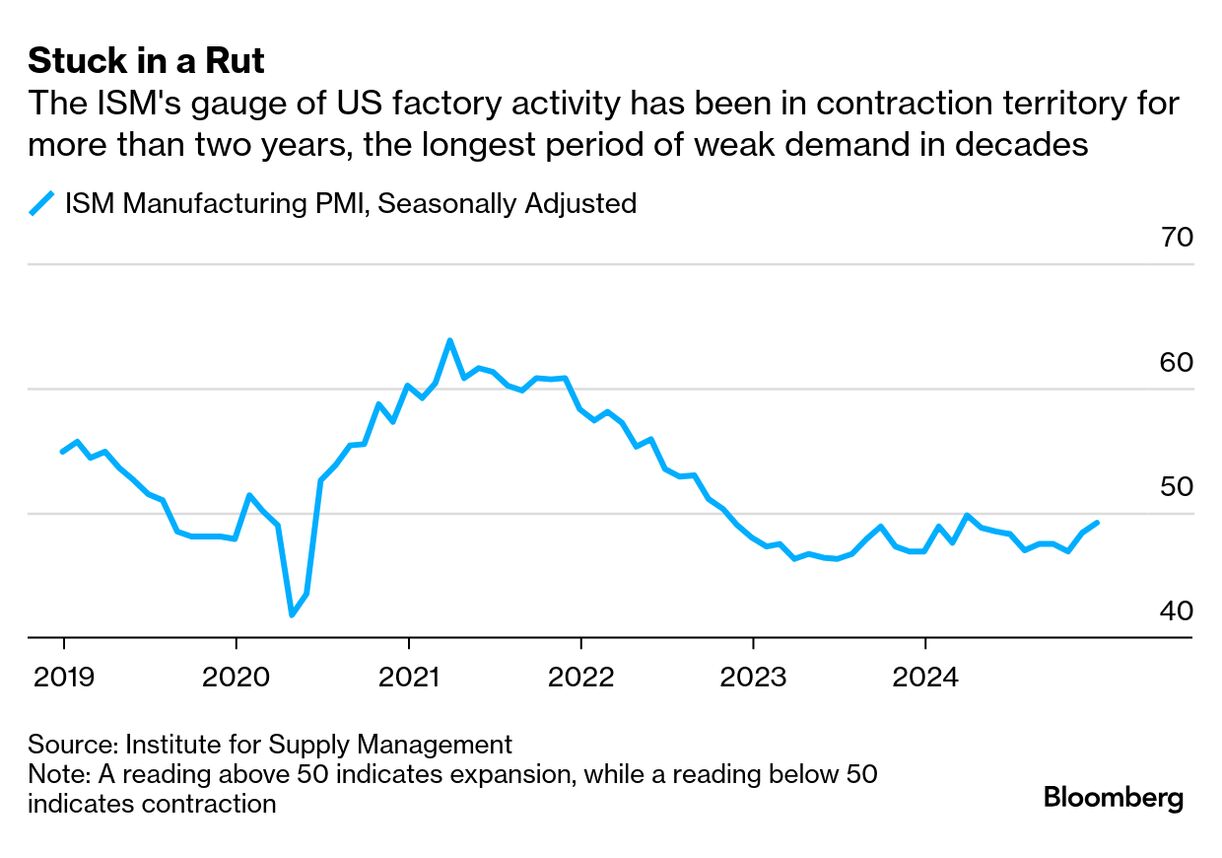

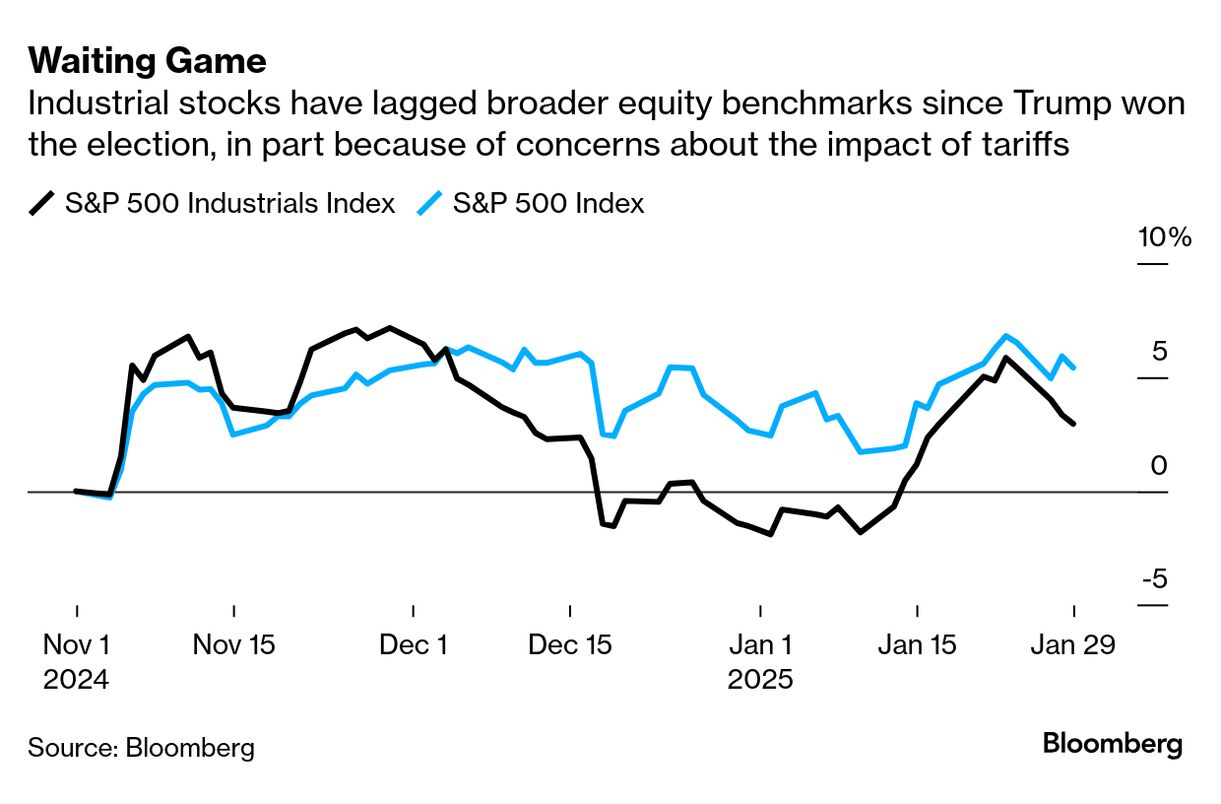

| Apologies for the unexpected lack of a newsletter last week. I got hit hard by the flu; it's rough out there this winter — make sure to wash your hands! Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. There has been plenty of talk about tariffs but no one — including perhaps the Trump administration itself — seems to have clarity on what actions, if any, the US will actually take and what the timeline would be. The only thing manufacturers seem sure of is that if tariffs do come, their first response will be price increases. For those just catching up, President Donald Trump held off on announcing specific tariffs on Chinese imports on his first day in office as initially pledged and instead ordered a review of unfair trade practices and an investigation into Beijing's compliance with the trade deal signed during his first term. Trump then said he was thinking about putting 25% tariffs on goods from Mexico and Canada by Feb. 1. Just one day later, he said that he may put a 10% tariff on Chinese imports on Feb. 1 too, and also criticized the US trade deficit with the European Union. Trump then told Fox News he would "rather not" put more tariffs on China goods. Trump slapped tariffs on all Colombian imports after the country refused to accept two military jets carrying migrants but walked those levies back after the South American country struck a deal. He said the US would put tariffs on strategic imports such as semiconductors, pharmaceuticals and certain metals. But Trump also said he wants to impose tariffs across the board on all foreign goods, with any levy being "much bigger" than 2.5%. Mexico's President Claudia Sheinbaum said she doesn't expect Trump to follow through on his proposed Feb. 1 timeline for tariffs, but Trump on Thursday reiterated the pledge. US manufacturing CEOs, like the rest of us, are just trying to keep up. "The tariff is very much a wildcard. I mean, we don't know. We don't know the specifics," Scott Donnelly, chief executive officer of private jet and helicopter manufacturer Textron Inc., said on the company's fourth quarter earnings call this month. The Providence, Rhode Island-based company has significant operations in both Mexico and Canada. "We're going to steer clear of trying to forecast where this is all headed," added Michael Speetzen, CEO of snowmobile manufacturer Polaris Inc. "It changes by the hour." Read more: Factory Recovery Looms and So Do Tariffs Most industrial companies have spent the better part of the past five years rewiring their supply chains to reduce their reliance