| The Federal Reserve sent a clear message that it intends to keep interest rates unchanged for the foreseeable future. US stock futures gaine |

| |

| Markets Snapshot | | | | Market data as of 06:19 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- The Federal Reserve sent a clear message that it intends to keep interest rates unchanged for the foreseeable future. US stock futures gained as traders awaited earnings from Apple. Treasury yields ticked lower.

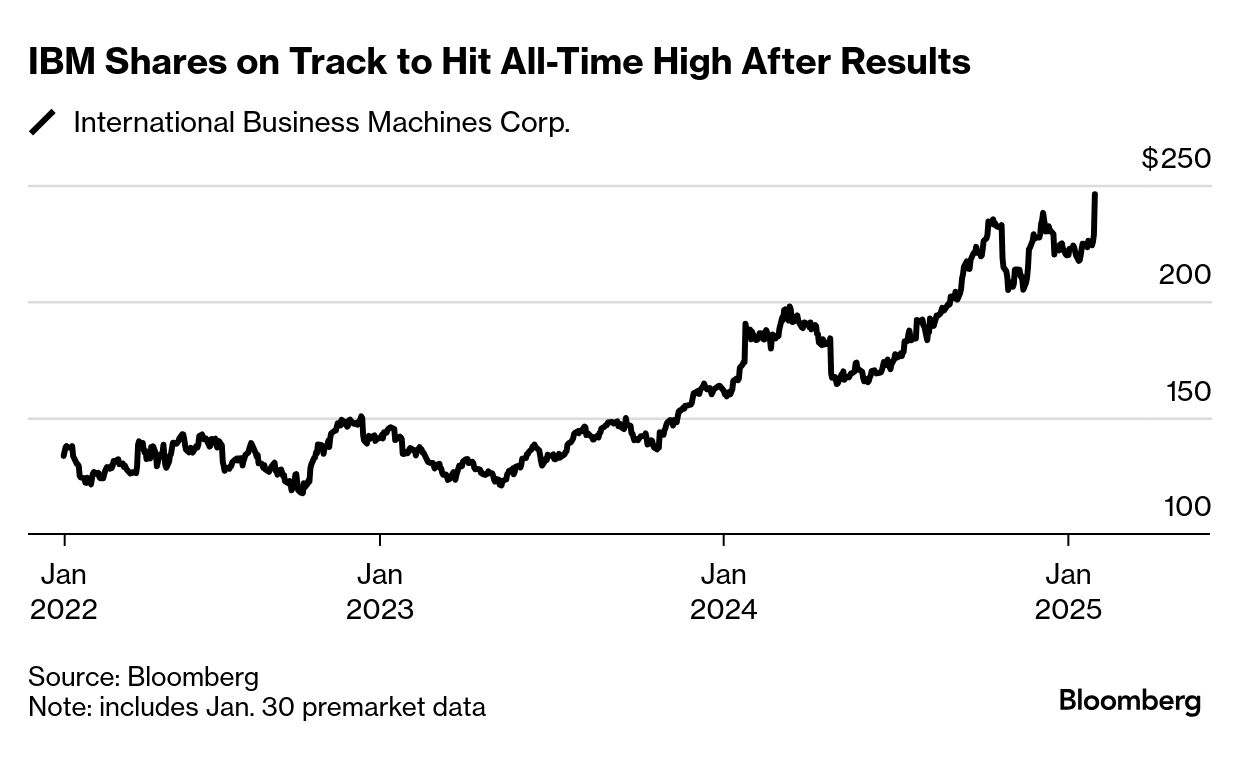

- Microsoft shares drop 3.5%. The company is struggling to build enough data centers to handle AI demand, weighing on growth. Meta is rising after Mark Zuckerberg said 2025 will be a "really big year" for its AI assistant.

- Tesla gains 3%. The carmaker expects to start offering a paid service in June to use self-driving Teslas that won't rely on humans supervising the steering wheel, and also forecast a sales recovery this year.

