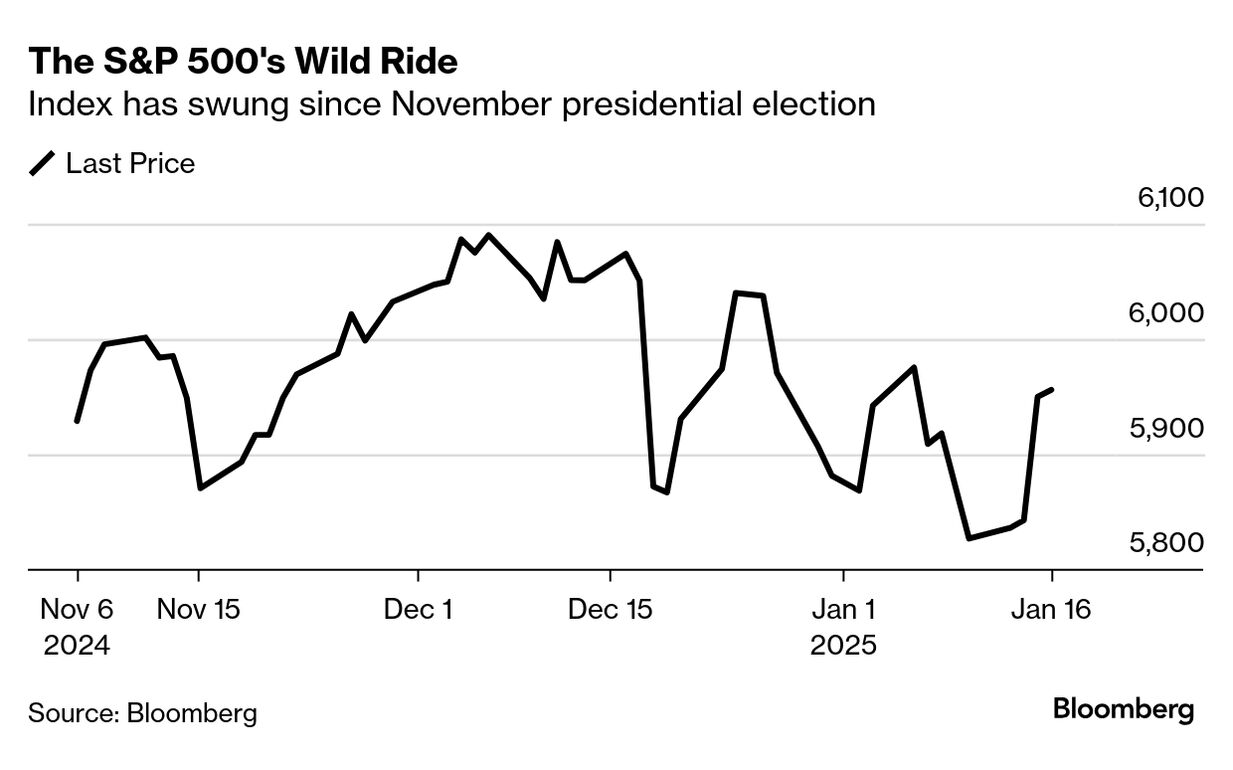

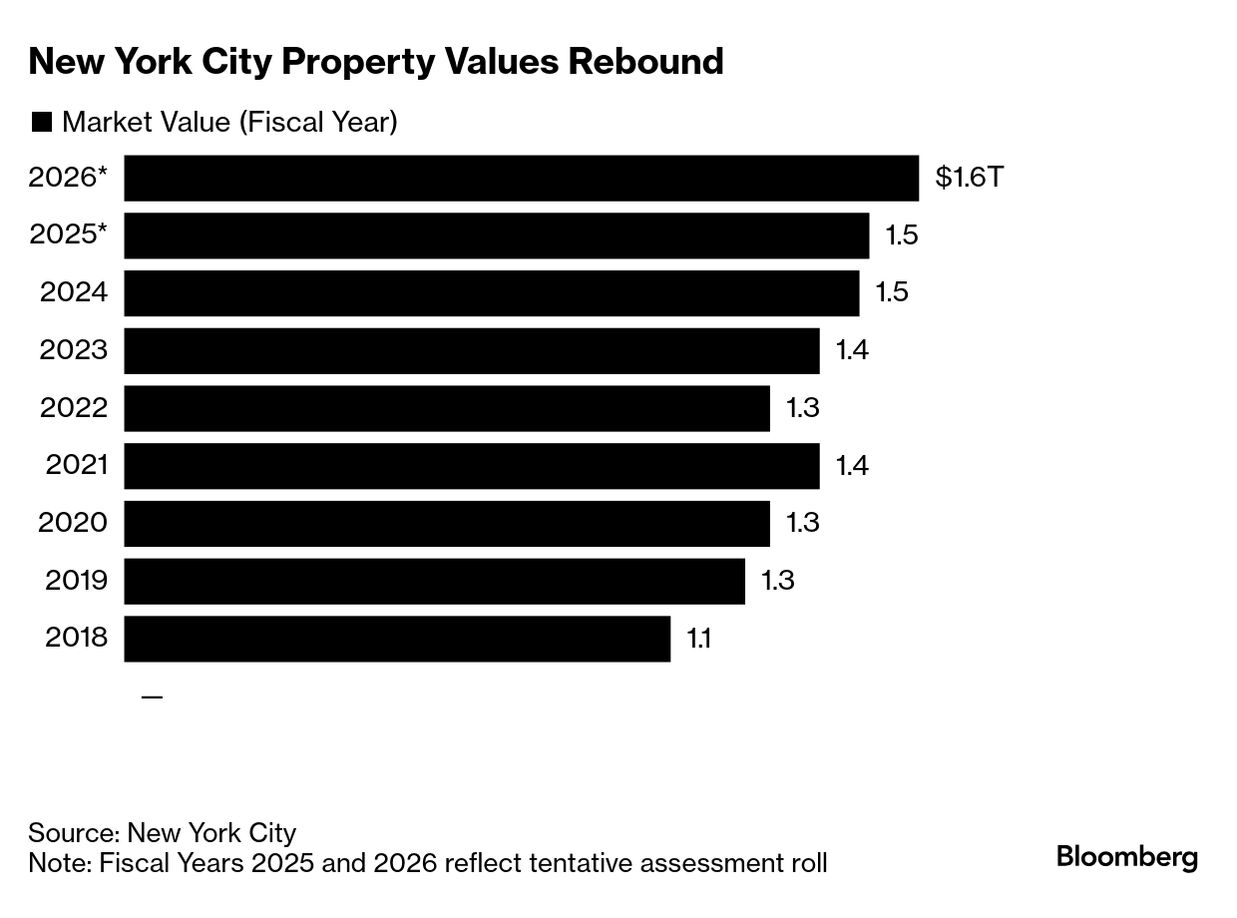

| Change is afoot. So go check your portfolio. That's the takeaway I got this week after calling up financial advisers and asking them two questions: "What's going on with the markets — and what does it mean for the everyday person?" Standard advice from planners is to set and forget your long-term investments. But there are moments when it makes sense to look at your allocations and make sure they haven't gone too far astray, or that you're not missing out on obvious opportunities. Now might be one of those moments: We're days away from the beginning of a new presidential administration promising new policies already reshaping markets. Stocks have been on a wild ride since November's election. The narrative has been one of a "Trump bump" fueled by euphoria over potential tax and regulatory cuts. While the S&P 500 climbed after the vote, it has since pared those gains and until Wednesday was down slightly year-to-date. Bonds have also surprised investors. Despite the Federal Reserve kicking off a rate-cutting cycle in September, yields have risen. The 10-year Treasury — a key indicator of economic health — hit 4.8% Tuesday, close to the 5% threshold that could more easily catch the eyes of investors. Yields have climbed higher in part on concerns that the new president's tariff and immigration policies will stoke inflation, keeping interest rates higher for longer. "Much of the real risk to inflation is still ahead," says Lauren Goodwin, chief market strategist at New York Life Investments. "Both the White House and Congress turn over on Monday, and several key policy areas — tax, spending, trade, and immigration — could have yet-unknown, but meaningful impacts to the labor market, inflation, and therefore Fed policy." I asked advisers for suggestions on what people at various life stages should do as they reevaluate their investments now. They offered considerations for people who have largely checked off the basics and have some room to maneuver. I'll start with retirees, because they theoretically have the most at stake, follow with mid-career professionals, and end with young investors. Retirees: Now is a good time to consider bonds Chris Stevenson, founder of Forrest Financial Partners in New York, worries about retirees who are camped out in the equity market. Many have grown accustomed to doing so because for years it was one of the only places to earn solid returns. But the changing bond market means that is no longer the case. "For anyone in retirement, I think there's a great opportunity to lock in higher yields and higher interest rates to provide sustainable income for the long term," says Stevenson. Allocating to more conservative bonds could