| It was what Wall Street wanted. And this week at least, it's what Wall Street is getting: A market-friendly Donald Trump – talking up policies to boost growth and lower taxes, while dialing back plans to immediately disrupt the world trading order. Despite the protectionist threats of the campaign trail, Trump held off on imposing levies on key trading partners this week, and just last night delivered his most mollifying message yet to China by saying that he would rather not have to use tariffs against the world's second-biggest economy. Cue a relief rally across markets. Add new White House-backed AI investments and friendly words to allies, and Trump's business-friendly posture is adding fuel to the market melt-up. He's also echoing businesses by seeming to pressure the Federal Reserve to cut interest rates.

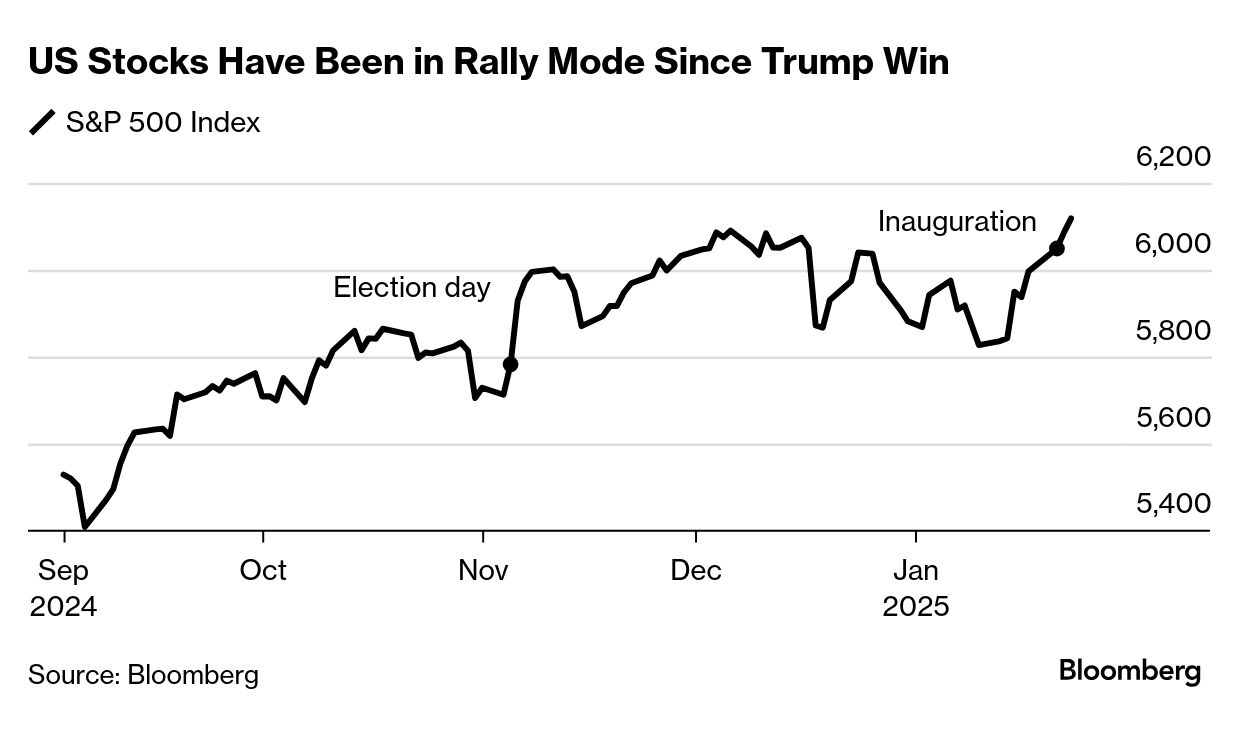

Up 2% this week so far, the S&P 500 is poised for the best start for a new president since Ronald Reagan was sworn in to power in 1985. Global shares have extended their longest advance since August, while haven assets such as Treasury bonds have retreated in the holiday-shortened week. Trump is "going to go into radical capitalism,'' said Michael Kelly, global head of multi asset at PineBridge Investments. "It's going to be a very, very pro-business, pro-capitalist kind of remove-all-the-obstacles type of setting; it's going to be let-it-rip economically and politically. Markets like that." While Trump continues to rage against the globalist order, the disrupter-in-chief is proving no enemy to financial markets so far. Indeed, some remember the trend of his first presidency in which decisions were often "two weeks" away from being implemented.

In fact, the likes of Cathie Wood are betting that the Trump regime will boost innovation and revive IPOs from their slumber, while crypto traders are getting fired up about the new permissive regulatory era. Early losers from the new climate include US electric-vehicle makers and renewable-energy producers. There's been plenty of trademark jawboning in a preview of what the next four years will look like. In his virtual appearance at the World Economic Forum in Davos, Switzerland, on Thursday, the president urged OPEC nations to bring down the cost of oil and for the Federal Reserve to cut interest rates immediately — comments that helped push the S&P 500 back to records.

All told, if anything conclusive can be said about the first week, it's this:

Wall Street optimism abounds that Trump — who famously cited rising share prices as a scorecard on his governance in the first term — will refrain from implementing the most aggressive aspects of his policy agenda, an agenda that has stoked fears about the inflationary outlook and the nation's finances. It's a gamble, of course, with fresh Trump fireworks expected next week, in an already jam-packed trading period thanks to the Fed policy gathering and the start of the Big Tech earnings season. —Isabelle Lee and Lu Wang |

No comments:

Post a Comment