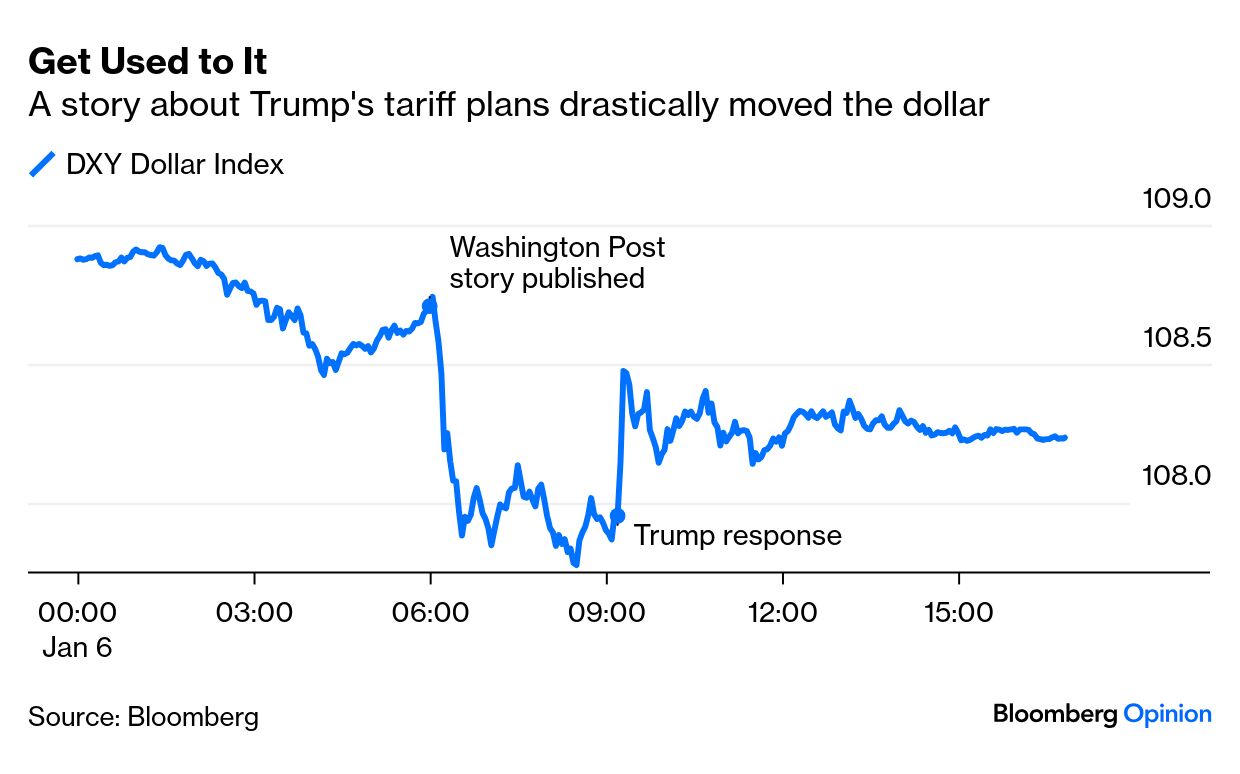

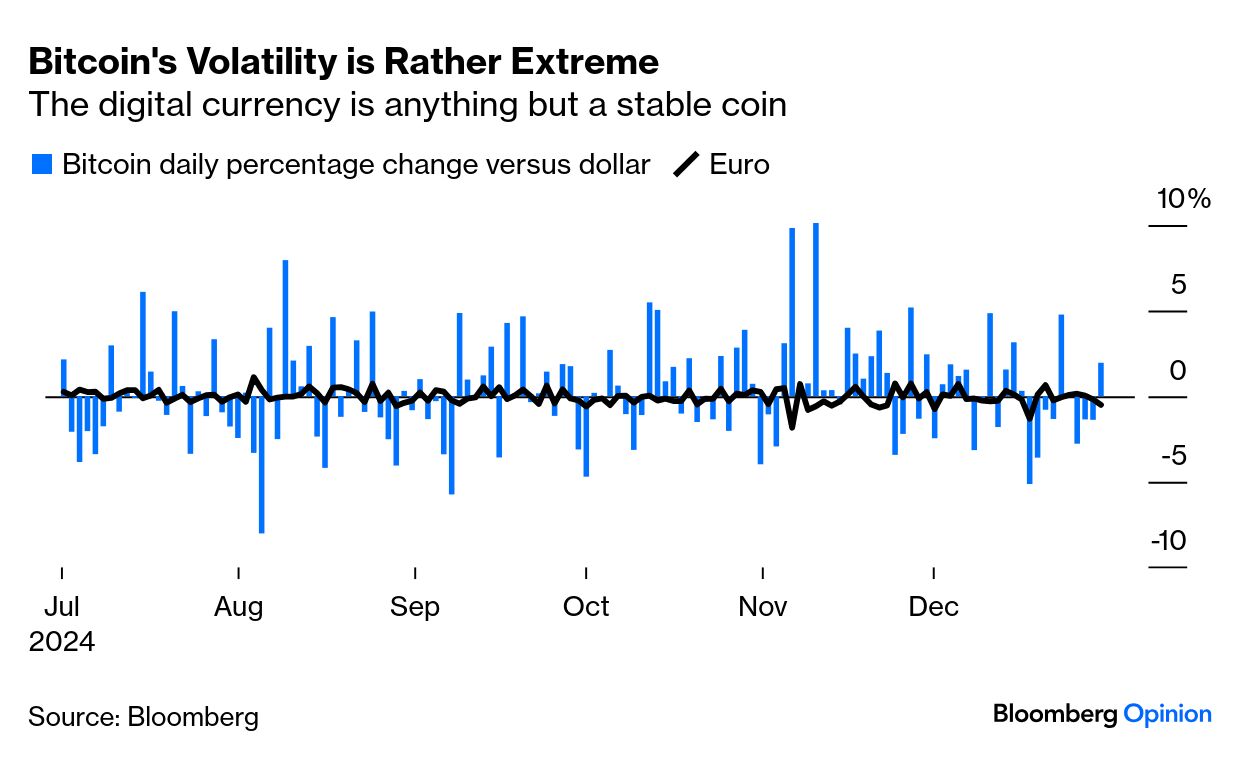

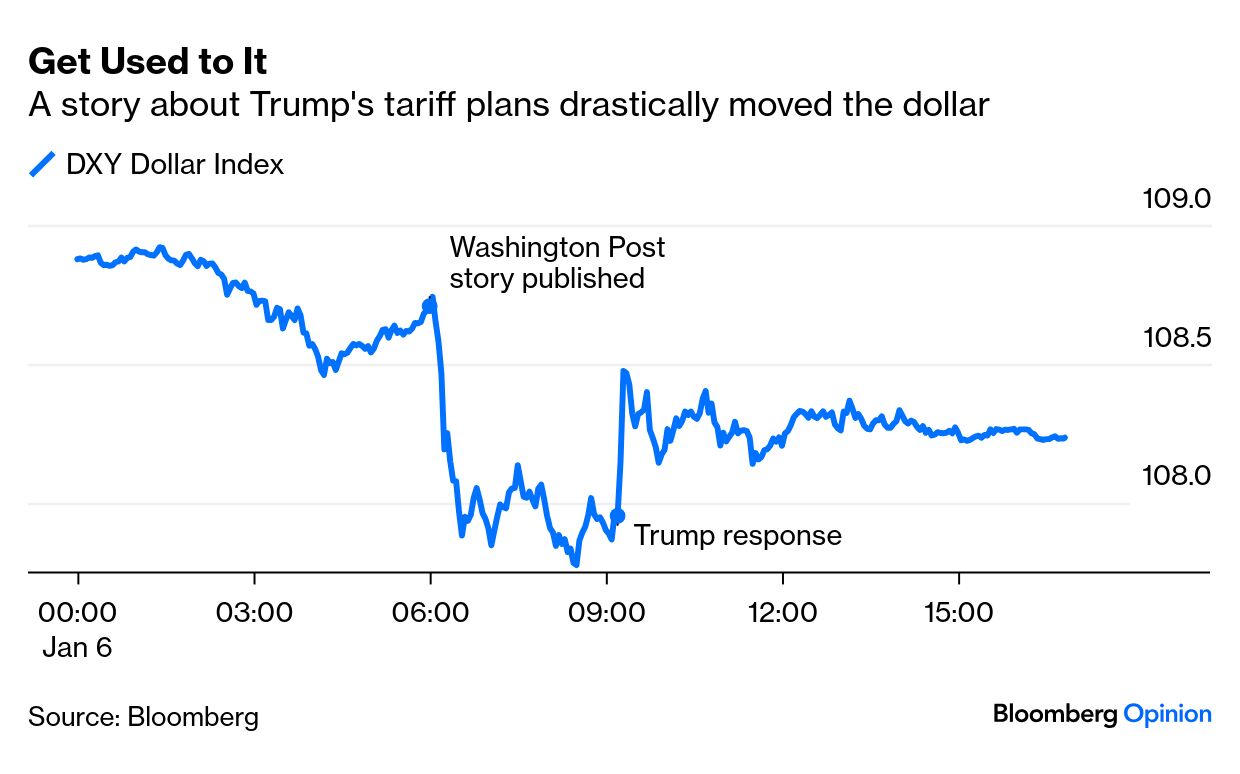

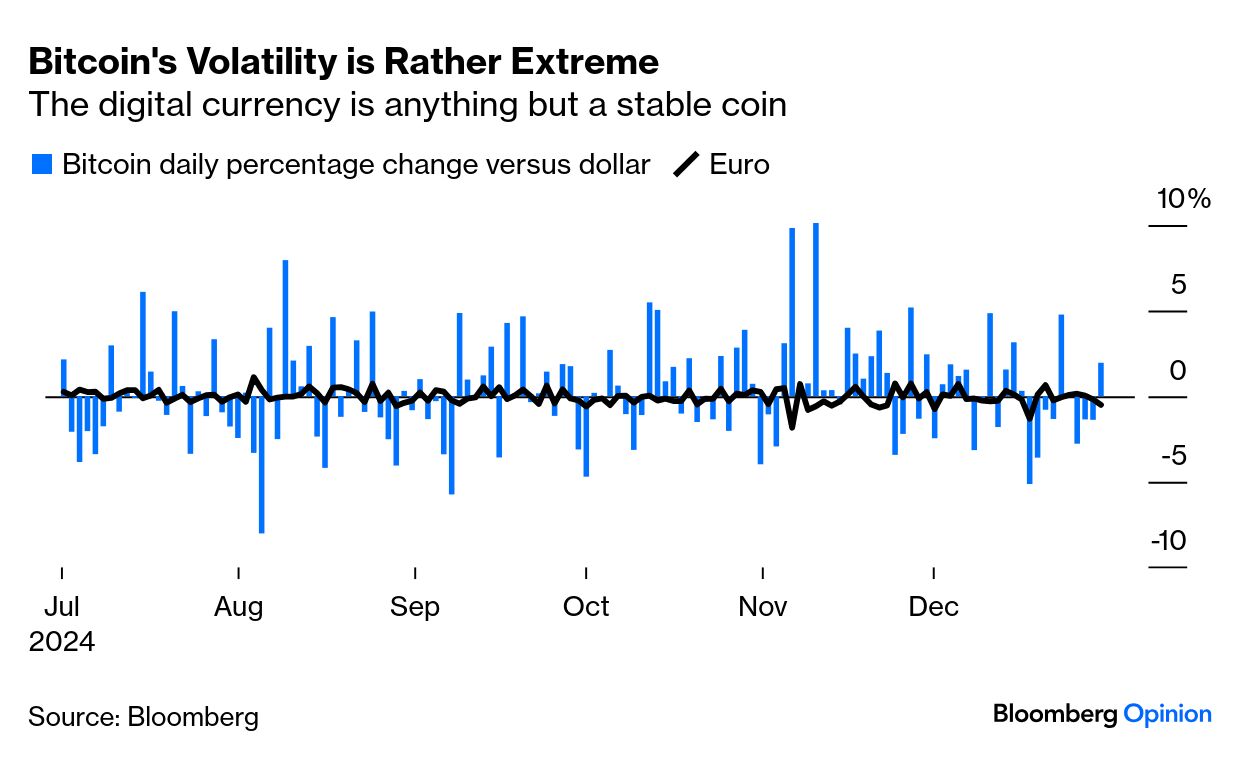

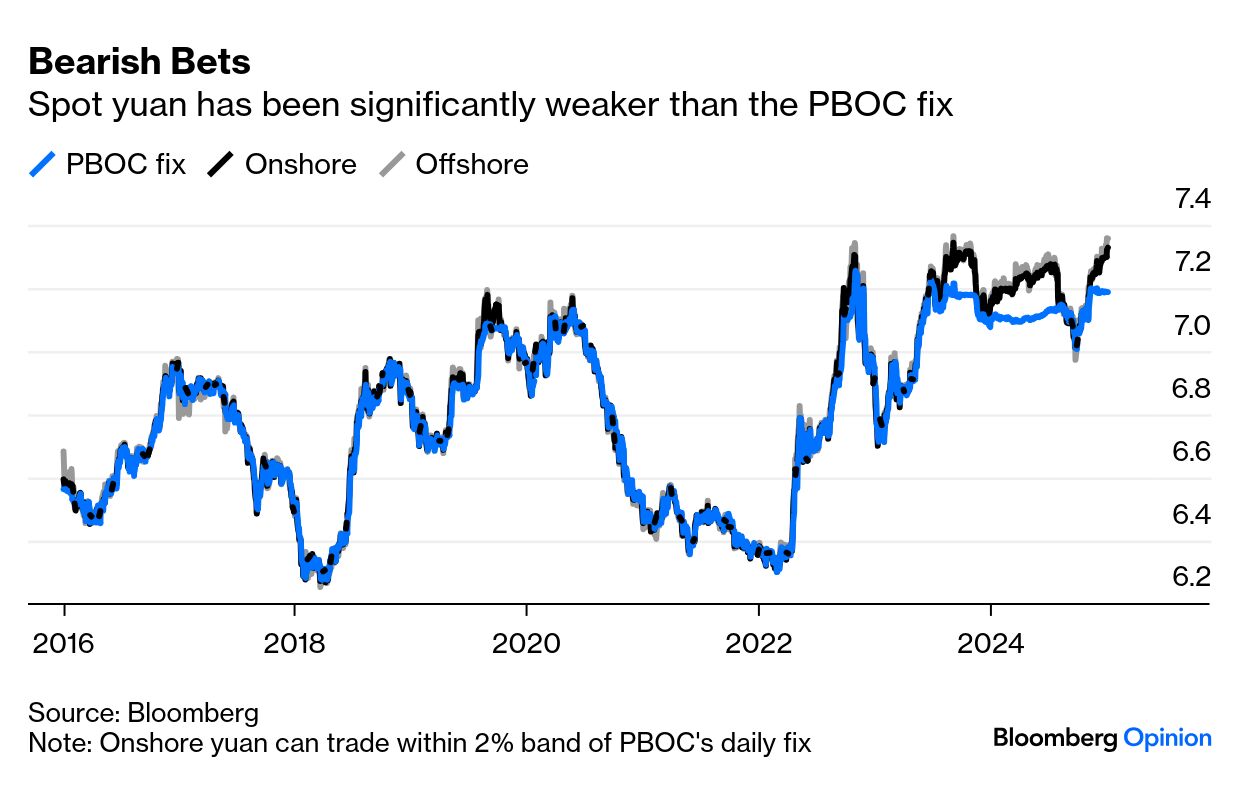

| This is Bloomberg Opinion Today, a coup de théâtre of Bloomberg Opinion's opinions. Sign up here. Red Light, Green Light and What's Next for Korea? | South Korea is often held up as a harbinger of things to come, from culture (what did we do before K-Pop and K-dramas?) to economics (global growth often takes cues from the country's nimble export-sector). When it comes to politics, however, Korean democracy simply reflects the state of governance in most of the world: it's a mess. And since early December, Seoul's politics has been especially disordered. Here's a quick recap for those of us who may have been too distracted by the return of Squid Game to pay attention to anything else Korea-related. On Dec. 3, President Yoon Suk Yeol — whose party lost control of the legislature earlier in the year — declared martial law in an attempt to be more than a lame duck. That failed spectacularly when the country's lawmakers — including Yoon's own party — declared his imposition of military rule null and void. The opposition also cobbled together enough votes to impeach him. However, attempts to investigate Yoon — much less arrest him — were stymied by the presidential guard protecting the humiliated head of state. His erstwhile successor — his prime minister — has also been impeached, but Yoon's