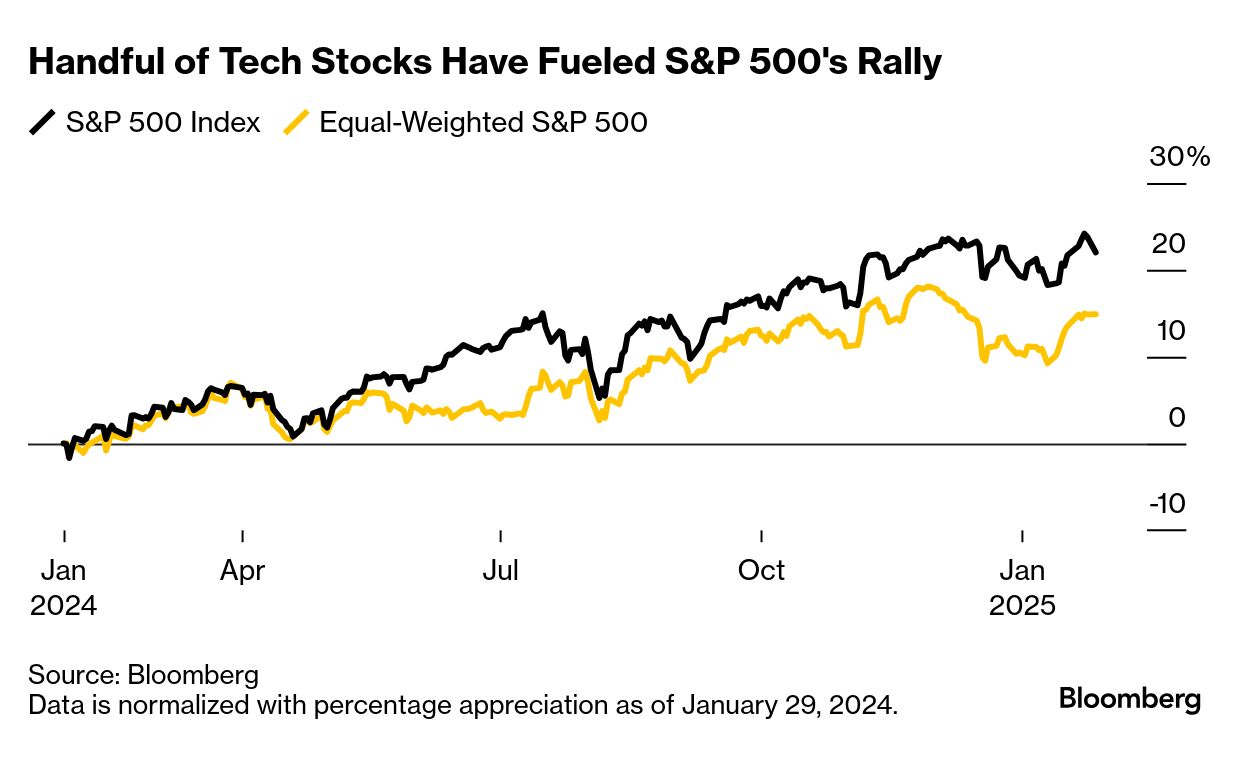

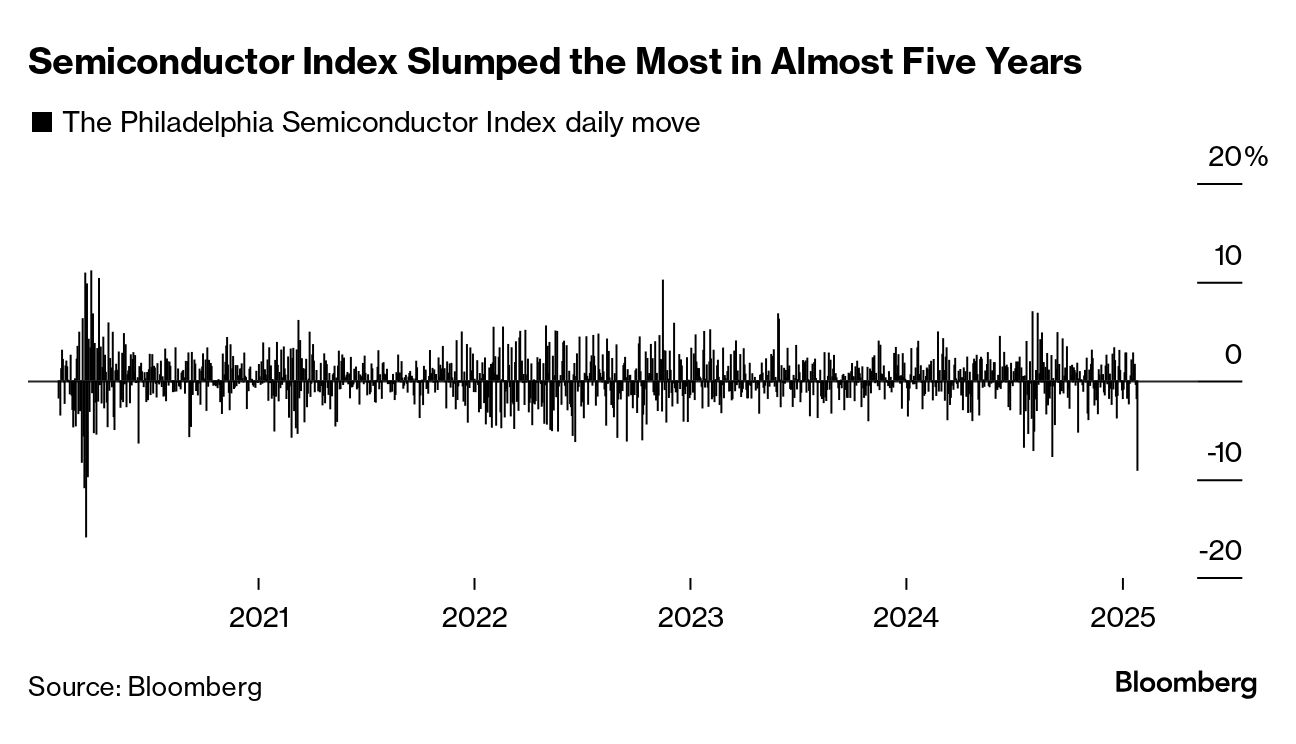

| A breakthrough is announced in China promising to make AI cheaper, and a handful of US chip stocks — many trading at 30 times earnings or more — plummet. Monday was a brutal session to be a tech trader. But did anything bad actually happen to the broader US economy? To answer that question you might consult the bond market, where falling rates ordinarily indicate easing growth expectations. And yields did indeed drop, with the 10-year Treasury posting the second-biggest decline of the year. Still, a single session's signal is muddy, and much of the move was written off as the migration of money out of the tech-stock dumpster fire. There is a channel by which all the volatility could end up making a near-term dent in the macro picture, should it persist, says Ian Lyngen, the head of rates strategy for BMO Capital Markets. The reason is the enormous influence AI-related stocks now represent in American brokerage accounts. While a longshot, Lyngen mentioned the possibility that the rout snowballs into a "wholesale repricing that undercuts the wealth effect" generated by the stock market's $20 trillion advance since the end of 2022. The poster child of that rally has been Nvidia, until yesterday the world's largest company and S&P 500's biggest member, which saw almost $600 billion shorn off of its market value in a blow to retirement savers far and wide. To be sure, a sustained drop in share prices wouldn't be opposed by everyone. Federal Reserve board members convening in Washington on Tuesday are one constituency that comes to mind. "One could readily argue that a round of de-wealthing would be quietly welcomed by monetary policymakers as it would serve to lessen the potential inflationary impulse associated with record-high stock valuations and household net worth," Lyngen wrote. That logic may explain some of the bid seen across the Treasury yield curve on Monday — including in the policy-sensitive two-year note, which tends to fluctuate with shifting Fed rate expectations. But to others, Monday's bond rally simply amounted to a haven rush. "Why would you be buying Treasuries? Because you're worried about what's going on at a geopolitical level, perhaps," Jack Manley, JPMorgan Investment Management global market strategist, said on Bloomberg Television. "If we are indeed in this kind of cold war — at least from a technology perspective — with China, and we have a new administration in Washington, there is a lot of attention being paid to policy volatility." —Katie Greifeld |

No comments:

Post a Comment