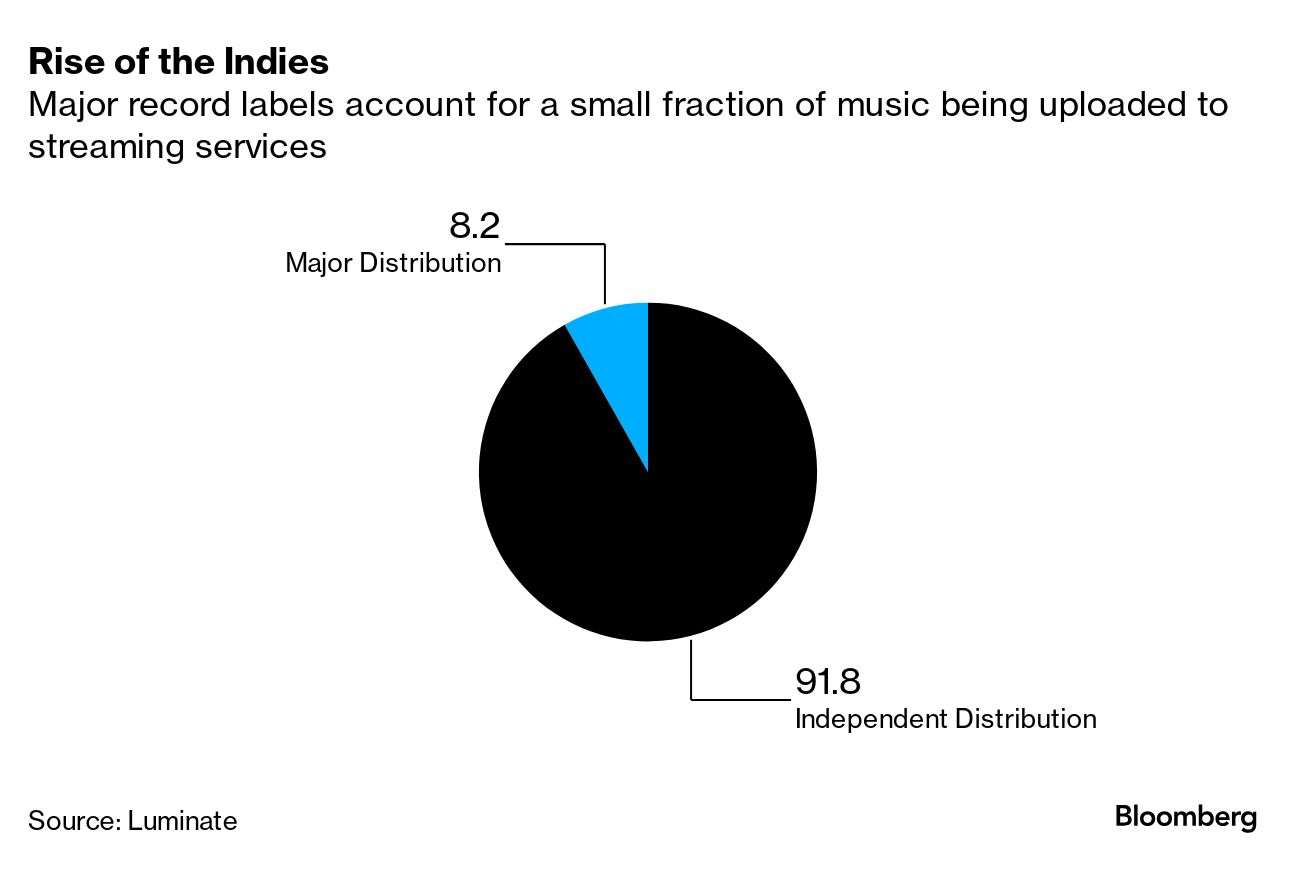

| Days before Thanksgiving last year, Kevin Hart's production company laid off about 20 people, nearly one quarter of its work force. Not long after that, the chief executive officer, chief financial officer and chief content officer of Hartbeat all departed. The departures are amicable, but followed a disagreement about the direction of the company, which produces films and TV shows, audio series and branded content, according to several people familiar with the matter. Hart has stepped in as CEO, at least for the time being, the third leader for the company in less than two years. The turmoil at Hartbeat reflects the challenges facing all independent production companies during Hollywood's current age of austerity. As major studios and networks cut their output and budgets, production companies aren't selling as many shows or getting the same terms. Hartbeat is a profitable, diversified media company in a down market. There are worse places to be. But Hartbeat isn't just another production company. It's one of a handful of firms run by major celebrities that capitalized on the streaming boom to raise hundreds of millions of dollars at valuations that boggled the mind. Hartbeat raised $100 million from Abry Partners at a reported valuation of $650 million in 2022. These companies are tweeners — much larger than your average production company, but not large enough to be a proper studio. That was fine during the streaming boom when media companies produced more film and TV than at any point in Hollywood history. But it's become more of an issue as the industry suffers through a recession. These companies are too big to subsist on producer fees and too small to command ownership of most of their output. We've covered the challenges of Reese Witherspoon's Hello Sunshine and LeBron James' SpringHill. Unlike SpringHill, Hartbeat is profitable and has a more modest staff. Yet like those companies, Hartbeat must figure out how to deliver on a valuation that is far too high given its financial performance. One of the most successful comedians and actors of his generation, Hart has always been one of the hardest-working people in Hollywood. He is one of the biggest touring comedians alive, acts in at least one movie every year and appears in more commercials than you can remember. He started producing film and TV projects more than a decade ago. Celebrities that want to produce only need a few employees. They need a producing partner to run the show, executives to oversee development of projects and a couple assistants. These companies collect fees for producing the projects in which their famous founders star. The good