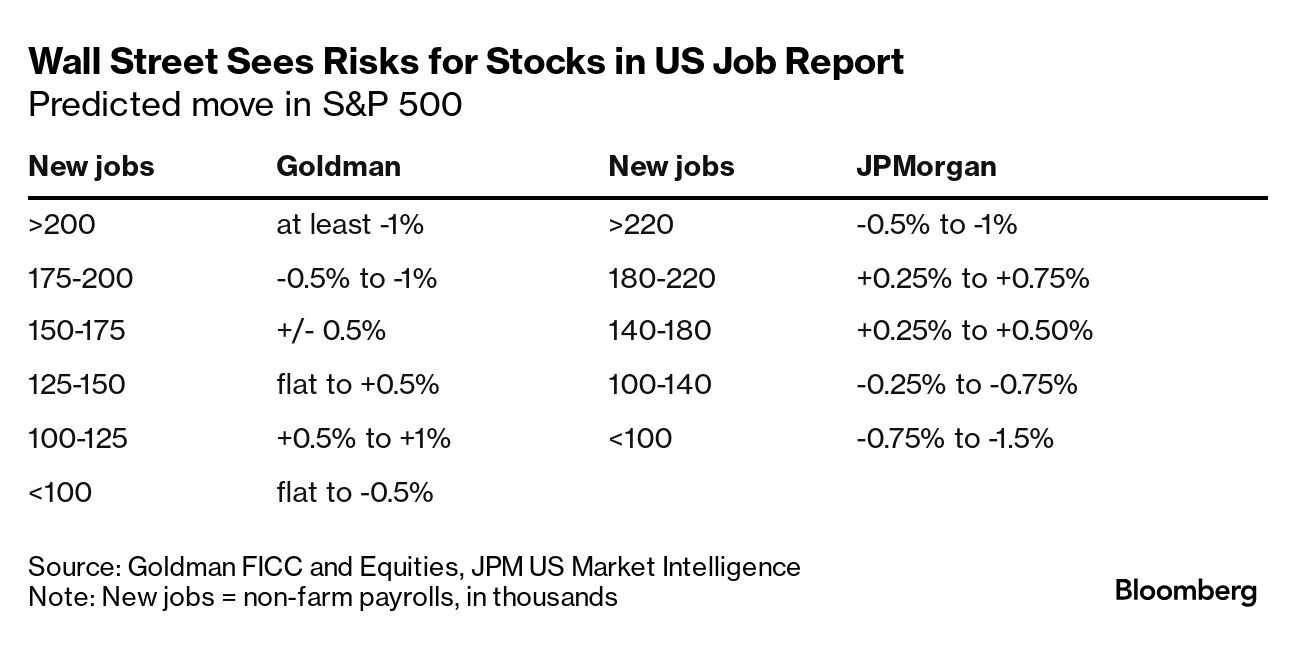

| How important are rate cuts to the bull case on equities? It's a pressing question for investors in risky assets, who've lately struggled to ignore the bond market's agitated reaction to inflation risk. Key evidence comes in the form of the December US employment report. Economists predict that non-farm payrolls increased by 165,000, based on the median forecast, with the unemployment rate steady at 4.2%. Bloomberg Economics puts the number of new jobs a lot higher -- at 268,000 -- while Nomura Securities cites indicators including hiring surveys and jobless claims in pegging it at 180,000. In short, blowout jobs data isn't inconceivable, the kind of report that might lead Fed Chair Jerome Powell to put a fork in hopes he will keep lowering rates in 2025. How investors might react to such a print would say a lot about what the future holds for risk assets. It's been a long time since better-than-expected employment numbers touched off a decline in equity prices, testament to how confident traders became that inflation had been licked. The last time was June, when a since-revised 92,000-jobs beat in payrolls rattled investors looking for a tamer print. Even then, the drop in the S&P 500 was a scant 0.1% Since then the stock market has behaved pretty much how you'd expect it to when growth was the obsession of choice, going up when data was good. According to Peter Cecchini, director of research at Axonic Capital, there's reason to believe that's changing. It's a different story in the bond market, where yields on the 10-year Treasury have surged more than a full percentage point since the Fed began cutting rates in September, reaching 4.72% this week amid concern of resurgent inflation. Given the speed of that rise, strong data will hurt the market less than weak data will help it, some investors and strategists say. Stocks, though, have rallied even as yields have jumped. Anything above 200,000 new jobs and the S&P 500 Index is seen dropping about 1%, according to Goldman Sachs. A JPMorgan Chase trading desk note sees the gauge poised to fall 0.5% to 1% if the print is above 220,000. "As we continue to creep towards 5% on the 10-year yield, the reflexive reaction for equities on any strong growth/employment data prints becomes increasingly negative, especially given how stretched valuations have been," said Cecchini. "Equities are pricing in near perfection," but "'inflation has been far stickier than the Fed admits." Good news has been good news for a while now. The possibility of it becoming bad news again for stock investors is going up. —Denitsa Tsekova, Liz Capo McCormick and Jan-Patrick Barnert |

No comments:

Post a Comment