| UK assets tumbled on mounting concern over the deficit, with the pound hitting the lowest in more than a year against the dollar. The 10-yea |

| |

| Markets Snapshot | | | | Market data as of 06:18 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- UK assets tumbled on mounting concern over the deficit, with the pound hitting the lowest in more than a year against the dollar. The 10-year gilt yield jumped to 4.92% and the FTSE 250 Index of smaller companies sank for a third day.

- The wildfires tearing across Los Angeles are on track to be among the most expensive natural disasters in US history, draining insurance coffers and threatening California's state coverage program. Insured losses may approach $10 billion, JPMorgan said.

- The US stock market is closed today and bond trading ends early, at 2 p.m. New York time, for the funeral of former President Jimmy Carter. Treasuries rose after a four-day selloff.

- China's consumer inflation weakened further toward zero, decelerating for a fourth straight month in a setback for government efforts revive the economy.

- Investors pulled $583 million from Bitcoin exchange-traded funds in the US on Wednesday, the second-highest outflow since they debuted a year ago. The crypto rally has stalled in recent weeks as investors pull back on risky assets.

| |

| |

| Higher interest rates, all things equal, typically lead to a strengthening currency. Yet the surge in gilt yields this week has been accompanied by a slide in the pound, possibly indicating capital flight as investors fret about persistent inflationary pressures and fiscal sustainability. Britain's markets are at the forefront of a global rout sparked by Donald Trump's latest threats to impose tariffs and worries that inflation will remain elevated for longer than expected. The speed of the moves has drawn comparisons with the fallout from Liz Truss's ill-fated mini-budget in 2022. In a measure of the extent of the anxiety, Wednesday was the busiest day for pound options trading since the currency slumped toward an all-time low during the Truss episode. While market structure has been strengthened to prevent a crisis of that scale, the government's escalating debt burden is once again a source of concern for investors. A more apt comparison would be to the 1976 crisis that forced the government to ask the International Monetary Fund for a bailout, according to former Bank of England rate-setter Martin Weale. If sentiment doesn't change, the Labour government may have to resort to austerity to reassure markets that it will address the escalating debt burden, he says. Chancellor of the Exchequer Rachel Reeves will favor fresh cuts to public spending over tax hikes if the rise in borrowing costs wipe out her dwindling £9.9 billion of fiscal headroom, according to people familiar with her plans. "We haven't really seen the toxic combination of a sharp fall in sterling and long-term interest rates going up since 1976. That led to the IMF bailout," said Weale, now professor of economics at King's College London. "So far we are not in that position but it must be one of the chancellor's nightmares." —Phil Serafino, Philip Aldrick, Greg Ritchie, Alice Atkins and Vassilis Karamanis | |

