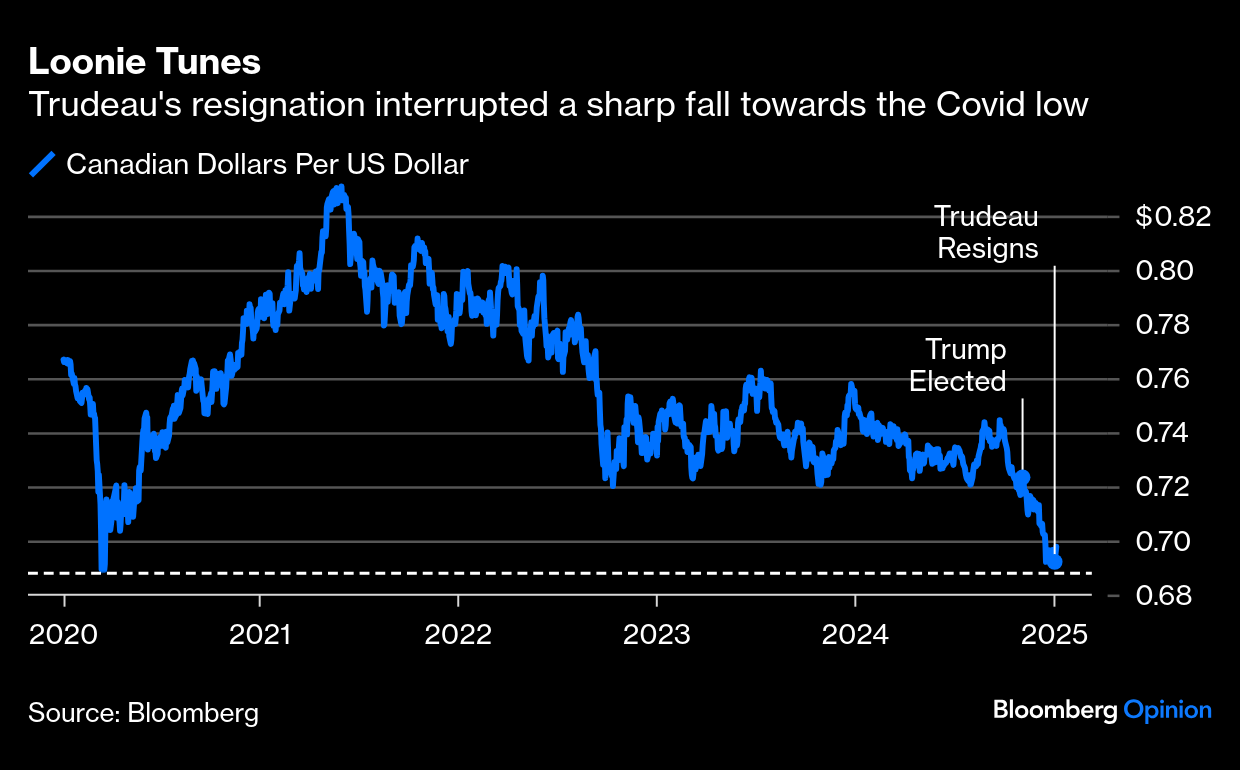

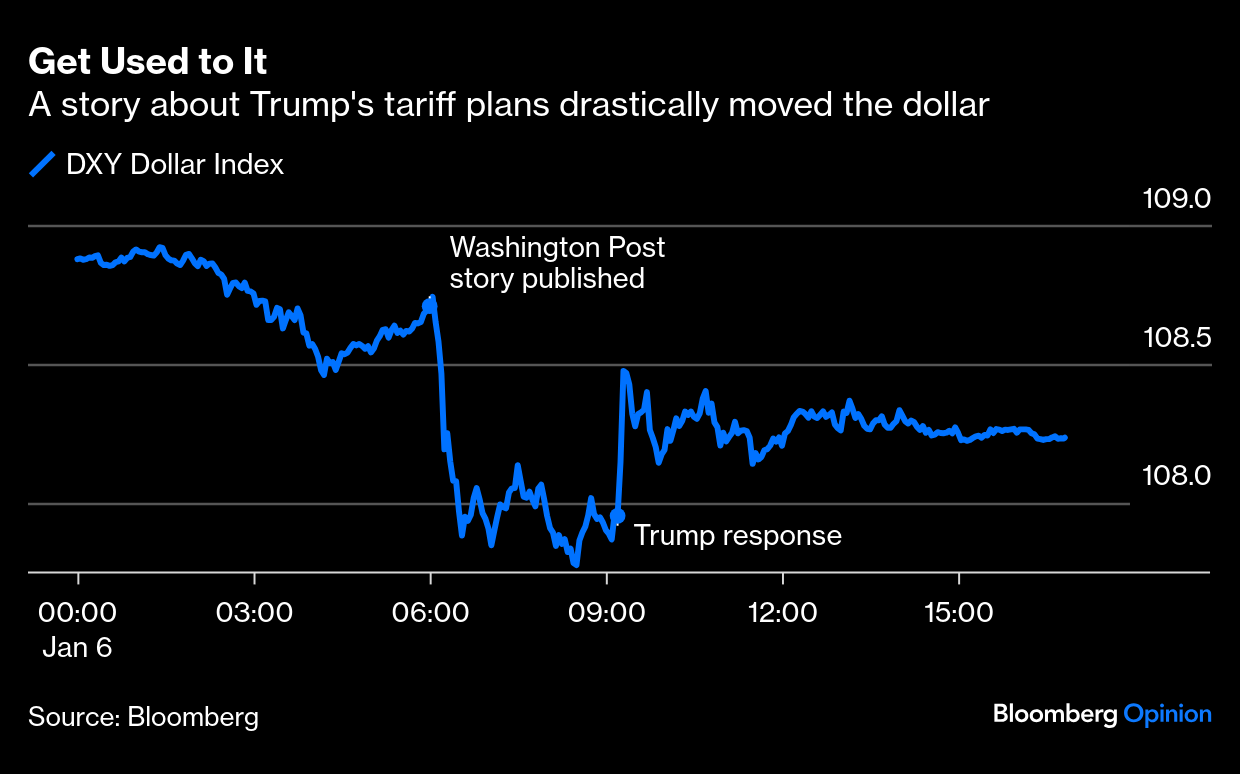

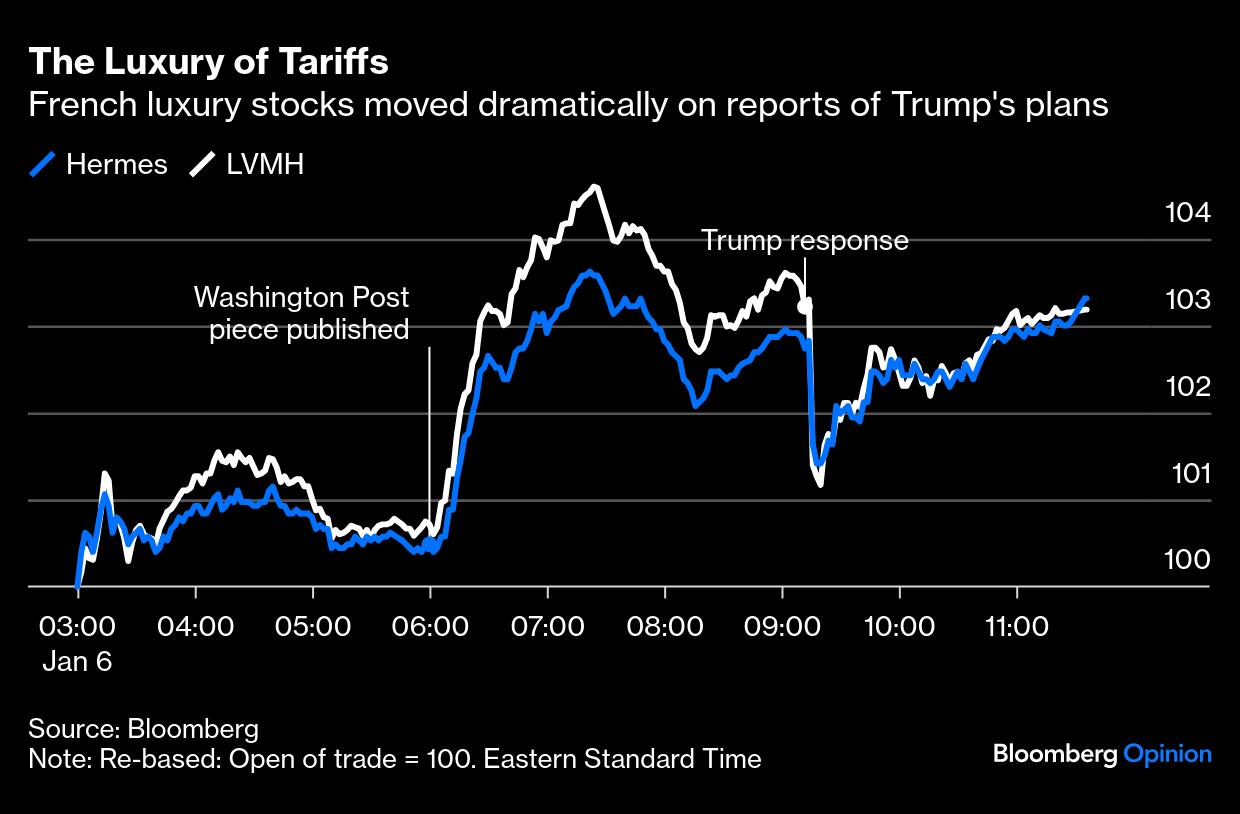

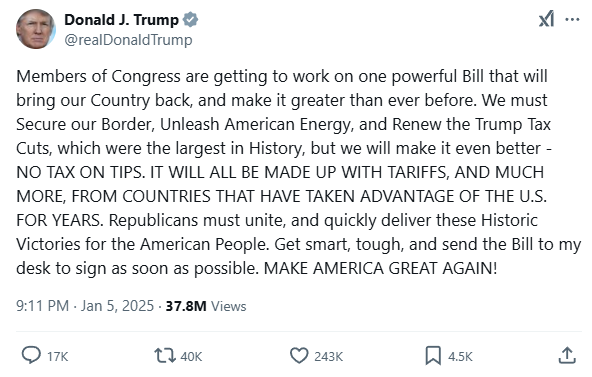

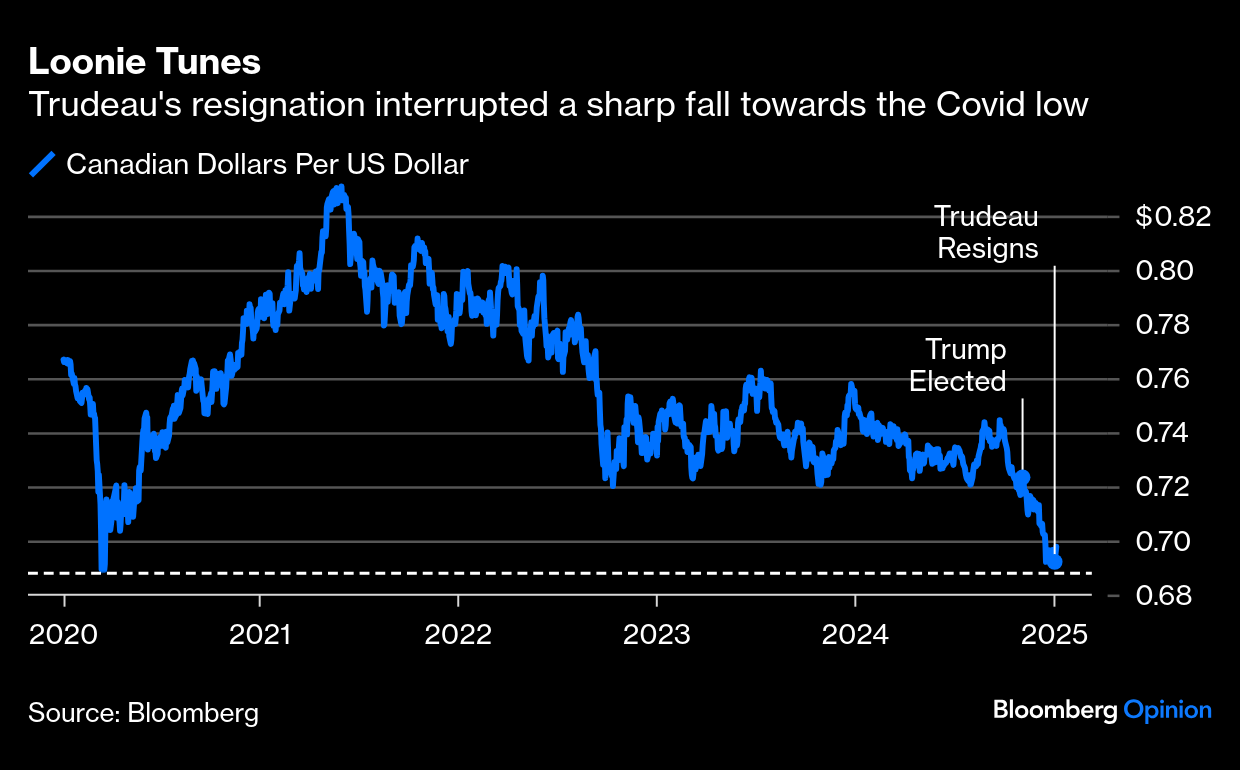

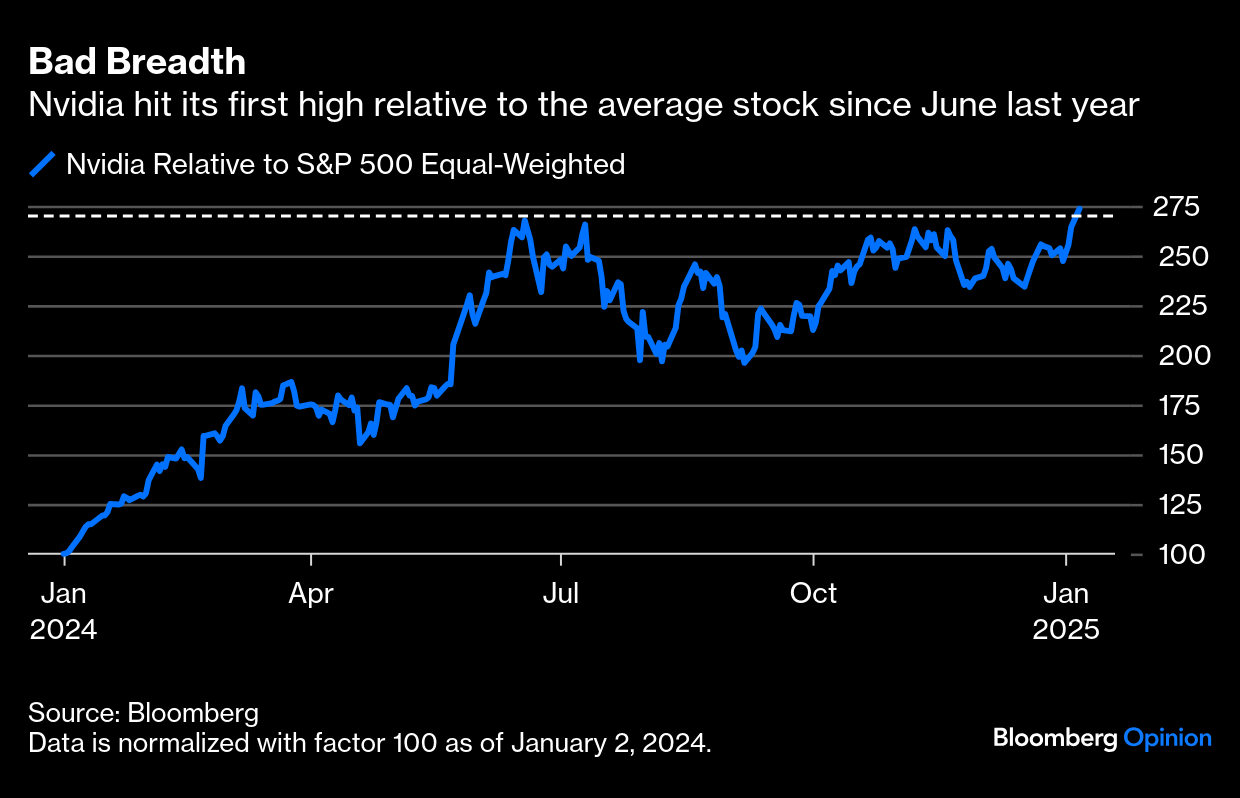

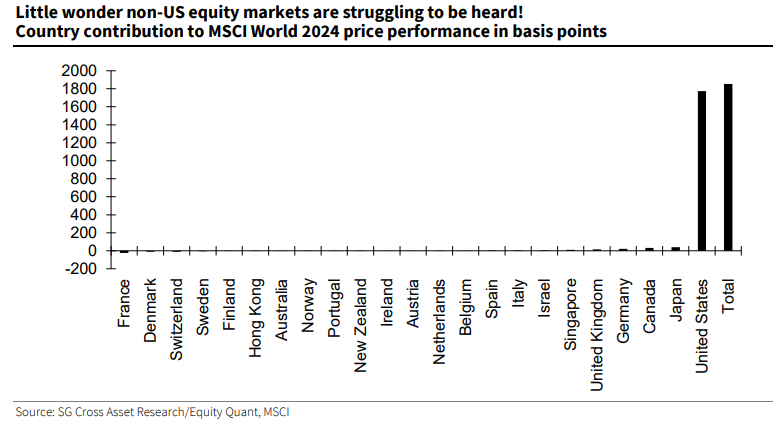

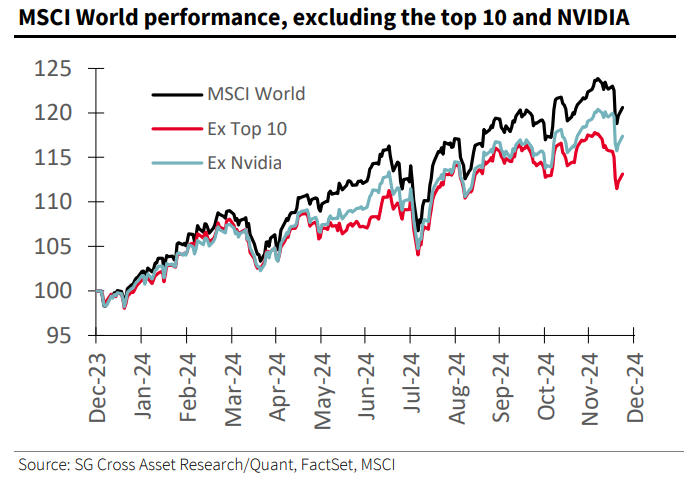

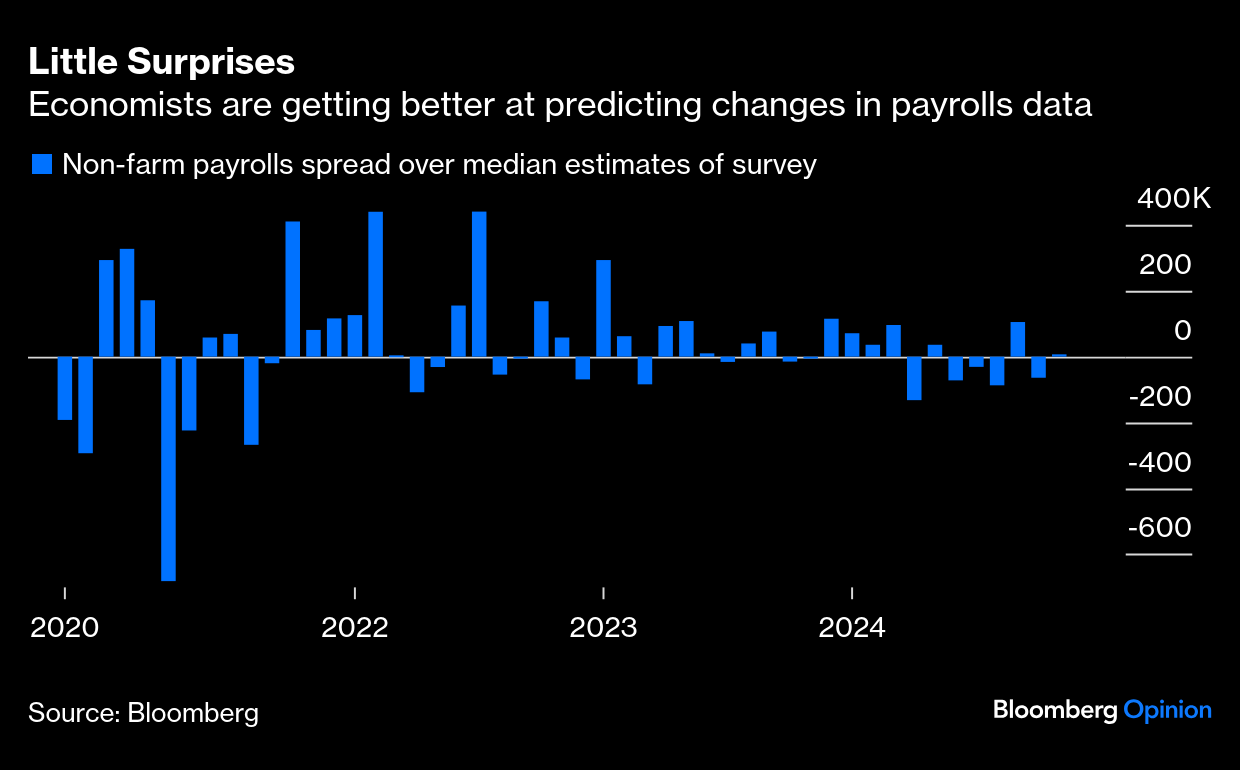

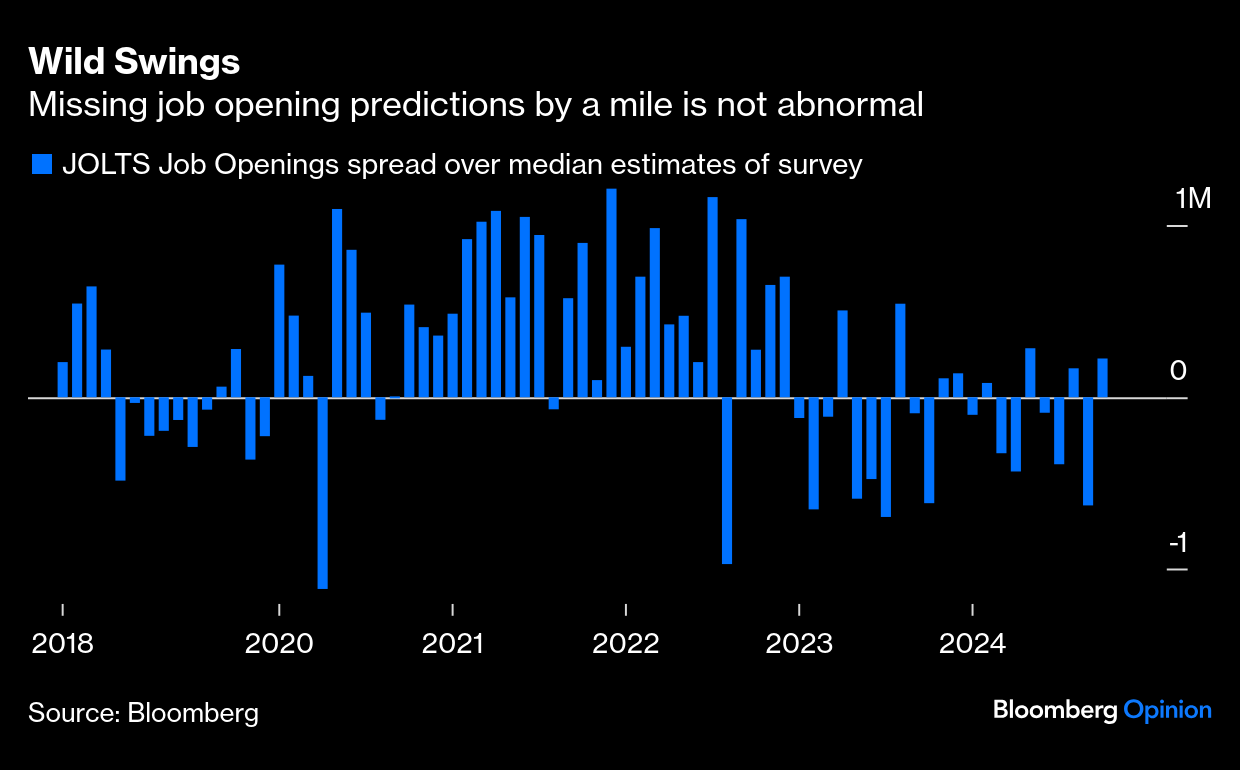

Signals, Noise and Guardrails | We must get used to this. Capital markets' first day back in earnest after the holiday season saw a series of whipsaws that owed more to politics than anything else. Donald Trump's confirmation as the next president was barely more than background noise, largely because as far as the markets are concerned his presidency has already begun. Noise, and the occasional signal, is blocking out everything else. At 6 a.m., the Washington Post published a story saying that the Trump team was "exploring tariff plans that would be applied to every country but only cover critical imports," which it said would "pare back" what had been announced during the campaign. The dollar dropped sharply. A little more than three hours later, Trump's riposte appeared on social media: "The story in the Washington Post, quoting so-called anonymous sources, which don't exist, incorrectly states that my tariff policy will be pared back. That is wrong." The dollar went back up: What's most interesting, apart from establishing that higher tariffs do indeed strengthen the dollar, is that the rebound after Trump's rebuttal wasn't strong. The currency closed weaker for the day. As one banker put it, with "so much in the price, any question mark and you get hurt." The incident also established, if proof were needed, that Trump's tariffs matter far beyond US shores. The big French-based luxury goods manufacturers are greatly dependent on demand from China. This is what happened to the shares in Hermes International SA and LVMH Moet Hennessy Louis Vuitton SE during Paris trading as the story ricocheted across the screens: Why did stocks remain a bit stronger and the dollar weaker after the tariff story and its response? Possibly because markets also had to digest this overnight social media post: This was quite a statement of intent, but it also served as a reminder that the new president's powers won't be unlimited and that constitutional guardrails remains intact. Indeed, Viktor Shvets, global strategist at Macquarie, suggests that the next year will be more about assessing the strength of those guardrails than about second-guessing Trump's first moves. The president-elect has a majority of two in the House, and is far short of a filibuster-proof Senate majority. That explains why he's bundling everything into "one powerful Bill" to be put through the budget reconciliation process, which can avoid the filibuster. Even with Trump's great political strength at present, steering one huge and ungainly bill through Congress will not be easy or quick. Shvets added that other guardrails are stronger than they appear. Most cases don't get to reach the Supreme Court, populated by a comfortable majority of Republican nominees. In lower courts, Presidents Joe Biden and Barack Obama did a good job of ensuring that there are plenty of more sympathetic judges, who could function as a check on power. And then there is the ultimate check of the capital markets. If any policy announcements prompt a surge in bond yields, a run on the dollar, or particularly a bad fall in the stock market, then Trump may well reconsider. This is a strong guardrail — although Shvets concedes that it needs a frightening selloff to do its work. That's not great. Other political moves were afoot. At 11 a.m., the Federal Reserve announced that Michael Barr was standing down as vice chairman for supervision (although not as a governor). He has been seen as a tough bank regulator, and had been the point man for a proposal to require the biggest banks to hold a larger capital buffer. Faced with a possible undignified battle with the new administration over whether it had the power to demote him, Barr decided it was better to go before he was pushed. The result was joy for bank stocks. Although again, the excitement petered out badly in the afternoon:  All of this paled in comparison with the biggest political bombshell of the day — that Justin Trudeau was resigning as prime minister of Canada after nine years. The Canadian dollar had tanked ever since Trump was elected and started talking about imposing a 20% tariff. Already deeply unpopular, Trudeau's fate was sealed last month when he fell out with his finance minister, Chrystia Freeland, who resigned in protest at what she thought was a misguided approach to dealing with Trump. The loonie's free fall ended when Trudeau's news hit the wires:  Canada must hold an election by October and is very likely to install a new right-wing government. The rest of this year promises to be chaotic as the governing Liberal Party chooses Trudeau's successor, who will then have to deal with Trump while trying to rebuild the party's chances with the Canadian electorate. Good luck with that. Trump's latest social media post on the subject, saying that Canadians "Love being the 51st state," is best dismissed, we can hope, as noise. And Shvets points out that tariff arrangements with Canada are codified into US law through the US Mexico Canada Agreement that Trump himself signed. That's a guardrail that should stand.  | | | Another reason for concern: Stock markets are back to relying on the ascendancy of a very few big players. Nvidia Corp. set another new high Monday, which was significant for market breadth. Relative to the equal-weighted S&P 500, a measure of the performance of the average stock, the chipmaker peaked last June, and then lagged as the market broadened. This was its first new high compared to the average stock since then. Maybe the market isn't so much wider after all: Calling the market for this year continues to depend on predicting the fortunes of a few trillion-dollar stocks. To illustrate just how skewed global returns became last year, here's a chart from Societe Generale SA's chief quantitative strategist Andrew Lapthorne that made me laugh out loud. It shows the number of points of the MSCI World index's rise last year that could be attributed to each member country: To ram home that we enter the year uncomfortably reliant on a few dominant platform groups, led by Nvidia, here is another chart from Lapthorne, showing how the MSCI World, which includes 1,400 companies, would do without its 10 largest stocks, and without just Nvidia: The narrowness of the advance is breathtaking, and the incentives to spend time analyzing and understanding smaller markets and non-tech companies are dwindling. Getting a market call right at present has involved getting tech right, and little or nothing else. This must surely reverse at some point, and give stockpickers their chance to shine. But when? Nothing explains resurging US exceptionalism better than the resilience of its consumers. A year ago, a recession forecast made sense. While there have been scares, notably the triggering of the Sahm Rule — named for Bloomberg Opinion colleague Claudia Sahm — the economy still hums along, thanks in large part to the US consumer's continuing appetite. If the optimism on Wall Street is anything to go by, exceptionalism can keep going, but that will require prolonged consumer resilience. Ascertaining consumer health is an intense data-driven exercise with many moving parts, some of which we'll see in action this week. Friday's nonfarm payrolls will offer a snapshot of the labor market. The median estimate of economists surveyed by Bloomberg is a rise of 160,000 jobs, significantly down from November's 227,000. Although recent forecasts haven't necessarily been spot on, the deviation from the actual prints is narrowing, which suggests that the pandemic is no longer distorting predictions: The Job Openings and Labor Turnover Survey (JOLTS), another vital data point, should be out within hours of receiving this newsletter. Data collection problems appear to threaten the reliability of this metric. Bloomberg Economics notes the survey has low response rates, which have correlated with volatility and large revisions, as shown in this chart: Still, the economists highlight a labor market trend that shouldn't be dismissed. The labor market is now back to almost perfect balance, with one vacancy for each unemployed worker: After job openings declined swiftly in September and partially recovered in October, private-sector data suggest they increased in November by approximately 120,000 to 7.86 million. Despite the increase in openings, the increase in unemployment that month would bring the ratio of vacancies to unemployed workers down to 1.075 from 1.109 in October — a further loosening of the labor market that policymakers will view unfavorably.

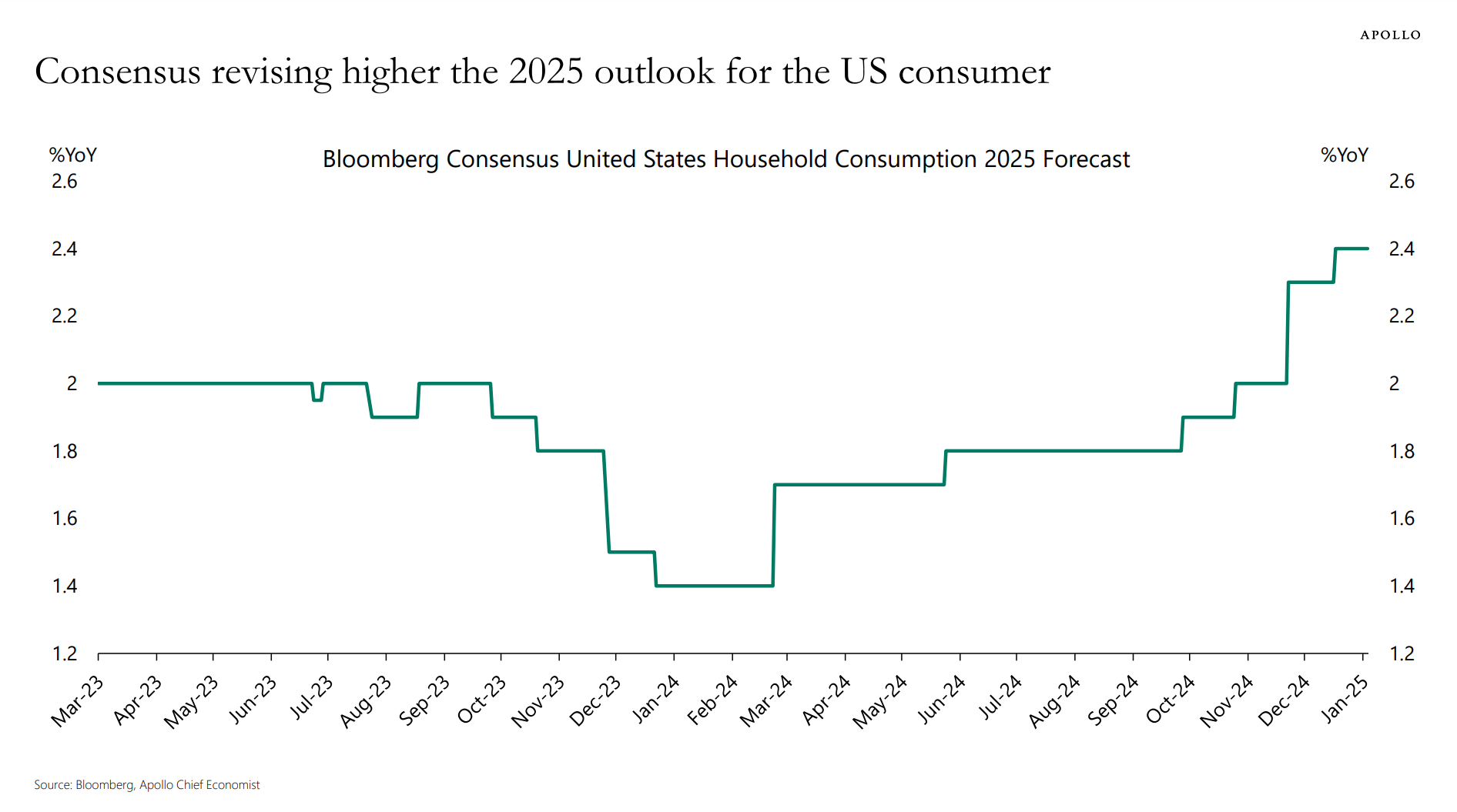

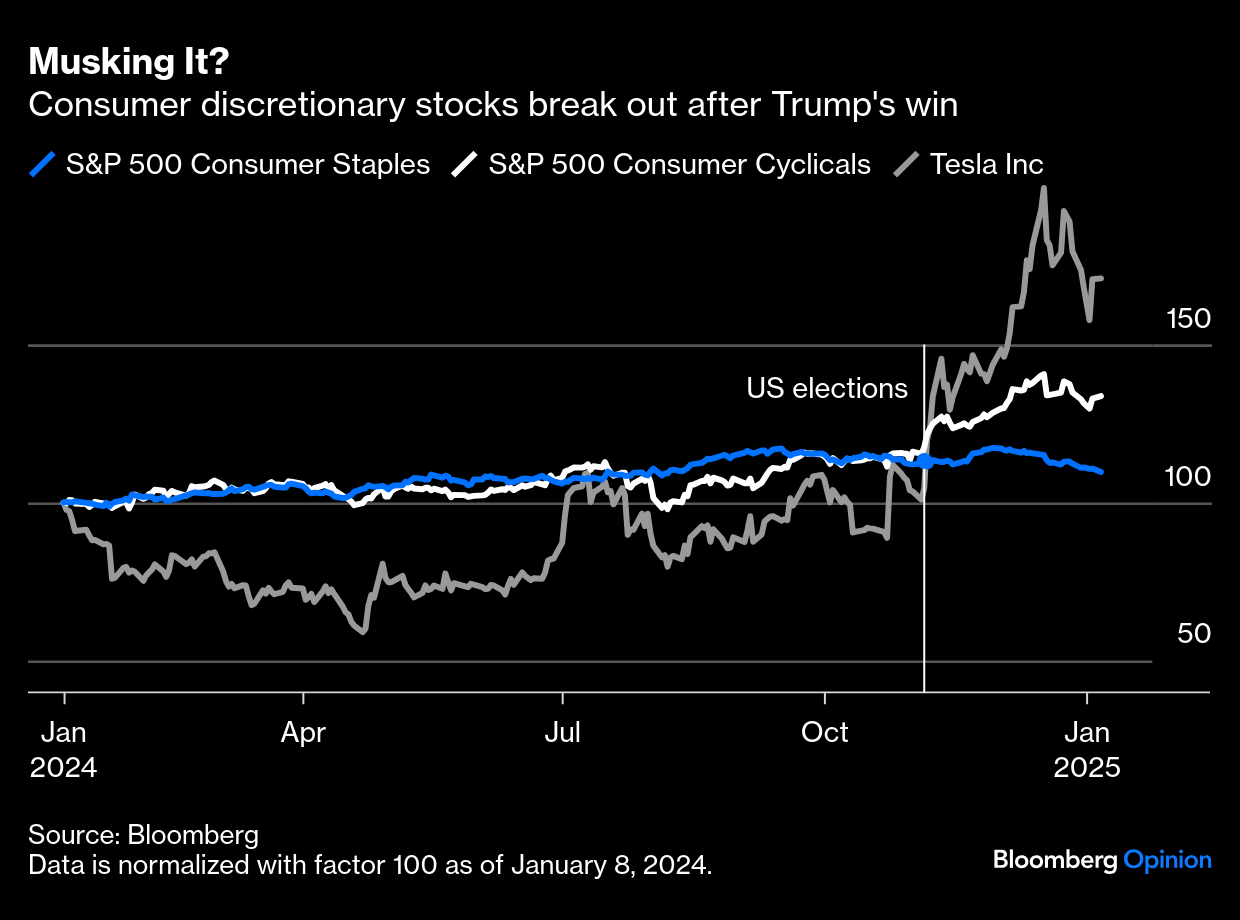

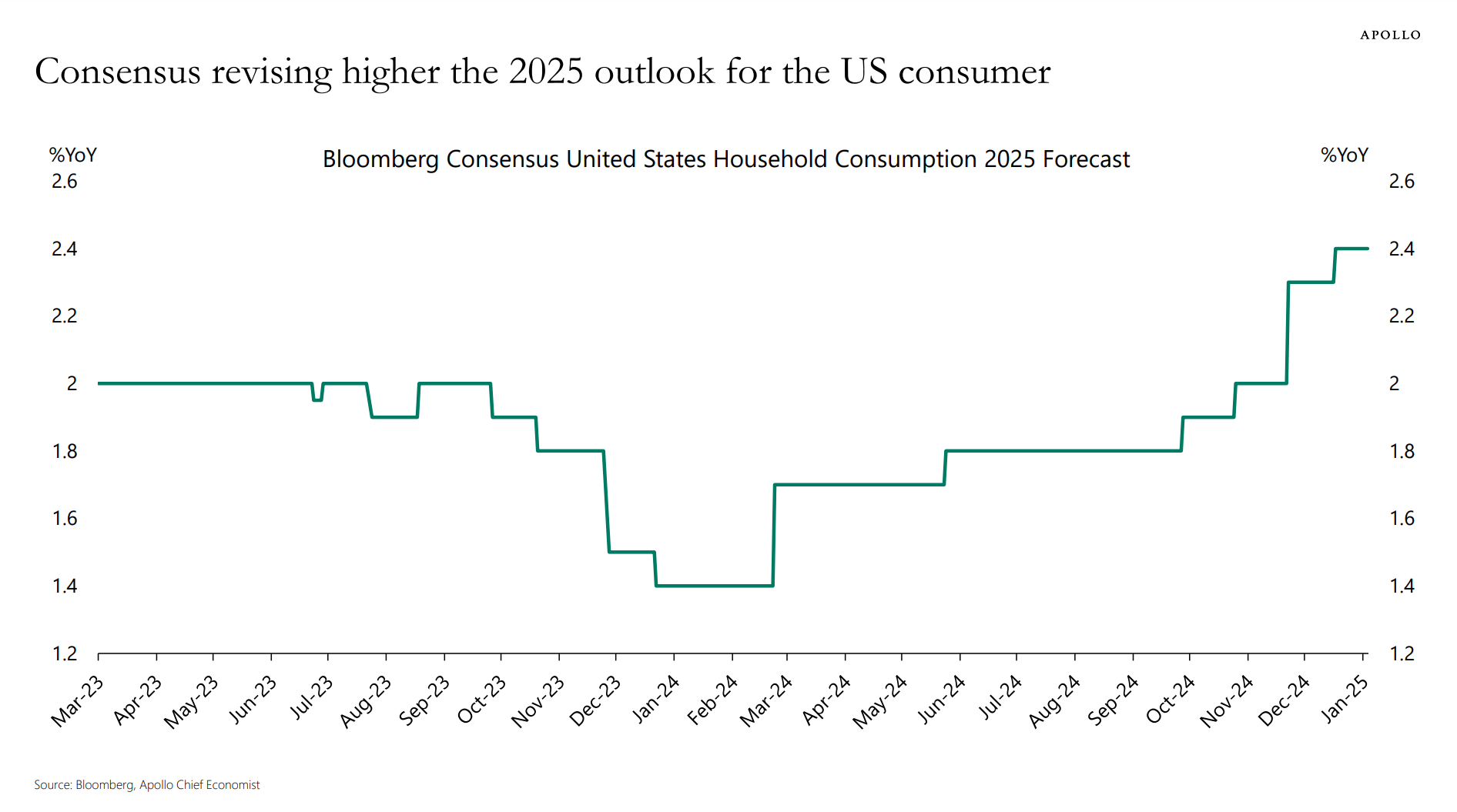

Wall Street's US optimism isn't new, but the US consumer looks to be in good shape. A healthy consumer probably means good business for consumer discretionary stocks, which have indeed surged since the election — although much of that is driven by Tesla Inc. and Elon Musk's perceived strength: Staples were range-bound for the better part of last year, but outperformed cyclicals until Fed cuts and the election changed things in the last quarter. On balance, they're unlikely to outperform again for a while. Torsten Slok of Apollo Global Management Inc. sees no immediate deterioration in consumers' health. He reasons that incomes, stocks and home prices are high, debt levels and interest-rate sensitivity are low, and banks are more willing to lend to households. As he shows, consensus estimates polled by Bloomberg suggest that the Street is with him, with 2025 household spending predictions hiked several times since the election:  An analysis of consumer-spending data via the Bloomberg Second Measure suggests an uptick in some categories of discretionary-services spending — such as air transportation and accommodation — compared to a year ago. This aligns with the latest Bloomberg household consumption survey. If this week's employment data are in line with forecasts, the story will continue to look good — and any negative surprises would be important. For now, the consumer is in a better place, and that props up US exceptionalism. —Richard Abbey Getting back to signal and noise, the best use for the latter is to provide music to help you vent. I used to have a mix-tape called "Noisy." Some of my faves included Ride's Leave Them All Behind, Ace of Spades by Motorhead, Enter Sandman by Metallica, The Electric Co. by U2, and Led Zeppelin's Immigrant Song. Sometimes you need to blast yourself. Any other suggestions? Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment