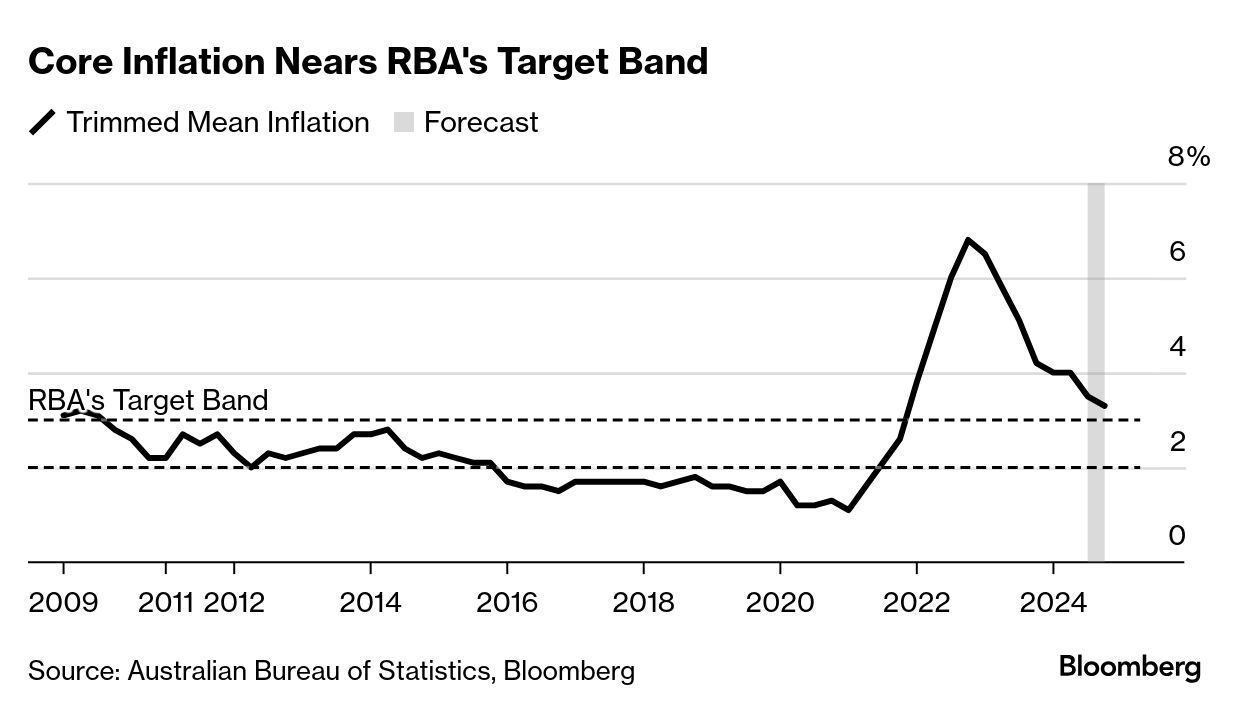

| Quarterly inflation data this week may be key to whether the Reserve Bank finally embarks on a monetary easing cycle soon, and in turn, help decide the timing of an election due by May 17. While money markets are pricing some 70% chance the RBA will cut the target rate at its February meeting, a lot depends on price data scheduled Wednesday. Economists expect the trimmed mean inflation to have eased to 3.3%, a three-year low. Some advanced economies shouldn't delay interest-rate cuts at a time when their labor markets may be about to sour, according to TS Lombard economist Dario Perkins. The former official at Britain's Treasury said in a report that among six "monetary canaries" he identified in 2022 as susceptible to higher borrowing costs, some now appear vulnerable. His list includes Australia, Canada, New Zealand, Norway, Sweden and the UK. Prime Minister Anthony Albanese's Labor Party is trailing the opposition coalition despite a summer campaign blitz, according to the latest opinion poll. A Newspoll survey released by The Australian showed that voter support for the center-left Labor Party dropped to 49% while that for the center-right Liberal-National Coalition opposition climbed to 51%. They were tied at 50% in the December poll. New Zealand relaxed its visa rules to allow foreign visitors to work remotely while in the nation. The government will target highly skilled people, particularly IT workers from Southeast Asia and the US, Economic Growth Minister Nicola Willis said. The new visa rules, which take effect immediately, will also allow travelers to extend their time in New Zealand. New Zealand is reviewing its aid to Kiribati after the tiny Pacific nation's president canceled a meeting with Foreign Minister Winston Peters at short notice |

No comments:

Post a Comment