ones, like Margot Robbie's LuckyChap Entertainment or Brad Pitt's Plan B, build up slates that have nothing to do with their founder. Hart had ambitions of building something more. He wasn't content to be a famous multi-millionaire. He wanted to be a billionaire. He formed a separate company, Laugh Out Loud, to create comedy video for the internet. He built an advertising business with clients like Lyft and Procter & Gamble. He produced YouTube videos and podcasts for SiriusXM. He was a media entrepreneur before many of his peers. Hart formed the current incarnation of Hartbeat in 2022 by merging all his businesses under one roof. Just months earlier, SpringHill earned a valuation of $725 million while Hello Sunshine sold in a deal that valued the firm at $900 million. Neither firm owned much. Hart sold a 15% stake in Hartbeat to Abry and put Thai Randolph, who had been running Laugh Out Loud, in charge. Randolph had spent most of her career up to that point working in marketing and advertising. "We've been very deliberate about diversifying our businesses," Randolph told Bloomberg TV in 2023. Hart made that deal just as Hollywood entered a recession. In late 2023, Hart parted ways with Randolph and later reduced the company's head count in its advertising business. Hart asked several of his advisers who he should hire to run his company, and they introduced him to Jay Levine, who had spent most of his career working at Warner Bros. Levine took over Hartbeat in early 2024 with the mission to clean up many of its deals and put the company on stronger financial footing. Now Levine and two of the most senior members of the management team are leaving as well. Many of Hart's long-time lieutenants remain. But it's Hart, the company's face and largest shareholder, who faces a decision. He can merge with another entity, like SpringHill just did, he can shrink the company or he must find some other way to grow. The best of Screentime (and other stuff) | The biggest music trends: Turkey, Swift and pop | People still mostly listen to new music. This shouldn't be a controversial sentence, but there have been a lot of stories about how catalog is replacing new music. It really depends on your definition of 'new.' The fastest-growing segment of the market has been what the industry calls shallow catalog. Music released this decade accounts for about half of all streaming. And music released since 2010 accounts for about 80%. That's according to a new report from Luminate, which is full of revealing nuggets about the music business, such as: - Major record labels account for less than 10% of the music being uploaded to streaming services. That explains the latest wave of M&A.

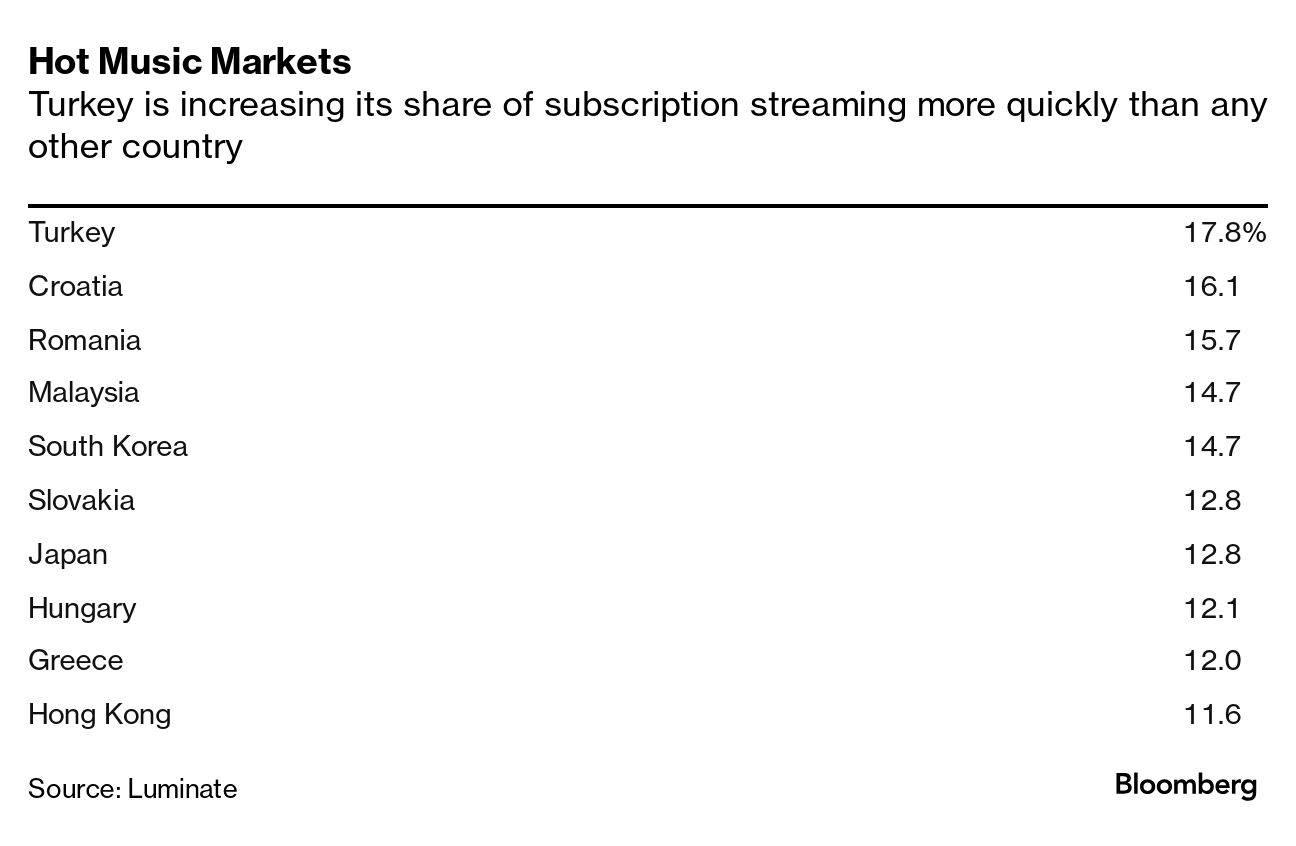

- Eastern Europe and Asia are the fastest-growing music regions, as measured by new subscribers. Turkey, Croatia and Romania are the top countries.

- Pop was the fastest-growing genre last year in the US, while R&B/Hip-hop's share of listening dropped by more than 2%.

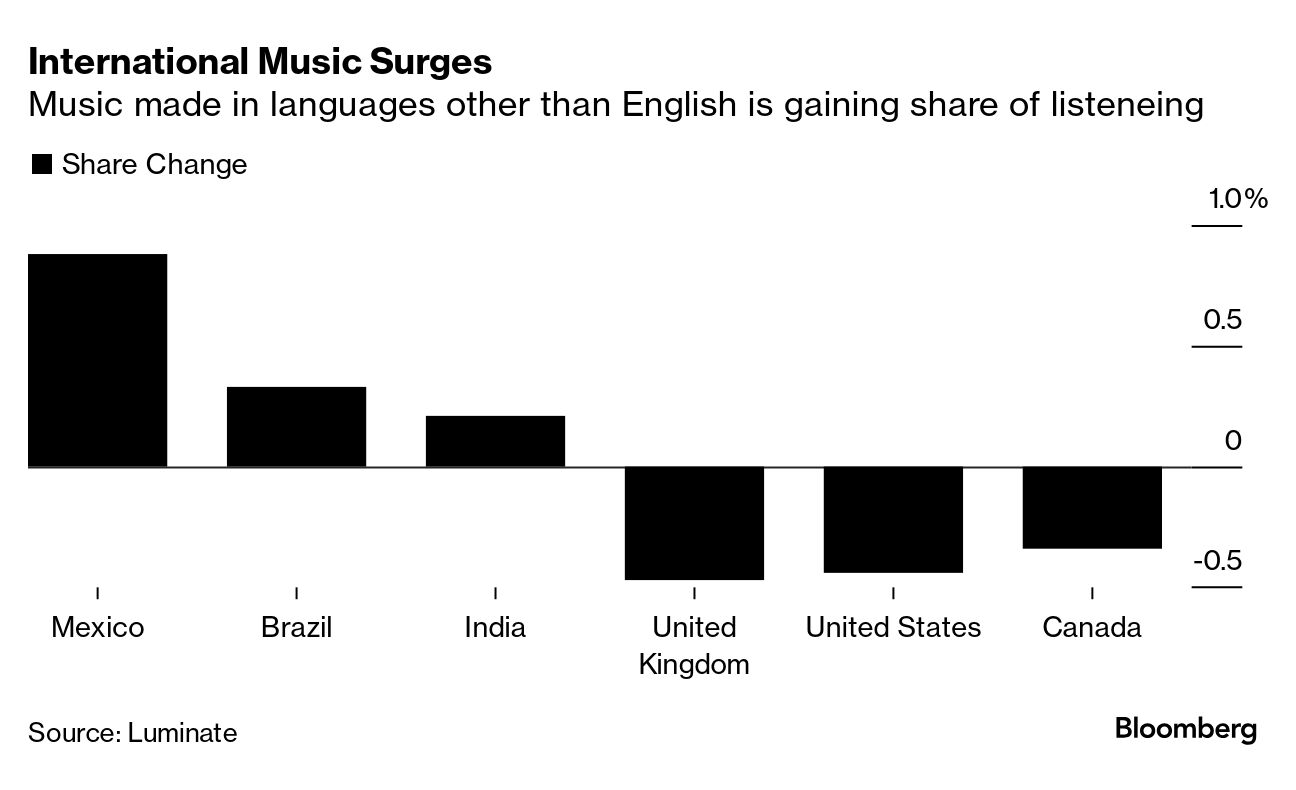

- Artists who perform in English are losing ground.

The No. 1 song from last year was Benson Boone's Beautiful Things, which narrowly beat Sabrina Carpenter's Espresso and Billie Eilish's Birds of a Feather. The No. 1 album was Taylor Swift's Tortured Poets Department. It sold twice as many copies as the next biggest, which was Morgan Wallen's album from March 2023. Swift accounted for three times as much listening as the second-biggest pop act in the US, which was Eilish, and songs she wrote outperformed the biggest producers in the world, such as Max Martin and Daniel Nigro. The No. 1 album in the US is…Lil Baby's WHAM. It edged out Bad Bunny's new record thanks to a couple of extra days. Bad Bunny released his album on a Sunday, which nobody does. But Benito's Debí Tirar Más Fotos is tops globally by a wide margin. Skydance's Paramount deal hits a speed bumpLawmakers are calling for a federal review of Skydance's merger with Paramount, citing concerns about Tencent's stake in Skydance. The federal government has blacklisted Tencent, designating it a Chinese military company. Republican John Moolenaar, chairman of the House China Select Committee, and Democrat Mark Warner, vice chairman of the Senate's Select Committee on Intelligence, both said the deal should be scrutinized by the Treasury Department's Committee on Foreign Investment in the US. Tencent will have a less-than 5% stake in the merged Paramount-Skydance and will be a passive, nonvoting investor. Deals, deals, dealsAt the end of every year I like to examine the "best of" lists from my favorite critics. That includes Vulture's music critic Craig Jenkins. While our tastes diverge, I always find something great I didn't previously know about. For 2024, that was British singer-songwriter Rachel Chinouriri. |

No comments:

Post a Comment