| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Elon Musk's Department of Government Efficiency has vowed to stop wasteful spending in Washington and slash the federal workforce under President Donald Trump. Musk is keen to "delete" entire US agencies, much in the way he likes to delete parts and processes at Tesla, SpaceX and the other four companies he runs. But current and former employees who've worked for Musk say there are a number of examples of decision-making that run counter to that narrative when looking back on how the world's richest person has run his corporate empire. In the early days of Tesla, for example, the EV maker worried it wouldn't be able to churn out its Model S sedan fast enough because shipping key parts was taking longer than expected. Tesla sacrificed cost for speed, and flew a bunch of tires from the Czech Republic to keep production going, Musk said during a February 2013 earnings call. Though no dollar figure was disclosed about that specific decision, Musk called the move "really inefficient." "We had to fly a lot of stuff," Musk said. "And when you fly something, it can cost as much as 10 times what it costs to ship it by sea or rail or truck, particularly if it's heavy. And so, we had to do some pretty dumb things."  Musk at a rally with Trump, not pictured, on Jan. 19. Photographer: Al Drago/Bloomberg Placing urgency over financial discipline is a trait that's characterized Musk throughout his career. The billionaire is known for making quick decisions that often have a big impact on the companies he runs — think substantial layoffs, design changes, product launches — then reversing course just as swiftly. The whiplash can sometimes lead to spending even more money to fix the initial issues, say current and former employees who weren't authorized to speak publicly about their boss. "Musk's track record of efficiency is a ledger," said longtime Tesla analyst Gene Munster. "There is success in one column and in the other is failures." Munster said Musk has excelled at wringing out productivity from his workers, but that operational inefficiencies do come with real costs. Take the job cuts at Tesla last year, in which Musk slashed more than 10% of its workforce. The billionaire axed its Supercharger team, only to rehire several people back. Or when Musk backtracked on a 2019 plan to close Tesla's showrooms, a decision analysts said came after Musk probably realized the company was locked into long-term leases it would have to pay either way. Musk also famously reversed course on a highly automated factory he built full of robots to manufacture the mass market Model 3 in 2018. After telling analysts Tesla's parts-conveyance system was "probably the most sophisticated in the world," he ripped out the entire system weeks later when he realized it wasn't working. "Excessive automation was a mistake," he said. Tesla burned through $1.79 billion in just the first half of that year, before Model 3 sales took off and helped get the company back on track. There's much to admire about the industrial powerhouses Musk's built. Tesla pushed the auto industry to embrace electric cars and is now worth almost $1.3 trillion. SpaceX took on legacy aerospace with lower-cost reusable rockets and is a key partner to NASA and the US military. Engineering teams within Musk's companies are lean and nimble, and constant iteration is part of the ethos. In Silicon Valley, investors are accustomed to stomaching prolonged financial losses for the promise of a bigger payout later. Tesla went 10 years without making an annual profit until 2020 — a decade in which the S&P 500 rose by 180% but Tesla shares increased more than 5,000%. The federal government is a different beast. Musk is going up against a labyrinth of bureaucracy that's difficult to nudge in a different direction, let alone overhaul. And DOGE might not have the luxury of time for Musk's trial-and-error methods. Trump has given it a deadline of July 4, 2026. "Successful companies experiment all the time," says Don Moynihan, a professor of public policy at the University of Michigan. "That is very different from government. When government fails, it is always a big deal." Musk, who donated more than $250 million to help elect Trump and Republican allies, pitched the idea of an efficiency commission in August. After predicting DOGE could slash $2 trillion from the US budget, Musk recently tempered expectations. "If we try for $2 trillion," he said, "we've got a good shot" at cutting $1 trillion. - Tesla, BMW sue EU over China EV tariffs.

- Honda aims for 50% share of global motorcycle market.

- Citi says Trump can't reverse energy transition.

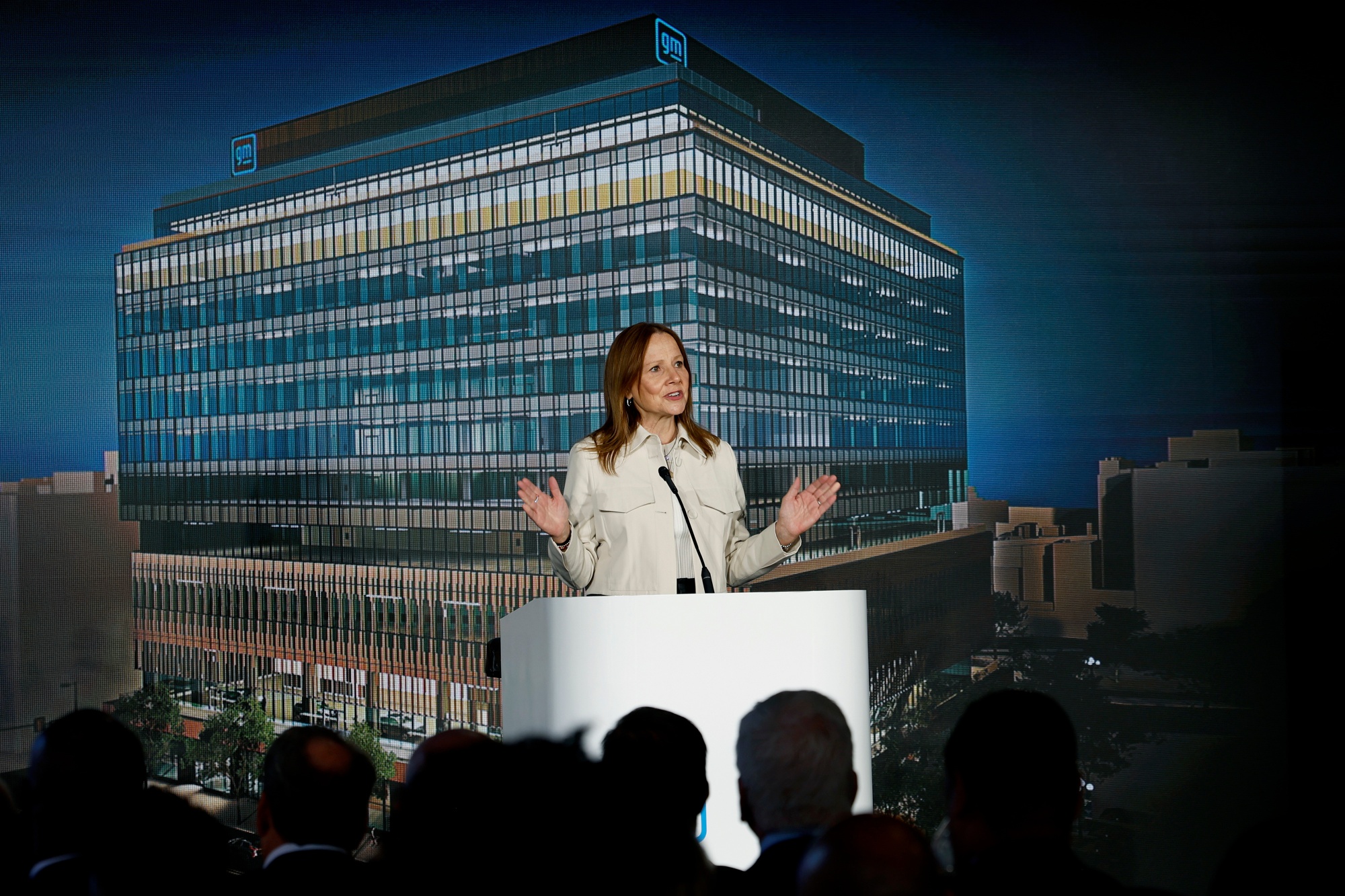

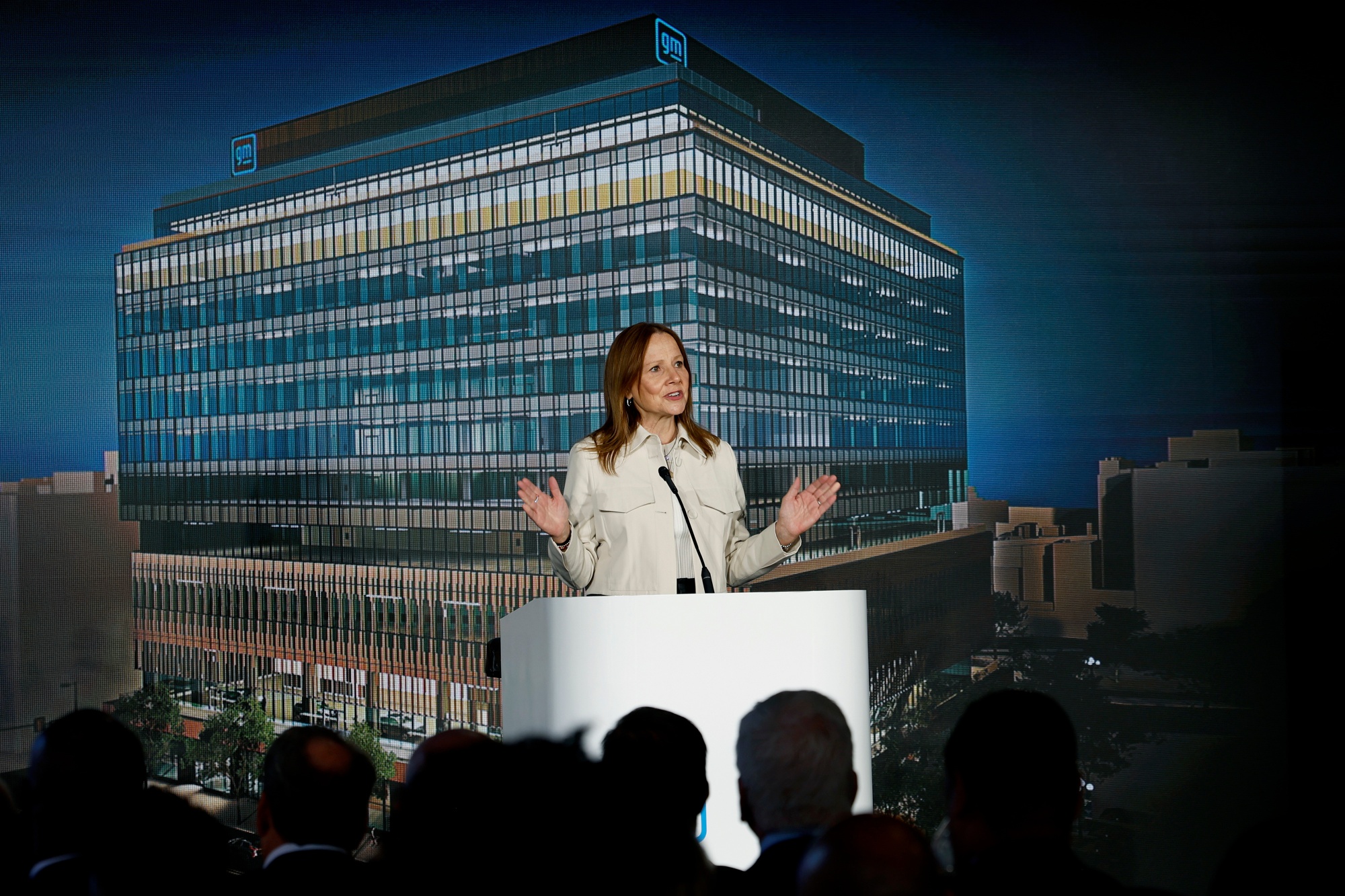

GM CEO Mary Barra. Photographer: Bloomberg/Bloomberg General Motors offered an upbeat profit outlook, though the automaker cautioned that plenty remains uncertain in the early days of the Trump administration. Adjusted earnings before interest and taxes will range from $13.7 billion to $15.7 billion this year, the company said Tuesday, which compares to $14.9 billion last year. The guidance is boosted by the recent decision to shutter Cruise, GM's self-driving car unit, which is expected to save about $500 million this year, and twice as much in future years. One big caveat to GM's forecasts: They don't account for President Donald Trump's threats to levy 25% tariffs on Canada and Mexico, which are crucial to the automaker's supply chain. More on earnings: - BMW sees auto margin at low end of guidance on weak sales.

|

No comments:

Post a Comment