on China and ring-fence their local operations, so they're generally not overly fussed about the prospect of more tariffs on imports from that country. Unfortunately for many of those manufacturers, this reboot has tended to involve substantial investments in Mexico. The country's geographic proximity to the US, its long-standing and closely knit trade relationship with America and relatively low labor costs put it at the least risky intersection of economic and political realities — up until recently, that is. Lennox International Inc. is the perfect example of this. The company has curbed its use of Chinese imports, in part by striking a joint venture with Samsung Electronics Co. that shifted some of its mini-split sourcing to South Korea. It also recently opened a new $150 million factory in Saltillo, Mexico, to build commercial air conditioners after its plant in Stuttgart, Arkansas, struggled to find workers. That added to an existing Mexico campus for its residential business and put the company more in-line with peers, including Carrier Global Corp., who have leaned more on Mexico factories. (Carrier was infamously targeted by Trump in his first election campaign over its decision to shutter an Indiana factory and move the work to Mexico; Trump claimed to have saved the plant, but the reality is more complicated.) About 40% of the production capacity for the US heating, ventilation and air conditioner industry is now in Mexico, Lennox CEO Alok Maskara said on the company's fourth-quarter earnings call this week. The primary way in which Lennox and other manufacturers will respond to tariffs on Mexican goods is through price increases, he said. In layman's terms, that means the cost of a new air conditioner or heating unit is going to go up, whether you buy a Lennox model or not. "It impacts the whole industry, and pricing would be the first lever we would all default to, right?," Maskara said in December at a Goldman Sachs Group Inc. conference. Lennox still makes premium high-efficiency rooftop systems out of the Arkansas plant and operates three other factories in the US. If tariffs become a more permanent reality, the company could shift more work to those American plants but that would take years, Maskara said. Gates Industrial Corp., which makes power transmission components and automotive belts, has been even more blunt about price increases. The company imports about $25 million worth of products from China. If Trump adds to the existing levies on Chinese imports, "we will price for that," CEO Ivo Jurek said in December. "If there was a tariff on Mexico produced goods, we would price for it."

Graco Inc. didn't factor tariffs into its usual annual price increase in January, in part because the related discussions with its customers started to happen last fall. But "if we need to, we could always make a decision to do some other pricing actions" should the tariff impact become significant for the company, CEO Mark Sheahan said on the company's earnings call this week. Graco, which makes paint sprayers and truck lubrication systems, primarily manufactures its products in the US, so it would be a beneficiary of any tax changes that favor American producers, Sheahan said. Read more: Tariff Bluster and Reality Jolt Factories Some companies are still holding out hope that Trump is merely using the threat of tariffs on Mexican imports as a negotiating tactic. US consumers are not going to "love to have an increase in prices because of a dispute — unless there's some strategic reason that the president needs to do that for security of the country," Union Pacific Corp. CEO Jim Vena said on the railroad's earnings call this month. To give a sense of the scale of disruption that tariffs on Mexico would cause relative to levies on China, Polaris now procures about $500 million worth of components from the latter country, with only about half of that headed to the US and therefore subject to existing tariffs. The other half goes to its factories in Mexico, which collectively account for a couple billion dollars of revenue and a third of the production responsible for its US sales, Speetzen, the CEO said. Should Trump move ahead with the tariffs he's proposed on Mexican imports, "we as American citizens would have bigger issues in front of us, because I think there would be a larger economic implication," Speetzen said. Polaris does have some US manufacturing operations and over time, it could lean more heavily on those facilities. But "I'm not suggesting that we could flip a switch and move everything today," he said.  | | | "I don't think of it as a bubble at all." — GE Vernova Inc. CEO Scott Strazik

Strazik made the comments in an interview last week after the company reported fourth-quarter results and highlighted growing demand for gas turbines to help support explosive data center growth. In just one month late last year, GE Vernova signed 9 gigawatts of reservation agreements for gas turbine production for US customers, driven by artificial intelligence-related data center demand. "When I look at our interactions right now with the hyper-scalers, the intensity, the conversations are only accelerating," Strazik said. Infrastructure and supply constraints are also stretching out the timeline for data center development — meaning the hype might be at a peak but the actual spending hasn't followed the patterns of other boom-bust type cycles, he said. Read more: AI Data Center Spending Boom Isn't Over Yet

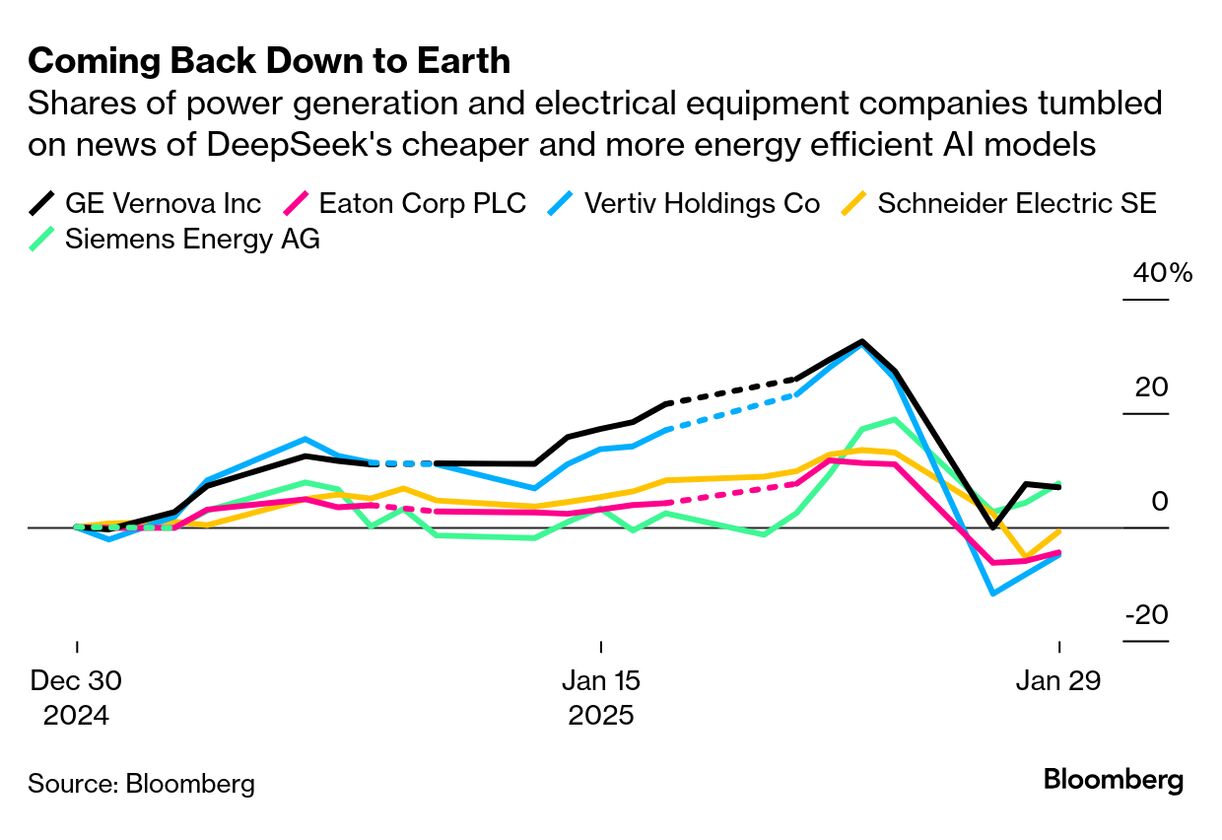

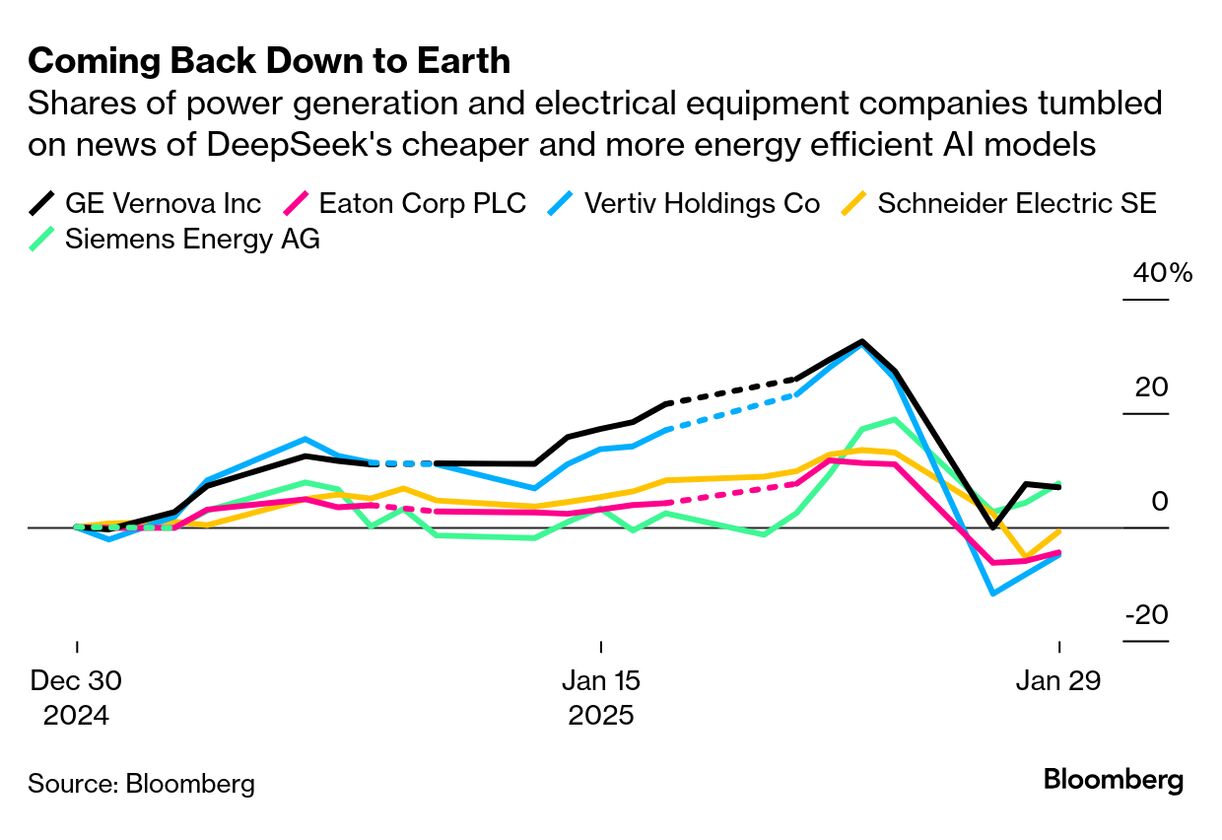

GE Vernova booked about 20 gigawatts of global gas turbine orders in 2024 — essentially double the 11 gigawatts it recorded in 2023 — and it expects that pace to continue for at least the next few years. That seemed like a reasonable, or even conservative, expectation when SoftBank Group Corp., OpenAI and Oracle Corp. separately announced last week that they're forming a $100 billion joint venture to fund artificial intelligence infrastructure. But by Monday all anyone could talk about was DeepSeek, which recently released a new, open-source AI model that can mimic the way humans reason — and, according to the Chinese company, was developed at a fraction of the cost of rival US platforms and with significantly lower power needs. GE Vernova shares fell more than 20% in just one day, wiping out about $25 billion in market value before partially rebounding later in the week. Shares of electrical equipment manufacturers including Eaton Corp. and Vertiv Holdings Co. also tumbled sharply.  David Sacks, President Donald Trump's artificial intelligence czar, has said there's "substantial evidence" DeepSeek used the output of OpenAI's models to develop its own, suggesting that the true cost of building the technology was higher. Better, more efficient AI models may increase the adoption and use cases, ultimately translating into more demand for data center infrastructure such as electrical equipment and power generation, Bank of America Corp. analyst Andrew Obin wrote in a note. On the other hand, mobile data usage has soared since the early 2000s, but the companies who built out the initial telecom networks — including Nortel and Motorola — have largely been relegated to the sidelines, writes Barclays Plc analyst Julian Mitchell. Governments, technology companies and consumers, meanwhile, are all motivated to decrease the strain on power grids from data centers, he said. But GE Vernova has a backlog of gas-related orders worth more than $73 billion, much of which has nothing to do with artificial intelligence. The company also has a large service operation, meaning it should benefit from a push by data center developers to squeeze out more power from existing equipment. Even if cheaper AI allows for more competition among cloud service