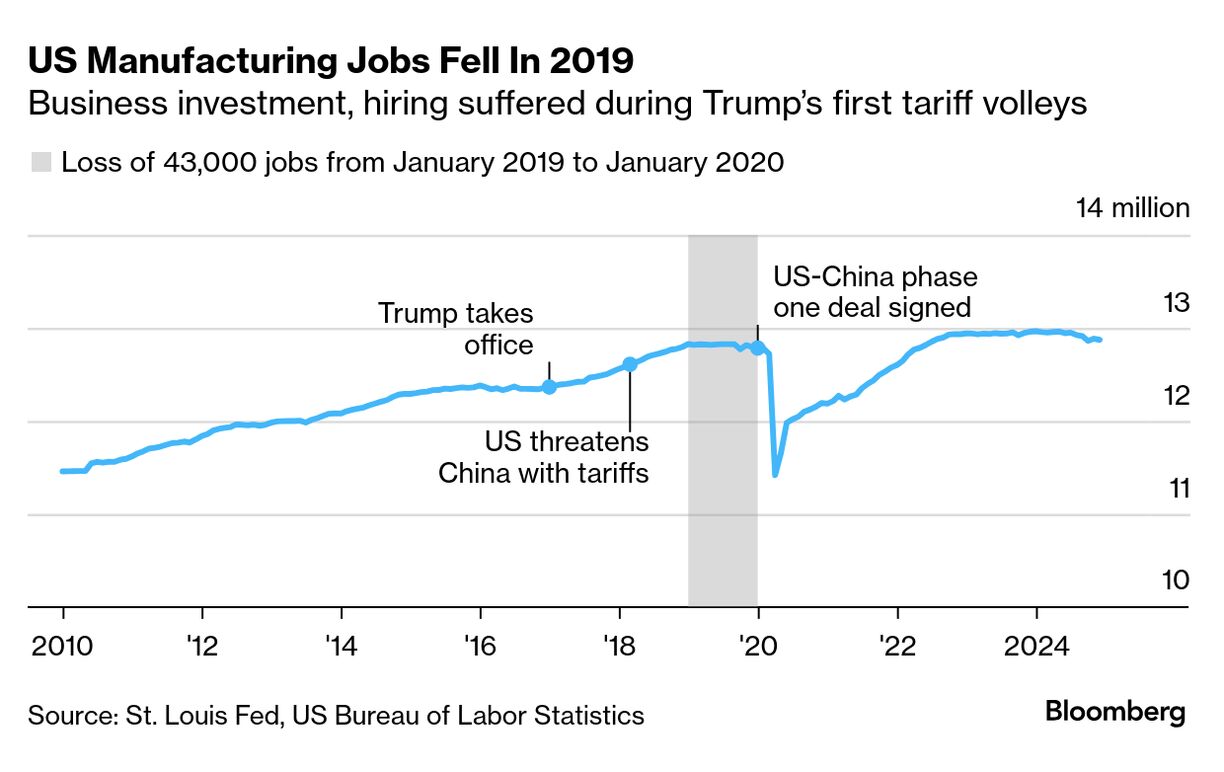

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Newly appointed Transportation Secretary Sean Duffy ordered a rewrite of more stringent US fuel-economy rules, following through on one of President Donald Trump's first directives after he retook the White House. The memorandum Duffy signed in the first act after his swearing in Tuesday directs the National Highway Traffic Safety Administration to immediately review and reconsider all existing fuel-economy standards for vehicles produced from the 2022 model year onward. He told NHTSA to propose rescinding or replacing the standards so that they're in line with the administration's fossil fuel-favoring energy policy.  US Transportation Secretary Sean Duffy during a Jan. 15 confirmation hearing. Photographer: Kent Nishimura/Bloomberg Duffy, a former US congressman and Fox News contributor, portrayed the action as removing government overreach by former President Joe Biden that had driven up the cost of new cars. The Biden administration's standards require automakers to reach an average of 50.4 miles per gallon across their new-car fleets by the 2031 model year. In addition to wanting to unwind Biden-era fuel economy rules, Trump has ordered his administration to consider eliminating subsidies and other policies aimed at boosting electric vehicles. Automakers plowed billions of dollars into manufacturing EVs and batteries in the US after Biden signed the Inflation Reduction Act into law in 2022. Those investments already were showing signs of strain due to tepid demand for plug-in models that are still more expensive than those powered by gasoline-burning engines. Since Trump's victory in the November election, automakers have made a series of moves reflecting expectations for less regulatory pressure to move away from gas-powered cars and trucks. Stellantis postponed its first all-electric Ram pickup, pulled back from plans to lay off workers at a Jeep sport utility vehicle plant in Ohio and recommitted to building a new midsize truck at a factory in Illinois. Volkswagen told Automotive News this week that it no longer plans to bring its ID.7 electric sedan to the US market. The publication also has reported that Stellantis paused work on an electric Chrysler crossover and abandoned plans for its Alfa Romeo brand to only sell EVs by 2027. Trump also is presumed to want the Environmental Protection Agency to review or rewrite limits on vehicle tailpipe pollution that compel carmakers to sell more electric models. Although the Biden administration eased near-term requirements after pushback from automakers, the EPA estimated early last year that manufacturers might seek to comply with the requirements by boosting battery-electric vehicles to more than half of total US sales by 2032. Following Trump's election win, analysts at BloombergNEF lowered their forecasts for sales of fully electric and plug-in hybrid vehicle sales through the rest of the decade. BNEF said it expected plug-in models to be one-third of total US sales by 2030, down from the 48% share expected previously. BNEF may cut forecasts further if Trump rescinds waivers granting California the permission to set its own more stringent auto-pollution limits. The EPA said in a motion to the US Supreme Court last week that it had decided to reassess a 2022 Biden administration decision to authorize the state's emissions limits. — By Keith Laing  Photo Illustration by 731. Photos: NASA (1). Getty Images (5) Listen and subscribe to Elon, Inc. on Apple, Spotify, iHeart and the Bloomberg Terminal ahead of Tesla's latest quarterly earnings, coming after the close of US trading. For the latest episode, host David Papadopoulos is joined by Businessweek's Max Chafkin, Musk reporter Dana Hull and editor Craig Trudell talk Tesla, while senior banking reporter Sridhar Natarajan discusses how Wall Street banks are shopping the debt tied Musk's buyout of Twitter.  Gerry McGovern, chief creative officer for Jaguar Land Rover, at Miami Art Week in December. Photographer: Jason Koerner/Getty Images Jaguar Land Rover reported a drop in quarterly profit as the maker of luxury sport utility vehicles braces for potential tariffs in the US, its largest market. The threat looms large over JLR, with the country accounting for almost a quarter of the £29 billion in revenue the company generated in its fiscal year that ended last March. Donald Trump's promise of a return of factory jobs — fueled by protective tariffs that spur investment — stands at the heart of his inaugural pledge of a new "golden age" for the US. "As tariffs on other countries go up, taxes on American workers and businesses will come down and massive numbers of jobs and factories will come home," Trump told Republican lawmakers in Miami on Monday. But the last time he deployed them, almost the exact opposite happened. Instead, the Federal Reserve confronted a slowing economy led by a manufacturing sector shedding rather than gaining jobs, data and new transcripts of policymakers' discussions at the height of Trump's first trade war show. Central bankers are likely contemplating the effects again in their meeting concluding Wednesday, especially with Trump threatening to start imposing tariffs as soon as Saturday. |

No comments:

Post a Comment