also cut down on the dreaded "sequence risk" retirees face if they have to withdraw from their stock accounts in a bear market. Mid-career professionals: A time to diversify Robert Stromberg is pretty bullish on the outlook for those in the midst of their careers. The founder of Mountain River Financial in Abington, Pennsylvania, doesn't want investors twisting and turning with each headline and advises against timing the market. But he does think this age bracket needs to remember to stay diversified, particularly at a moment when US equity indexes have become concentrated in a few large-cap, tech-heavy names. Many analysts fear that such stocks may be out of room to run. What's more, small-cap and international names are comparatively cheap — and may have more upside. Stromberg says now could be a "tremendous" time for investors who have become too US-focused to diversify. "In effect, you're selling high and buying low," he says. "Which we all know is kind of the core recipe to successful investing." Young investors: Use the right account Those fortunate enough to have long time horizons can absorb many of the ups and downs of the stock market, reminds Alvin Carlos, financial planner and managing partner of District Capital Management in Washington, DC. They should just be sure they are putting their money in the right accounts. "Some people when they think about investing think, 'Oh I'm going to open a brokerage account,'" without considering tax-advantaged accounts such as Roth IRAs or 401(k)s. Failing to do so can add tax obligations to an investor's portfolio that diminish returns. We're entering a new era in politics and in markets. No matter your age, you're going to want to pay attention. — Charlie Wells Oil retreated from a five-month high. It came as the market adjusts to new sanctions on Russian crude and on the prospect that President-elect Donald Trump will weaken the measures. West Texas Intermediate slid about 1.5% to below $79 a barrel after hitting the highest since July on Wednesday. Richemont sales unexpectedly jumped. The lift came during the holiday shopping season as consumers splurged on Cartier jewelry, lifting shares across the luxury-goods sector Thursday on hopes of a rebound. Sales soared 10% during the three months through December at constant exchange rates, Richemont said. Analysts had expected an increase of less than 1%. The Americas and Europe drove the performance, with purchases of expensive jewelry outweighing weak watch sales. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Tom Morris was the biggest gainer in percentage terms, clocking a 30% gain that brought his net worth to $9.1 billion. Morris is founder and largest shareholder of TJ Morris, the Liverpool, England-based company behind discount retail chain Home Bargains. His wealth surged after the low-cost retailer posted record revenue and earnings. Mangal Prabhat Lodha was the biggest loser in percentage terms, seeing a 16% loss that took his worth to $11.9 billion. Lodha is the founder of Macrotech Developers, a residential real estate company in India. The majority of his fortune is derived from his stake in Macrotech Developers, which has plunged since the beginning of 2025. NYC Apartment Values Are Expected to Jump  Photographer: Yuki Iwamura/Bloomberg Residential real estate is poised to lead a comeback in New York City property values amid a housing shortage and still high interest rates capping sales. The market value of the city's more than 1 million properties is projected to rise 5.7% to $1.6 trillion in the upcoming fiscal year that begins on July 1, according to a tentative assessment roll released by the Department of Finance on Wednesday. Last year, values rose just 0.7%, reflecting the Federal Reserve's aggressive rate hikes. Mortgage Rates in US Climb to 7.04%, Highest in Eight Months Freddie Mac's measure of mortgage rates in the US crossed 7% for the first time since May. The average for 30-year loans rose to 7.04%, up from 6.93% last week, according to a statement Thursday. Borrowing costs have climbed steadily in recent weeks, adding to the affordability crunch for homebuyers. Cold weather in parts of the US and wildfires in California are pressuring demand even further. In the four weeks ended Jan. 12, contracts to buy previously owned homes fell 8.4%, the biggest year-over-year decrease since October 2023, according to Redfin Corp. This week, we're looking for recent MBA graduates who are struggling to find jobs. If this is you — or someone you know — drop us a line. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. Against the backdrop of the World Economic Forum on Jan. 20-23, Bloomberg House will be an unparalleled hub where global leaders converge to chart a path forward. Join us for breakfast, afternoon tea or a cocktail. Meet thought leaders, listen to newsmakers, sit in on a podcast taping, have a candid conversation with our journalists and help us identify the trends that will impact the year ahead. Request an invite here. Like Bloomberg Wealth? Here are a few other newsletters we think you might enjoy: - Pursuits for a guide to the best in travel, eating, drinking, fashion, driving, and living well

- Work Shift for exclusive insight and data on the future of work

- Money Distilled for John Stepek's daily newsletter on what market moves mean for your money

- Economics Daily for what the changing landscape means for policymakers, investors and you

- CFO Briefing for what finance leaders need to know

|

No comments:

Post a Comment