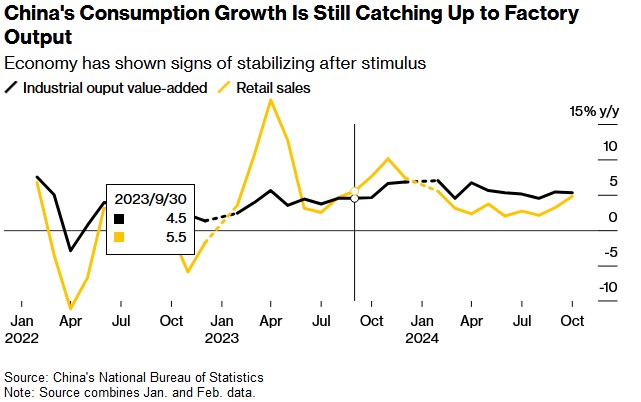

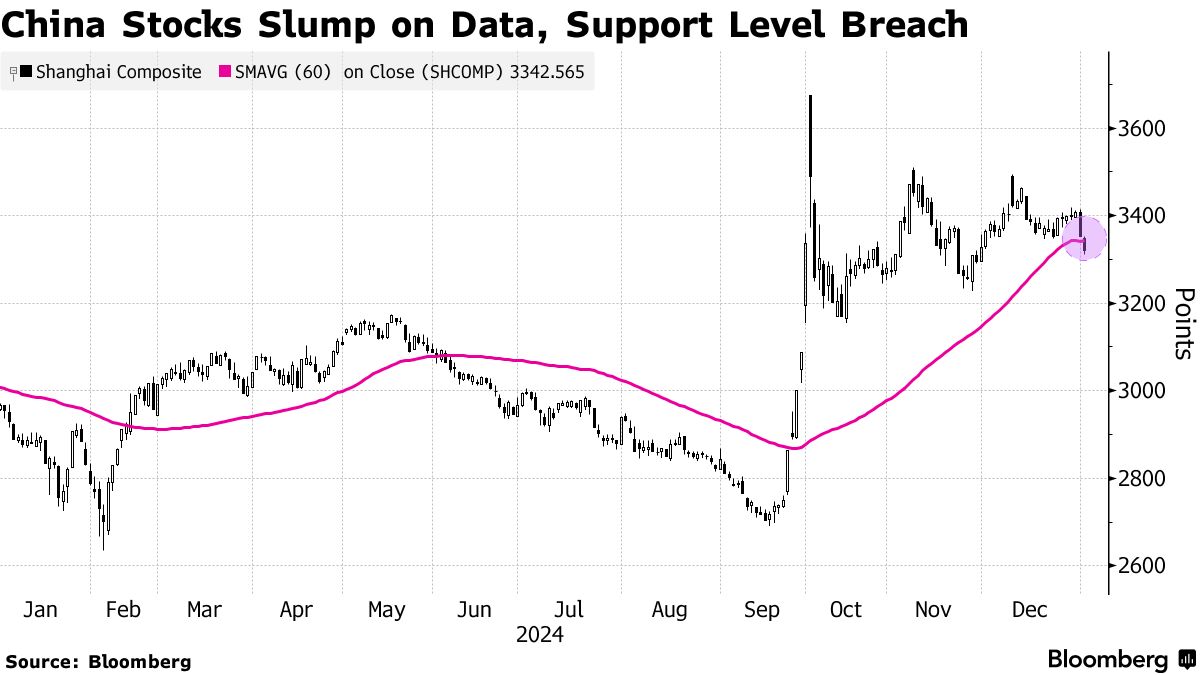

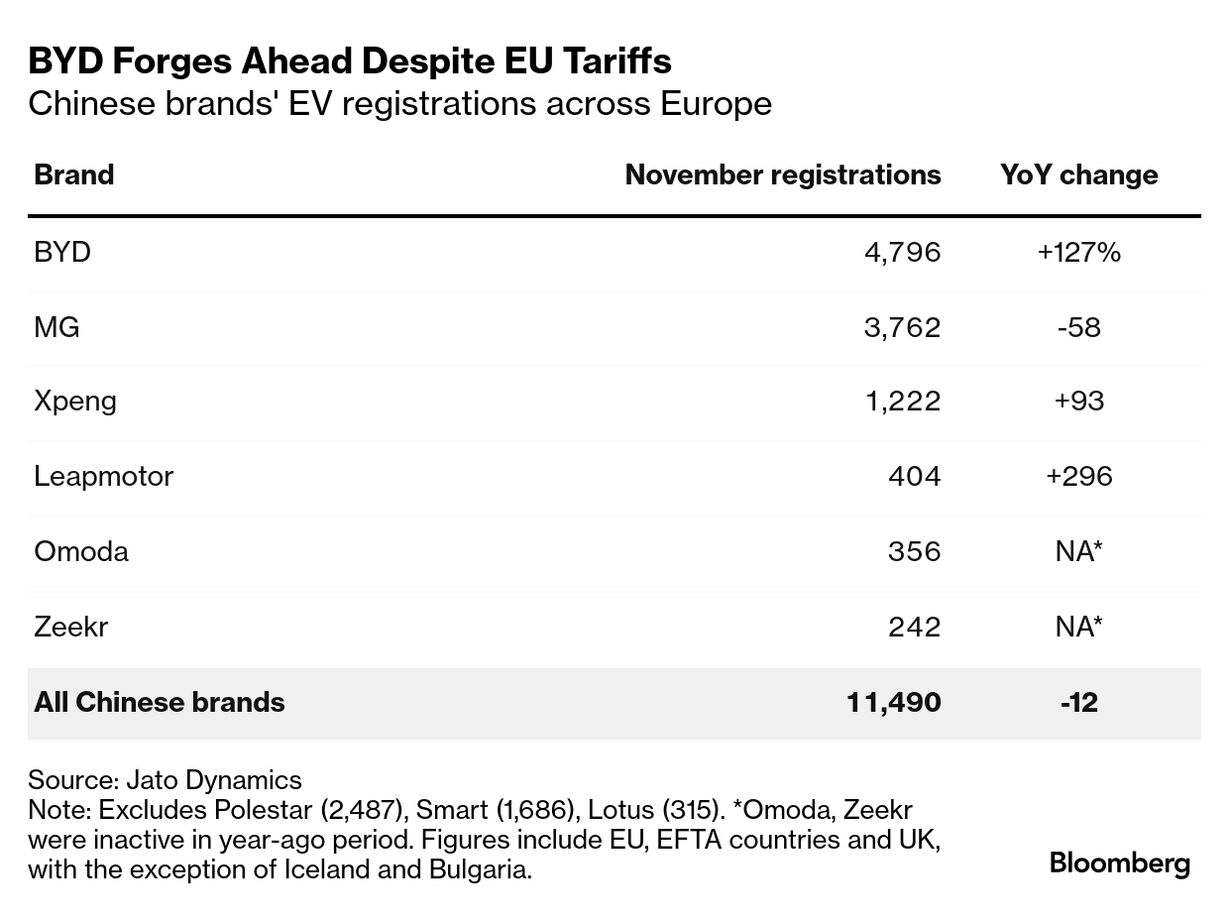

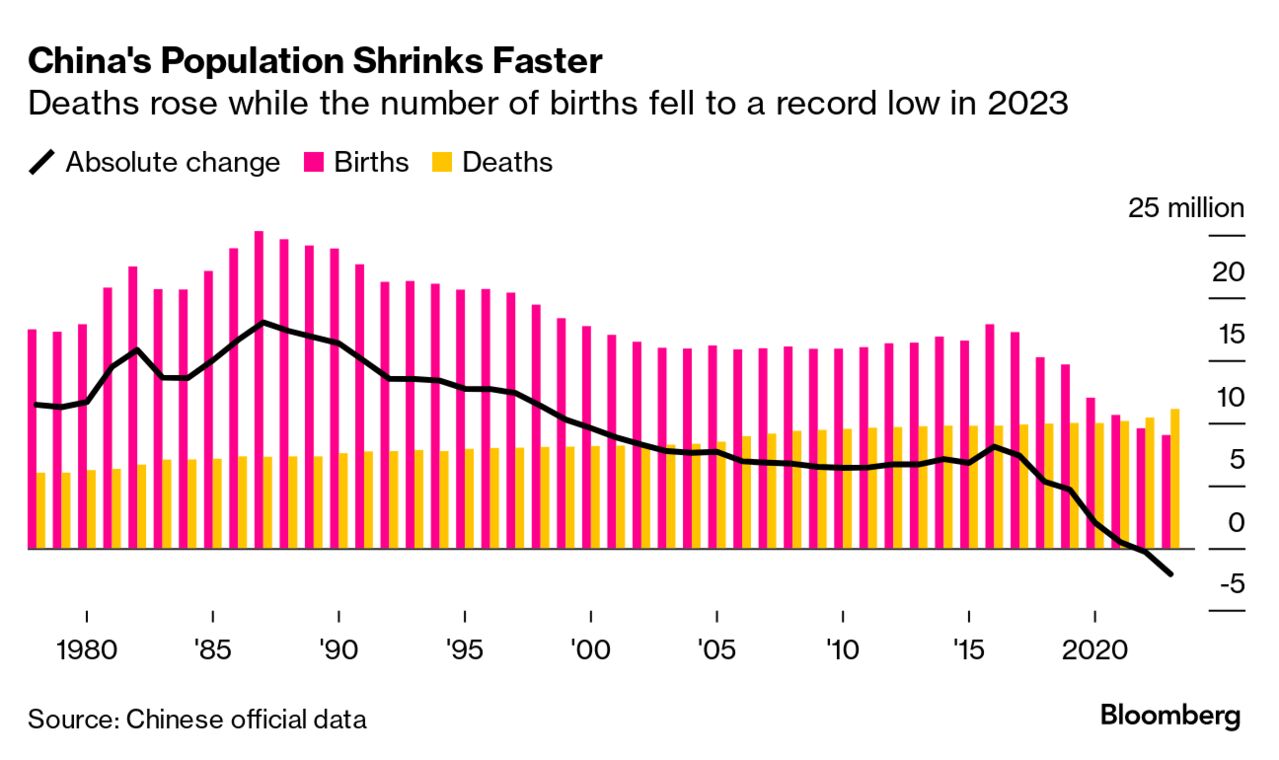

| Hi, this is Allen Wan in Shanghai, where we're just about recovered from the new year revelries! With the looming return of Donald Trump to the White House, it seems likely that China is set for a tough 2025. Yet decision-makers in Beijing will have a lot more to worry about than Trump and his penchant for tariffs. For starters, they're trying to pull off an economic turnaround, one they hope consumers will buy into. Then there's the pressure to keep investors happy, overcoming resistance in some places around the world to the nation's electric vehicles and dealing with a shrinking population. Here's a closer look at what I think will be five key things to watch in 2025: The million-dollar question is whether Trump will take a different approach to China than he did in his first term, when a trade war soured relations. While it's hard to see him backtracking on one of his main pledges — boosting tariffs on Chinese goods — he might impose levies lower than the 60% he has threatened in return for concessions or possibly stagger them, as Bloomberg Economics predicts.  Donald Trump and Xi Jinping back in 2019. Photographer: Susan Walsh/AP And Trump may be more amenable to swinging deals. His push to cut the flow of the deadly drug fentanyl into the US requires getting Xi to clamp down harder on Chinese chemical manufacturers. Trump may even revert to his old playbook, pressuring Beijing to buy more US products, such as agricultural and energy goods, though that could be tricky given China's economic difficulties. But unlike the first trade war, when retaliation was sometimes just symbolic, Xi has more options in his toolbox this time around — and is more willing to use them. One of the more potentially economically damaging ones would be a ban on key metals and materials in which China dominates production, such as rare earths. Beijing recently signaled its willingness to go this route after Biden slapped fresh export curbs on chips. Yet, while Trump is placing many China hawks in his administration, such as Marco Rubio for Secretary of State, he has also brought in business-friendly types, like Elon Musk. Trump can be unpredictable, as evidenced by his flip-flop on a TikTok ban, so be ready for anything. China is likely to hit its growth target of around 5% in 2024, helped by booming exports. Yet that tailwind may not blow as strong this year due to tariffs from the US and Europe. So the nation's hopes for an economic turnaround could hinge on consumption. That may be a tall order given stagnant wages, a tough job market, persistent deflation and a prolonged housing crisis. Instead, the government is likely to boost spending, raise the fiscal deficit target and cut interest rates as part of its strongest pro-growth stance in a decade. It's already giving a range of civil servants their first significant pay rise in years. But consumers shouldn't expect checks in the mail. Xi seems likely to continue resisting direct cash handouts considering the ruling Communist Party's distaste for what it terms "welfarism." The good news for investors in 2024 was that China stocks snapped a three-year losing streak. The benchmark CSI 300 Index rose almost 15% last year, fueled in part by gains in AI-related stocks such as Cambricon Technologies. Also, a gauge of Chinese equities listed in Hong Kong jumped 26%, its biggest increase since 2009. The bad news is the rebound was largely built on expectations for massive fiscal stimulus and it's not clear that's something the government wants to do. Worries about economic uncertainties have already caused Chinese stocks to post their worst start to a year in nearly a decade. The gloomy outlook is also driving down the yuan, which seems set for a turbulent year. Wall Street banks are forecasting a continued slide to 7.5 per dollar in 2025. Economic concerns aren't bad for all asset classes. China's government bonds beat major global peers in 2024 and are expected to remain winners this year on bets for more monetary easing to counter the slowdown. China's electric vehicles roared onto the scene in 2024. The shock to automotive industries around the world was massive and will likely reverberate for years. The US and Europe responded by erecting tariff walls to try to protect their automakers. And the challenge from China was one reason that heavyweights Honda and Nissan started talking about a possible merger. BYD, which is challenging Tesla as the world's top EV maker, has been preparing for growing protectionism by targeting key markets such as Southeast Asia, Hungary and Brazil. Yet 2025 is likely to be another year of fierce competition in the world's biggest auto market, which has already endured a relentless price war that's seen major manufacturers carve out bigger shares while smaller players get shoved aside. Since losing its mantle as the world's most populous nation to India in 2023, China has tried to to cushion the impact of a smaller workforce on its economy. One big change last year that had seemed taboo: Beijing raised retirement ages for the first time since 1978. The revamp will take place over 15 years starting this month and bring the Asian nation more in line with developed countries. Men will retire at 63 instead of 60. Women will retire at 55 instead of 50 for ordinary workers, and 58 instead of 55 for those in management. While the move wasn't exactly popular, the authorities felt it was necessary to stem a decline in the size of the labor force. For one thing, Xi's exhortations for women to have more babies didn't exactly have the desired effect for some reason. Chinese officials worry their nation risks falling into the middle-income trap (missing out on high-income status), growing old before it gets wealthy. They are looking to bolster the social safety net by expanding pension coverage. But as this Bloomberg Originals video shows, younger people are reluctant to chip in right now. These are some of the thorny issues China will be grappling with in 2025. Here's hoping your year is a bit more smooth sailing! Start the 2025 off with these stories, podcasts and videos: |

No comments:

Post a Comment