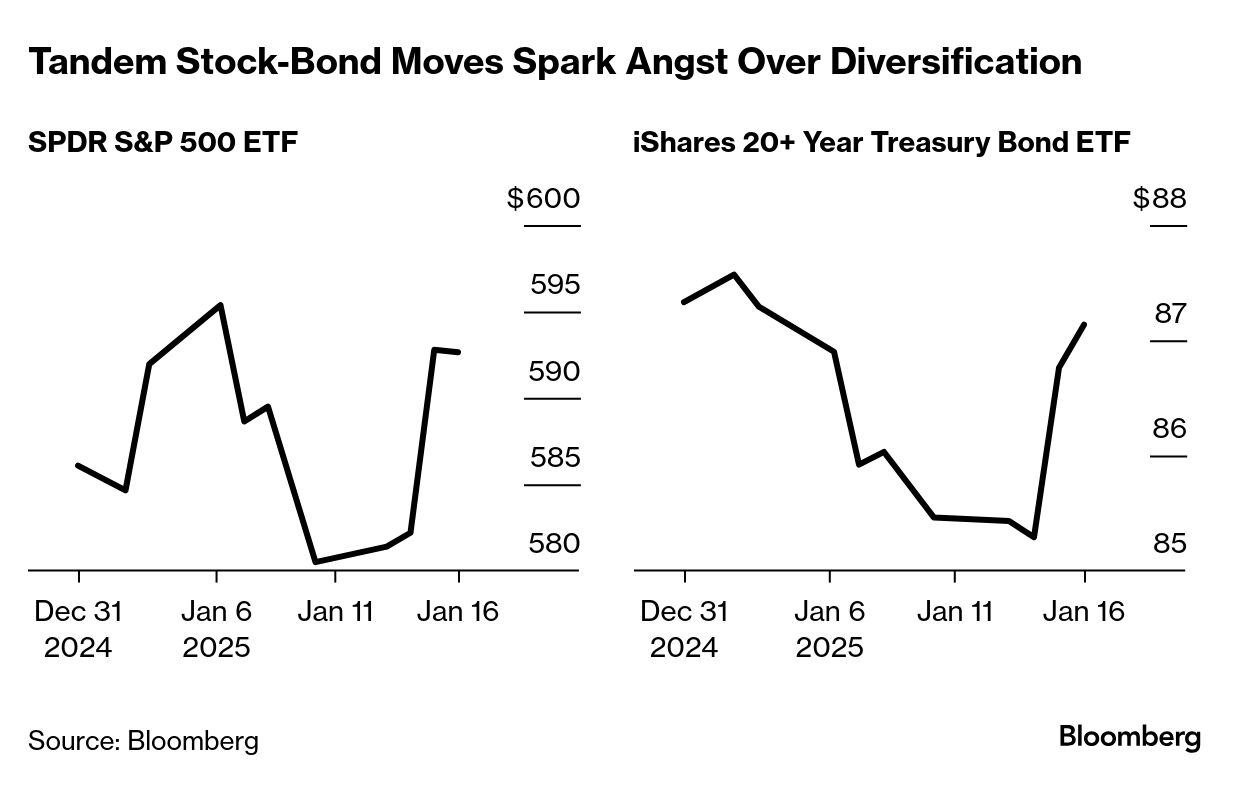

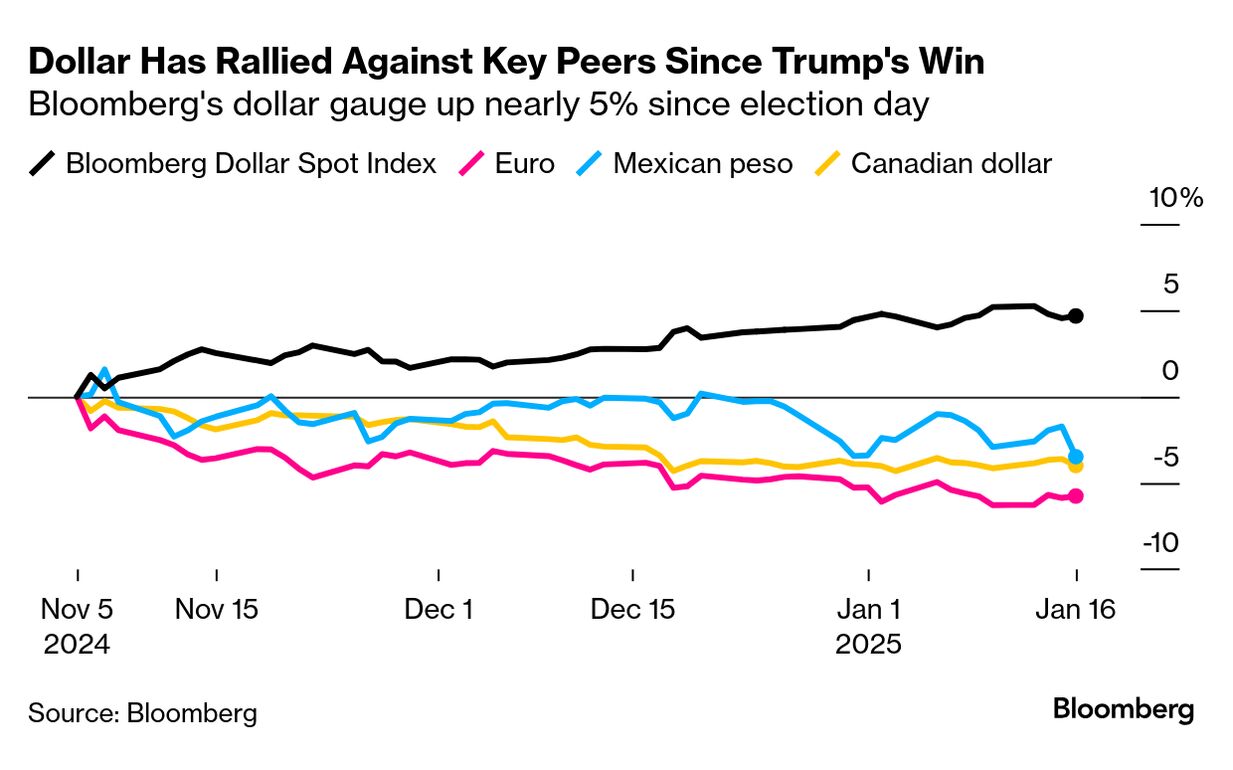

| Say what you will about the year so far for markets, it hasn't been boring. The S&P 500 has posted single-day moves exceeding 1% in nearly half the trading sessions since Christmas, oil briefly touched $80 and Treasuries have proved anything but risk free. The volatility may be disquieting, but it's what Wall Street has been hoping for. Banks spent last year touting all manner of exotic market hedges and diversification strategies, only to see them steamrolled as US tech stocks went straight up. This year is shaping up to be a different story. Consider follow-the-trend allocations: One exchange-traded fund tracking this systematic strategy – buying the likes of bonds and commodities on the way up and selling them on the way down – is up a healthy 4% this year. Meanwhile, an investing style that uses leverage to juice up returns from diversified assets, as exemplified by the Return Stacked US Stocks & Managed Futures exchange-traded fund, is off to a solid start. And the popular call-writing strategy, which sells bullish options while taking long stock positions along the way, is on the up. It's still early in the year, and vanilla allocation strategies in stocks and bonds – snubbing more complex trades — may yet prove smart in the Trump-led market era that begins officially next week. At the same time, the threat of faster inflation has reawakened the debate about the efficacy of splitting money into 60% equities and 40% bonds. The issue is not with performance per se. In fact, quant giant AQR Capital Management just upgraded its expectations for the performance of a global 60/40 portfolio, predicting an inflation-adjusted return in the next five to 10 years to reach 3.5%. The challenge is that bonds and stocks are increasingly moving in lockstep. Wednesday marked the second time in as many weeks when the major ETFs tracking the S&P 500 and long-dated Treasuries rose or fell more than 1% simultaneously. The in-tandem moves cast doubt on the effectiveness of using bonds as a way to hedge risky assets. While Treasuries have served as a source of diversification during most of the past four decades, the post-pandemic inflation scare — and the lingering price pressure — has sparked losses in the iShares 20+ Year Treasury Bond ETF for four straight years. All told, Treasuries have been under more pressure. Nomura and T. Rowe Price are both predicting 10-year Treasury yields could hit 6% this year. "This is to emphasize how critical the health of US government bond market is and that without an adult in the room, an accident could be in the making," Dean Curnutt, founder of Macro Risk Advisors, wrote in a note. "I've argued that the ten-year note is the risk asset." —Lu Wang |

No comments:

Post a Comment