providers and chipmakers, presumably power will still be needed regardless of who operates the data center, putting the company in a better position than electrical equipment manufacturers who are aligned with a specific architecture or chip, Mitchell wrote. GE Vernova separately this week announced a deal to provide gas turbines for a new venture by Chevron Corp. and investor Engine No. 1 to build power plants next to data centers, with the goal of providing up to four gigawatts of power, enough for as many as 3.5 million US homes, by the end of 2027. The company also announced that it plans to invest $600 million in its US factories and facilities over the next two years to satisfy surging electricity demand, with about half of that earmarked for expanding its production of gas turbines. The question is what that all means for a stock price that has taken off like a rocket since GE Vernova's spinoff from the General Electric Co. aerospace business last April. "GE Vernova looks like it will have a great next 3-4 years, but we don't know how to extrapolate after, and don't know how investors will think about multiples as the AI productivity/efficiency curve plays out," Melius Research analyst Rob Wertheimer wrote in a note. Deals, Activists and Corporate Governance | Frontier Group Holdings Inc. is giving a takeover of Spirit Airlines Inc. another shot. The company had originally agreed to acquire Spirit in early 2022 before JetBlue Airways Corp. wrested the deal away with a series of increasingly expensive and aggressive offers. JetBlue's takeover was ultimately blocked on antitrust grounds, forcing Spirit to grapple with its mounting losses on its own and to eventually file for bankruptcy. Frontier is now reentering the fray with a takeover proposal that it values at about $2.2 billion. Spirit has said it will emerge from the Chapter 11 process as early as the first quarter but Frontier says the resulting airline will be crippled by its continued unprofitability and high debt load and should instead consider a merger. Frontier and Spirit's bare-bones business models have been squeezed by greater competition from larger airlines offering basic economy seats, forcing the carriers to cut routes, defer planes and launch premium offerings. The idea would be that they're better off fighting that battle together than apart.

Read more: Everyone Wants to Be a Premium Airline Now

Spirit rebuffed Frontier's offer, calling the terms "inadequate and unactionable." Should the companies finally find their way toward a deal, a combination likely won't draw the same kind of antitrust scrutiny as the JetBlue tie-up did, particularly under a Trump administration that's expected to take a light touch to regulatory enforcement. The more interesting question is whether that anything-goes attitude could induce other airlines to revisit tie-ups. JetBlue is having conversations with a number of carriers about potential partnerships, CEO Joanna Geraghty said on the company's earnings call this week. Recall that JetBlue's commercial agreement with American Airlines Group Inc. was actually blessed by the first Trump administration on its way out the door before President Joe Biden's Justice Department successfully sued to unravel the collaboration.

Emerson Electric Co. increased its bid to buy out the shares in industrial software maker Aspen Technology Inc. that it doesn't already own. Emerson is now offering $265 a share, implying a total value for Aspen Technology of $16.8 billion including net cash. It had previously proposed to buy out the remaining minority stake in Aspen Technology for $240 a share. The partial ownership structure was modeled after a similar acquisition by Schneider Electric SE of a majority position in industrial software maker Aveva Group PLC. The creative setup was meant to give the software arm more operational independence and its own stock currency with which to more aggressively chase technology deals. Instead, it just ended up confusing things. Schneider ended up buying out the rest of Aveva in 2023. "The accounting complexities with the two publicly traded company structure has been one of the bigger pushbacks we have heard, so alleviating that pain-point is a welcomed step to simplifying the Emerson story," RBC analyst Deane Dray wrote in a note.

Middleby Corp., the $9 billion cooking equipment manufacturer, is exploring a potential breakup that would separate out its food processing unit or residential division. The food processing business makes industrial-grade baking equipment, meat grinders and tools used to produce sausages, while the residential unit sells Masterbuilt grills and Viking oven ranges. Middleby's largest division, the commercial service business, sells cooking equipment and ice cream machines to restaurant chains including McDonald's Corp. Garden Investments, a new firm started by Trian Fund Management co-founder Ed Garden, has built up a position in Middleby and is seeking to refocus the company on its core commercial food service business, the Wall Street Journal separately reported last week, citing people familiar with the matter. A breakup, should one play out, again begs the question of just how focused manufacturing companies need to be. Fancy residential ovens have different customers and growth forecasts than McDonald's ice cream machines, but it's not that crazy to think one company might sell both. The obvious breakups of companies that sold things as different as jet engines and MRI machines have largely already happened; anything from here is bound to be a lot more nuanced. United States Steel Corp. should abandon efforts to salvage its sale to Nippon Steel Corp., overhaul its board and replace its CEO, according to activist investor Ancora Holdings Group. Biden blocked Nippon's takeover of US Steel on national security grounds in his final weeks in office, leading the two companies to file lawsuits seeking to overturn a decision that they say was actually motivated by politics. Ancora wants steel industry veteran Alan Kestenbaum to lead US Steel, replacing current CEO David Burritt. Kestenbaum purchased US Steel's Canadian assets out of bankruptcy and helped steer a multi-year turnaround that resulted in the sale of the Stelco Holdings Inc. business to Cleveland-Cliffs Inc. in November for more than $2.5 billion. It's not clear how effective Ancora ultimately will be in its proxy fight. According to US Steel, the investor has just a 0.18% stake in the company currently. Pentwater Capital Management LP, US Steel's third largest investor, told Bloomberg News it supports the company's current board and management. |

No comments:

Post a Comment