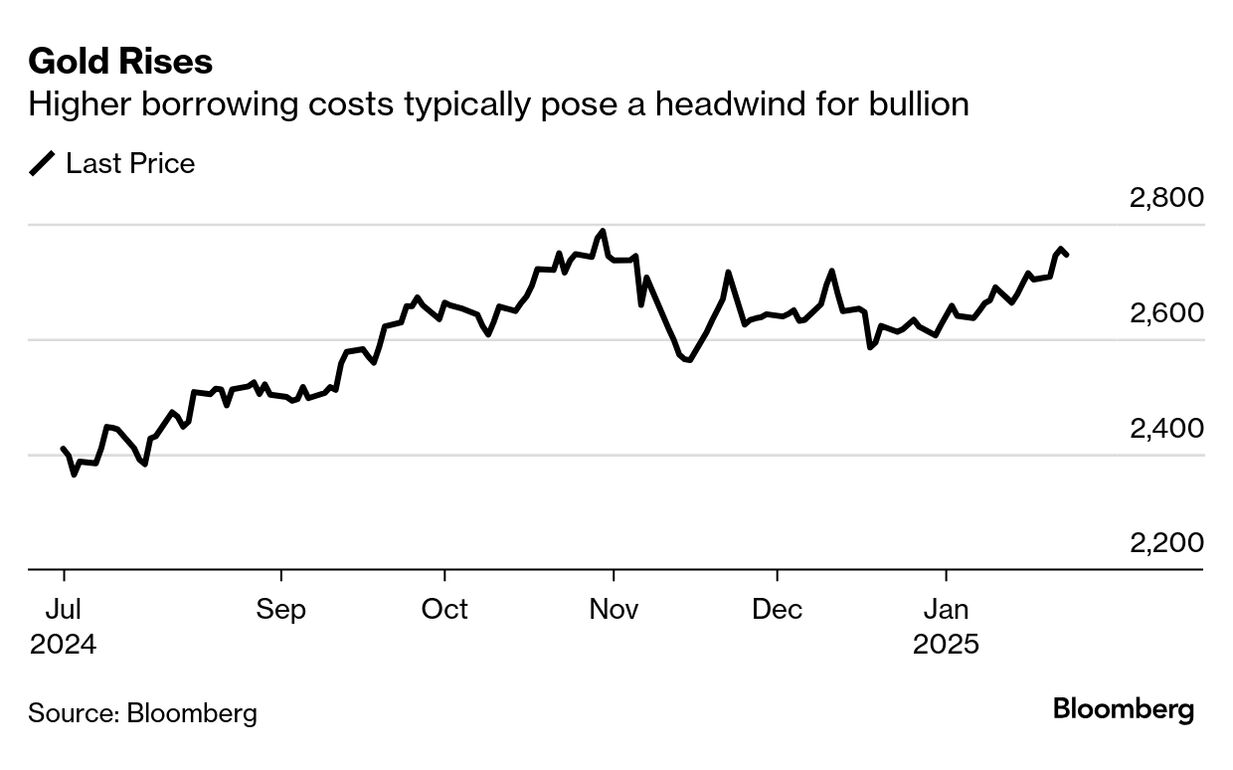

| The debate over remote work is back — and it will probably be here for years to come. Failing to recognize this could easily hurt your career, your finances and potentially your happiness. As predicted, President Donald Trump added fuel to the remote-work fire this week when he called federal workers back to the office full-time, following similar moves by JPMorgan and Amazon. It renewed tensions between those in favor of in-person work and the cohort that has been working remotely or with a hybrid arrangement since the pandemic. And it's a conflict with all the markers of one that will likely not be resolved soon. "The reality is it's not settleable," Mark Mortensen, associate professor of organizational behavior at business school INSEAD, told me this week. He has been studying remote work since the late 1990s and points out that it has already had a very long life. Companies and countries have been using what is called "distributed work" for centuries. One study looked at how the Hudson's Bay Company, founded in 1670, was effectively a "virtual" organization. "Every single empire in all of history has been a remote organization. It's just that they had a longer travel time for the information flow." Flexible work's many dimensions make it easy to argue about. It brings into play ideas of power, productivity and the meaning of work. Generational differences ensure the conversation will continue long after many now assume. "2025 might be the year of return to office," says Kyle M.K., a talent strategy adviser at the job site Indeed. But he also says firms are in the middle of a changing of the guard. Older managers pushing for office returns are also poised to retire soon. As millennials and Gen Z rise the management ranks, M.K. sees them bringing back the flexibility many grew accustomed to early in their careers. So what does this mean for you? My biggest takeaway from calling experts was not to panic, particularly if you're hearing about in-office mandates at other employers and worry about your own. "The bulk of the herd is somewhere in the middle," said Michael Distefano, chief executive officer of professional search and interim at Korn Ferry. There may be some outlier employers who want to make a big show about getting everyone back in person, but much of it is noise, he said. Even within recent announcements, there appears to be wiggle room. Take the latest White House memo on the subject. It generated an awful lot of angst, but is actually just two sentences long, uses the vague timeline of "as soon as practicable" and makes room for exemptions. What's more, given that remote work has all the hallmarks of a long-run issue, even if you lose it as a perk in your current role, you might get it in your next one. But don't get complacent. Executive coach Monique Valcour encourages employees to keep up-to-date on the dynamics surrounding remote work. Some firms are using return-to-office calls as a way of pushing staff to quit. Employees at such firms will find they have less leverage to cling to remote privileges than they had in the past, she says. And job seekers may need to reset their expectations. Ariel Schur, CEO of boutique recruitment firm ABS Staffing Solutions, likes the hybrid model. It's one she often recommends for her corporate clients. Still, she says it can be "astounding" to hear the expectations of job candidates who tell her they want new jobs, but also want to keep so much flexibility that they can continue to go to exercise classes in the middle of the day. That's fine, but she encourages people to honestly assess what they value from work and outline the pros and cons of being very present, or being very not. "Realize it's a job," Schur says. — Charlie Wells American Airlines tumbled. The slump came after the airline forecast a surprise first-quarter loss in a setback as the carrier works to win back corporate travel after a strategic blunder last year. The pessimistic forecast contrasts with more bullish outlooks from rivals United and Delta, which are capitalizing on strong demand for winter trips to Europe and higher domestic ticket prices. Gold climbed to its highest intraday level since the end of October. Traders were monitoring the outlook for the global economy as President Trump continued sketching out his views on trade and immigration policies. Investors are focused on the implications of the Trump administration's tariff and tax cut policies, which economists say may reignite inflation — limiting the Federal Reserve's ability to keep easing monetary policy. Higher borrowing costs typically pose a headwind for bullion since it doesn't pay interest. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Larry Ellison was the biggest gainer in dollar terms. The founder and largest shareholder of Oracle clocked a $23.1 billion gain, brining his net worth up to $208.8 billion, his all-time high. Oracle shares jumped on news it will join a $100 billion joint venture with SoftBank and OpenAI to fund AI projects. Elon Musk was the biggest loser in dollar terms. The chief executive of Tesla lost $9.4 billion, which took his wealth to $449.8. Tesla's shares slid alongside other electric-vehicle makers after Trump ordered his administration to consider removing subsidies for EVs. Musk remains the world's richest person. Blackstone to Buy Kimpton Hotel Eventi for $175 Million  The Kimpton Hotel Eventi in New York. Photographer: Dia Dipasupil/Getty Images for IHG Rewards Club Blackstone agreed to buy the Kimpton Hotel Eventi in New York City as strong travel demand makes Manhattan hotels attractive to property investors. The alternative asset manager agreed to pay about $175 million to acquire the 292-room property from DLJ Real Estate Capital Partners, according to a Blackstone representative. Blackstone's deal comes at a time when New York hotels are enjoying favorable demand trends. Bookings are approaching 2019 levels, and new supply has been limited by zoning changes that restrict the development of more hotels. Those dynamics have appealed to investors recently, with buyers snapping up properties such as the 1 Hotel Central Park and the Thompson Central Park. Brookfield REIT Posts Second Straight Loss A Brookfield Asset Management property fund for wealthy individuals recorded its second consecutive annual loss, but ended the year on a stronger note. Brookfield Real Estate Income Trust Inc. lost 0.45% in 2024 after positive returns from September onward weren't enough to erase earlier losses, according to disclosures on the company's website. In 2023, the fund fell 6.7%. This week, we're looking to speak with people who are thinking of changing jobs this year — or bosses who think their staff might be making plans to move. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. When it comes to your world and your money, you want answers from leaders who know how to build empires, protect portfolios and create the next big thing. Held in the heart of New York's Financial District, Bloomberg Invest is an essential gathering that convenes allocators, dealmakers and investors from across the globe. Powered by one of the world's largest newsrooms and led by Global Finance Correspondent Sonali Basak, join us on March 4-5 as we help you track, dissect and navigate the markets with the industry's most influential voices. Learn more here. Like Bloomberg Wealth? Here are a few other newsletters we think you might enjoy: - Pursuits for a guide to the best in travel, eating, drinking, fashion, driving, and living well

- Work Shift for exclusive insight and data on the future of work

- Money Distilled for John Stepek's daily newsletter on what market moves mean for your money

- Economics Daily for what the changing landscape means for policymakers, investors and you

- CFO Briefing for what finance leaders need to know

Explore all newsletters at Bloomberg.com. |

No comments:

Post a Comment