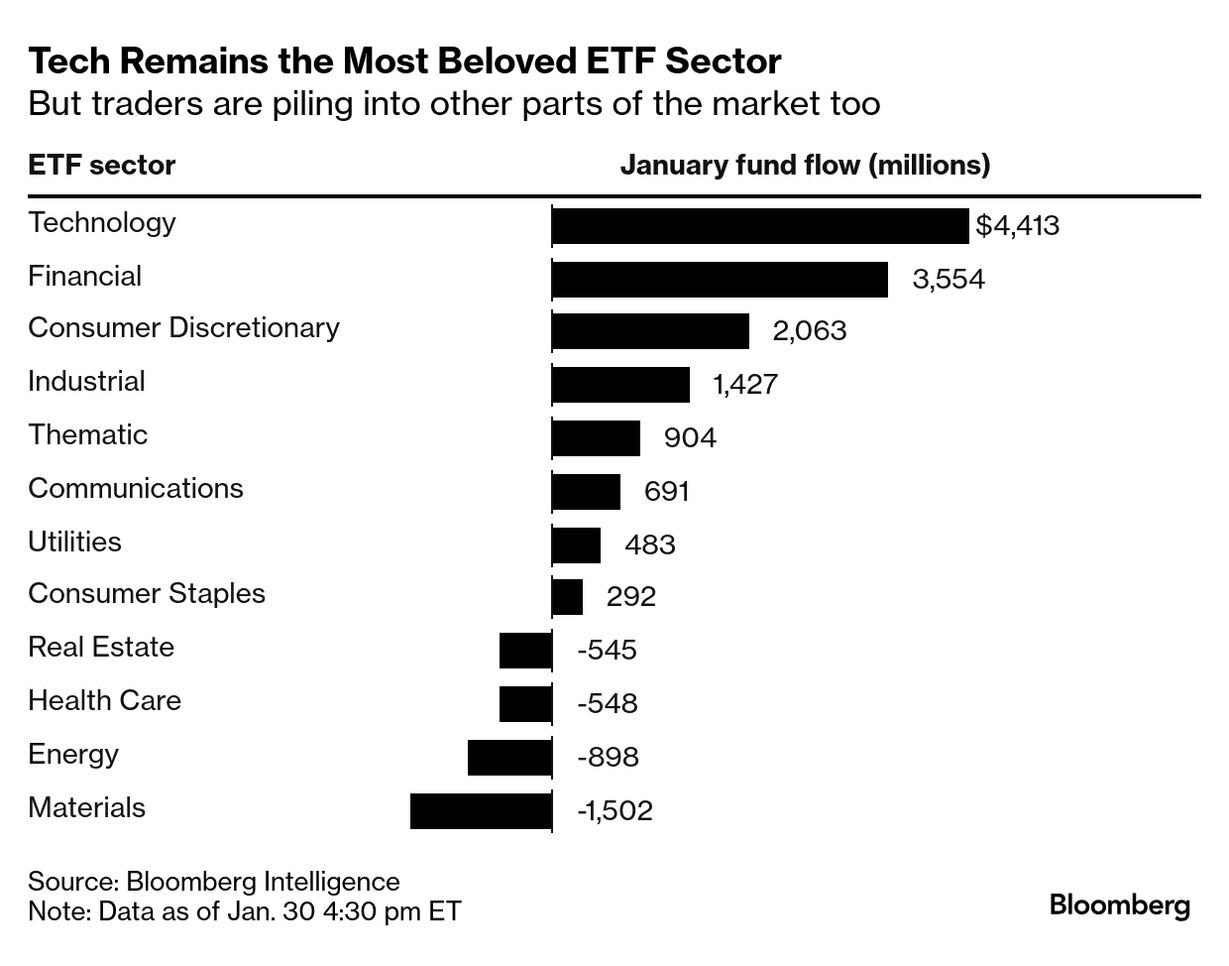

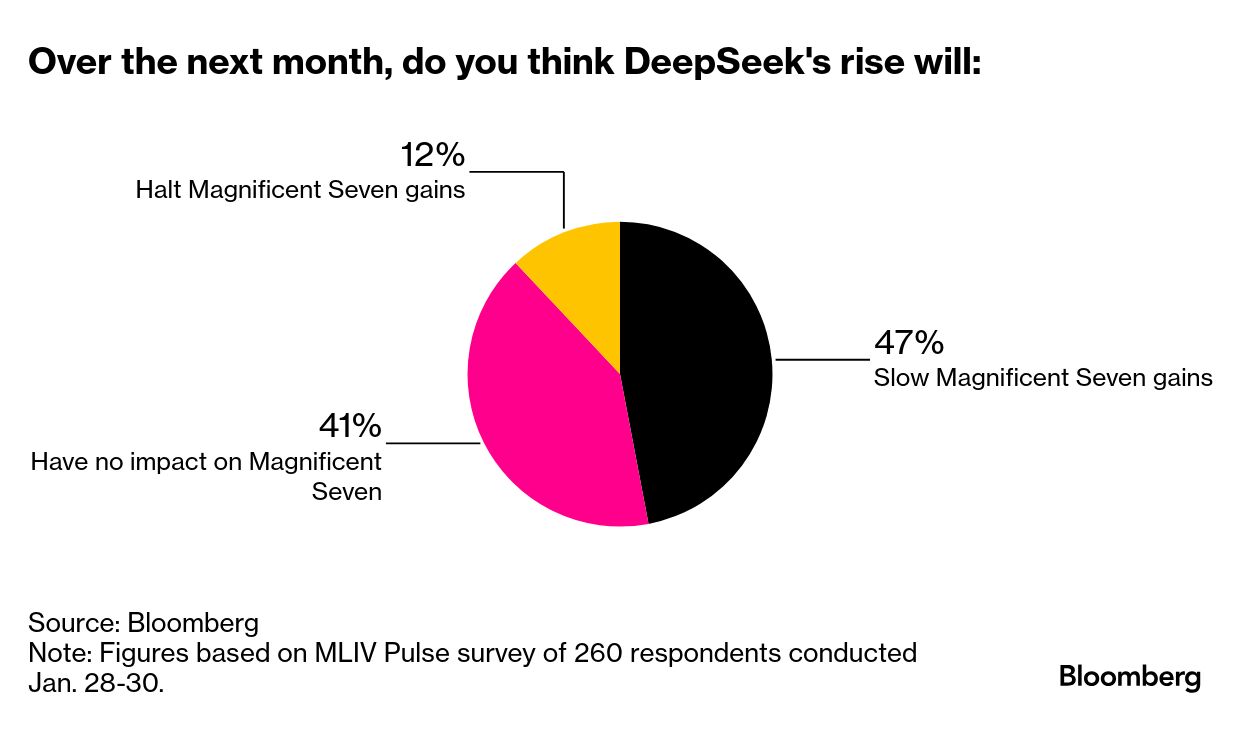

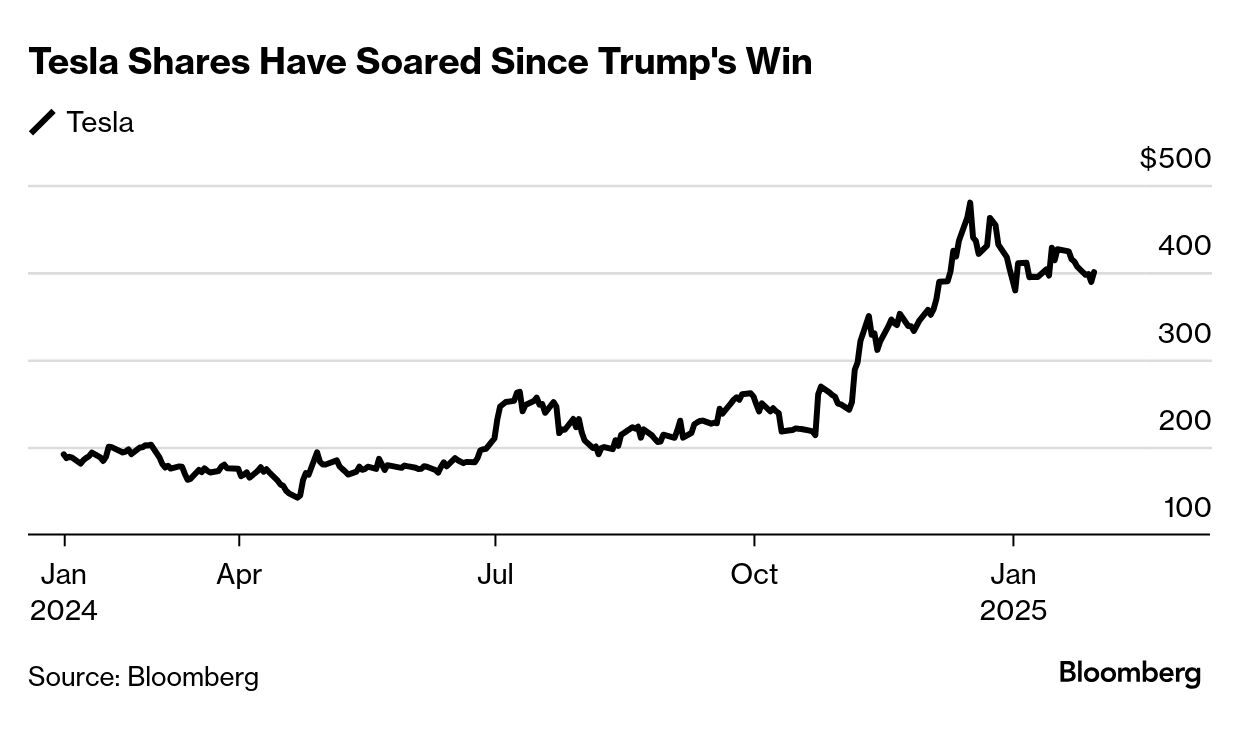

| Dip buyers in the world of exchange-traded funds are keeping the faith, brushing off AI-related fears that battered markets from New York to Tokyo at the start of the week. The insatiable buying demand is on full display in famous funds like QQQ, the biggest ETF tracking the Nasdaq 100. Even as the tech-heavy gauge fell nearly 3% Monday, QQQ notched its biggest one-day inflow since 2021 with more than $4.3 billion. A triple-leveraged semiconductor ETF known as SOXL also witnessed the biggest daily intake in at least five months. Retail speculators are still Nvidia uber-bulls, too, judging by a gush of flows to NVDL -- a product that amps up gains in the famous stock. At $1 billion, it got its biggest one-day inflow on record Monday, despite tumbling an unprecedented 34% on fears that Chinese upstart DeepSeek could upend America's dominance in the artificial-intelligence race. Flows into these derivatives-powered funds "show that retail investors seem to want more leveraged exposure, not less, after Monday's selloff," said Rocky Fishman of research firm Asym 500. In the latest Bloomberg Markets Live Pulse survey, 88% said the debut of DeepSeek's latest model will have little to no impact on the shares of the US technology behemoths in coming weeks. Momentum-chasing day traders are also scooping up financials and consumer-discretionary ETFs, in a sign of confidence about the US economic expansion, with this week's GDP data only adding to the bull case. Yet the market whiplash may not be over this week. The Fed's favored inflation gauge, the PCE, is due this morning. It's expected to show a small acceleration at 2.5% from a year earlier, up from 2.4% in the previous month, according to the median forecast of economists surveyed by Bloomberg. With tech valuations elevated, any surprise that stokes Wall Street's interest-rate fears has the potential to stir up fresh turbulence — and a fresh dash for lower-valued assets. "We continue to see value in diversification across strategies and regions as well as in downside protection," Goldman Sachs analysts wrote in a note. "We caution that US equities are vulnerable to further disappointments." —Isabelle Lee |

No comments:

Post a Comment