- The ECB is set to lower rates for a fifth meeting as cooling inflation lets officials further loosen shackles on growth. The euro zone economy unexpectedly stagnated at the end of last year as government collapses in France and Germany bruised confidence.

- Search operations are under way outside Washington this morning after an American Airlines regional jet collided with a military helicopter near National Airport.

| |

Bond traders kept in limbo | |

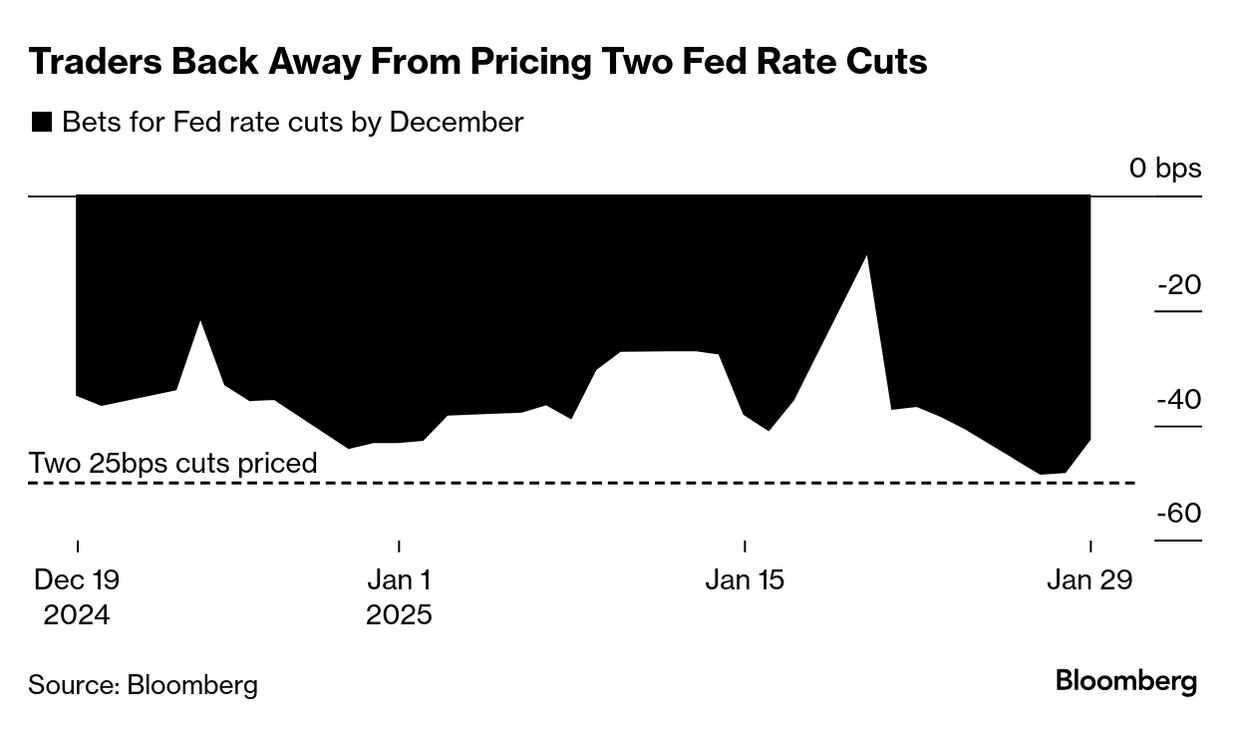

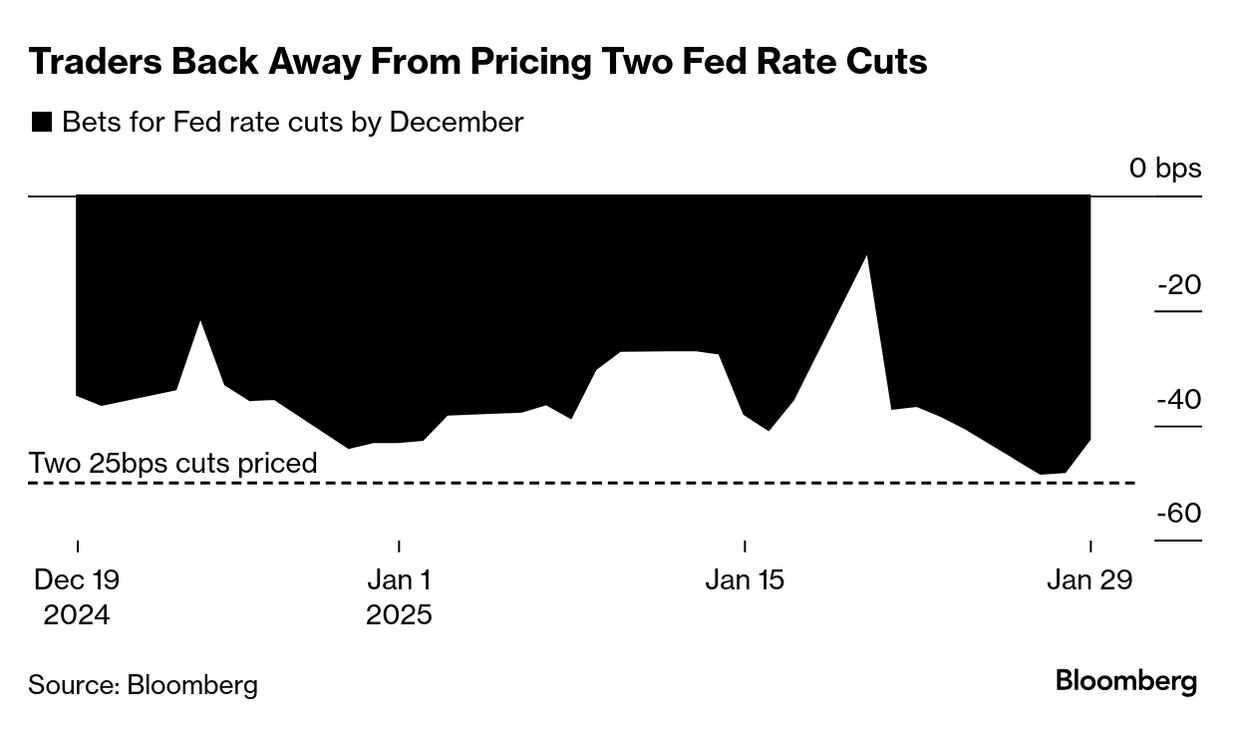

| Bond traders emerged from the Fed meeting with little conviction about where rates are headed as Trump casts uncertainty over the direction of the economy. Treasury yields briefly jumped after the central bank's statement appeared to indicate it held rates steady because its progress on taming inflation had ebbed. But Jerome Powell swatted away those worries — saying he expects consumer-price increases to slow further— and yields came back down, ending the day virtually unchanged and echoing the swings in US stocks.  Powell did little to chart the bond market's direction. He said he expects that the still-restrictive level of rates will slow inflation, which appeared to ease concern that the Fed could shift gears to raising rates. He also declined to comment on how Trump's policies may affect the Fed's path.

"This does not sound like a Fed that's looking for the next opportunity to cut rates," Bob Michele, JPMorgan Asset Management's chief investment officer for global fixed income, said on Bloomberg Television.

Traders are anticipating just one more quarter-point reduction this year, with the potential of a second such move. US GDP data today may show a slower pace of economic growth, while on Friday the Fed's preferred inflation gauge is forecast to show a slight acceleration in December. "There's heightened caution in the bond market at the moment," said Lon Erickson, a portfolio manager at Thornburg Investment Management in Santa Fe, New Mexico. "There's nervousness around the outcome of those policies of the administration." —Liz Capo McCormick and Ye Xie | |

| |

- Today is one of the busiest days for fourth-quarter earnings, with Apple, Intel and Visa reporting. Results are also due from Caterpillar, Mastercard, Cigna, Altria, UPS, Southwest Airlines, Comcast, Northrop Grumman and Blackstone.

- ServiceNow slides 9.4%. The software maker's forecast for subscription revenue was weaker than expected. If the decline in premarket trading holds, the stock is set for its biggest fall since May 2024.

- In Europe, chipmaker STMicro is plunging 8% after the company forecast disappointing first-quarter revenue because of weak demand from industrial and auto clients. —Subrat Patnaik

| |

| |

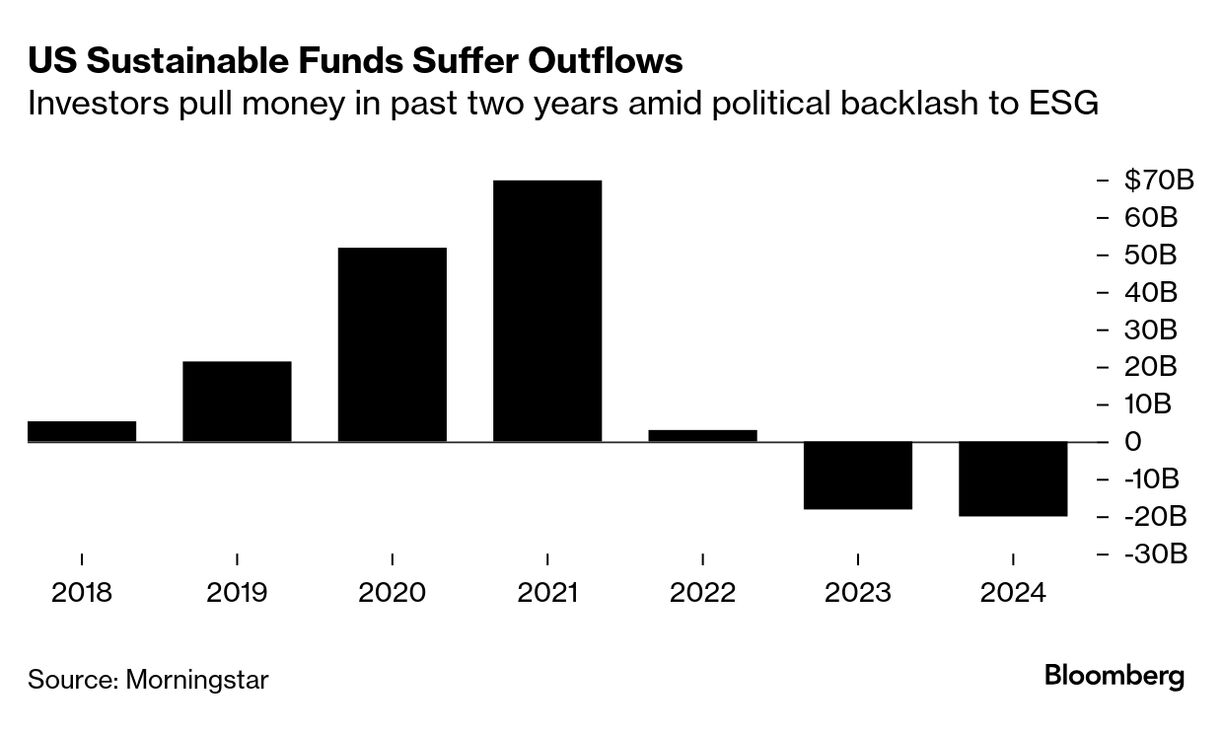

| ESG fund managers are facing one of the toughest moments as investors pull record amounts of money. Funds complying with the EU's strictest ESG standards suffered record outflows last quarter, according to data from Morningstar. ESG fund managers in the US also just had their worst year ever. A record number of funds have scrapped ESG and related terms from their names. It's more evidence that investors are turning away from a strategy that's been plagued by lackluster returns, regulatory fatigue and political backlash. — Frances Schwartzkopff | |

| |

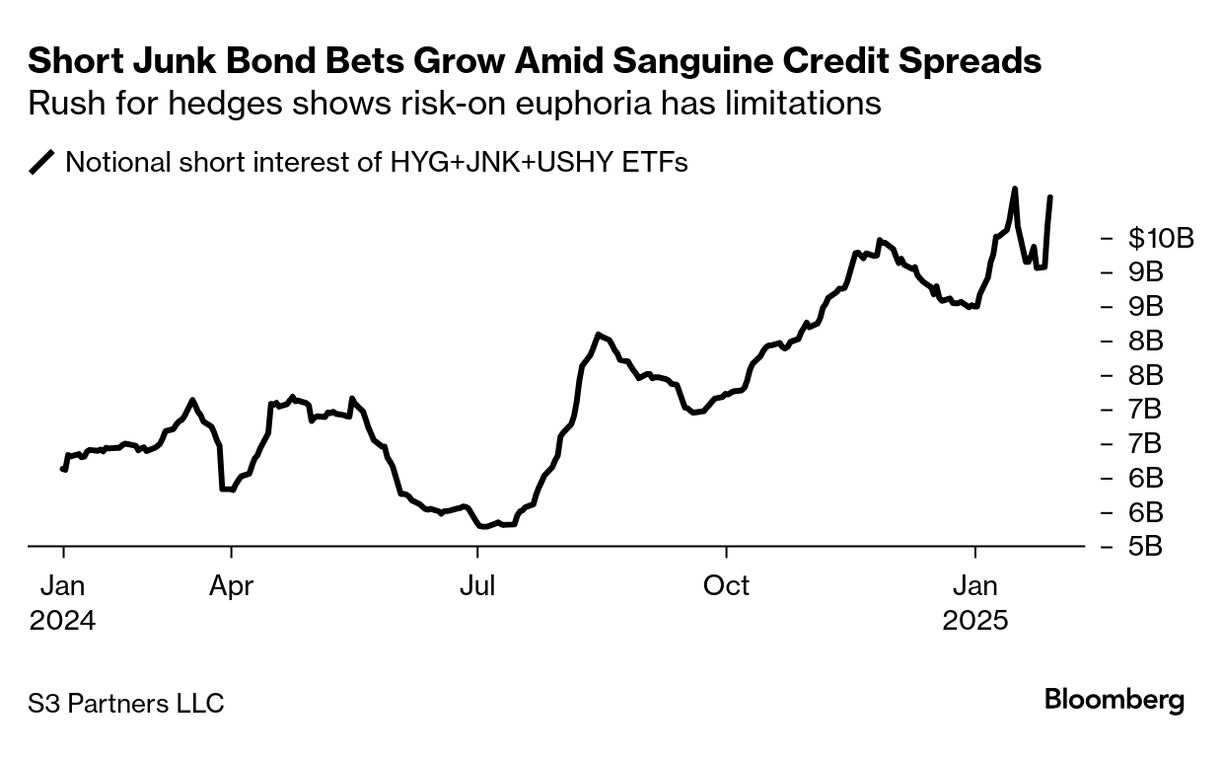

| A small band of Wall Street skeptics are moving to protect their credit portfolios against a market priced like nothing in the economy could possibly go wrong. Investors have placed $10 billion of bets that high-yield corporate bond ETFs will drop, the most since at least 2023, running counter to a New Year rally that's swept through global markets. JPMorgan Chase derivatives strategists are warning that risk premiums are narrowing to levels that are no longer equal to the unpredictable economic and political climate. "You want to take a step back from the market as a whole and buy protection here," said Alberto Gallo, chief investment officer at Andromeda Capital Management in London. "Credit investors have never been so complacent." —Denitsa Tsekova and Ethan M. Steinberg | |

Word from Wall Street | | "We are entering what will be the golden age of private markets." | | Alisa Wood Partner overseeing KKR's private equity strategies for wealth | | Click here to read more | | |

One number to start your day... | | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment