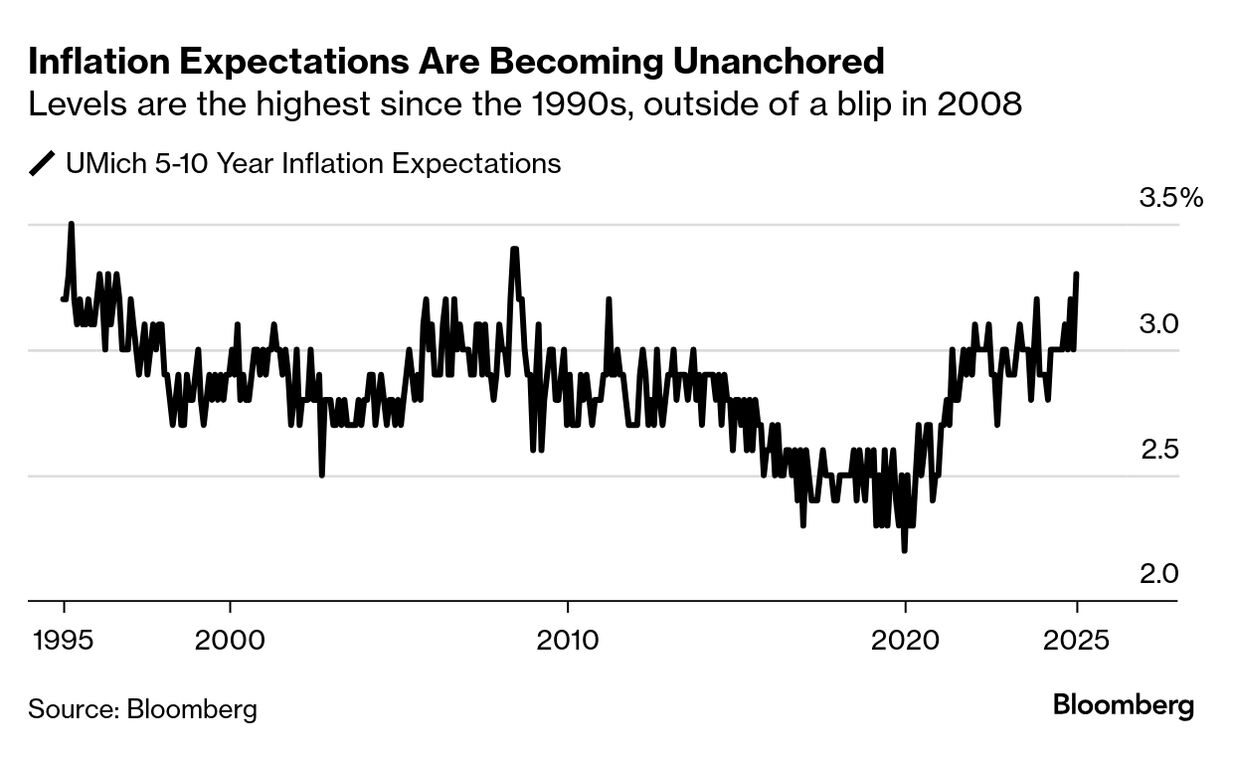

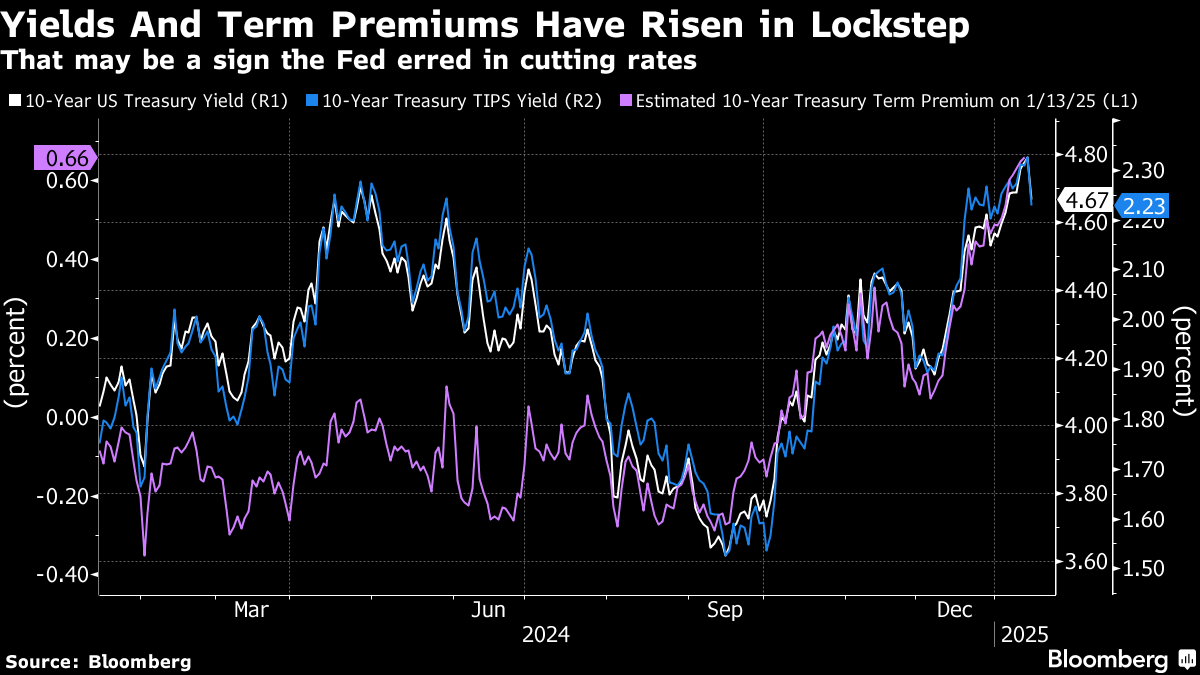

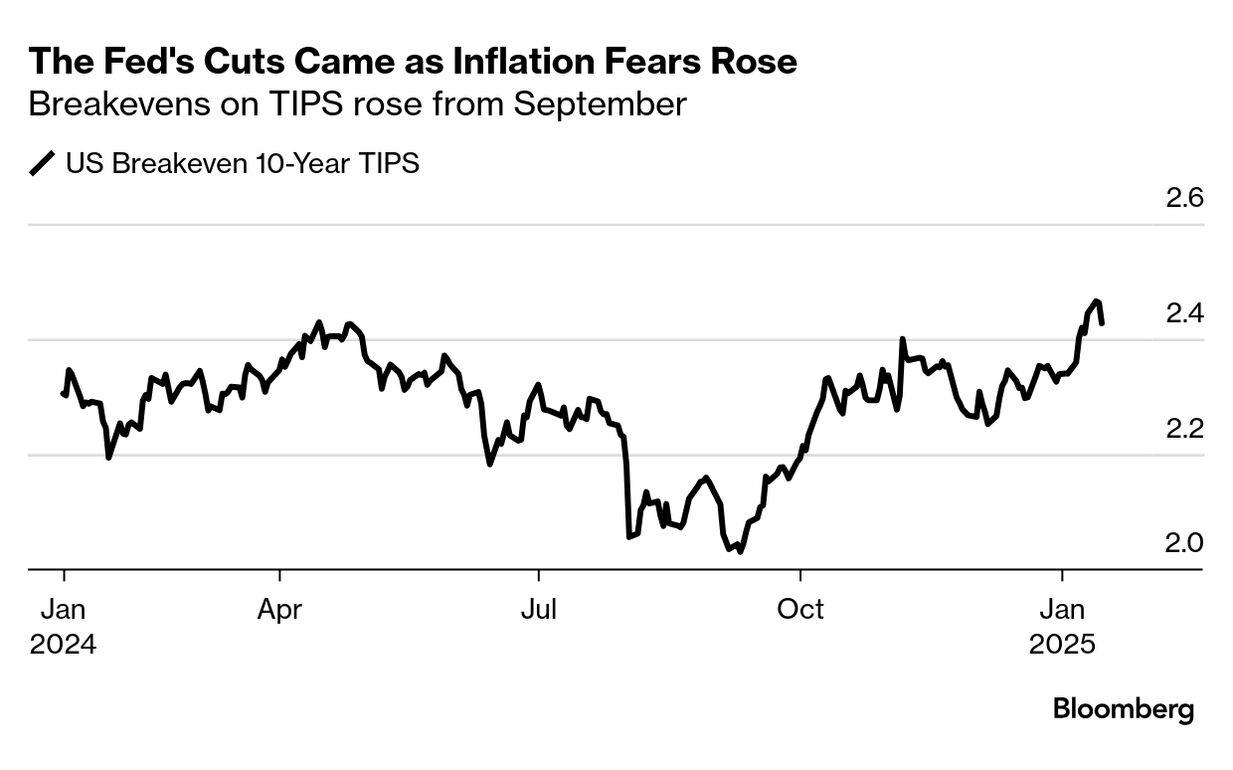

| The story I told you last week was that the Fed had raised the fed funds rate after the pandemic to create enough financial strictures to slow the economy and bring down inflation. Fearful of a recession, though, they reversed course at almost precisely the wrong time, with economic data surprising to the upside since September, including inflation. Inflation fears became so pronounced that people started asking for a premium to hold longer-term US government debt. And the rate at which premium was rising started to destabilize other markets. If it rises any further, the whole bull market will unravel — and quite violently, given the overly optimistic premises upon which it is now built. You can see inflation expectations becoming potentially unanchored. The last University of Michigan Consumer Sentiment Survey showed long-term inflation expectations higher than anything we've seen since the 1990s, outside of a blip during the financial crisis. Fast forward to this week, and what we see is producer and consumer price data calming fears of inflation. After core CPI rose less than expected, we saw a big rally in Treasury bonds bringing yields down as much as 15 basis points along the curve in some places. In essence, the whole uptick in term premiums, this whole strike against holding long-lived assets, was about inflation fears. If lower inflation data can calm those fears, then long-term bond yields will continue to retreat. And if those yields retreat, equity investors can go back to worrying about earnings instead of inflation. That gives the bull market more scope to continue — even as skeptical of this rally as I have now become. How to think about the US market rally | One way to look at this is through the prism of alternatives. Rob Armstrong did just that over at the FT when asking whether British stocks were cheap. As he put it, "US big-cap stocks' valuation premium over UK stocks has exploded since 2021." We're talking a PE premium over 100% now. His conclusion? "The same sort of company with a similar growth rate carries a similar valuation." Basically, the recent US earnings multiple expansion and its premium to other markets is all about growth. Earnings per share in S&P 500 companies are projected to grow at double the rate of UK FTSE 100 companies over the next two years, for example. It's no wonder, then, that you have a premium on US stocks when other countries like Germany saw their economy contract in 2024. Still, for that 100% US-to-UK premium to work, Armstrong says we're talking about growth differential estimates over the next two years only, not the next 10. So-called US exceptionalism is real because the US is growing more than other countries. A lot of that growth is tied to large capitalization technology companies. And that explains why they have been driving the market. Nevertheless, investors seem to be extrapolating the present forward. If US exceptionalism falters in any way, watch out. |

No comments:

Post a Comment