| |

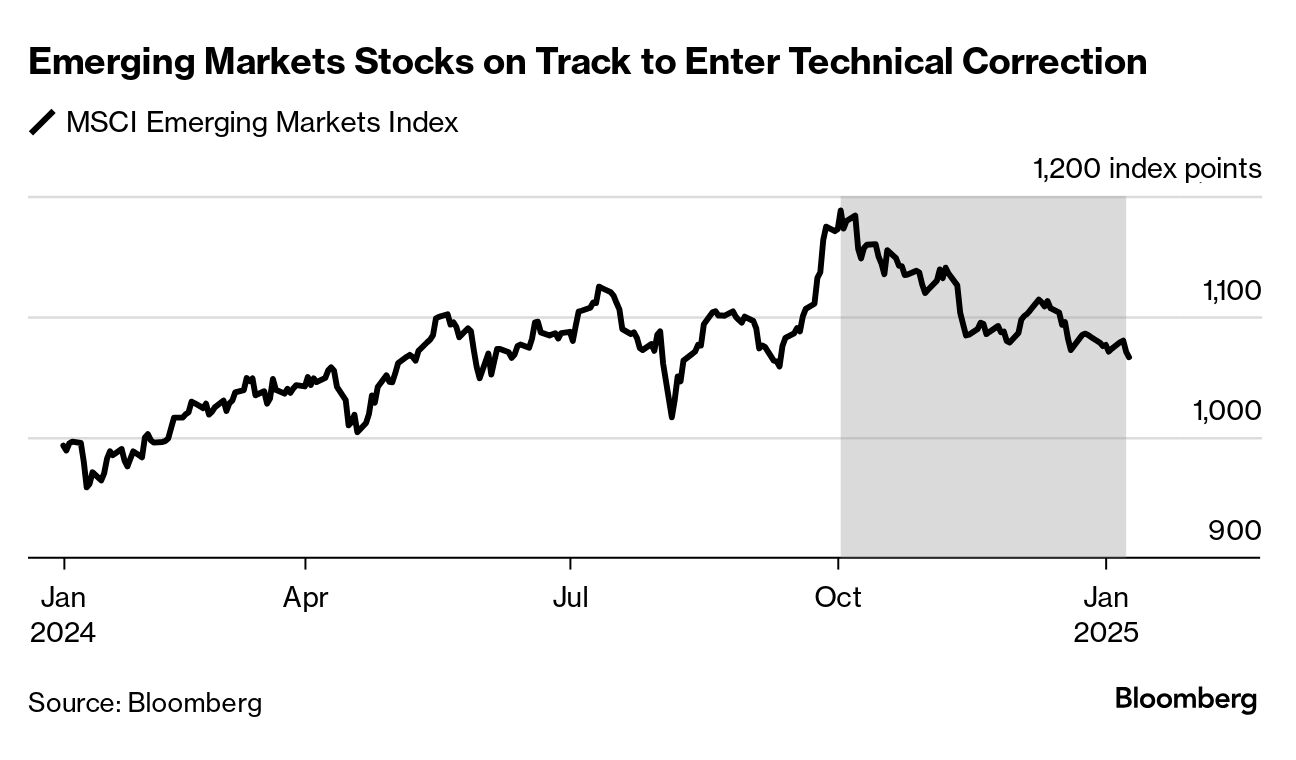

| MSCI's emerging-markets index is on the cusp of a correction — a 10% drop from a recent high. Chinese stocks have been among the worst performers, with investor confidence weak amid a lackluster economic recovery. Plus, investors are worried about the impact of Trump's potential tariffs. | |

Shrinking equity research | |

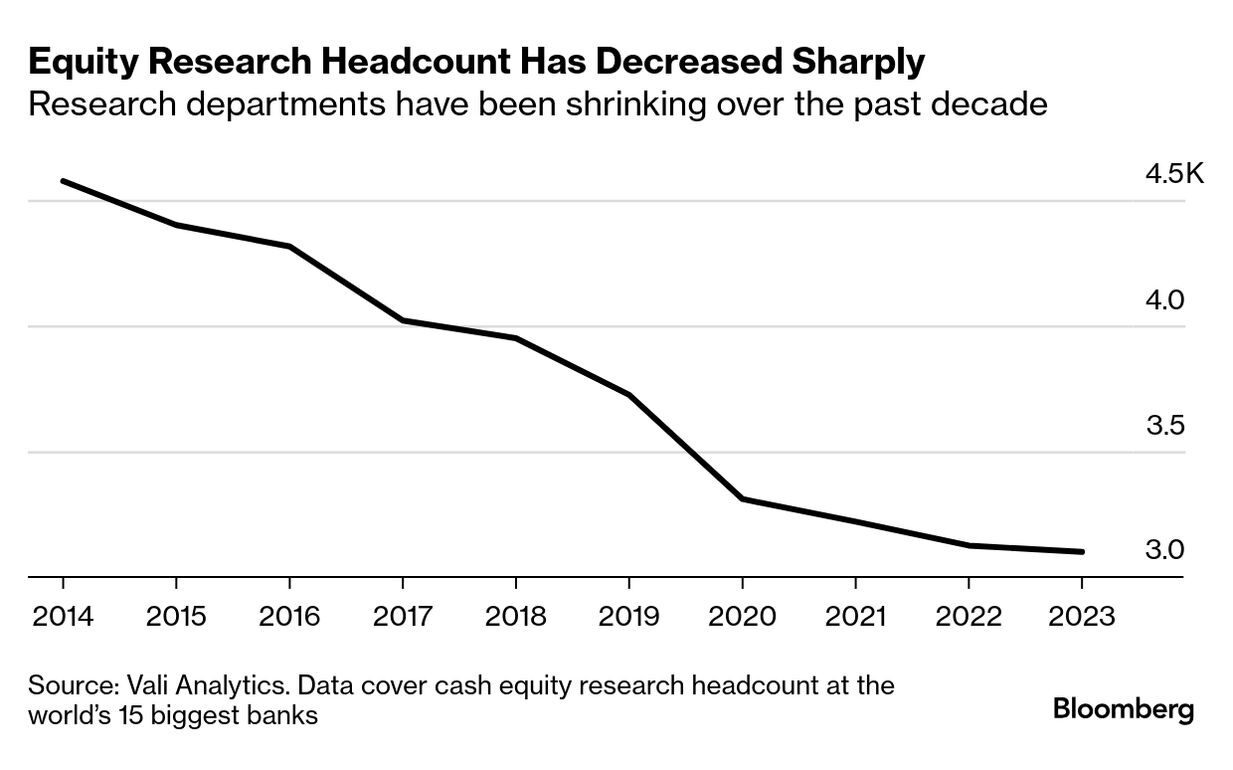

| The job of researching stocks for a big Wall Street bank has lost a lot of its luster, and the result for investors is less efficient markets. Potent forces such as regulation and the rise of passive investing have been gutting the industry for years, as we report in today's Big Take. Artificial intelligence is now accelerating that trend. At the world's 15 biggest banks, the number of equity analysts has fallen to about 3,000 from almost 4,600 a decade ago, according to Vali Analytics. The number of companies in the Russell 2000 Index with fewer than 10 analyst recommendations has nearly doubled from a decade ago, at around 1,500, data compiled by Bloomberg show. A growing body of evidence suggests stocks that fall off the sell-side radar often struggle to attract investors, distorting valuations and making markets less efficient. "For small companies that are already covered by fewer analysts to start with, each one less will hurt them more," said Kevin Li of Santa Clara University. "The downtrend is probably not preventable, given the move away from active investment.'' —Sujata Rao, Denitsa Tsekova and Isolde MacDonogh | |

Word from Wall Street | | "Inflation and rates might not be too high. This may be the economy we now have. 3% inflation and 5% rates (2% real) are now normal. The cycle turned in 2020. Shutting down and restarting the global economy changes things in ways that take years to understand or accept.'' | | James Bianco President, Bianco Research LLC | | Click here to read the post on LinkedIn | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment