| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, financiers with dubious links to Gulf royals are clouding the $1 trillion market, Abu Dhabi Investment Authority is deepening its hedge fund push and Saudi listings are grabbing the spotlight in the Gulf's IPO boom. But first, Jared Kushner is doubling down on his Gulf relationships. In the days leading up to Donald Trump's swearing in, his son-in-law has unveiled a slew of deals with entities tied to the Middle East. Just over a month ago, Jared Kushner disclosed that his Affinity Partners had raised an additional $1.5 billion from the Qatar Investment Authority and Abu Dhabi-based asset manager Lunate. Last week, Bloomberg News reported that the firm got the approval to double its stake in one of Israel's top financial firms and is partnering with Emirati billionaire Mohamed Alabbar on a luxury development in the Serbian capital: Trump Hotel Belgrade.  Rendering of the Trump Hotel Belgrade. Source: Studio Genesis "I thought the tower would make a tremendous Trump Tower, so I spoke to Eric about it, and he was very excited," Kushner said in an interview with Bloomberg News. "So we'll be bringing them in as our hotel partner." Eric Trump, is Kushner's brother-in-law and executive vice president at the Trump Organization. Kushner served as a senior White House adviser and played a pivotal role in the agreement that normalized relations between Israel and some Arab nations in 2020. After leaving his government role, he set up Affinity, which now counts the Saudi Public Investment Fund, the QIA and Lunate as its three largest limited partners.  Jared Kushner Photographer: Hollie Adams/Bloomberg Kushner has previously said he closed on the firm's recent fundraise before the election. "I made very clear to them that in the event that Trump was elected, that they should not expect anything from me," he said in December. That's a message echoed by Eric Trump, who was in Riyadh recently. The Trump Organization has in recent months inked deals to build villas in Oman and new towers in Saudi Arabia and Dubai. Anyone doing business with the firm to curry favor with the incoming president will be coming to the wrong guy, he said at the time — "My father has nothing to do with the company and I have nothing to do with Washington DC."

Related Coverage: Trump's Inauguration

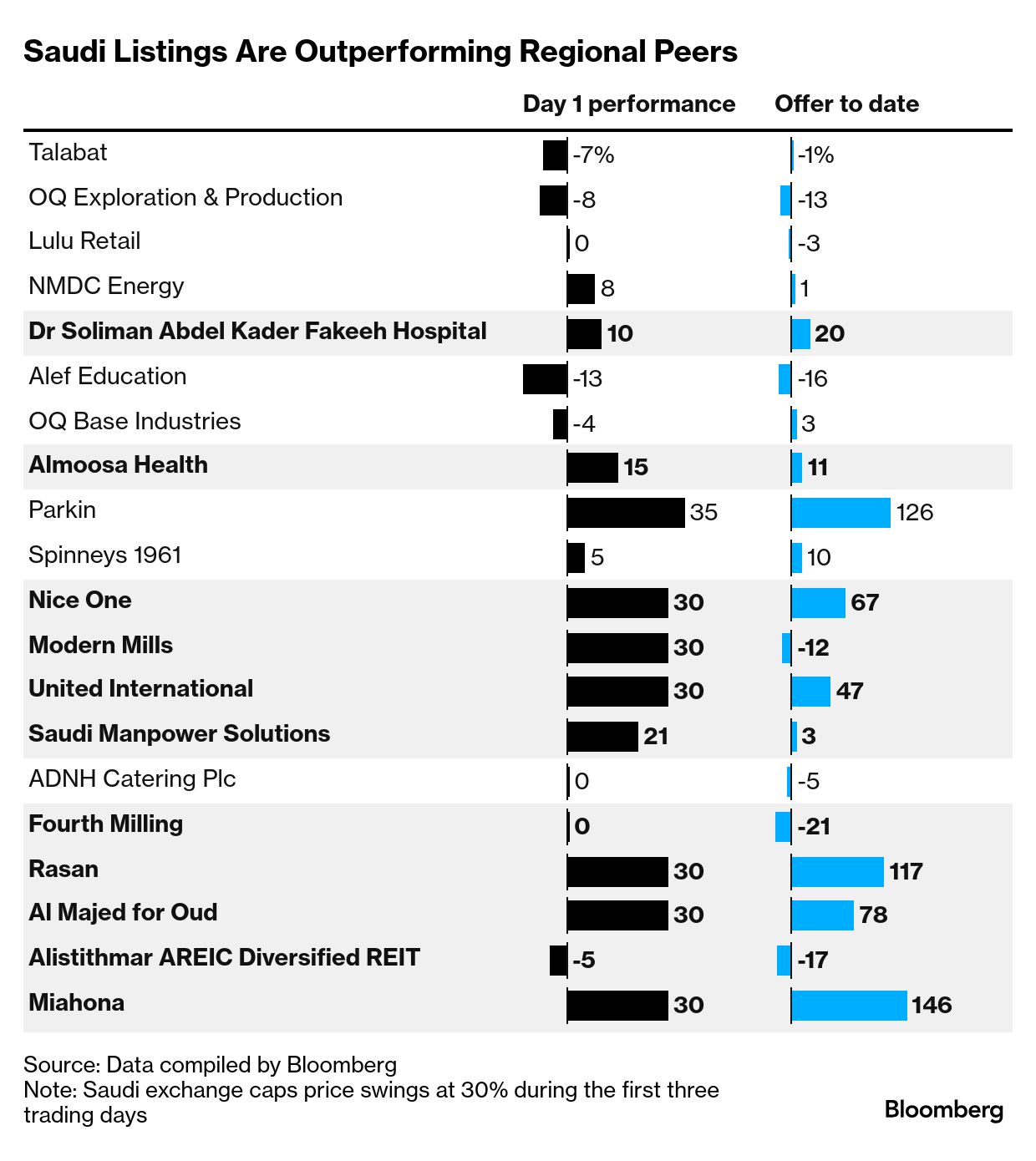

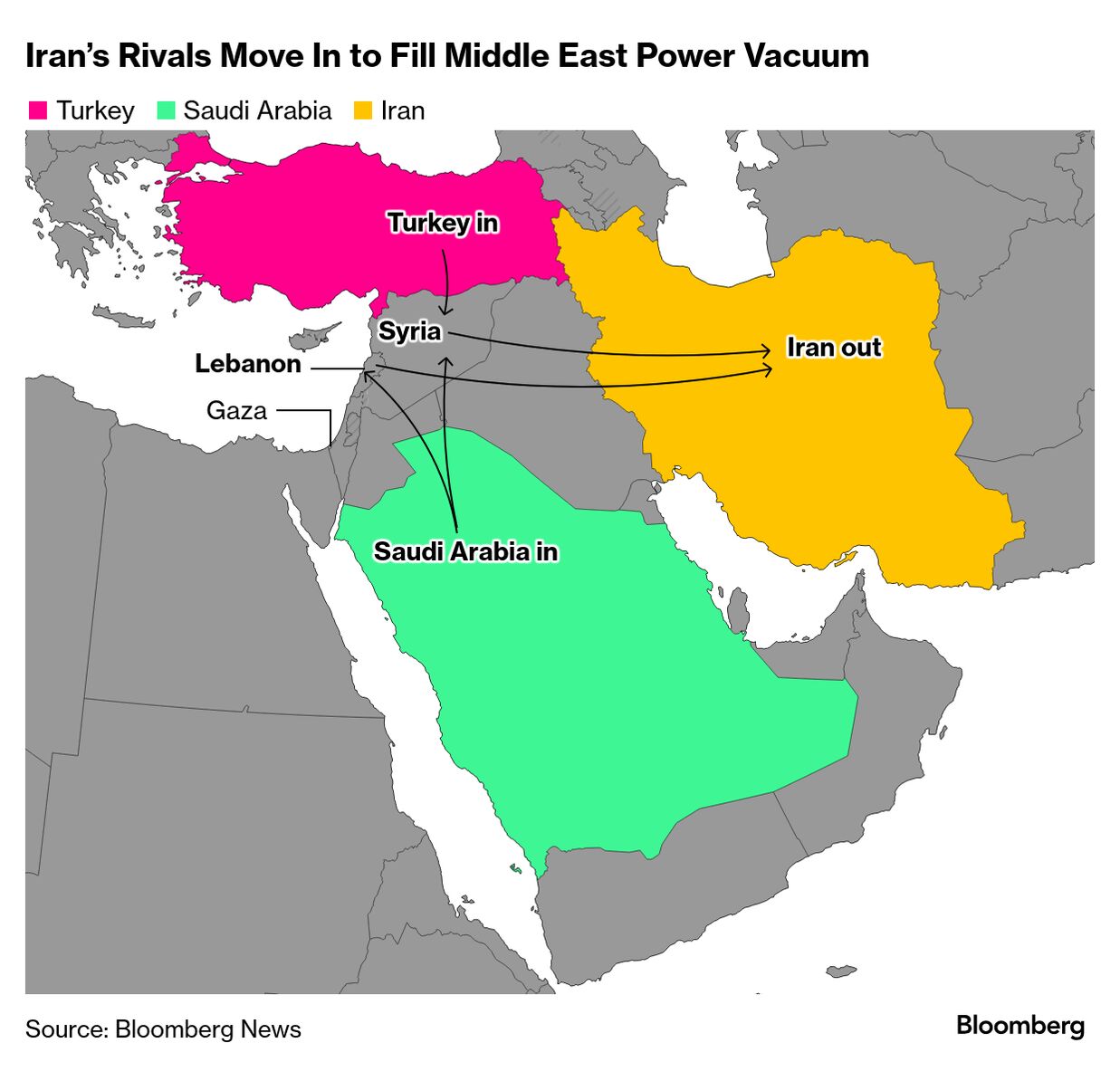

Initial public offerings from Saudi Arabia have been the star performers in the Middle East, where some high profile regional listings have had tepid debuts in the last few months. While not all Saudi listings have done well over the past 12 months, stocks that went public in the kingdom have seen more first-day pops and better after-market performance than in any other Gulf bourse, data compiled by Bloomberg show. It's a contrast with three of the region's largest listings last year. Talabat Holding and Lulu Retail from the United Arab Emirates as well as Oman's OQ Exploration & Production all saw disappointing starts. Aside from Parkin's blowout Dubai IPO, all other newly-listed stocks in the UAE have seen more muted gains. The divergence boils down to investor preferences, according to Salah Shamma, Franklin Templeton's head of investment for Middle East and North Africa equities. In Saudi Arabia "investors have become much more appreciative of growth companies, which is typical of the private companies that're coming to market," Shamma said in an interview with Bloomberg TV's Lizzy Burden. "That is a breakaway from the rest of the Gulf Cooperation Council — specifically in the UAE, where investors are much more anchored on high-yield, dividend-paying names, which is typical of mature companies." Must-read Mideast stories | The Abu Dhabi Investment Authority bought a minority stake in a Canadian platform that makes it easier to allocate capital to multiple hedge funds. KKR is set to buy a stake in one of the Middle East's largest data center firms as demand for digital infrastructure skyrockets. Abu Dhabi wealth fund Mubadala will proceed with a restructuring of Turkey's grocery delivery startup Getir. Co-founder Nazim Salur vowed to fight on. First Abu Dhabi Bank's head of global markets and chief operating officer are leaving as the exodus of senior managers continues. Saudi Arabian lender Riyad Bank is working with JPMorgan Chase on a potential IPO its investment banking arm, at a valuation of around $2.5 billion. The operator of Zara clothing and Virgin Megastore chains in the Middle East has invited banks to pitch for roles on a potential IPO. GEMS Education is opening a new $100 million campus in Dubai where annual fees could reach as high as $56,000.  A rendering of the new private school from GEMS. Source: GEMS Education Saudi Arabia's largest miner is considering an international bond sale to help fund its expansion plans. Saudi Arabia's crown prince is moving swiftly to fill the void in the Middle East left by a weakened Iran. Abu Dhabi's main renewables energy company is looking to expand its business in the US. A mixed martial arts company backed by Saudi Arabia is in discussions to host events in Dubai and Qatar.  A Professional Fighters League fight in Riyadh in November. Photographer: Mohammed Saad/Getty Images Here're a few other stories that caught my eye:

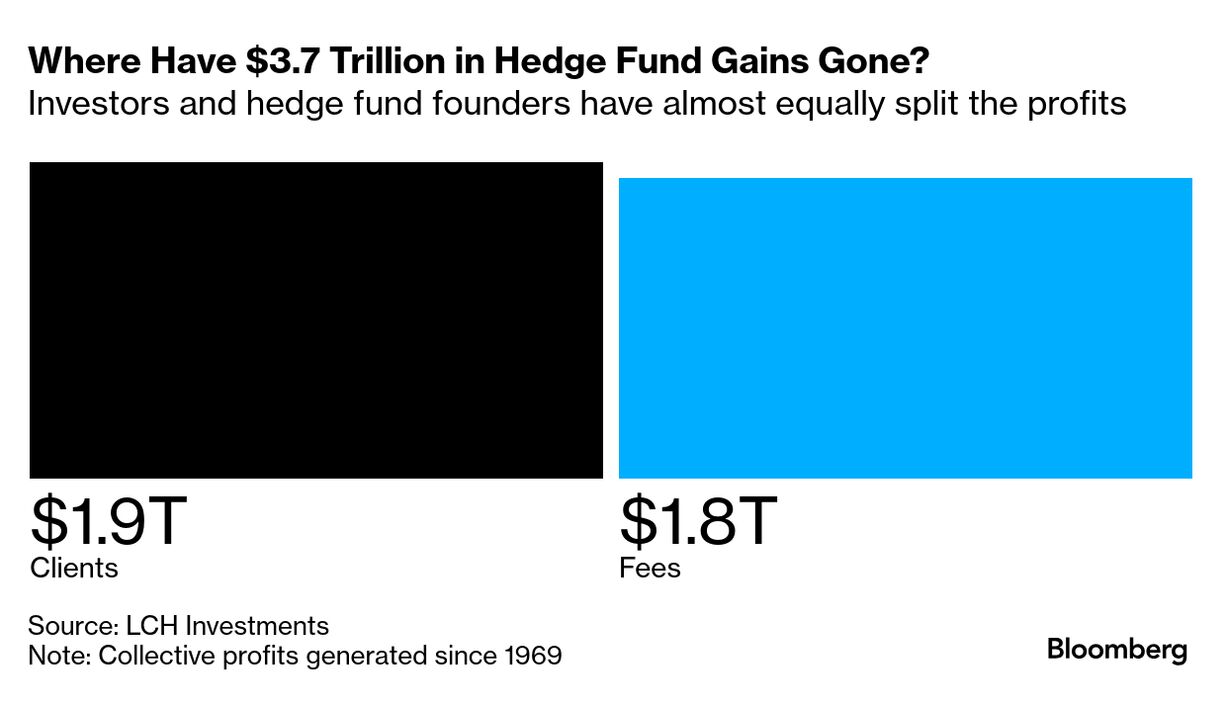

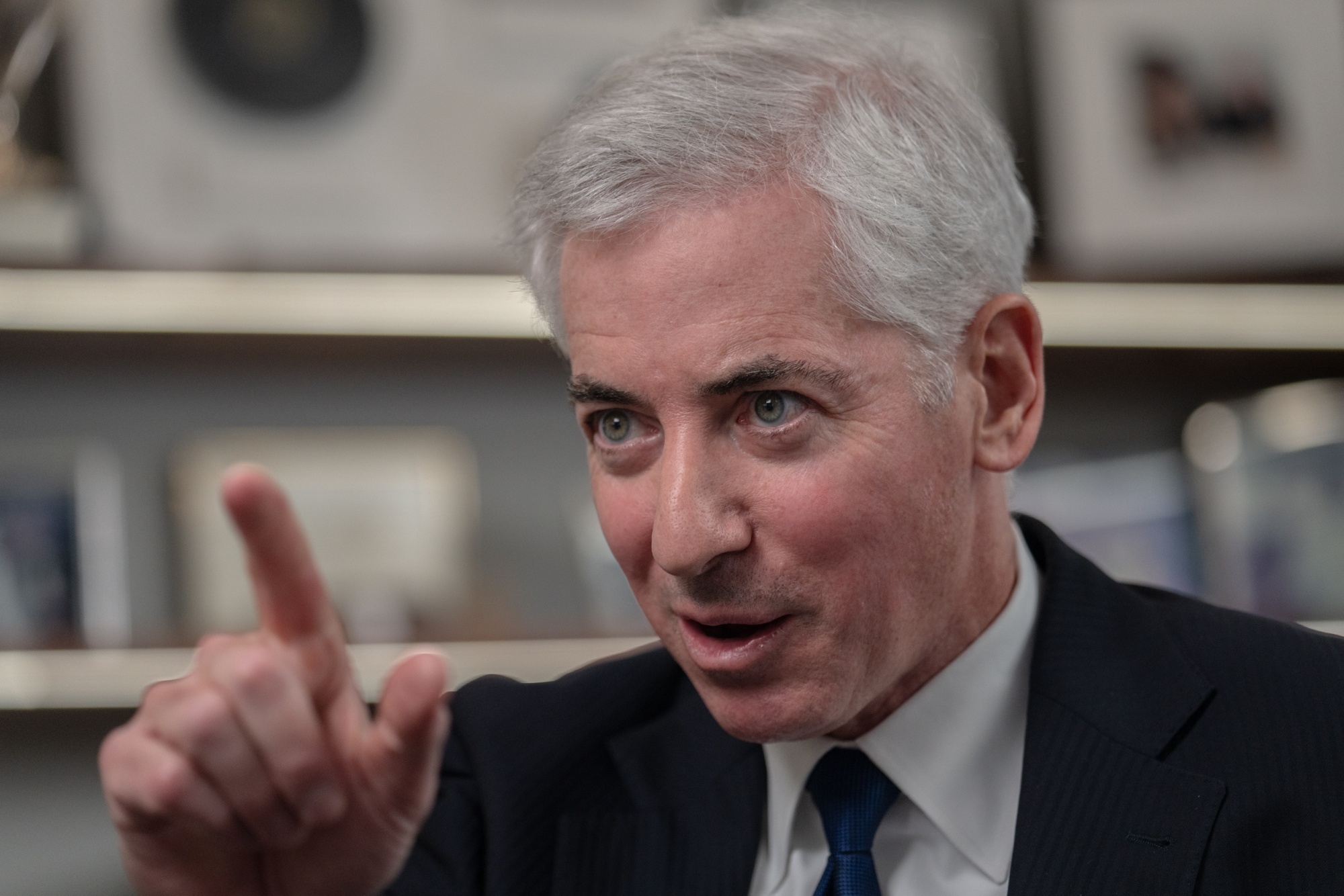

| Hedge funds have kept $1.8 trillion as fees since 1969, nearly half their total gains, according to a new estimate. Citadel, the hedge fund manager founded by Ken Griffin, sold $1 billion of high-grade bonds to fund a payout to its owners. BlackRock attracted an annual record of $641 billion in client cash, lifting its total assets to almost $11.6 trillion. Bill Ackman's Pershing Square proposed a deal to merge a subsidiary with Howard Hughes Holdings in an effort to build the real estate developer into a "modern-day" version of Warren Buffett's Berkshire Hathaway.  Bill Ackman, chief executive officer of Pershing Square Capital Management. Photographer: Jeenah Moon/Bloomberg Citigroup eliminated more jobs in a push to meet CEO Jane Fraser's commitment to expense reductions. Meantime, HSBC is set to buck an industrywide trend of higher banker bonuses. Goldman Sachs got a $472 million boost from a type of investment the firm has been trying to wind down. Also Read: Short Seller Nate Anderson Says He's Disbanding Hindenburg Indian startup Byju's downfall is wiping out US debtholders. Hong Kong's government is exploring options to raise taxes on the city's highest earners for a second straight year. Investors looking to raise money from the wealthy Gulf petrostates are increasingly facing a conundrum: How to navigate a landscape littered with people touting tenuous ties to the region's royals. Take these recent examples: A Lebanese national who pitched himself to Texas small-business owners as a Dubai prince, was running a complex financial fraud. One dealmaker recently claimed to represent the family office of a little-known Emirati princess. Another said he would start a multi-million dollar family office in Hong Kong, touting his relationship to the ruler of Dubai. A third presented himself as a powerful sheikh's adviser who could help foreign investors secure exclusive access to the country's fledgling casino industry. The biographies were different, though the implication the same: Wealth beyond imagination and access to a more than $1 trillion family office market. But in those cases the vaunted royal ties were distant at best, the biographies exaggerated, the money a specter. For the UAE, the recent cases have cast a shadow over the reputable family office scene — and opened the door to confusion. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment