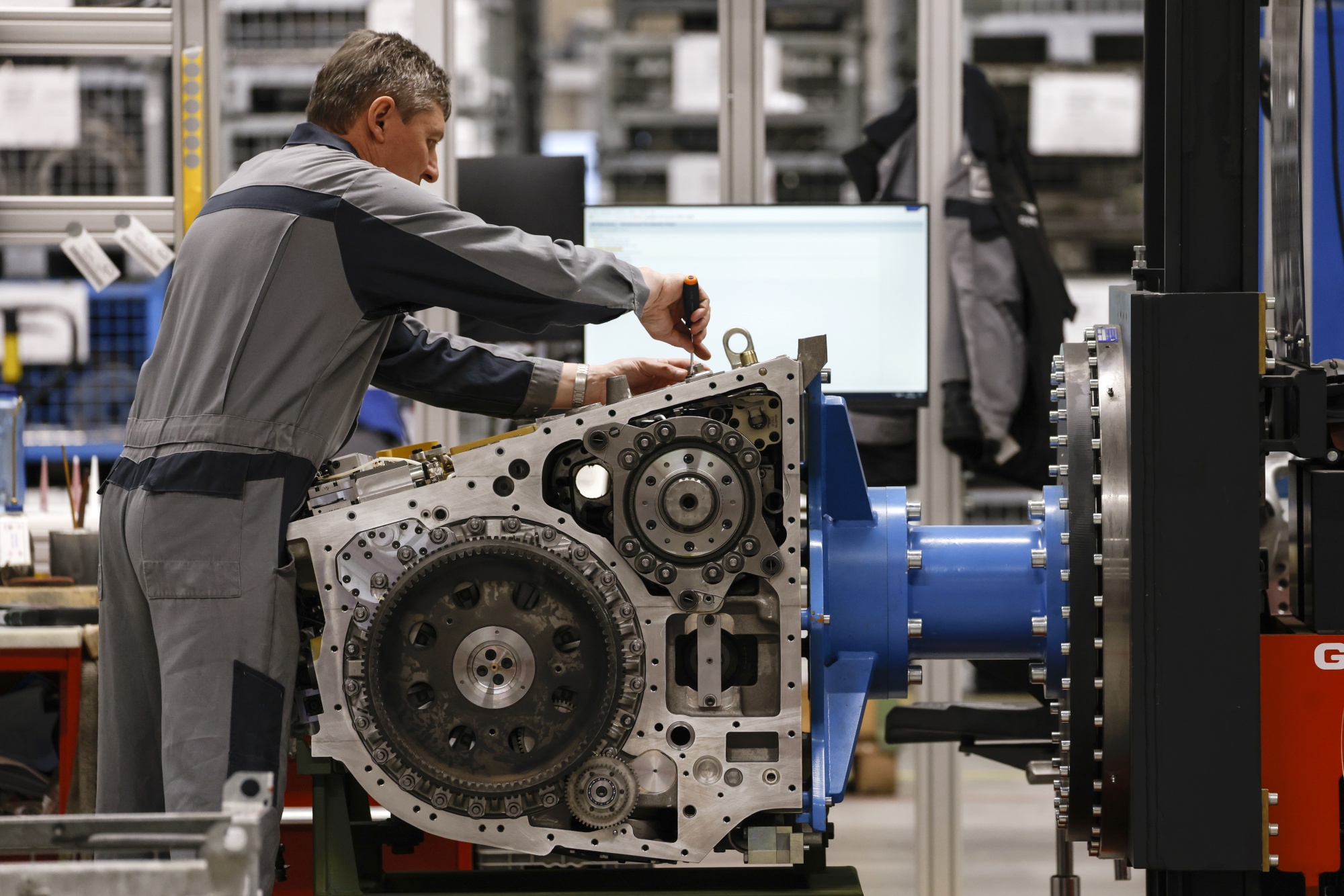

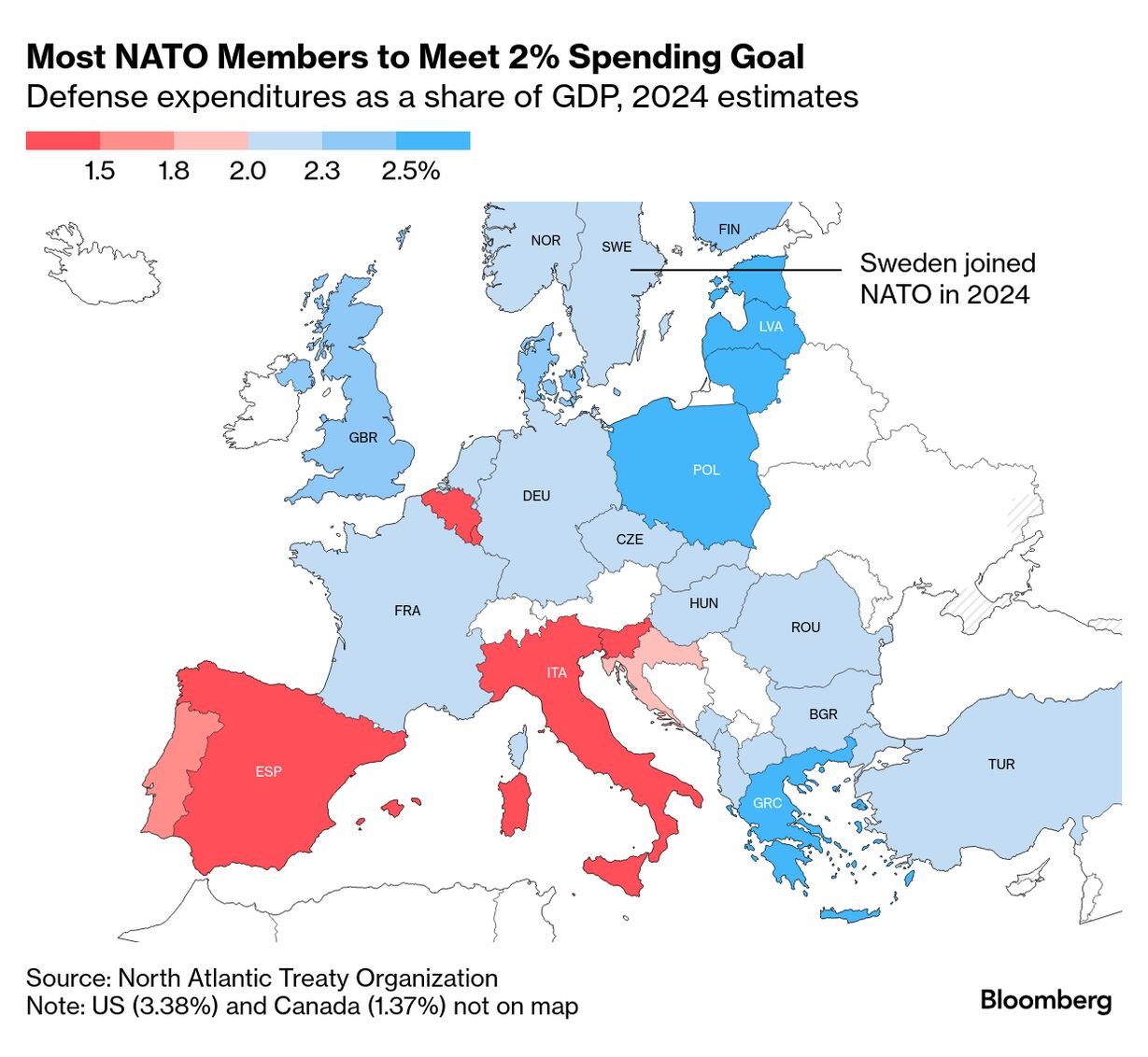

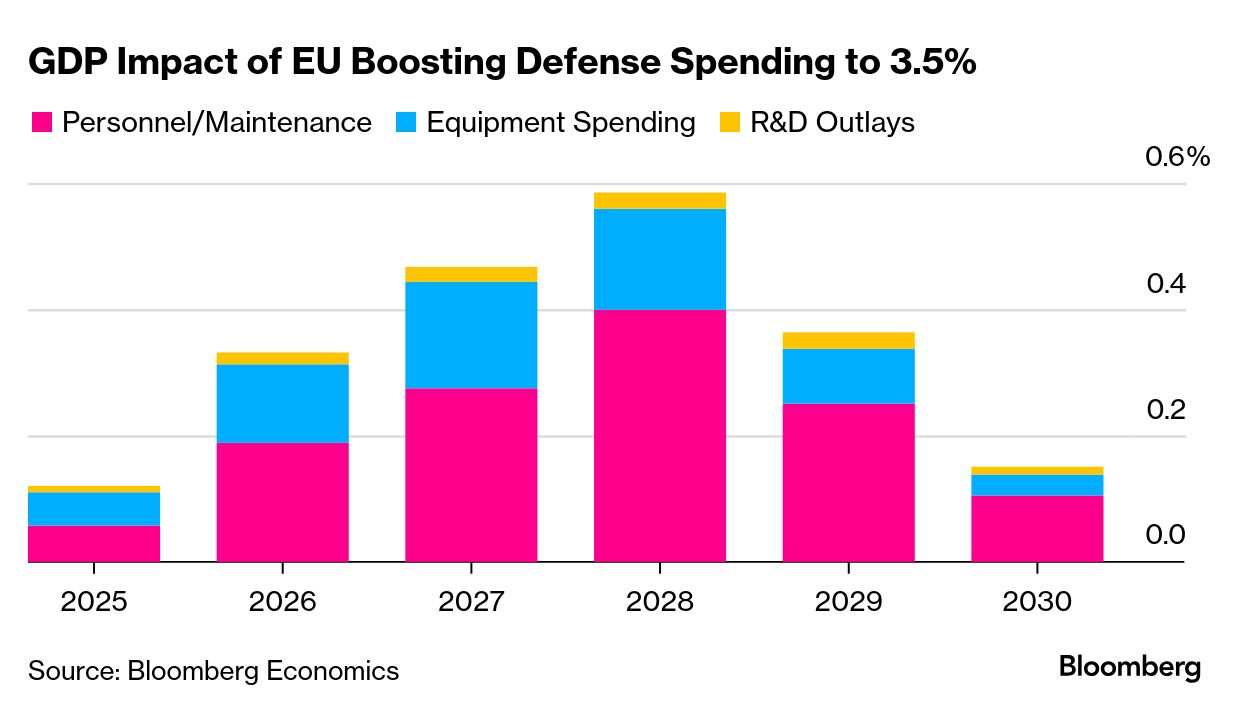

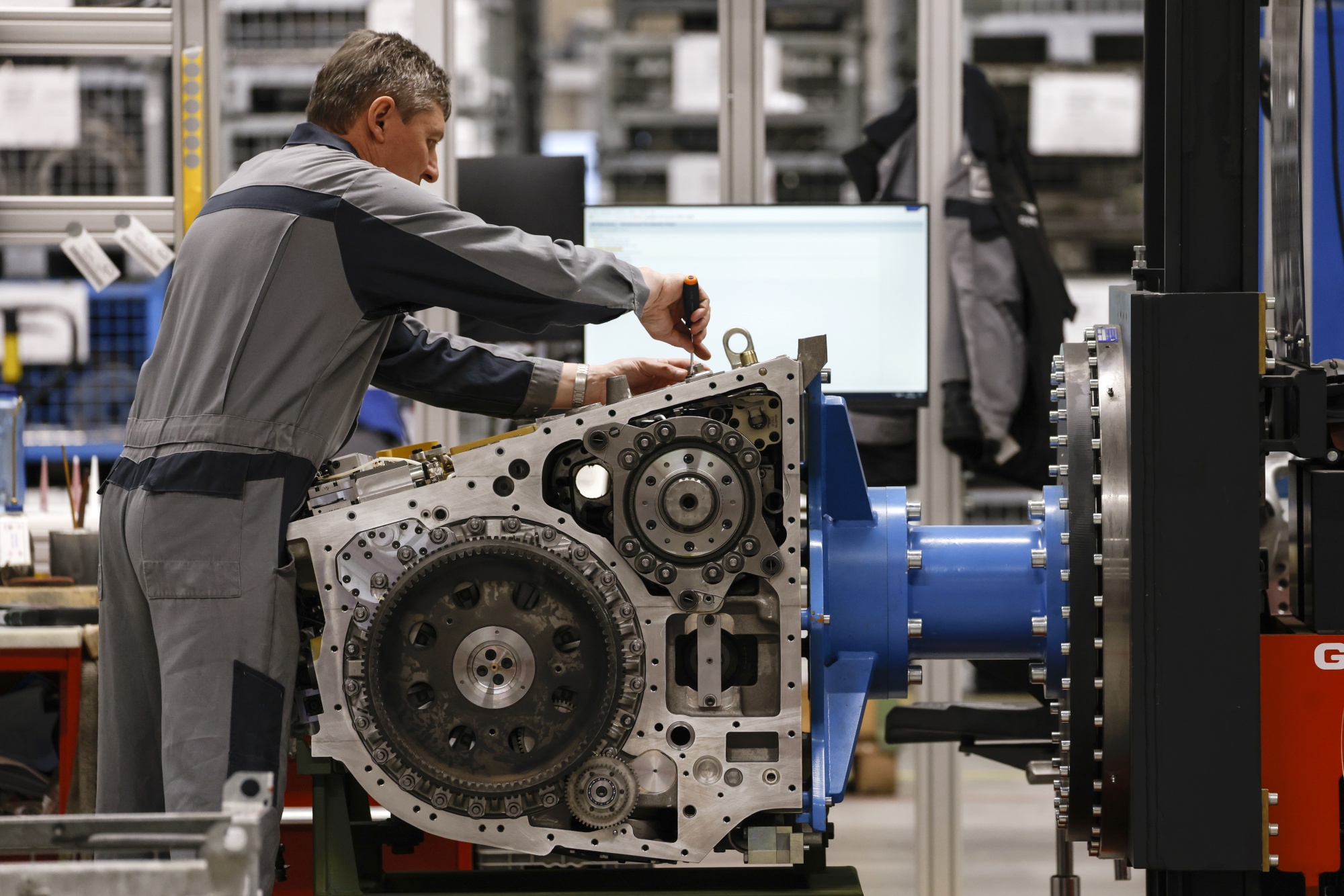

| The end of the Cold War had countless benefits. But for California, by far the largest US state by economic output, it was a crippling event. As defense spending slumped, the Golden State lost hundreds of thousands of middle-class jobs, contributing to its worst slump since the 1930s. Only after enduring a fiscal crisis and real-estate implosion did California finally stage a comeback in the latter 1990s, with the technology boom. If a defense-industry contraction can prove so economically powerful, it makes sense to think a major build-up could prove a big stimulus. And the European Union—whose biggest economy, Germany, has been shrinking for two years—could surely use one. Back in the White House this week, Donald Trump has resumed his browbeating of Europe to spend more on its own defense. Whatever EU members thought of that criticism in his first term, Russia's full invasion of Ukraine in 2022 was a game-changer, and many nations have already been ramping up outlays. Investors have cottoned on to the defense-buildup theme. Two of the four best-performing European stocks over the past 12 months are Germany's Rheinmetall, which makes battle tanks among other things, and Norway's missile-producing Kongsberg Gruppen. The economic benefits are unlikely to be enough to usher in any new "golden age" for Europe, as Bloomberg Economics analysis this week makes clear—but this sort of military Keynesianism may prove enough to prevent an even worse outcome for the continent's stagnating economy. This Week in the New Economy | Europe's recognition of its new geopolitical reality was clear this week. The prime minister of new NATO member Sweden, Ulf Kristersson, said his nation "is not at war. But there is no peace either." The recently installed secretary general of NATO, former Dutch premier Mark Rutte, went further in an interview with Bloomberg Editor-in-Chief John Micklethwait at the World Economic Forum in Davos, saying the alliance should move to a "war mindset." And Rutte encouraged Europeans to look beyond Trump's call earlier this month for NATO members to spend the equivalent of 5% of gross domestic product on defense—upping the target from 2%. "The problem is not Trump, the problem is Europe," Rutte said. "We could pay more of the financial burden." Fresh proposals on that front are due soon. Andrius Kubilius, the EU's defense commissioner, said in an interview with Bloomberg at Davos that he'll publish a price tag for the bloc's rearmament needs in a March report. The actual decisions will be up to member states, and it's not clear how much they'll be willing to ramp up military spending. Jamie Rush, chief European economist at Bloomberg Economics, has mapped out the economic implications of an increase to 3.5% of GDP over the next few years (from about 1.9% in 2024), financed by higher debt sales. He noted that if the spending were funded with tax increases, or cuts in other areas, that could wipe out any positive impact—0r worse. One factor limiting the stimulus to be had from rearmament is that Europe buys much of its military gear from American suppliers. Former European Central Bank President Mario Draghi's competitiveness report estimated that 78% of purchases come from production outside the EU—and 63% from the US alone. That means any "multiplier" effect of stepped-up spending on growth would be low. What's more, recruiting more Europeans to the military and defense industry would bring down unemployment, possibly fueling inflationary pressures that would lead to higher interest rates. In all, Rush calculates that EU economic output might be higher by about 0.6% in 2028, "which implies a modest nudge up in GDP growth in the next few years." See his full note on the Bloomberg terminal here. But what if the EU increased its own defense-industry production? That could bring the GDP boost closer to 1%, Rush says. Another consideration is that, if other industries are losing jobs, the inflationary impact of a defense build-out may not be so large.  An employee works on a K2 Black Panther tank gear transmission in a production hall at the Renk AG plant in Augsburg, Germany, May 8, 2023. Photographer: Michaela Rehle/Bloomberg Germany's automobile industry is a case in point. Having fallen behind in global competitiveness, it's in downsizing mode, with Volkswagen alone envisioning tens of thousands of job losses in coming years. The flipside of that: a pool of skilled workers available for the defense industry. Bloomberg reported on one example last month: radar maker Hensoldt was in talks to hire two full teams from two separate auto-parts suppliers—in one case, involving up to 100 people. Even if Europe has to source from the US, there's a potential silver lining. Trump is threatening tariffs on European imports to address a US deficit with the EU that exceeds $200 billion a year. A pledge to step up imports of American defense products could help convince Washington to temper the blow. Before its post-Cold War slump, California enjoyed the economic lift from President Ronald Reagan's rearmament against the Soviet Union. Few think that today's Europe is likely to pull off anything on that scale. But without the coming expansion of defense spending, the region's gloomy outlook could well be even worse. |

No comments:

Post a Comment