partisans are rallying and, in scenes vaguely reminiscent of the US after the 2020 election, have denounced the opposition with cries of "Stop the Steal!" (A horrific plane crash has also darkened the popular mood.) Karishma Vaswani says Yoon's fate "has become a lightning rod for South Korea's growing political divisions." And if the crisis isn't dispelled soon, the country may sink deeper into a morass. "At home," says Karishma, "[Seoul] must deal with a weak economy and struggling currency, which fell 10% last quarter versus the dollar. And in a reminder of the threat North Korea poses, this week, Kim Jong Un's regime fired the first missile of the year toward the Sea of Japan. Pyongyang's closer collaboration with Moscow means that the North could have access to new technology to help it further its nuclear weapons program." Meanwhile, Daniel Moss asks: "The economy could use a lift and the currency has taken some blows. But who is actually in charge here?" He suggests that Rhee Chang-yong, the governor of the Bank of Korea, assume the role of the adult in the room. Dan is aware that "central bankers themselves prefer their roles to be boring. Mervyn King, who led the Bank of England for a decade, once made the point of saying that officials should aspire to be dull." But the times are way too interesting to take refuge in a false equanimity. All Rhee has control over is the cost of borrowing, but that's more control than anyone else in the country seems to have at the moment. Says Dan: "The record of the past few decades shows policymakers being sucked into other areas regardless of how much they might resist. Rate setters became public health experts in 2020. Central banks are crisis managers. Why run from that?" He writes: "Someone needs to make the big calls." If Seoul can't get its house in order, says Karishma, "the alternative is further instability." And at the moment, South Korea can't expect any counsel or help from the incoming Trump administration. Seoul, alas, isn't Greenland. Trumperialism! Or Just Another Manic Monday? | Or Tuesday, Wednesday, Thursday or Friday, for that matter. Apart from trying to seize Greenland and the Panama Canal, renaming the Gulf of Mexico and other unnerving geographic ambitions — credit to my Bloomberg colleague Michael McDonough for coming up with"Trumperialism" — the once and future president's economic and financial declarations have been giving Wall Street a bit of agita. As John Authers says, "as far as the markets are concerned his presidency has already begun." This week began with Trump denying a Washington Post story about the selectivity of his bruited tariffs. Then Trump said the Post had made up the policy pare-down. John says we'd all better get used to the swings and denials of Trumponomics.  Still, there may be a boy-who-cried-wolf factor to all the Trump-oratory to come. Says John: "What's most interesting, apart from establishing that higher tariffs do indeed strengthen the dollar, is that the rebound after Trump's rebuttal wasn't strong." Tales full of sound of fury? We'll have four years to figure that out. "I'd argue that the extreme intraday price moves in Bitcoin compared with, say, the euro are evidence of its unbound nature. While volatility is neither inherently good nor bad, Bitcoin's wild mood swings do highlight that its value is solely based on the fickleness of buyers and sellers rather than anything — and I do mean anything — that might qualify as a fundamental." — Mark Gilbert in "Bitcoin Is Not a Nothing, But Not a Something Either."  "[Chinese] State media may tout the yuan's resilience, but an epic drop in China's government bond yields sends a clear signal that the yuan is not a good store of value. Since mid-September, the 10-year yield has dropped by as much as 60 basis points. Much of this bear rally is a result of Beijing's own muddled policy signaling. In late September, traders got excited after the quarterly Politburo meeting uncharacteristically discussed economic matters and vowed strong fiscal measures. … But as weeks dragged into months and words were not followed by actions, investors realized Beijing was merely grandstanding and that China's whatever-it-takes moment may never come." — Shuli Ren in "Scott Bessent Can Break China's Stubborn Central Bank, Too." Walk of the Town: One Cold Morning in the South Bronx | Who'd pass up a visit to an ice factory in the South Bronx at 8:30 am when the temperature's 25 degrees Fahrenheit (-4 degrees Celsius)? Not me. Erected at the cusp of the 20th century, the six-story, thick-walled building at 20 Bruckner Boulevard today is just about a 10-minute walk from the 6 Train stop at 138 Street. Its owner was the beer baron Jacob Ruppert, who would eventually buy the New York Yankees and move them from Washington Heights in Manhattan across the Harlem River to the Bronx. In the age before refrigeration, it was a place where ice could be stored for months for use in his breweries. Ruppert died in 1939, and his brewery (in what's called Germantown on the east side of Manhattan) would shut down by the 1960s. The Bronx ice plant was abandoned as the borough fell into a terrible economic collapse. Its roof would be put to use as the pedestal for enormous commercial signage, including the History Channel, Uber and currently the NYC Langone Medical Center, visible to folks driving into Manhattan via the Robert F. Kennedy Bridge (formerly known as the Triborough). Otherwise, 20 Bruckner Boulevard became a decrepit shell, the toilet of pigeons and rats. But the building I entered this week is a wonder.  Dream Charter School's library Photograph by Howard Chua-Eoan/Bloomberg Since 2023, the old ice house has become part of the Dream Charter School. Its interior — full of tall spaces and wells of light — was revamped by the firm of David Adjaye, the Ghanaian British architect who also designed the National Museum of African American History and Culture in Washington, DC. The sturdy walls and metal-beamed cathedral ceilings necessary to preserve temperatures have been put to dramatic and practical use. About 1,000 students — from kindergarten to high school — attend classes there. Indeed, Dream's South Bronx outpost (it has one more in the borough, closer to Yankee Stadium, and another in Harlem) is also a kind of community hub, providing counsel and support for the families of its students who tend to come from the immediate area. Private donors fund those services and other activities (like summer school and a program that assists students well past college completion). Otherwise, independent schools like Dream receive public funds because they have contracts — or charters — with the government. As the New York Times architecture critic Michael Kimmelman wrote shortly after the school opened in 2023: "Adaptive reuse is the architectural term of art to describe what Adjaye has done with the ice plant. It's how great cities have always balanced preservation with progress, decline with opportunity." There's a lot to learn here. Bad tidings from Christmas Past. — Andrea Felsted Good cheer for bankers: What could possible go wrong? — Paul J. Davies China's startling AI workaround. — Tyler Cowen The US must stay in the WHO. — Gordon Brown The far right rises in Hitler's birthplace. — Marc Champion Sam Altman's AI doublespeak. — Parmy Olson Why Desis aren't special in the US anymore. — Mihir Sharma German skies don't fly right. — Chris Bryant Notes: Please send survival tips and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment